main textbooks

advertisement

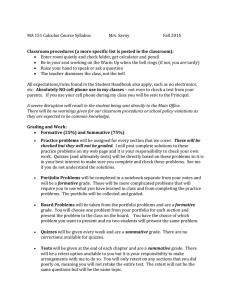

PORTFOLIO MANAGEMENT MSc Programmes Module Handbook 2013/14 Business Faculty Plekhanov Russian University of Economics Contents Lecturer Aims and Objectives Delivery Mechanisms Summative Assessments Formative Assessment Tutorials/Seminars Communication Obtaining Help Main Textbooks Course Outline Tutorial/Seminar Questions 1 PORTFOLIO MANAGEMENT MSc Programmes Module handbook 2013/14 Lecturer: Otto Khatamov (Senior Lecturer) Tel: E-Mail: mr.khatamov@mail.ru MODULE AIMS AND OBJECTIVES: This module aims to: develop students’ knowledge and understanding of key issues in asset allocation and portfolio composition and management at an advanced level; provide students with the opportunity to develop the ability to critically understand current theoretical and empirical research in the field of portfolio theories and their implications on alternative portfolio composition and management strategies. Learning Outcomes Upon completion of the module, you should have: used highly specialised and advanced technical, professional and academic skills in asset allocation and composition and management of portfolios; explored, understood and appreciated the complexity and contradictions of the current academic literature and its implications for professional practice, and be able to identify open questions for their own research; demonstrated ability to learn and work independently in this area, exercising critical judgement and discrimination in the resolution of complex problematic situations; practised problem solving and analytical skills in a complex specialised context. In addition, you should also have developed further the following key skills: Written Communication - e.g. by completing summative assessment Interpersonal Communication - e.g. by working in teams to prepare the discussion for group presentations; using e-mail to communicate with other students and class leaders; discussing prepared material in classes with both the class leader and other students in the group. Oral Presentation - e.g. by giving group presentations and explaining the answers to class questions to other students and the class leader; in general, by actively participating in discussion during classes. Planning, Organisation and Time Management - e.g. by working in teams; preparing for classes; observing the strict assignment deadlines; revising relevant material before lectures; preparing for examinations. Problem Solving and Analysis - e.g. by applying the necessary analytical and quantitative skills, as well as the ability to manipulate concepts in market microstructure, in answering class questions and undertaking assessed work. 2 Initiative - e.g. by organising teamwork and group presentations; searching relevant literature and information in preparation of the formative essay. Numeracy - e.g. by applying core mathematical and statistical skills to answer a range of class and examination questions. Computer Literacy and Information Retrieval - e.g. by word-processing formative assignments; using e-mail to communicate with the class leader and other students; undertaking bibliographical search and information retrieval for studentcentred learning. DELIVERY MECHANISMS Lecture: 4-hours per week Tutorial/Seminar: 2-hours per fortnight (3 seminars) Seminars/computer labs are designed to give students the opportunity to explore issues in depth and participate in discussion on contemporary issues related to the topics covered. SUMMATIVE ASSESSMENT The summative assessment is by a 3000 word (maximum) written assignment YOUR COMPLETED ASSIGNMENT MUST BE SUBMITTED TO THE MSc OFFICE NO LATER THAN 12PM ON…. COMMUNICATION: Staff will communicate with students via announcements in lectures and classes, notices by e-mail, and during the consultation hours. All students should also check their e-mail for messages. If students wish to communicate with fellow class group members on matters relating to the module they may do so by e-mail. OBTAINING HELP Students who are experiencing difficulties regarding this module should contact the member of staff responsible for their class group in the first instance. All staff teaching on the module will have regular consultation hours. Alternatively, students can contact the relevant member of staff by e-mail to raise difficulties or to arrange a meeting. Students may also contact the module leader to discuss difficulties. MAIN TEXTBOOKS The main textbooks for this module is: Z. Bodie, A. Kane and A. J. Marcus, (2005), Investments, Irwin, 6th edition or latest edition 7th if available. F. K. Reilly and K. C. Brown (2005), Investment Analysis and Portfolio Management, Thomson – South-Western, 8th edition J. L. Maginn, D. L. Tuttle, J. E. Pinto and D. W. McLeavey (2007), Managing Investment Portfolios: A dynamic process, Wiley, 3rd edition Note: not all topics of this module are covered in these textbooks. Detailed reading list on each topic will be given at lecture. Further references, wherever necessary, will 3 be provided during the lecture sessions. Students should also undertake their own search for additional relevant literature and follow up relevant references contained in the literature identified below. COURSE OUTLINE Investment Policy Statement Expected Returns and Risk Capital Allocation Asset allocation Efficient Market Hypothesis Passive Investments Active Investments Portfolio Performance Evaluation Fixed Income Securities: Analysis and valuation Managing fixed income securities Derivative Securities and Portfolio Risk Management 4