Basic Financial Statements

advertisement

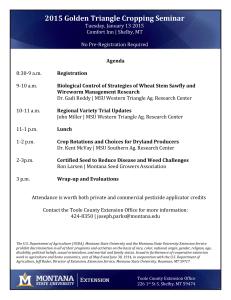

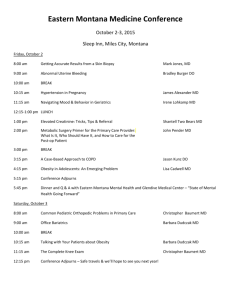

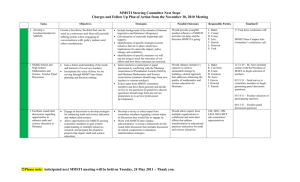

Managing Risks With Financial Analysis What's Your Plan? What's Your Plan? Production Financial Marketing Human Resource Montana State University 2 Are You a Risk Taker????? Production Financial Marketing Human Resource Montana State University 3 Do You Take Unnecessary Risks???? Montana State University 4 Objectives For This Session Gain an understanding of: Business’s financial position & performance analysis Interaction among financial statements Financial interaction/impact the family has on the business Different types of risk affecting the business. Montana State University 5 Key Producer Items/Concerns Adequate funds for family living (All Families) Alternative enterprises, enterprise mix Debt Load and Structure Expansion plans/capabilities Dependences Government payments Off Farm Inflows Managing cost of production, financial info, marketing, labor (family) Tight profit margins Montana State University 6 Financial Trends in Agriculture Suggest several slides reviewing Ag financial health Trends in Farm Net Income Debt Load and Structure Number of farms Sources of Ag Household income Use these as background information Three examples follow Montana State University 7 Net Farm Income Montana State University 8 Net Cash Farm Income Montana State University 9 Total Production Expenses Montana State University 10 Complete Financials Required Beginning and Ending Balance Sheets Cash Flow Statement New form = Statement of Cash Flows Accrual Adjusted Income Statement Statement of Owner Equity Montana State University 11 Terminology Causes Us Problems All cash inflows are not income All cash outflows are not expenses Principal payments to lenders Expense versus Expenditure You can have non-cash expenses Loan proceeds from lenders Depreciation most common Also through accrual adjustments You can have non-cash income Accrual adjustments Montana State University 12 Just Like Balancing a Check Book + - = Beginning Cash Balance Inflows These are Linked Outflows Ending Cash Balance Your business performance is measured the same way using a complete set of financial statements Montana State University 13 Statement of Owner Equity Beginning Owner Equity + Net Income Balancing a Checkbook - Withdrawals Beginning Equity + Contributions +/- Activity = Ending Equity - Distributions +/- Change in Valuation = Ending Owner Equity Montana State University 14 Some Topics for Examination Withdrawals Non-business income Government Payments Cost of Production Debt Load (asset and liability structure) Asset revaluation Capital asset purchase Risk Protection Tools (Insurance) Non-cash income Non-cash expense (not depreciation) Contributed capital Distributed capital Montana State University 15 Withdrawals Note the: Net worth (equity) on the balance sheet and the change in equity from beginning to end of year Note net income (Accrual Adjusted Income Statement) The relationship between cash flow and the balance sheet, follow the red arrows. Change family withdrawals to zero What is relationship of Net Income and change in equity What does this tell us about how equity growth in the business MUST occur Change family withdrawals back to $30,000 Montana State University 16 Continuation of Owner Withdrawals With a positive Cash Flow No operating loan carryover May be a negative net worth change If so, the system tells how much owner draw is impacting net worth Also indicates the amount of money from nonbusiness sources that must be brought into the operation Montana State University 17 Continuation of Owner Withdrawals With a negative Cash Flow Will have an operating loan carryover Carryover amount indicates the dollar adjustment necessary from: Off farm earnings Income and/or expense adjustements Combination of all the above If from Off-Farm, enter as a nonbusiness cash inflow. May still be a negative equity change Correct with more non-business inflow Montana State University 18 Family Living & Form of Ownership Sole Proprietor versus Corporation Change family living withdrawal to a business expense Zero out Owner Withdrawals and enter total dollars of “family living” on the “Other Cash Business Expense” line of the Cash Flow Illustrates the effects of a corporate form of ownership Review effects on Income Statement, Cash Flow, Balance Sheets, Relationship between Net Income and Net Worth Change Montana State University 19 Non Business Income Income not generated by business assets Types of non business income Off farm wages Non farm earnings (interest, dividends, etc) Interest earned on a farm business checking account would be considered business income. Montana State University 20 Government Payments Note current profit levels and cash flow position Reduce/eliminate government payments on crops Effects on cash flow, net income, equity Implications for profit Profit Net Cash Flow Taxable Income Implications for the size of the business Where is the risk? Montana State University 21 Cost of Production Implications for this operation Do you know your cost of production?????? Enterprise record keeping system Quicken or QuickBooks Spreadsheets that allow you to allocate income and expenses to enterprises If you can not measure it, you can not manage it Montana State University 22 Debt Load and Structure Example starts with approximately 16.5% debt load What is the debt load that can be carried by an operation this size? What about debt structure? Short vs long term debt How does family living withdrawal effect debt carrying capacity? Crop vs Livestock operations Montana State University 23 Asset Revaluation Assets are occasionally revalued to reflect inflationary pressures Machinery, land, buildings, improvements, breeding livestock Necessary to accurately reflect the market value of these assets Do not misinterpret this increase in equity Is not due to business performance Can be very misleading and can mask serious business performance issues Montana State University 24 Capital Asset Purchase Question: Will purchasing a new capital asset increase your net worth? What is affected Pickup, new bull, combine, center pivot, etc. Ending asset balance, ending liabilities, cash inflows and cash outflows, net income Bottom line, You CAN NOT buy equity Equity or growth in equity must be earned The only way to do this is make the new asset earn additional revenue and/or reduce costs Increase net income Montana State University 25 Risk Protection Tools (Insurance) Example used here is limited to the Basic Unit coverage provided by MPCI Only three Basic Units are allowed in this example Enter “example” levels of MPCI coverage for up to three Basic Units. Set initial yields and prices at low levels to simulate bad year. Turn MPCI section on/off to show affects of using MPCI insurance. Montana State University 26 Non-Cash Income Non-cash income adjustments are made on the Accrual Adjusted Income Statement to reflect changes in Current Asset values on the beginning and ending balance sheet. Include changes in: Crops Held for Sale Market Livestock Other Current Assets Cash Invested in Growing Crops See the AccrualAdj tab for complete details Montana State University 27 Non-Cash Expense (Not Depreciation) Non-cash expense adjustments are Made on the Accrual Adjusted Income Statement Reflect changes in Current Asset and Current Liabilities section of the beginning and ending Balance Sheet. See the AccrualAdj tab of the spreadsheet for a detailed review of these adjustments Montana State University 28 Three Types of Contributed/Distributed Assets Cash or Near Cash Listed on the Current Assets portion of the Balance Sheet Capital assets, which include: Long term depreciable assets Breeding livestock Machinery and equipment Buildings and improvements Land Montana State University 29 What is Contributed Capital Capital not generated by the operation but given to the operation to support our farming habit Will have affects on: Off farm income (wages/salary) Nonbusiness income (dividends, etc.) Gifts, inheritances, etc. Equity, Profits, Cash Flow Earned versus Unearned Montana State University 30 What is Distributed Capital What is distributed capital? Capital taken out of the operation Will have different affects on: Equity - Short term vs long term Profits - Short term vs long term Immediate reduction in asset value Reduction in ability to produce income in the future Cash flow - Short term vs long term Swapping assets within a family structure run as one business? Montana State University 31 Income Taxes The RDFinancial spreadsheet is distributed with the Income and S.S. tax estimator turned off. It can be turned on in cell W8 on the Statements tab Users can enter additional cash business expenses in cell I22 of the Statements tab to show the affects on the financials Net Worth, Net Income, Cash Flow Montana State University 32 Summary You MUST measure your Financial Business Positions and Performance Must be efficient Maximize output per unit of input Often we try to maximize just output Low cost producer The right size producer (size matters) Family structure matters Manage marketing, production, family risk Financial analysis measures the impact of these Montana State University 33 Business Position & Performance What is key to your ability to survive? Managing all forms of risk Production, Human, Marketing, Financial, Legal With respect to the financial end Profits are critical Profits Net Cash Flow Taxable Income Earned positive Cash Flow also helps a great deal If you can’t measure it, you can’t manage it!! Montana State University 34 Business Must Produce Net Worth Internally Every dollar of income goes towards increasing net worth Every dollar of expense goes towards decreasing net worth If growth in Net Worth comes only from external sources, your on shaky ground You must be profitable enough to pay for: Family Living , Debt Principal, Savings, Reinvestment, Retirement Positive Cash Flow is good but…… Montana State University 35 Accrual Adjusted Financials: Catch problems with: Inventory sell down to manage cash needs Selling capital asset base, your manufacturing plant (livestock, machinery, land, etc.) Capital distributions Unearned equity increases Allows accurate business performance evaluation for each time period Shows strengths and weaknesses Will not be easy the first time through Montana State University 36 Must Do Your Own Detailed Analysis http://www.montana.edu/extensionecon/soft waredownloads.html “RDFinancial” = Readers Digest Version “WFBudgets” = Intermediate version “Financial Statements” = Very detailed “Machines” = Enterprise budgeting for crops “CCFS” = Cow-Calf, Feeder, Stocker enterprise budgeting Montana State University 37 How To Get There What is your business plan? Do you have a management team to help with: Production decisions Marketing decisions Financial analysis Human resources Are communications good among team members? Are team members missing that are critical to the overall success of the business? Montana State University 38 Parting Comment Do not risk the future of your operation (family and business) with frustration over preparing detailed financial statements. Just do it! Montana State University 39