Distributions

advertisement

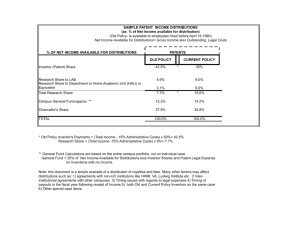

Distributions Actual and Deemed Actual – real distribution of assets by the partnership to the partner Deemed – adjustments to capital account where partner, per se, has not actually received an asset, but received a benefit or reallocation of their capital account – expenses paid on behalf of partner etc. Whenever capital account is adjusted not due to operations, likelihood is some form or distribution Look at general rule in Sec 731 Common Capital Account Adjustments Distributions treated as sales for purposes or partnership taxation – Disguised Sales Payments made on behalf of partner but not deducted by partnership– Charity / Medical Expenses / Foreign Taxes Paid, Alimony / Health Insurance / Personal expenses Sec 736 Payments (liquidating re-classed as Guaranteed Payments (ordinary income) Special Situations Distributions of Encumbered Property Relief of Debt / Assumption of debt deemed to occur concurrently Relief of Debt = Cash Distribution Assumption of Debt = Cash Distribution of marketable securities included as cash Exclude the appreciation related to his share of the gain since will be recognized upon sale Marketable securities – actively traded financial instruments (stocks, equity contracts, debt, options, futures contracts and foreign currencies) Sections Related to Distributions Sec 731 Sec 732 Sec 733 What is the rationale behind the distribution rules? Current and Liquidating Distributions (excluding Sec. 751(b) assets Most common distributions are cash In the case of cash distributions - gain is recognized to the extent cash distributions exceed basis (Sec.731) Loss is never recognized on current distributions Test cash distributions at year end, provides opportunity to correct basis problem before year end. Distributions other than cash - no gain/loss is recognized Basis of the property in the hands of the partner after distribution is the basis in the hands of the partnership unless the partners basis is less than the amount of the asset distributed. If combination of cash and property, first reduce basis by cash Other current distributions If unrealized receivables and/or inventory are distributed as a current distribution - allocate basis to them first to preserve basis in ordinary income property Ordering of distributions First to cash (Sec. 731) Next to 751(b) assets - unrealized receivables / Inv. Residual is allocated to the remaining property allocate first to the adjusted basis in the hands of the partnership allocate next to the relative appreciation of the assets finally, the residual allocated is based on fair market values. Liquidating Distributions Loss is recognized on complete liquidations only if cash, unrealized receivables or inventory is distributed. Other property distributions - basis of the property is determined under sections 732(b) and 732 (c) Basis of the property distributed - value of the partners basis. No loss recognized. Unrealized receivables and Inventory are allocated first.