Government Intervention Indirect Taxes

advertisement

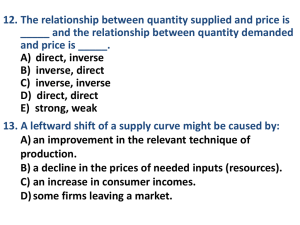

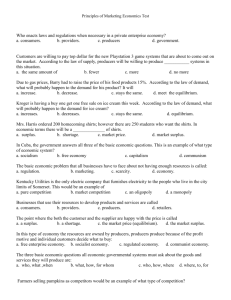

Taxes Adam Smith, 1776 – the “invisible hand of the market” Markets allocate resources using the price mechanism (shortage, surplus, equilibrium) Allocation is automatic due to the signal and incentive role of price Related markets are concatenated (linked) through demand and supply, and the price mechanism Result is social optimum (community surplus maximized) at equilibrium price Adam Smith, 1776 – the “invisible hand of the market” Markets allocate resources using the price mechanism (shortage, surplus, equilibrium) Allocation is automatic due to the signal and incentive role of price Related markets are concatenated (joined) through demand and supply, and the price mechanism Result is social optimum (community surplus maximized) at equilibrium price Governments intervene in markets using their legal authority to… ▪ ▪ ▪ ▪ ▪ Raise funds through taxation Regulate activity (enforce laws) Support industries through subsidies Provide public goods, and merit goods Deal with “externalities”, e.g. pollution Consider government intervention in markets as a question! Should government intervene? ▪ Maybe yes, maybe no… it all depends Sometimes government action helps resource allocation, and sometimes it doesn’t! You have to weigh the plusses and minuses of the results of government action Taxes – indirect and direct taxes Government takes funds $$$ Subsidies – industry support Government gives funds $$$ Price Controls – government sets prices Ceilings Floors Minimum Wages For 99% of the world, governments get the money they need in the form of taxes Goods and Services are taxed (indirect tax) Income is taxed (direct tax) This revenue allows government to provide services (Governments also borrow money) Specific tax, per unit (domestic) Excise tax, per unit (domestic) Value-added Tax, percentage (domestic) GST, percentage (domestic) Customs Duty, percentage (international) Supply curves are parallel because the same amount of tax applied for each unit of output Excise tax, specific tax look like this Supply curves diverge from the origin because the amount of tax rises as output increases, e.g. 10% of price 10% of $100 = $10 while 10% of $300 = $30 Sales Taxes, VAT, GST and Customs Duties look like this Indirect taxes are imposed on goods and services by the government. The burden is shared between consumers and producers. Taxes are remitted by producers to the government. Direct taxes are on the income of the citizen directly, e.g. income tax (more later) Excise Tax: Taxes imposed on particular G+S– usually goods with inelastic demand eg: petrol, cigarettes and alcohol Thinking Point: Can you think of an economic reasons why governments target these types of goods?? General Sales Tax (GST) or Value Added Tax (VAT): Taxes imposed on all or (most) G+S Specific Tax: A tax of a specific amount to be paid on every unit of a product sold. Eg: $2 per pack tax on cigarettes. Ad Valorem Tax: A tax based on a particular percentage of the sales price of a product. In this case the tax increases as the price of G+S increases. Eg: 50% tax on sales of cigarettes ($PxQ) S2 curve is parallel to S1. Amount of tax is fixed for each unit of output S2 curve is steeper than S1 because tax increases as price increases If tax = 10% and P = $ 20 Tax per unit sold = $2 (0.1x 20) If Tax = 10% and P = $ 30 Tax per unit sold = $ 3 (0.1x 30) Source of Government Revenue Method to discourage consumption of goods that are harmful to individuals/ society Tax revenues used to redistribute income from rich to poor Method to improve allocation of resources (reduce allocative inefficiency) or to correct negative externalities When tax is imposed on G+S it is paid to government by firms. This leaves fewer resources for production, c.p. Thus, for every price the firm produces less The supply curve shifts left Let’s use diagrammatic analysis to find the extent of the reduction in output, and the incidence of the tax burden Market Outcomes of Specific Tax Before Tax: P* = Eqb P Q* = Eqb Q (intersection of S1 & D curves) After Tax: S curve shift to S2 (S1+Tax) P paid by consumers increase to Pc and Q falls to Qt. Pc= P paid by consumers Amount of tax = Pc – Pp (tax per unit) Equilibrium quantity produced and consumed fall from Q* to Qt Equilibrium price increases from P* to Pc (P paid by consumers) Consumer expenditure on the good changes from P*x Q* to Pc x Qt Price received by firms fall from P* to Pp =( Pc – tax) Firm revenues fall from (P* x Q*) to (Pp x Qt) Government receives tax revenues = (Pc – Pp) x Qt amount of tax per unit times the number of units sold (shaded area) There is an under allocation of resources to the production of the good Qt less than free market Q (Q*) Market Outcomes of Ad Valorem Tax Before Tax: After Tax : Student Task: Use same steps as the previous diagram to determine the market outcomes Outcomes are exactly the same as the specific tax – just relate back to diagram (b) instead. Consumers Society Stakeholders affected Government Producers Consumers (households) are worse off – how?? Pay higher prices Consume less quantities Spending is reduced also on other goods due to paying more on the taxed good Increase consumption of substitute good which may be less desirable. Producers (firms) are worse off – how?? Receive lower prices than before Sell less quantities – ie leads to lower revenues and profits Firms produce less output so leads to supply shortages in the future Governments are the only winners from taxes Increase revenues – lead to budget surpluses Decrease spending on public goods such as health care and environment because people who smoke or use petrol now contribute to the costs Society as whole is worse off due to higher prices of goods and lower quantities consumed and produced. Allocative inefficiencies – society not producing what is desirable