- CompiledWordformsAT Staffing App

advertisement

Staffing, LLC

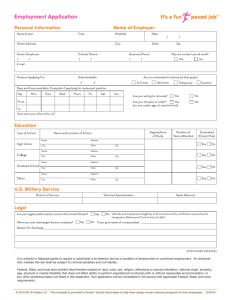

APPLICATION FOR EMPLOYMENT

DATE: ____/____/____

WE CONSIDER APPLICANTS FOR ALL POSITIONS WITHOUT REGARD TO RACE, COLOR, RELIGION, SEXUAL ORIENTATION, NATIONAL ORIGIN, AGE, CREED,

GENDER, MARITAL OR VETERAN STATUS, AND HANDICAP DISABILITY, THE PRESENCE OF A NON-JOB-RELATED MEDICAL CONDITION OR ANY OTHER

LEGALLY PROTECTED STATUS.

SEX OFFENDERS NEED NOT APPLY

PERSONAL INFORMATION

S.S. #______-______-______

Name:_________________________________________________________________________________

(First)

(Middle)

(Last)

Address:_______________________________________________________________________________

(Street)

(Apt. #)

_______________________________________________________________________________

(City)

(State)

(Zip Code)

Email Address:__________________________________________________________________________

Home Phone #:__________________________

Cell Phone #:________________________________

Emergency Contact:______________________

Emergency Contact #:_________________________

POSITION INFORMATION

Position(s) applying for:__________________________________________________________________

Days available to work (please circle)

Salary Desired: $________________

Mon

Tues

Wed

Thurs

Fri

Sat

Sun

Minimum Rate willing to work for: $____________________

Willing to work (please circle all that apply)

TEMP

TEMP-TO-HIRE

PERM

Have you applied here before? __________ If yes, were you sent on assignment? ___________________

Are you currently employed? ___________ May we contact your present employer? _________________

Have you ever been convicted of a FELONY? (please check one) YES____________NO______________

If yes, please explain:

(Conviction will not necessarily disqualify applicant from employment)

EDUCATION

School

LOCATION

(city and state)

DATES

ATTENDED

DEGREE

OBTAINED

MAJOR

G.P.A.

EMPLOYMENT HISTORY

Company:

Address:

Phone :

Position Held:

City/State:

Industry:

Fax:

Supervisor’s Name:

Dates of Employment:

Ending Salary:

May we contact this employer?

Job Duties

Reason for Leaving

Company:

Address:

Phone :

Position Held:

City/State:

Industry:

Fax:

Supervisor’s Name:

Dates of Employment:

Ending Salary:

May we contact this employer?

Company:

Address:

Phone :

Position Held:

City/State:

Industry:

Fax:

Supervisor’s Name:

Dates of Employment:

Ending Salary:

May we contact this employer?

Job Duties

Reason for Leaving

Job Duties

Reason for Leaving

Company:

Address:

Phone :

Position Held:

City/State:

Industry:

Fax:

Supervisor’s Name:

Dates of Employment:

Ending Salary:

May we contact this employer?

Company:

Address:

Phone :

Position Held:

City/State:

Industry:

Fax:

Supervisor’s Name:

Dates of Employment:

Ending Salary:

May we contact this employer?

Job Duties

Reason for Leaving

Job Duties

Reason for Leaving

REFERENCES

Name

Relation

Telephone

Yrs. Known

I certify that the answers given herein are true and complete to the best of my knowledge. I authorize an

investigation of all statements contained in this application for employment as may be necessary in arriving

at an employment decision. I understand that neither this document nor any other offer of employment from

the employer constitutes an employment contract unless, a specific document to that effect, is executed by

the employer and me in writing. In the event of employment, I understand that false or misleading

information given in any application or interview(s) may result in discharge. I understand, also, that I am

required to abide by all rules and regulations of the employer.

Signed: ________________________________________________Date: _________________________

\

Staffing, LLC

CONFIDENTIAL INFORMATON

Name:_________________________________________________________________________________

Have you ever been convicted of a crime? ________YES ________NO

If yes, please explain:

____________________________________________________________________________________________

____________________________________________________________________________________________

List any Health/medical problems you now have which should be considered prior to assignment:

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

List ANY medications that you are currently taking:

____________________________________________________________________________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

**Some companies require drug testing therefore, you can be subject to drug testing.**

__________________________________________

Signature

_________________________

Date

Pre-Employment Inquiry Authorization Release

I. I understand that an investigative report may be generated on me that may include information as to my character, general reputation,

personal characteristics, or mode of living; work habits, performance or experience, along with reasons for termination of past

employment/professional license or credentials; financial/credit history; or criminal/civil/driving record history. I understand that USA

Intel, on behalf of (AT STAFFING, LLC) or its authorized agents may be requesting information from public and private sources about

any of the information noted earlier in this paragraph in connection with (AT STAFFING, LLC)’s consideration of me for employment,

promotion or position re-assignment or contract now, or at any time during my tenure with (AT STAFFING, LLC) and give my full consent

for this information to be obtained.

II. I acknowledge that a telephonic facsimile (FAX) or photographic copy of this release shall be as valid as the original. This release is valid

for most federal, state and county agencies.

III. I hereby authorize, without reservation, any financial institution, law enforcement agency, information service bureau, school, employer or

insurance company contacted by (USA INTEL, INC.) or our authorized agents, to furnish the information described in Section I.

APPLICANT – PLEASE COMPLETE THE FOLLOWING:

___________

__

Today’s Date

Signature

______

Print Name:

______

(First)

(Middle)

(Last)

(Maiden)

_______________________________________________________________________________________________________________

Other Names Used

Current Address Since:

_________

(Mo/Yr)

(State/Zip)

_________________________________________________________________________________

(Street)

(City)

Current Address Since:

_________

(Mo/Yr)

(State/Zip)

_________________________________________________________________________________

(Street)

(City)

Current Address Since:

_________

(Mo/Yr)

(State/Zip)

_________________________________________________________________________________

(Street)

(City)

The following information is required by law enforcement agencies and other entities for positive identification purposes when checking

public records.

It is confidential and will not be used for any other purposes.

Date of Birth

Social Security Number

Driver’s License Number and State

Have you ever been convicted of a crime? ___ No

Name as it appears on License

___ Yes

If yes, please provide city and state of conviction and details of conviction.

_______________________________________________________________________________________________________________

_______________________________________________________________________________________________________________

FAIR CREDIT REPORTING ACT NOTICE:

In accordance with the Fair Credit Reporting Act (FCRA, Public Law 91-508, Title VI), this information may only be used to verify a statement(s) made

by an individual in connection with legitimate business needs.

The depth of information available varies from state to state. Status of updates are available on request. Although every effort has been made to assure

accuracy, DirectScreening.com cannot act as guarantor of information accuracy or completeness. Final verification of an individual’s identity and proper

use of report contents are the user's responsibility. Our authorized agent, DirectScreening.com, has a policy that requires purchasers of these reports to

have signed a Service Agreement. This assures DirectScreening.com that users are familiar with and will abide by their obligations, as stated in the

FCRA, to the individuals named in these reports.

If information contained in this report is responsible for the suspension or termination of an employee or the application process, have the

Candidate/employee contact DirectScreening.com at 190 Haverhill Street, Methuen, MA 01844.

NOTICE TO CALIFORNIA CANDIDATES

You have a right to obtain a copy of any consumer report or investigative consumer report obtained by (enter company name here) by checking the box provided below. The report will be

provided to you within (3) business days after we receive the requested reports related to the matter investigated.

� I request to receive a free copy of this report by checking this box.

Under section 1786.22 of the California Civil Code, you may view the file maintained on you by DirectScreening.com during normal business hours. You may also obtain a copy of this file

upon submitting proper identification and paying the costs of duplication services, by appearing at DirectScreening.com in person or by mail. You may also receive a summary of the file by

telephone. The agency is required to have personnel available to explain your file to you and the agency must explain to you any coded information appearing in your file. If you appear in

person, a person of your choice may accompany you, provided that this person furnishes proper identification.

Form W-4 (2015)

Purpose. Complete Form W-4 so that your employer can

withhold the correct federal income tax from your pay.

Consider completing a new Form W-4 each year and

when your personal or financial situation changes.

Exemption from withholding. If you are exempt,

complete only lines 1, 2, 3, 4, and 7 and sign the form to

validate it. Your exemption for 2015 expires February 16,

2016. See Pub. 505, Tax Withholding

and Estimated Tax.

Note. If another person can claim you as a dependent

on his or her tax return, you cannot claim exemption

from withholding if your income exceeds $1,050 and

includes more than $350 of unearned income (for

example, interest and dividends).

Exceptions. An employee may be able to claim

exemption from withholding even if the employee is a

dependent, if the employee:

• Is age 65 or older,

• Is blind, or

• Will claim adjustments to income; tax credits; or

itemized deductions, on his or her tax return.

The exceptions do not apply to supplemental wages

greater than $1,000,000.

Basic instructions. If you are not exempt, complete

the Personal Allowances Worksheet below. The

worksheets on page 2 further adjust your

withholding allowances based on itemized deductions,

certain credits, adjustments to income, or twoearners/multiple jobs situations.

Complete all worksheets that apply. However, you

may claim fewer (or zero) allowances. For regular

wages, withholding must be based on allowances you

claimed and may not be a flat amount or percentage of

wages.

Head of household. Generally, you can claim head of

household filing status on your tax return only if you

are unmarried and pay more than 50% of the costs of

keeping up a home for yourself and your dependent(s)

or other qualifying individuals. See Pub. 501,

Exemptions, Standard Deduction, and Filing

Information, for information.

Tax credits. You can take projected tax credits into account in

figuring your allowable number of withholding allowances.

Credits for child or dependent care expenses and the child tax

credit may be claimed using the Personal Allowances

Worksheet below. See Pub. 505 for information on converting

your other credits into withholding allowances.

Nonwage income. If you have a large amount of

nonwage income, such as interest or dividends, consider

making estimated tax payments using Form

1040-ES, Estimated Tax for Individuals. Otherwise, you

may owe additional tax. If you have pension or annuity

income, see Pub. 505 to find out if you should adjust

your withholding on Form W-4 or W-4P.

Two earners or multiple jobs. If you have a working

spouse or more than one job, figure the total number of

allowances you are entitled to claim on all jobs using

worksheets from only one FormW-4. Your withholding

usually will be most accurate when all allowances are

claimed on the Form W-4 for the highest paying job

and zero allowances are claimed on the others. See

Pub. 505 for details.

Nonresident alien. If you are a nonresident alien, see

Notice 1392, Supplemental Form W-4Instructions for

Nonresident Aliens, before completing this form.

Check your withholding. After your Form W-4 takes

effect, use Pub. 505 to see how the amount you are

having withheld compares to your projected total tax

for 2015. See Pub. 505, especially if your earnings

exceed $130,000 (Single) or $180,000 (Married).

Future developments. Information about any future

developments affecting Form W-4 (such as legislation enacted

after we release it) will be posted at www.irs.gov/w4.

Personal Allowances Worksheet (Keep for your records.)

Enter “1” for yourself if no one else can claim you as a dependent . . . . . . . . . . . . . . . . . .

A

• You are single and have only one job; or

• You are married, have only one job, and your spouse does not work; or

Enter “1” if:

. . .

B

• Your wages from a second job or your spouse’s wages (or the total of both) are $1,500 or less.

Enter “1” for your spouse. But, you may choose to enter “-0-” if you are married and have either a working spouse or more

than one job. (Entering “-0-” may help you avoid having too little tax withheld.) . . . . . . . . . . . . . .

C

Enter number of dependents (other than your spouse or yourself) you will claim on your tax return . . . . . . . .

D

Enter “1” if you will file as head of household on your tax return (see conditions under Head of household above)

. .

E

Enter “1” if you have at least $2,000 of child or dependent care expenses for which you plan to claim a credit

. . .

F

(Note. Do not include child support payments. See Pub. 503, Child and Dependent Care Expenses, for details.)

Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $65,000 ($100,000 if married), enter “2” for each eligible child; then less “1” if you

have two to four eligible children or less “2” if you have five or more eligible children.

G

• If your total income will be between $65,000 and $84,000 ($100,000 and $119,000 if married), enter “1” for each eligible child . . .

Add lines A through G and enter total here. (Note. This may be different from the number of exemptions you claim on your tax return.) ▶ H

A

{

B

C

D

E

F

G

H

For accuracy,

complete all

worksheets

that apply.

}

{

• If you plan to itemize or claim adjustments to income and want to reduce your withholding, see the Deductions

and Adjustments Worksheet on page 2.

• If you are single and have more than one job or are married and you and your spouse both work and the combined

earnings from all jobs exceed $50,000 ($20,000 if married), see the Two-Earners/Multiple Jobs Worksheet on page 2 to

avoid having too little tax withheld.

• If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 below.

Separate here and give Form W-4 to your employer. Keep the top part for your records.

Form

W-4

Department of the Treasury

Internal Revenue Service

1

Employee's Withholding Allowance Certificate

OMB No. 1545-0074

▶ Whether you are entitled to claim a certain number of allowances or exemption from withholding is

2015

subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS.

Your first name and middle initial

Last name

Home address (number and street or rural route)

2

3

Single

Married

Your social security number

Married, but withhold at higher Single rate.

Note. If married, but legally separated, or spouse is a nonresident alien, check the “Single” box.

City or town, state, and ZIP code

4 If your last name differs from that shown on your social security card,

check here. You must call 1-800-772-1213 for a replacement card. ▶

5

6

7

Total number of allowances you are claiming (from line H above or from the applicable worksheet on page 2)

5

Additional amount, if any, you want withheld from each paycheck

. . . . . . . . . . . . . .

6 $

I claim exemption from withholding for 2015, and I certify that I meet both of the following conditions for exemption.

• Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and

• This year I expect a refund of all federal income tax withheld because I expect to have no tax liability.

If you meet both conditions, write “Exempt” here . . . . . . . . . . . . . . . ▶ 7

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete.

Employee’s signature

(This form is not valid unless you sign it.)

8

Date

▶

Employer’s name and address (Employer: Complete lines 8 and 10 only if sending to the IRS.)

9 Office code (optional)

Cat. No. 10220Q

10

▶

Employer identification number (EIN)

Form W-4 (2015)

Staffing, LLC

EMPLOYEE EXPECTATIONS

As an employee of AT Staffing, LLC, you will be expected to adhere to the following policies. Failure to do so could result in

immediate termination of employment. Please initial next to each statement and sign and date at the bottom.

Failure to report to an assignment without notifying AT Staffing, LLC in advance will result in immediate termination. You

WILL NOT be offered any future assignments.

It is ultimately your responsibility to turn in your time sheet, even if the client tells you that he will fax it. Hours must be

received by 9:00 am on Monday. We value you as an employee and want to ensure that you are paid in a timely manner.

Time sheets must be faxed or handed in at the end of each work week, All –Temps work weeks end on Sunday. AT Staffing,

LLC pays on a weekly payroll cycle, with funds deposited on Friday. The deadline for time sheet submittal is Monday at 9:00

am.

AT Staffing, LLC policy is to pay via Direct Deposit. Please print and complete a direct deposit form, with voided check or

stamped direct deposit information from your financial institution.

Direct Deposit receipts will be distributed ONLY to its recipient. AT Staffing DOES NOT give out cash advances.

The reason given for calling in for time off will be accepted at the discretion of AT Staffing, LLC. It may or may not be deemed

a reasonable excuse, and you will be advised immediately if you are expected to continue on assignment.

If you walk off of an assignment without giving prior notification to AT Staffing, LLC, any hours that you have not yet been

paid for, will automatically be paid at the current minimum wage rate.

All employees must provide their own work or steel-toe boots and be available by phone. Shorts are NOT permitted on any job

site.

All injuries must be reported immediately of occurrence.

Our policy includes random drug screens; refusal will result in immediate termination. Reporting to a job site under the

influence of drugs or alcohol will result in immediate termination.

It is clearly understood that, while on assignment, you are an employee of AT Staffing, LLC and NOT the company at which

you are assigned. Any employment issues must be brought to the attention of our office, IN ADDITION TO a supervisor at the

location that you are currently reporting to.

While on assignment, you are representing the quality of employees that we provide to our clients. You are expected to conduct

yourself accordingly. Any negative behavior that misrepresents AT Staffing, LLC will have consequences that may result in

termination.

You must notify our office within 24 hours of being released from an assignment.

I have read and understood all “Employee Expectations.” I agree to comply with the above policies while

employed with AT Staffing, LLC.

SIGNED___________________________________ DATE _________________

Staffing, LLC

Sexual Harassment Employee Acknowledgment

It is the policy of this Firm not to condone or permit any sexual harassment of our personnel. This would be in

violation of Title VII of the Civil Rights Act. Any person guilty of committing any of the following acts may be

discharged without notice. These acts include, but are not limited to unwelcome sexual advances, request for

sexual favors, or other verbal or physical conduct of a sexual nature that constitute unlawful sexual harassment

by:

1. Indicating submission to the conduct is either an explicit or implicit term or condition of employment;

2. Utilizing submission to or rejection of sexual advances as a basis for an employment decision affecting

the person rejecting or submitting to the conductor; or

3. If the conduct has the purpose or effect of substantially interfering with an affected person’s work or

performance or creating an intimidation, hostile or offensive work environment.

In the event that any of our employees feel that there is a violation of the type mentioned herein or any other

type of discriminatory conduct prohibited by Title VII of the Civil Rights Act or by any local, state or federal

anti discrimination ordinance, law or regulation, he or she should immediately bring it to the attention of your

immediate Supervisor and/ pr Ronald H. Park, Owner.

I ____________________ understand and agree to abide by the Sexual Harassment policy set forth by AT

Staffing, LLC.

________________________________

Employee’s Signature

______________________

Date

________________________________

Witness

_______________________

Date

Signed/dated copy will be retained in employee personnel file.

4639 Corona, Suite 99 • Corpus Christi, TX 78411

Office (361) 808-8367 • Fax (361) 808-8369

Staffing, LLC

Alcohol and Drug Abuse Policy

AT Staffing, LLC is a drug-free workplace. The purpose of this policy is to ensure the safety of all employees

and to promote productivity. This policy applies to all employees, contractors, and temporary workers.

Substances covered under this policy include alcohol, illegal drugs, inhalants, prescription, and over-the-counter

drugs.

We reserve the right to inspect our premises or these substances. We reserve the right to conduct alcohol and

drug test at anytime. We may terminate your employment if you violate this policy, refuse to be tested, or

provide false information.

Company Rules

You must follow these rules while you are on company premises and while you conduct company business. The

rules apply any place you conduct business, including a company vehicle or your own vehicle:

AT Staffing, LLC will not tolerate any use of illegal drugs, non prescribed drugs or alcohol during work hours.

If the employee comes to work under the influence of drugs or alcohol or uses drugs or alcohol during work

time, the employee will be immediately terminated.

PRE-EMPLOYMENT TESTING: any employee may need to submit to a pre-employment drug screen based on

the client request prior to start date. If the employee refuses to submit to the drug screen he or she will not be

allowed to work for that client and this will result in termination.

POST-ACCIDENT TESTING: any employee involved in an on-the-job accident or injury will be required to

submit to a drug test. “Involved in an on-the-job accident or injury” means not only the one who was injured,

but also any employee who potentially contribute to the accident or injury event in any way.

You must cooperate with any investigation into substance abuse. An investigation may include tests to detect

alcohol, drugs, or inhalants.

4639 Corona, Suite 99 • Corpus Christi, TX 78411

Office (361) 808-8367 • Fax (361) 808-8369

Testing

Testing may include urine, blood, swab, and breathalyzer tests. Before testing you will have the chance to

explain the use of any prescription drugs. We will follow all laws for keeping test results confidential.

If the employer receives notice that the employee’s test results were confirmed positive, the employee will be

responsible for all expenses associated with the injury. The employee will be given the opportunity to explain

the positive result following the employee’s receipt of the test result. AT Staffing, LLC and the client will not

be responsible for any liability associated with the injury.

An individual testing positive may not work or apply with AT Staffing, LLC for a time period of 90 days. At

the end of this period, the individual is responsible for any cost associated with testing for employment

considerations.

Agreement to follow policy

I have received and read a copy of the Safety Policy for AT Staffing, LLC. I agree to follow the rules in the

policy.

___________________________

Employee signature

_________________________

Date

___________________________

Witness signature

_________________________

Date

4639 Corona, Suite 99 • Corpus Christi, TX 78411

Office (361) 808-8367 • Fax (361) 808-8369

Staffing, LLC

EMPLOYEE TERMINATION NOTICE REQUIREMENT

I understand that Texas in an “Employment at Will” state and agree that my employment is for no definite period and may be

terminated at any time for any reason.

I understand that once a specific job assignment is completed or I am terminated, I am required to report back to my AT Staffing, LLC

representative within 72 hours for future employment assignments.

FAILURE TO COMPLY WITH THIS REQUIREMENT MAY CAUSE UNEMPLOYMENT BENEFITS TO BE DENIED.

_________________________________________

Employee’s signature

_________________________

Date

-------------------------- ------ ------ ----- ------- ----- ----- ---- ----- FOR OFFICE USE ONLY

Date of Termination:

____________________________________

Date Employee Reported for Reassignment:

____________________________________

_________________________________________

Signature of Employer

___________________________

Date

4639 Corona, Suite 99 • Corpus Christi, TX 78411

Office (361) 808-8367 • Fax (361) 808-8369

4639 Corona, Suite 99 • Corpus Christi, TX 78411

Office (361) 808-8367 • Fax (361) 808-8369

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)