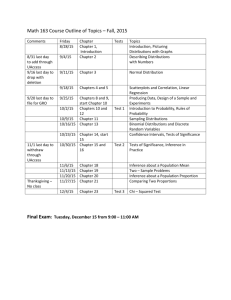

SAMPLE PATENT INCOME DISTRIBUTIONS (as % of Net Income

advertisement

SAMPLE PATENT INCOME DISTRIBUTIONS (as % of Net Income available for distribution) (Old Policy- Is available to employees hired before April 16,1990) Net Income Available for Distributions= Gross Income less Outstanding Legal Costs % OF NET INCOME AVAILABLE FOR DISTRIBUTIONS PATENTS OLD POLICY CURRENT POLICY Inventor (Patent) Share 42.5% Research Share to LAB Research Share to Department or Home Academic Unit (HAU) or Equivalent Total Research Share 4.6% Campus General Fund-approx. ** 12.3% 14.2% Chancellor's Share 37.5% 35.8% TOTAL 100.0% 100.0% 3.1% 7.7% * 35% 9.0% * 6.0% 15.0% * Old Policy Inventor's Payments = (Total Income - 15% Administrative Costs) x 50%= 42.5% Research Share = (Total Income -15% Administrative Costs) x 9%= 7.7% ** General Fund Calculations are based on the entire campus portfolio, not on individual case. General Fund = 25% of Net Income Available for Distributions less Inventor Shares and Patent Legal Expense on Inventions with no Income. Note: this document is a simple example of a distribution of royalties and fees. Many other factors may affect distributions such as: 1) agreements with non-UC institutions like HHMI, VA, Ludwig Institute etc. 2 InterInstitutional agreements with other campuses 3) Timing issues with regards to legal expenses 4) Timing of payouts in the fiscal year following receipt of Income 5) both Old and Current Policy Inventors on the same case 6) Other special case items.