Perfect Competition

advertisement

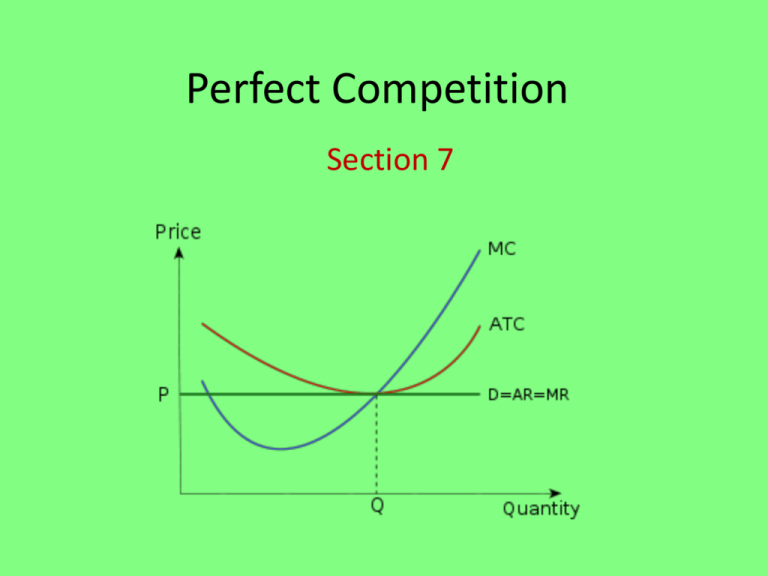

Perfect Competition Section 7 Objectives • Explain the assumptions of perfect competition. • Distinguish between the demand curve for the industry and for the firm in perfect competition. • Explain how the firm maximizes (short-run) profit in perfect competition. • Explain and illustrate short-run profit and loss situations in perfect competition. • Explain and illustrate long-run equilibrium in perfect competition. • Explain and illustrate the movement from short run to long run in perfect competition. • Define and illustrate productive efficiency. • Define and illustrate allocative efficiency. • Explain and illustrate productive and allocative efficiency in the short and long run in perfect competition. Introduction • As you know, economist build models. • The models are build to simply explanations of how things work and to allow us to visualize possible outcomes of different economic situations. • Perfect competition is a model used as a starting point to explain how firms operate. • It is theoretical and based on some very precise assumptions. Assumptions of perfect competition • Industry is composed of an extremely large number of independent firms, each so small, relative to the size of the industry, that it cannot alter its output (supply) in order to influence price. • Individual firms must sell at whatever price is set by demand and supply in the industry as a whole; the firm is a price-taker. • Firms produce homogeneous (identical) products. • It is not possible to distinguish between goods produced at different firms. • There are no brand names and no marketing to attempt to make goods different from each other. Assumptions continued… • Firms are completely free to enter or exit the industry, there are no barriers to entry or exit. • Firms already in the industry do not have the ability to stop new firms from entering the industry. • There are no costs barriers and no legal barriers. • They can exit freely as well. • All producers and consumers have perfect knowledge of the market. • The producers are fully aware of market prices, costs in the industry and workings of the market. • The consumers are fully aware of prices in the market, the quality of products and the availability of goods. Perfect competition is theoretical • The industry that is closest to perfect competition is the agricultural industry. • Textbook example- wheat market • El Salvador Mango example The demand curve for the industry and the firm in Perfect Competition Industry P ($) Firm P S ($) D=MR=AR=P D Q Q • The firm is a price taker. • Price is set by the interactions of supply and demand within the industry • The firm cannot affect price by changing its output (it is so relatively small), therefore attempting to charge a higher price would be irrational as products are identical from firm to firm (homogenous) and consumers will simply go elsewhere (due to perfect information). Profit Maximization • Firms maximize profits when they produce at the level of output where MC=MR. • The firm takes the price “P” from the industry and because demand is perfectly elastic, P=D=AR=MR. • Profit is maximized where MC=MR, at the level of output Q1 • It is important to remember that although the scale of the price indexes are the same for the industry and firm, this is not true for output. • The quantity produced is very small in relation to the total industry output. (hence the small q) Possible abnormal profits in the short run in perfect competition P ($) The Industry The Firm S MC P ($) AC D=AR=MR Abnormal profits D Q Q q Q Possible losses in the short run in perfect competition P ($) The Industry The Firm S MC P ($) Losses AC D=AR=MR D Q Q q Q Short run abnormal profits will not remain for long in Perfect Competition P ($) The Industry The Firm S S1 MC P ($) AC P Abnormal profits D=AR=MR P1 D Q Q1 Quantity q1 q Quantity Short run losses will not remain for long in Perfect Competition P ($) The Industry S1 The Firm S MC P ($) P1 Losses P AC D=AR=MR D Q1 Q Q q q1 Q Long Run Equilibrium in Perfect Competition P ($) The Industry The Firm S MC AC P ($) P D=AR=MR PC D Q Q q1 Q Equilibrium will persist until there is a change in either the industry demand curve or the costs that the firm faces. If this happens the firm will either make short-run abnormal profits or losses until the adjustments are made with firms entering or exiting the market or until long-run equilibrium is restored. Productive efficiency • Productive efficiency- If a firm produces its product at the lowest possible unit cost (average total cost), it is said to be productively efficient. Costs ($) Productive efficiency MC AC •At output q the firm is able to produce at the most efficient level of output (the lowest average total cost of production). •MC=ATC [productively efficient level of output] C •Productive efficiency means the firm is combining its resources as efficiently as possible and resources are not being wasted by inefficient use. q Q (output) Allocative efficiency • Allocative efficiency (the socially optimal level of output) occurs where suppliers are producing the optimal mix of goods and services required by consumers. • Price reflects the value that consumers place on a good and is shown on the demand curve (average revenue) • Marginal cost reflects the cost to society of all the resources used in producing an extra unit of a good, including the normal profit required for a firm to stay in business. • Allocative efficiency occurs where marginal cost (the cost of producing one more unit) is equal to average revenue (the price received for a unit). • MC=AR [allocatively efficient (socially optimal) level of output] Allocative efficiency Imperfectly competitive firm MC Price ($) Price ($) Perfectly competitive firm MC D=AR=MR D=AR 0 q Output 0 Allocative efficient level of output: MC=AR The cost to producers The value to consumers q MR Output Allocative efficiency • Allocative efficiency is important because when a firm is producing at the allocatively efficient level of output there is a situation of “Pareto optimality” – where it is impossible to make one person better off without making someone else worse off Productive and allocative efficiency in the short run in perfect competition • Abnormal profits in Perfect competition in the short run means a lack of productive efficiency P ($) The Industry The Firm S MC P ($) AC Abnormal profits The firm always produces at MR=MC (profit maximizing) MC=AR (allocatively efficiency) X MC=AC (productively efficiency) D=AR=MR D Q q q2 Q Productive and allocative efficiency in the short run in perfect competition • Losses in Perfect competition in the short run also means a lack of productive efficiency The firm always produces at MR=MC (profit maximizing) P ($) The Industry The Firm S P ($) Losses MC AC D=AR= MR D Q q q2 Q MC=AR (allocatively efficiency) X MC=AC (productively efficiency) Productive and allocative efficiency in the long run in perfect competition P ($) The Industry The Firm S MC AC P ($) Pc P D=AR=MR D Q Q q Q q (MR=MC) q (MC=AC) productively efficient q (MC=AR) allocatively efficient