Accounting 10 Final

advertisement

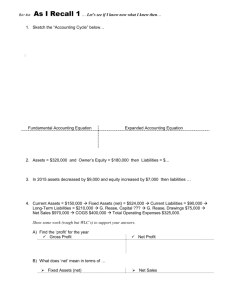

ACCOUNTING 10 FINAL HANDOUT– 2015 INFORMATION: Day of the Exam: Hand in your textbook and signed out chapter exams. Hand in study notes the day before the exam for bonus marks. I will then hand them back for you to study Ask yourself the following questions and some advice: 1. What do I need to do to finish this class off strong? 2. Do I have my computerized case study in and will I get 100%? 3. What do I need to do to prepare for the comprehensive final? 4. Do I plan on creating study notes/cheat sheets that will give me bonus marks? 5. Take ownership for your own learning! HOW TO STUDY: 1. Review your notes, questions, vocabulary and multiple choice questions from each chapter. 2. Skim over each chapter, take notes and copy examples in areas that you need to become stronger in. 3. Do the multiple choice questions at the end of each chapter in your workbooks. 4. Review chapter questions from each chapter. 5. Review problems from each chapter. 6. Vocabulary is key! 7. Go over the exams and redo them for practice. 8. Create study notes from each chapter; if you hand them the day before the exam you will get bonus marks on your final. Maximum one page per chapter. 9. Quiz each other – try and think of the types of questions the teacher would ask. 10. Quia Quizzes Accounting 10 Final Review 1 EXAM Comprehensive Final o 10-15% of your final mark o 100 mark Comprehensive Exam o 100 mark Monopoly Project Content: o Chapter 1- 6, Chapter 7, Accounting Careers Theory: o Multiple Choice, Fill in the Blank, Matching, Charts (debit or credit, income statement or balance sheet), Short Answer, Balance Sheet and Income Statement Problems TOPICS GAAP GAAPs (entity, revenue principle, expense principle, matching principle, objectivity principle, cost principle, CICA Handbook, going-concern concept, time-period concept) CICA Handbook/CPA Career Managerial Accounting – Special purpose reports Financial (general) Accounting – General purpose reports Careers, bookkeeper, accountant, Certified Professional Accountant, Educational choices: college, university, on job training, designation, co-operative education Public, private and government sector of business 8 Steps in the Accounting Cycle 1. 2. 3. 4. 5. 6. 7. 8. Originating Data Journalizing Posting Trial Balance Work Sheet Financial Statements Closing entries Post-Closing Trial Balance Accounting 10 Final Review 2 ** You must be able to perform tasks related to each step! Chapter 1 Establishing a Business Definitions (economic resources, creditor, debitor, cash, mortgage payable, accounts receivable, accounts payable, balance sheet, capital, liquidity) Difference between sole proprietorship, a partnership and a business corporation Accounting Equation (examples of assets, liabilities, and owner’s equity) Calculate owner’s equity Balance Sheet (you will need to know the account form, report form and classified balance sheet – refer to chapter 5) You must know how to do the Owner’s Equity part of the balance sheet 1. C.Lapointe, Capital $1000 2. Add: Net Income 500 3. 1500 4. Less: C.L,. Drawings 300 5. Total Owner’s Equity 1200 Placement of the dollar signs (first amount in a column and with any subtotal or total in a column) Order of listing assets and liabilities Single line and double line, how to make corrections Chapter 2 Analyzing Changes in the Accounting Equation Definitions (business transaction, summary table, drawings, commissions, expenses, net income/loss, Revenue and Expense Transactions, How to do an income statement (dollar signs, indents, order, single and double underline – REVIEW AND KNOW IT FOR THE EXAM) How to complete a balance sheet (columns, indents, totals, order, titles, centering, dollar signs, - CHECK YOUR NOTES AND MAKE SURE YOU KNOW IT) Benefits of using a spreadsheets (what if statements, formulas – sum, subtraction, programming abilities, etc) Chapter 3 Using Accounts Definitions (account, debit, credit, T-account, opening balance, balance) Know your debits and credits for each type of account Know how to increase and decrease all accounts (review your notes) Double entry – for every transaction, the debit entry or entries must equal the credit entry or entries Compound entry – more than two accounts affected by a transaction Owner’s Equity: capital, revenue, expenses, drawings (which ones increase and decrease owner’s equity) Accounting 10 Final Review 3 Chapter 4 Identifying the Bookkeeping Base of Accounting Definitions (source documents, purchase invoice, sales invoice, cheque record, remittance slip, journal, general journal, journalizing, post reference, opening entry, compound entry, posting, ledger, book of original entry, book of final entry, general ledger, chart of accounts (Assets 100-199, Liabilities 200-299, etc.) There are 5 steps to journalizing There are 6 steps to posting (left to right, don’t forget to post reference in the journal and go line by line) The Steps in the Accounting Cycle (all eight steps – Chapter 6 – GUARENTEED TO BE ON THE EXAM) Accounting Proofs (journal proof, individual account balances) Trial Balance Bookkeeping vs Accountant (There will be a couple questions on the exam) Chapter 5 Preparing Financial Statements Definitions (worksheet, primary revenue, secondary source of revenue, auditors) 6 Steps to complete the 6 column worksheet (finding a net loss or a net income) PAY ATTENTION TO DETAILS - the totals should all be on the SAME LINE AND YOU NEED DOUBLE LINES UNDER THE END TOTALS Preparing financial statements (income statement and balance sheet) Balance sheet (account form, report form, classified balance sheet, current assets, fixed assets, current liabilities, long term liabilities, mortgage, security, current portion of mortgage payable – PAY ATTENTION TO DETAILS (dollar signs, underlines, indents, totals, etc) All steps of the accounting cycle How to interpret income statement and balance sheet – read the handouts and know the points Expired costs – expenses - costs used up in the process of making revenue Unexpired costs – assets – economic resources to be used in the future to create revenue Accounting 10 Final Review 4 Chapter 6 Closing the Ledger and Completing the Accounting Cycle (Note: need to change for future years) The need for closing o 1st – update the capital account balance so that it agrees with the total owner’s equity in the balance sheet, this account is balanced by transferring the net income through ledger accounts to the Capital account o 2nd – it is necessary to clear all revenue and expense accounts at the end of the accounting period so that they can receive only the figures of the next period. All revenue and expense accounts must be closed (equal to zero) 399 Transfer revenue account balances, transfer expense account balances, transfer the R & E Summary Balance to the Capital Account, Transfer Drawings to the Capital Account Definitions: temporary account (revenue, expense, R & E summary and drawings), permanent accounts, revenue and expense summary Spreadsheets /SAGE Simple Accounting Benefits of spreadsheets Benefits of computerized accounting software General Information about each one Chapter 7 – Adjusting Entries Prepaid Expense/Prepaid Assets Adjusting entries Depreciation Straight-line method Accumulated depreciation/Contra Accounts Depreciation expenses 10 column worksheet Other terms: physical deterioration, obsolescence, disposal value, estimated useful life, book value, adjusted trial balance Practical Problems Financial Statements (Opening BS, Income Statement, Classified Report Form BS, Classified Account Form BS) Work sheet Closing Entries Trial Balance Journalizing Posting Accounting 10 Final Review 5