Economic Efficiency

advertisement

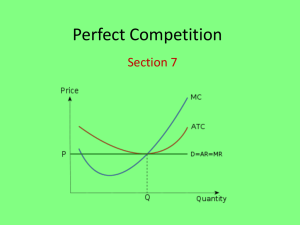

Today Economic Efficiency Producer’s surplus Perfect competition and economic efficiency Return exams at end of class Economic Efficiency Reading: end of Chapter 21 Definition Economic Efficiency: When goods are produced in the least costly manner and distributed to those who value them most. Requires: Productive Efficiency Allocative Efficiency Productive Efficiency There is no way to re-direct production among firms to increase total output. Perfect Comp and Productive Efficiency In LR firms produce at lowest possible LRAC. There is no way to cut costs by changing plant size. Since all firms take the same price, all firms have same MC (why?) There is no way to re-direct production to other firms and get lower marginal costs. Productive efficiency holds. Allocative Efficiency Goods are consumed by those who most value them. There is no alternative comb. of goods that could be produced that would increase society’s well-being. Measuring Allocative Efficiency The sum of consumers’ surplus and producers’ surplus. Recall: Consumers’ Surplus $/unit 8 A 6 4 B D 2 1 2 3 4 5 6 7 units The difference between what a consumer is willing to pay & what he does pay. Producers’ Surplus-SR perspective The difference between the amount of revenue the firm earns and the minimum amount necessary to get the firm to produce that quantity of the good in the short run. PS = Revenue - total variable costs. Producers’ Surplus-Market $/unit SRS 8 6 4 B C 2 1 2 3 4 D 5 6 7 units Selling 4 units @$6/unit. Total revenue = B + C. TVC for all firms is represented by the area under the SRS curve (why?) = C B = producers’ surplus Allocative Efficiency $/unit SRS 8 A 6 4 B C 2 1 2 3 4 D 5 6 7 units A + B = The sum of consumers’ and producers’ surplus. Vertical distance between D and S is the difference between value to consumer and MC to producer. What Q maximizes CS+PS? Allocative Efficiency & Perfect Competition Perfectly competitive markets provide the allocatively efficient quantity of a good. Perfect Comp and Econ Efficiency Conclusion: Perfectly competitive markets are economically efficient! This is one reason why we use them as a benchmark for our study of other market structures. Excise Taxes and Allocative Efficiency Assume the market for wheat is perfectly competitive. Shade in the sum of consumers’ and producers’ surpluses for the competitive market equilibrium. Wheat Price/Gal. Identify the market equilibrium price and quantity. Shade in the CS + PS. S 1.25 1.00 0.75 D 4 5 6 Bushels of wheat Excise Tax Add an excise tax of $0.50 per bushel to this market. What happens to market price and quantity? Shade in CS + PS in light of the tax. Compare your answer to before the tax. Is it allocatively efficient to tax this industry? Excise tax on wheat-50¢ S’ Price/Gal. 0.50 Price paid by elevator is $1.25 Price kept by farmer is $0.75. What is quantity? How is CS + PS affected? S 1.25 1.00 0.75 D 4 5 6 Bushels of wheat Conclusions on Taxes & Efficiency An excise tax cuts the quantity exchanged below the optimal level. This reduces the surplus that consumers and producers receive. Conclusion: Excise taxes reduce market efficiency. Next Time Note: We are now one class period behind the syllabus. April 2-4: Monopoly, Ch. 22 April 9-11: Oligopoly and Monopolistic Competition, Ch. 23