GASB #34 – Annual Financial Report

advertisement

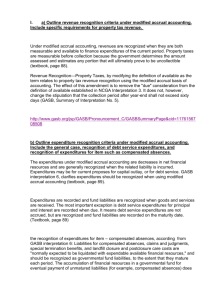

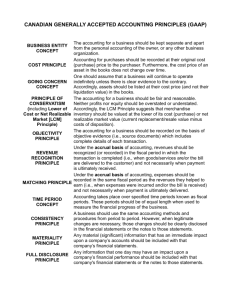

GASB #34 – Annual Financial Report What you need to know Presented by: Bonnie L. Kabonick, Chief LECS Comptroller’s Office School Finance Division bkabonick@state.pa.us Mary Kay Beer, Chief LECS Comptroller’s Office School Accounting Section mbeer@state.pa.us FYI With the implementation of Phase II, there will be over 400 LEAs using the new reporting model Early implementation is encouraged Schools required to implement in Phases I & II will not be given access to the “traditional” AFR reporting package Schools that do not complete the package in compliance with the new reporting model will have their files returned and will be considered not filed Required Reporting MD & A – separate reporting method Basic Financial Statements (BFS) – prepared using Access database Schedules - prepared using Access database Revenue and Expenditures – prepared using Access database Note Disclosures to the Financial Statements – separate reporting method Package will be available on the web A Look at the Statements Two Government Wide Statements Statement of Net Assets (Government Wide) Statement of Activities (Government Wide) Report financial data using the full Accrual basis of Accounting Old and New Statements Fund Financial Statements Similar to traditional statements Reported using the modified accrual basis Presented using the Major and Non Major fund criteria Reconciliation Statements (2) Provide a link from Fund Financial Statements to Government Wide Statements Old and New (continued) Budget and Actual Statement – additional column that reports Final budget Statement of Net Assets Proprietary Funds – reported using the full accrual basis of accounting and the Major and Non Major criteria Internal Service fund presented separately Old and New (continued) Statement of Revenues, Expenses and Changes in Fund Balance – reported using the Major and Non Major criteria Statement of Cash Flows – reported using the Major and Non Major fund criteria More Statements Statement of Cash Flows – Presented using the Major and Non Major criteria – accrual basis Internal Service fund reported as a separate column Statement of Net Assets – Fiduciary Funds Statement of Changes in Net Assets – Fiduciary Funds Important Information LEAs must report non current assets and liabilities on the government wide statements. A validation has been built into the database to check for accurate reporting. The Reconciliation Statements must be completed. A validation will check that this Statement is completed. What else should I know? You may still use the DFL to load your revenues and expenditures Revenues and Expenditures will still roll up to the appropriate Statements Refer to the Major Fund Determination worksheet for the formula to identify Major funds Where can I get help? The Comptroller’s website: www.pde.state.pa.us/school_acct The GASB website: www.gasb.org The PASBO website: www.pasbo.org Various reference books including the GAAFR, and the Manual of Accounting and Financial Reporting for PA Public Schools (available on the Comptroller’s web site).