KPMG Landscape Report Template

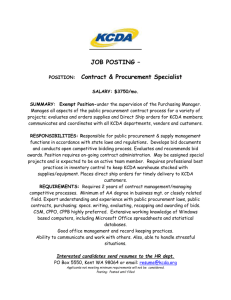

advertisement

IT Hardware Buyers Overview Click to edit Master title style September 2008 DISCUSSION PURPOSES ONLY Version control Version 1.0 1.1 1.2 1.3 Name Date Completed Comments Draft for consultation 16th January 2008 New version in PowerPoint format Draft for consultation 4th Comments from G Neill added Draft for consultation 24th February 2008 Comments from C Elliot Draft for consultation 12th March 2008 Comments from G Neill added February 2008 New material added on Managed/ Shared services 1.4 Final draft for NCF approval 29th August 2008 Final revision. 1 Contents The contacts in connection with this report are: Page Introduction 3 Executive Summary 4 Procurement Scotland Background, Scope & Objectives 7 Gill McLeod Strategic Buyer, IT Hardware Scope 9 Tel: + 44 131 244 8186 Current Expenditure 10 Key Suppliers to the Scottish Public Sector 11 Supply Market Overview 12 Current Procurement Practice 13 Recommended Procurement Practice 14 Gordon Neill Portfolio Manager, IT Hardware Tel: + 44 131 244 8145 gordon.neil@scotland.gsi.gov.uk IT Hardware gill.mcleod@scotland.gsi.gov.uk Lee Rutherford Technical Analyst, IT Hardware Tel: +44 131 244 0165 Lee.rutherford@scotland.gsi.gov.uk Factors to Consider in the Procurement of IT - Total Cost of Ownership 15 - Leasing 17 - eAuctions 18 - Commodity to Solution Based Procurement 19 - Buying a Managed Service 21 IT Hardware Strategy 23 Key Contacts for further information 24 2 Introduction Purpose Following analysis carried out by the Procurement Scotland on the procurement of IT Hardware across the public sector in Scotland, it is clear a diversity of practices currently exist. The purpose of this document is to provide public sector IT Managers and procurement staff with an introduction to current sourcing options and solutions that will help them procure the IT hardware they need to deliver the technology and services required by their organisation and staff. It promotes the role of Procurement Scotland as a key enabler in facilitating cross sector collaboration to achieve best value. The document starts by setting into context the background, scope and objectives of Procurement Scotland. It then outlines the scope of the IT hardware category and gives an overview of current expenditure across Scottish public sector bodies. The supply market in Scotland is then considered along with an overview of trends in the IT Hardware market. Sourcing options covering current procurement practices and the contractual arrangements in place across public sector organisations are then reviewed. The next section on leading practice provides an overview of current thinking and practices in the areas of Total Cost of Ownership, IT Leasing, eAuctions and Managed Service arrangements. This is followed by a section outlining the strategy for IT Hardware covering the current and future activities for the category. The final sections cover key contacts on IT Hardware in Procurement Scotland and sectoral Centres of Excellence and useful sites for further information. Approval This document has been reviewed by the National Category Forum prior to it being issued by Procurement Scotland. Notes The data contained in this document is based on data provided from several sources. These include: data extracted in August 2007 from the Spikes Cavell Observatory; market information and articles on IT Hardware and leading practice from Gartner Reports; and organisational and contract information from Sector web pages The document also takes into account information gathered during 2007, including that obtained from participants in the cross-sector National Category Forums held during this time. 3 Executive Summary Key Insights Procurement Scotland Background, Scope and Objectives • Procurement Scotland has been established as part of the Public Procurement Reform Programme to help drive advanced collaborative procurement across the public sector. It has been tasked with leading the sourcing of common (‘Category A’) requirements for Public Sector organisations in Scotland. • IT Hardware has been identified as a ‘Wave One’ commodity and is one of the first of a number of cross-sector sourcing initiatives led by Procurement Scotland . • One of the key objectives of Procurement Scotland is to use leading practice procurement techniques to achieve best value for end user organisations. IT Hardware Scope • The scope of the IT Hardware category includes desktop PCs, Laptops, flat panel monitors and servers. Maintenance and support services are outwith the scope of this document. Current Expenditure • The total estimated IT Hardware spend for the categories in scope is £131 million. • Local Authorities account for 52% of total spend at £68 million • Expenditure in local authorities is concentrated with the top 10 suppliers who account for 90% of expenditure. • Dell, Research Machines and Computacenter are the top 3 Suppliers to the Scottish public sector. Dell has the largest coverage of spend across sector organisations. • Procurement practices for IT Hardware vary across Scottish Public Sector organisations. Practices range from centralised procurement in Health to sectoral, consortia and inter Regional contracts in Local Authorities and Universities & Colleges. • Only a small number of organisations, typically the larger Local Authorities, have a managed service for IT Hardware. Most organisations use their in-house teams for added value services such as asset tagging, installation and support. • Sector spend on IT Hardware tends to be focused around the end of each financial year – typically March for Central & Local Government & June for Universities & Colleges Supply Market Overview • The IT Hardware industry is a global and highly competitive market. Strong competition among suppliers is driving consolidation and price reduction. • Laptops now account for 40% of all PC’s sold due to the increased emphasis on mobility. • The evolution of mobile devices, the move to thin client and server virtualisation are driving growth in PC technology. • The main areas of market growth are expected to be in emerging markets. 4 Executive Summary Current Procurement Practice • Procurement practices for the purchase of IT Hardware vary across Scottish Public Sector organisations. • Only a small number of organisations, typically the larger Local Authorities, have a managed service for IT Hardware. Recommended Procurement Practice • The recommended Procurement route going forward is for organisations to use the Procurement Scotland National Contract for desktop and laptop PCs, which is currently let through an e-auction via the OGC’s Catalist Framework • The Procurement Scotland e-auction in December 2007 achieved average price savings of 26%. This has delivered savings of over £3.6 million which are projected to rise to over £5 million in the next 12 months. 5 Executive Summary Factors to Consider in the Procurement of IT Total Cost of Ownership A managed lifecycle plan is leading practice for organisations to control their desktop costs. Effective lifecycle planning enables organisations to reduce complexity, better exploit technology advances and decrease lifecycle costs. Leasing Leasing works best when organisations match the terms of their lease to the amount of time they expect to use the equipment. Key areas to consider before entering into a lease are: • Understanding the organisation’s motivations for leasing IT equipment • Working with Finance to ensure the right type of lease is taken • Carefully negotiating terms and conditions • Negotiating the price of hardware first, then deciding If alternative funding models are appropriate • It should be noted that when IT hardware is as well priced as it was in December 2007, this makes leasing less attractive. eAuctions Reverse eAuction events are conducted on-line with pre-qualified suppliers being invited to compete typically on the basis of price. • eProcurement Scotl@nd (ePs) provides access to electronic auction functionality through the eSourcing Scotland System. • eAuctions are increasingly being adopted by major players in industry and in the public sector. Key benefits include: • price savings of over 25% are not uncommon (Procurement Scotland savings are typically in the region of 50% based on Dec 07 pricing) • procurement time savings • clear audit trail of activity • Best value not only based on price, but involves rigorous technical evaluation and demonstration of supplier capability. Commodity to Solutions Based Procurement • IT goods and services across the public sector today are typically purchased at a sub component level. • The increasing trend is to purchase IT as a solution which involves the bundling of these sub components. • This trend is being driven by the move to shared, managed and outsourced services. • The transformational journey to either a shared/managed or outsourced service needs to be underpinned by a structured change management process. Buying a Managed Service • The key factors to consider in deciding to buy a managed IT service cover risk and cost. • Risk considerations would include architecture and application complexity, availability and skills of internal resources, business impact and influence over the supply chain • Cost factors would include buying power, capital constraints and guaranteed benefits • Both risk and cost factors must be carefully considered as they will have an impact on the effective delivery and deployment of the solution 6 Executive Summary IT Hardware Strategy Core objectives for the procurement of IT Hardware are: • Public sector organisations will purchase requirements from Procurement Scotland agreements • There will a regular schedule of eauctions providing best value • Strategic relationships with key suppliers will be managed by Procurement Scotland • eProcurement will be used for the purchase of requirements • Active engagement with IT Managers to maximise compliance with Procurement Scotland agreements Key elements that will be required to achieve these objectives will be: • Evaluating if the development of a standalone framework for IT Hardware will be in the best interests of public sector organisations in Scotland • Strategic decision making through the National Category Forum and communicated to users by Sectoral CoE’s and UIG’s • Regular engagement with IT Managers to ensure commitment to contracts • Development of standard specifications that are future proofed • The use of leading practice techniques in the management of IT Hardware Key future activities include: • Development and execution of a sourcing strategy for servers • Feasibility study into desirability of establishing a stand-alone framework for Scotland • Development of a strategy to manage the procurement of Technology Transformation/ Managed Services programmes in conjunction with other portfolios (e.g. IT Software, Professional Services, Telecoms), 7 Procurement Scotland Background, Scope & Objectives Background Procurement Scotland has been established as part of the Public Procurement Reform Programme to help drive advanced, collaborative procurement across the public sector The vision of Procurement Scotland is: “We shall contribute benefits to the people of Scotland through the development of efficient and effective national procurement strategies.” Collaborative procurement is a core element of the Scottish Government’s efficiency drive to deliver better value services across the whole of the public sector. In response, public bodies across all sectors are developing a more strategic and more professional approach to how they buy from suppliers, and this involves developing national and sectoral strategies to drive value from contracts, and sharing best practice across the public sector Procurement Scotland is the organisation tasked with procuring national commodities and services on behalf of all Scottish public bodies. It has been established as part of the Public Procurement Reform Programme, which views national and sectoral Centres of Expertise as the major vehicles for driving collaborative, advanced procurement in the public sector. Procurement Scotland has ministerial endorsement to manage the procurement of a specified range of common goods and services across all sectors to deliver sustainable best economic value for money (VFM) solutions, in line with national targets via market-leading prices and terms. In order to maximise value from supply chains and compliance to national contracts, Procurement Scotland will facilitate effective collaboration throughout the procurement cycle, the development of innovative cross-sectoral strategies and dissemination of best practice guidance. Procurement Scotland also has a key role to play in ensuring a competitive supply base, with a view to fostering economic, environmental and social benefits across Scotland. Scope Procurement Scotland works closely with evolving Centres of Expertise across each of the sectors: Local Authority, Central Government, Higher and Further Education, Health, Police and Fire Services. Our Stakeholders Local Authorities The 32 local authorities across Scotland Central Government The core Scottish Executive, Agencies and 66 Non-Departmental Public Bodies Universities & Colleges The 63 Colleges and Higher Education Institutions Health The 22 Health boards, including Special Boards Fire & Rescue The 8 Fire and Rescue Services Police The 8 Police Forces 8 Procurement Scotland Background, Scope & Objectives Public sector spending on goods and services across Scotland is estimated to be circa £8 billion per annum. Spend has been broken down into three types of category expenditure: Procurement Scotland has been tasked with leading the sourcing of common (‘Category A’) requirements from Public Sector organisations in Scotland. • Category A - spend on goods and services e.g. IT hardware purchased on a national basis by public sector bodies in Scotland Identified as a ‘Wave One’ commodity, IT Hardware is one of the first of a number of cross-sector sourcing initiatives led by the Procurement Scotland • IT Hardware and Software Its objectives are to use leading practice procurement techniques to achieve best value for end user organisations. • Category B – sector specific spend such as Orthopaedic implants purchased in the Health sector • Category C – local requirements specific to the contracting entity such as specialist consultancy Of this expenditure, an estimated £1 billion of this relates to ‘Category A’ products, goods and services common to all parts of the public sector. Currently these include: • Telecommunications • Office Supplies and Equipment • Some Professional Services • Utilities Objectives It is the procurement of ’Category A’ products which the Procurement Scotland seeks to influence, helping Scottish public sector organisations achieve their aims by: • Utilising management information in relation to spend, existing contractual arrangements etc. to inform decision making; • Developing detailed Category strategies and planning to be shared across the public sector i.e. one overarching strategy and sourcing plan per category •Leading a number of Category Forums, which will oversee development of Category strategies, specification setting and tender development through to supplier selection and post contract award management; • Leverage scale and secure upfront demand and agreed specifications prior to going to market; • Manage the ‘through-life capability and delivery’ of the new contracts and frameworks. Category teams are responsible for setting-up new deals and frameworks as well as implementing them across the customer base and measuring and monitoring take-up and overall contract and supplier performance. 9 IT Hardware Scope Scope The scope of the IT Hardware category is desktop PC’s, laptops, flat panel monitors, printers and servers. Maintenance and support services are out of the scope of this document. For the purpose of this document the IT Hardware category has been defined as comprising desktop and laptop computers, monitors, desktop printers and servers. The key sub-categories are therefore: • Desktop PCs • Laptops • Flat Panel Monitors • Servers • Interactive Whiteboards • Disposal of Redundant IT Hardware Network and communications hardware, enterprise servers, storage, multi-function printers, support, maintenance and implementation services are all out of the scope of this document . Spend on IT services and contractors will be addressed separately under the Professional Services portfolio. 10 Current Expenditure IT Hardware Public Sector Expenditure The total “in scope” IT Hardware spend Is around £131 million. The total spend drawn from relevant sections of the 2005/6 Spikes Cavell spend data is over £131 million. As data is held at supplier level, and some provide a range of IT goods and services, it is likely that there are elements included that are outside the scope defined for this category plan e.g.. enterprise servers, maintenance and support, software, consumables and managed services. As a result total spend within the defined scope is estimated to be around £100 million per annum. Local Authorities account For 52% of total spend at £68 million Local authorities are the most significant buyers of IT Hardware within the public sector in Scotland, spending over £68 million and accounting for around 52% of the total spend. Local authority expenditure is over twice that of Central Government which at £23 million is the next largest. The expenditure by sector is shown in the Table below: 11 Key Suppliers to the Scottish Public Sector Supplier Expenditure in the Scottish Public Sector Expenditure in local authorities is concentrated, with the top 10 suppliers accounting for 90% of expenditure. The chart below shows the current suppliers to Scottish public sector organisations using spend data from 2005/6 Spikes Cavell analysis Dell, Research Machines and Computacenter are the top 3 Suppliers. Dell has the largest coverage of spend across a considerable number of public sector organisations. Key observations from the chart are that a significant proportion of all expenditure is in the Local Authority Sector. Expenditure is highly concentrated with the top 10 suppliers accounting for 90% of all expenditure. Dell, Research Machines and Computacenter are the top 3 suppliers each having a similar share of the spend amounting to a collective total of 60%. Dell dominates in terms of coverage with spend across a considerable number of public sector organisations. Research Machines is a leading supplier to the UK education market whose focus is on schools which they supply through Central Government and Local Authorities. Computacenter are a reseller of IT hardware where the majority of spend is with Local Authorities. There are a small number of large suppliers who sell a range of products into many organisations across all sectors. There are also a significant number of suppliers who provide goods and services into only a small number of organisations. Such suppliers may have a sectoral expertise or be geographically close to the procuring organisation. It should be recognised the data for the above overview of expenditure across the Scottish Public sector is based on 2005/6 Spikes Cavell data. As a result of the dynamic nature of the IT market, the ranking of suppliers may now be different and is likely to change over time. A good example of this would be the reseller Insight who have been successful in winning business in partnership with the manufacturer Lenovo on the recent National IT Hardware procurement exercise. 12 Supply Market Overview IT Hardware Market Trends The IT Hardware industry is a global and highly competitive market. Strong competition among suppliers is driving consolidation and price reduction in the market. The IT hardware industry is a global and highly competitive market. Driven by continued technological evolution and globalisation of supply chains, prices of hardware have fallen consistently over recent years. Price reductions have been driven by strong competition among suppliers, reducing costs and an oversupply in the market. It is likely that this situation will lead to further consolidation among the leading suppliers. The Gartner Magic Quadrant below shows who the key players are for PC’s and laptops: As a result of the increased emphasis on mobility laptops now account for 40% of all PC’s sold. The evolution of mobile devices, the move to thin client and server virtualisation is driving growth in PC technology. The main areas of market growth are expected to be in emerging markets. With the increasing emphasis on mobility, the popularity of laptops continues to rise in comparison with desktops and they now account for around 40% of all PCs sold. This is despite that total cost of ownership for laptops being up to 68% higher than for desktops. (Source: Gartner) The evolution of mobile devices, Personal Display Assistants (PDAs) and hand held devices is likely to drive further growth in PC technology. The continuing move towards thin client and server virtualisation technologies may also impact on this market. The release of Vista, the new operating system from Microsoft, may drive growth through technology refresh programmes and temper price cutting that has been a feature in recent years; particularly as older Microsoft operating platforms become unsupported e.g.. Windows 2000. The main area of growth is expected to be in emerging markets since sales in Europe and US have slowed considerably in recent years. Growth however is often tempered by reductions in prices which may mean that there is no commensurate increase in revenue. 13 Current Procurement Practice Current Practice Procurement practices for the purchase of IT Hardware vary across Scottish Public Sector organisations. There is a variety of procurement processes in use across the Scottish public sector. Some organisations make use of framework contracts available through OGC Catalist while others choose to tender directly with suppliers through publication of an OJEU notice. In general, contracts are rarely made on the basis of committed volumes. There are also instances of procurement activities not following legislative or best practice procurement guidelines. Furthermore the variations in practices are not presenting a consistent message to the suppliers resulting in lost procurement leverage. A number of organisations, typically the larger Local Authorities, have put in place major contracts to provide a managed service for IT hardware covering some part of their organisations. These contracts vary in terms of the scope and terms and conditions but typically are for a number of years to a planned technology refresh programme. Only a small number of organisations, typically the larger Local Authorities, have a managed service for IT Hardware. There is a wide variety in the IT hardware that organisations buy, both in terms of the technical specification and in the choice of service elements such as installation, support, warranties, maintenance and training. While some variations will be required to service local needs, it is unclear that there is any robust business case for much of the variation. A range of prices is being paid for hardware to meet equivalent needs of end users and it is likely that this is as a result of the diversity in both products and process. Most organisations use their in-house teams for added value services such as asset tagging, installation and support. The key suppliers and a number of organisations consulted report that there continues to be a concentrated spend on IT hardware towards the end of each financial year – typically end of March. Universities and colleges however operate a different financial year and therefore a different peak period. They also tend to operate a more structured asset refresh programme. The procurement of IT Hardware in each organisation reflects to some extent the IT Strategy and model adopted for the delivery of IT Services. The maturity of the approach employed varies by sector and within each organisation depending on its size and capability. There is awareness that the purchase of IT hardware should be seen in the context of total cost of ownership. This factor presents a challenge for many organisations both in meeting short timescales for procurement and in ensuring that terms of contract are competitive. Suppliers understand the pressures on organisations at this time of year, and may take advantage of the situation to improve the margins they might normally receive or to shift end of life stock. Sector spend on IT Hardware tends to be focused around the end of each financial year – typically March for Central & Local Government & June for Universities & Colleges 14 Recommended Procurement Practice The recommended Procurement route which has been endorsed by sectoral CoEs, is for organisations to use the Procurement Scotland National Agreement for IT Hardware The Procurement Scotland Collaborative Procurement Arrangement has achieved savings of 26%. It has delivered savings of over £3.7m which are forecasted to rise to over £5 million, Procurement Scotland is the organisation tasked with procuring national (Category A) commodities such as IT hardware on behalf of all Scottish public bodies. From now on, it is envisaged that Procurement Scotland will act on behalf of an increasingly large proportion of the Scottish Public Sector in the sourcing of IT Hardware, with organisations migrating across to the National Agreement as soon as is practicable. Procurement Scotland National Collaborative Arrangement for IT Hardware On 14 December 2007, Procurement Scotland held its first e-auction for IT Hardware. This project was the first demonstration of the benefits to be gained from collaboration at a Category A (National) level. To harness the combined purchasing power of the Scottish public sector, an eAuction was held for PCs, laptops and monitors, using the Catalist Framework of OGCbuying.solutions. Organisations from across the 6 Sectors in Scotland ranging from Central and Local Government to Fire and Rescue to the Police participated in the auction. It proved attractive to suppliers as it offered the opportunity to win crosssector business in Scotland for committed volumes of IT hardware equipment. It also offered the potential of substantial future volumes from other public sector organisations that can purchase off the contract over the next 12 months. The results of the auction have been very successful. Price savings have averaged 26% against an earlier auction held in February 2007, representing delivered savings of over £3.7 million Uplifts in the specification of hardware and improved energy efficiency will also bring additional business benefits to participating organisations. In addition, experience from previous auctions suggests that other organisations are likely to come on board later, with the result that projected savings will rise to over £5.7 million@ July 08 Further information about the e-auction and the national contracts for IT hardware can be obtained from Gordon Neill (Portfolio Manager for IT Hardware) and Gill McLeod (Strategic Buyer for IT Hardware) 15 Factors to consider in the Procurement of IT – Total Cost of Ownership A managed lifecycle plan is leading practice for organisations to control their desktop costs. Introduction Effective lifecycle planning will enable organisations to reduce complexity, better exploit technology advances and decrease lifecycle costs. Total Cost of Ownership (TCO) This section covers factors to consider in the procurement of IT goods and services. It firstly looks at Total Cost of Ownership (TCO) and the importance of developing a managed lifecycle plan to control desktop costs. It then introduces the concept of leasing and the factors for an organisation to consider before going into a leasing arrangement. The use of reverse eAuctions are reviewed and the benefits they provide are considered. The final part of this section looks at how the procurement of IT goods and services is moving from a commoditised to a solutions based approach. It also gives guidance on the factors organisations should consider before moving to models such as a managed, outsourced or shared service. To control costs, leading practice is for organisations to develop a managed lifecycle plan for their desktops environments. The diagram shows the key areas which the plan should cover: Procurement Strategies are where sourcing strategies, specifications etc. for hardware are agreed and communicated to business users, then executed in the market-place. Attributes include better supportability, manageability, a greater potential to invest in new technology and lower costs through increased negotiation leverage with suppliers. Technology Planning and Deployment refers to the multidisciplinary, multifunctional team that are responsible for managing the hardware requirements of the organisation to meet it objectives. Physical Management covers the ability to analyse the physical makeup of the installed base. Strategies include specifications for the purchase of new hardware, asset tracking, evaluating network based asset management tools and upgrading and redeploying hardware. Support Strategies cover the key role of technical support and help desk personnel in life cycle management. As they have a window to the installed base, they are critical to data gathering and vital to the development and ongoing success of life cycle management. Retirement and Disposal Strategies should be an explicit part of life cycle management and should specify retirement and refresh rates according to type of user, equipment or application requirements. It is strongly recommended that disposal is outsourced, as other disposal options e.g. donation, employee purchase often yield minimal financial return and introduce liability the organisation will need to manage. A life cycle strategy brings clarity rather then considering PC ownership as a series of isolated events. An effective life cycle plan will enable organisations to reduce complexity, better exploit technological advances and decrease life cycle costs. 16 Factors to consider in the Procurement of IT – Leasing A lease is a contractual arrangement by which the owner of the asset (the lessor) grants the use of his or her property to another party (the lessee) under certain conditions and for a specified period of time. Leasing works best when organisations match the terms of their lease to the amount of time they expect to use the equipment. Leading practice organisations evaluate a number of decision drivers before they proceed with lease analysis. Leasing Definition A lease is a contractual arrangement by which the owner of the asset (the lessor) grants the use of his or her property to another party (the lessee) under certain conditions and for a specified period of time. Leasing Decision Drivers Leasing works best when organisations match the terms of their lease to the amount of time they expect to use the equipment. When organisations do not return equipment to the leasing company at the end of the lease then additional costs are incurred. These costs will vary depending on a number of factors: • early termination of the lease, extending, renewing or end of term purchase • the relationship with the lessor • underlying terms and conditions Leading practice organisations evaluate the drivers of the decision making process, then proceed with lease analysis. The typical questions they ask are shown in the diagram below: 17 Factors to consider in the Procurement of IT – Leasing Key areas to consider before entering into a lease are that: Leasing Drivers •Replacement cycles for equipment are defined •The decision to lease is agreed across the organisation •Asset management is in place to track equipment •Equipment is future proofed to run planned applications The organisation needs to decide if it will replace equipment on a regular and pre-defined basis or use the equipment for an indefinite period of time Replacement Cycle Strategic View The decision to lease equipment is part of a well thought through strategy, with strong consensus across the organisation Asset Management The organisation has control of the means to keep track of the physical and contractual aspects of the equipment during its life cycle and to plan for equipment replacements and facilitate returns at the end of the lease term. Stable Applications The equipment being leased is powerful enough to run the applications expected to be used during the term of the lease. If these questions cannot be answered positively, then leasing is not an attractive alternative over purchase for the long term. In summary the key recommendations to consider before entering into a lease are: • Understanding the organisation’s motivations for leasing IT equipment • Working with finance to ensure the right type of lease either operating or capital is taken • Carefully negotiating terms and conditions • Negotiating the price of hardware first, then deciding if alternative funding models are appropriate 18 Factors to consider in the Procurement of IT – eAuctions eProcurement Scotl@nd (ePs) provides access to electronic auction functionality eAuctions through the eSourcing Scotland System. Reverse eAuction events are conducted on-line with pre-qualified suppliers being invited to compete normally on the basis of price. eAuctions are increasingly being adopted by major players in industry and in the public sector. Key benefits include: Potential price savings of over 25%, procurement time savings and a clear audit trail of activity Overview Electronic reverse auctions (eAuctions) are an innovative procurement technique that use secured internet-based technology. eProcurement Scotl@nd (ePs) provides access to electronic auction functionality through the eSourcing Scotland System. This system is an element of the ‘core’ ePs service and is available to any organisation participating in the programme. How Reverse eAuctions work Reverse eAuction events are conducted on-line with pre-qualified suppliers being invited to compete on predetermined and published award criteria. They can be on any combination of criteria but are normally on price. Bidders are able to introduce new or improved values to their bids in a visible and competitive environment. The procedure and duration of an event is defined before the auction commences. This includes the setting of a starting value that suppliers will bid against until the competition closes. Who uses eAuctions eAuctions are increasingly being adopted by major players in industry and in the public sector. eAuctions are firmly built into the procurement strategies of many private sector companies to source goods and services. They are increasingly used to support management of the supply chain and are not restricted to primary suppliers. Are eAuctions compliant with EU Directives The correct use of eAuctions is entirely compliant with both current legislation and the new EU public procurement legislative package which specifically features eAuctions. Key benefits of eAuctions are there transparency and that they have a strong competitive element. They also offer the buyer the opportunity to arrive either at or close to the true market price in an efficient and transparent way, but does not encourage suppliers to submit bids at unsustainable levels. Benefits of eAuctions • Cost savings – price savings of 20 – 25% are not uncommon • Time Savings – an auction can shorten the often lengthy post tender discussions • Ability to open up a procurement to a wider market • Transparency of the process to all participants • Electronic audit trail of activity 19 Factors to consider in the Procurement of IT – Commodity to Solutions Based Procurement Introduction The diagram below shows the typical sub components of areas purchased by IT: Enterprisew are Servers & Storage Desktop & Devices Netw ork Application Services Management & Security Application Softw are Internet & Intranet •IT goods and services across the public sector today are typically purchased at a sub component level. •The increasing trend is to purchase IT as a solution which involves the bundling of these sub components. •This trend is being driven by the move to shared, managed and outsourced services. Netw orks As we have seen from the section on current procurement practices across the public sector in Scotland, IT goods and services tend to be procured at a commodity level. The recent procurement of desktops and laptops through an eAuction is an example of this approach. Although this approach is appropriate at the present time it is increasingly evident there is an emerging trend for IT goods and services to purchased as a solution through the mechanism of a managed, shared or outsourced service. Today Tomorrow Purchase commodity items more cheaply Consider the cross category implications and interdependencies Buy Software Buy the commodities Buy Hardware But also…. Buy Telecoms Consider the interdependencies between the hardware, software, telecoms The future Buy managed services Buy managed services Activities & components Business outcome focused Buy a managed data centre, telecoms, software and servers Buy a payroll service Public Sector Transformational Agenda Supplier driven convergence e.g.. software and telecoms Improved cost and effectiveness of solutions 20 Factors to consider in the Procurement of IT – Commodity to Solutions Based Procurement The transformational journey to either a shared/managed or outsourced service can be decided by following a structured approach. The Transformational journey to a Shared/Managed Service There is a structured approach organisations can follow regarding how they decide about how they move to a shared/managed service. This approach is outlined below: 1. Overall operating model 2. Define the function and its scope Agree an organisational model based on managed services which have more than one customer Ownership route? Agree the scope, the priorities for improvement and the fit with the wider operating model 3. Arms Customer and provider roles It will be length made distinct necessary to management make it armslength from its customers Choose degree, style, behaviours, By creating a 4. Commercialisation accountabilities, mechanics customer role, commercialisation is inevitable but the Choose type of approach is flexible. independence, equity, 5. Externalisation rules, right to trade To provide to other organisations, it will be necessary to make Choose model - JV, sale, it independent but outsource, in source , 6. Private there are many sub-contractor, etc sector role Decide on need for options expertise, risk transfer, Manage role as 7. Manage investment, scale. owner, client new and or partner processes Ensure all parties are Decision-Making Process Internal shared service External shared service Private sector partner well equipped to play their new roles 21 Factors to consider in the Procurement of IT – Buying a Managed Service •The key factors to consider in deciding to buy a managed IT service cover risk and cost. •Risk considerations cover: - complexity of the infrastructure and applications being deployed -availability and skills of internal resources - impact on the business of failure - influence over suppliers in the market to get the support you need Buying a Managed Service There are a number of key factors to consider when procuring new IT systems that will dictate whether the procurement of component items is appropriate or whether a packed solution would deliver greater benefits. The decision criteria can broadly be split in to two categories. • Risk • Cost The inability to manage / mitigate risk may result in a cost impact however, in this context cost means the ability to procure goods or services at an economic rate. Risk Considerations: Complexity – is the internal organisation geared up to manage the complexity of the infrastructure and applications to be deployed? Do you have experience of delivering similar programmes or does the “newness” of the technology mean that there is the potential for large numbers of unknown issues that may cause delays / failures? Resources - can the organisation afford to dedicate resources to the project and if they do will this impact on Business as Usual (BAU) service delivery? If in house delivery can only be achieved through the use of contractors, can you make an effective knowledge transfer to BAU personnel? Does the use of contractors pose a continuity risk – will they stay? How easy is it to find appropriate skills in the market place and will this delay / prevent project initiation? Impact of failure – If the project fails or is delayed what are the consequences? Will there be large scale financial implications that need to be covered? Is there a consequential impact to the business that will be caused by delay? Influence over supply chain – Do you have the right relationships with the supply chain to manage their input effectively? Is your organisation / project significant enough to get the appropriate levels of pre sales and implementation support you need from the vendors? All of the above risks must be considered carefully before embarking on an IT procurement. The consequence of not having enough or appropriate resources can cause many impacts. Often the impacts are not valued and understood as internal resource costs remain “invisible”. However consequential impacts through late delivery or ineffective deployments can often mean that the benefits cannot be realised or are late to be realised impacting the early business case. By selecting a managed service, whether a managed implementation or an ongoing support arrangement as well, an organisation can mitigate some or all of these risks by accessing larger pools of skilled resources and having the comfort of contractual terms that will mitigate the impacts of failure. 22 Factors to consider in the Procurement of IT – Buying a Managed Service •Cost considerations include factors such as: - buying power of the organisation compared to the service provider - financial constraints where costs need to be revenue rather then capital based - guaranteed benefits where the delivery of benefits is underwritten by the supplier •All risk and cost factors must be carefully considered as they will have an impact on the effective delivery and deployment of the solution Cost Considerations: Scale – can you buy the components that make up the service you want to create in sufficient volumes to realise reasonable discounts? It may be the case that a managed service provider will have far better buying power with the component providers than you and can deliver some of the benefits to you. You may therefore incur additional external costs for implementation but off set this with hardware and software pricing (or vice versa). Capital Constraints – Do you have capital issues and need to have the costs presented in a revenue format. Managed services can be an effective way of managing capital efficiently. Guaranteed Benefits – in much the same way as managed services can protect you from variable project costs, it is possible to use managed services to provide guaranteed benefits. By inviting suppliers to take on the risk of the business success of the projects you may be able to guarantee your return. This is a high risk venture for the supplier and you will pay a premium, however it means you can effectively forecast the benefits and protect yourself from risk of failure to derive efficiencies etc. This also means that the supplier will necessarily become much more integrated and intimate with your business and this is a consideration. Managed services are seldom sought on a cost efficiency basis alone. There is typically a mix of factors that contribute to the decision and it is a balance of cost and risk that makes them attractive. The key challenge for an organisation is to recognise what they are good at and to be honest with themselves about what they are not so good at. It is vital that the organisation has good visibility of their internal costs and calculates there real costs of over runs and failures when reviewing their record at managing risk and cost. It is equally important that when buying a managed service, the organisation can define the boundaries of the responsibility of the supplier and have a clear mechanism for integration of the service into their governance models. When considering the benefits of a managed service, often the net result will be passing all or part of a role to the supplier. If it is only parts of roles, then the organisation must consider whether the role itself can be consolidated or removed to realise the benefit or whether residual responsibilities will persist post the service implementation meaning that costs are in fact increased. 23 IT Hardware Strategy Core objectives for the procurement of IT Hardware are: - Public sector organisations will purchase requirements from Procurement Scotland arrangements - There will a regular schedule of eauctions providing best value - Strategic relationships with key suppliers will be managed by Procurement Scotland - eProcurement will be used for the purchase of requirements - Active engagement with IT Managers ensuring compliance to Procurement Scotland arrangements -In-depth consultation with market players To achieve these objectives will require: - Evaluating the feasibility of developing a standalone framework for Scotland -Strategic decision making is made through the National Category Forum -Regular engagement with IT Managers -Development of standard specifications that are future proofed -The use of leading practice techniques in the management of IT Hardware e.g. managed services Category Objectives The core objectives for procurement of IT hardware in the public sector is that: • By 2009, significant levels of purchases of (in scope) IT hardware by public sector organisations will be executed through collaborative arrangements aligned to the Procurement Scotland’s strategy to meet the needs of the end user and provide best value. • There will be a planned schedule of regular e-auctions for high end specification hardware with committed volumes to ensure that the best market prices are consistently achieved and that organisations can benefit from advances in technology. • Procurement Scotland will manage the strategic relationships with key national suppliers working collaboratively across the sectors, to ensure that they are fully committed to working positively with the public sector to achieve the benefits that are possible. • eCommerce including eProcurement will be used extensively to manage the sourcing and procurement where appropriate. • There will be active and positive engagement by public sector IT managers in the work of Procurement Scotland to ensure that there is full commitment to the procurement routes established. • All organisations in public sector will have access to current thought leadership on technical and IT management issues which will influence their procurement activities. •Category development will include in-depth consultation with private sector players – both companies and representative groups – to ensure strategies reflect the full circumstances of the sectoral market, including the impact on competition and broader economic development (including SMEs). Long Term Goals/Aims In order to deliver the vision for IT hardware, a number of goals have been identified that must be met. These are: • Development of a schedule for collaborative procurement activities including e-auctions to support both tactical and strategic buying. • Evaluation of whether a standalone IT Hardware framework contract for Scotland is appropriate. • Communication and co-ordination of strategic decisions shall be managed through the National Category Forum and disseminated by the Sectoral CoEs and User Intelligence Groups (where they exist) to facilitate better buying and alignment with strategic direction of the end users organisations. • Implementation of a communication programme to engage public sector IT managers to identify any barriers and gauge commitment to central procurement. Use of existing networks such as the Society of IT Managers (Socitm) should be considered together with existing groups such as JISK, HEIDS (within HE/FE) and other evolving networks across the sectors. • Development of standard specifications for all sub-categories of IT Hardware across all sectors with focus towards future proofed, high end products. • Development of leading practice guidance in the management of IT hardware including the procurement of a managed service, servers and lease or buy arrangements. • TCO models shall be in place for the provision of IT Services together with supporting white papers in other technical areas that will influence procurement activities e.g.. server computing. • Development of an approach for the procurement of servers 24 Key Contacts for Further Information The contacts below are members of the National Category Forum for IT Hardware and should be approached if you have any questions on the purchase of IT Hardware for your organisation. Organisation Contact Role Tel Email Procurement Scotland Gordon Neill Portfolio Manager for IT 0131 244 8145 Hardware gordon.neill@scotland.gsi.gov.uk Procurement Scotland Gill McLeod Strategic Buyer for IT Hardware 0131 244 8186 gill.mcleod@scotland.gsi.gov.uk Advanced Procurement for Universities & Colleges Karen Andersen Procurement Portfolio Specialist 0131 455 3591 kanderson@apuc-scot.ac.uk Central Government Centre of Excellence Stephen Bennetts Sector Lead for IT Hardware 0131 244 7172 stephen.bennetts@scotland.gsi.gov.uk National Health Service Scotland Barry-John McGahon Sector Lead for IT Hardware 0131 275 7076 Barry-John.McGahon@shs.csa.scot.nhs.uk Scotland Excel Owen Paterson Sector Lead for IT Hardware 0141 842 6664 owen.paterson@scotland-excel.org.uk 25