2. Applications of Consumer Theory

advertisement

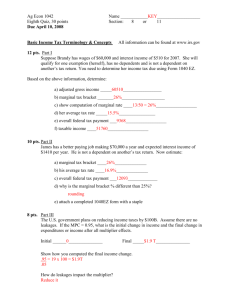

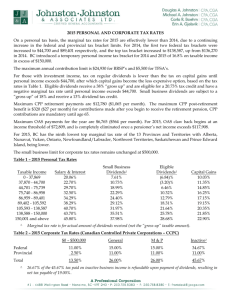

Using these slides • These slides are used in a second year undergraduate course, EC201, Microeconomic Principles I at the London School of Economics. • Details of the tax system change every year. The slides give sources and websites for the information. • The educational objective is to show students how economic analysis, particularly the modelling of budget constraints and income and substitution effects can be used to understand the impact of taxes on households. • The models used here oversimplify the tax system, but students find them quite complicated enough. • More details models are available on the Institute for Fiscal Studies website. © Margaret Bray LSE 1 Taxes • Start with a brief overview of the UK tax system to give you context. • You are not expected to remember the details of this. 2 Income tax rates • Data comes from HMRC (Her Majesty’s Revenue and Customs) • The home page is http://www.hmrc.gov.uk/ • Details of rates are at http://www.hmrc.gov.uk/rates/it.htm 3 • Changes in tax rates are usually announced in the budget in the spring. • But some changes are often announced in the pre-budget report in the autumn. • See the Treasury website http://www.hm-treasury.gov.uk/index.cfm 4 IFS • The IFS (Institute for Fiscal Studies) website http://www.ifs.org.uk/ has a large amount of useful information on taxes. • See particularly Fiscal Facts http://www.ifs.org.uk/fiscalfacts.php for details of the system “Labour Supply and Taxes”, Costas Meghir and David Phillips at http://www.ifs.org.uk/wps/wp0804.pdf IFS Working Paper IFS Working Papers, W08/04 (March 2008) for an overview of the literature on labour supply, taxes and benefits. 5 Stuart Adam, “A Survey of the UK Tax System”, IFS Briefing Note BN09 This explains the system and gives rates for 20056. You can find it on http://www.ifs.org.uk/bns/bn09.pdf 6 Revenue raised by UK taxes Total government receipts are projected to be £516 billion in 2006-2007, which is 40.3% of GDP. This Tax figure is equivalent to £12,740 for every member of the working age population (15-65), or to £8,515 per person. Income tax, National Insurance and VAT are the main source of revenue for the government, together accounting for 60.1% of total receipts. 7 Sources of government revenues – projection for 2006-2007 £bn % of total Income tax 144.0 27.9 National Insurance 89.6 17.4 Value added 76.5 14.8 Fuel 24.0 4.7 Tobacco 8.0 1.6 Betting and gaming 1.4 0.3 Other indirect tax 13.6 2.6 Capital gains tax 3.8 0.7 Corporate tax 49.0 9.5 Council tax 22.0 4.3 8 Source: HM treasury, Budget Report, 2006 Taxes on Consumption • VAT (value added tax) charged at 17.5% is the main tax on consumption. • Some goods are exempt from VAT. (e.g. children’s clothes) • Some goods are subject to additional taxes (e.g. alcohol, tobacco, fuel, these are often complicated as the next slides show) 9 Taxes on Alcohol (in addition to VAT) Product and basis of duty Duty Rate per litre of pure alcohol Spirits £19.56 Rate per hectolitre (100 litres) per cent of alcohol in the beer Beer £13.26 Rate per hectolitre (100 litres) of product Wine and made-wine: exceeding 1.2% - not exceeding 4% £53.06 abv. 10 Source: http://www.hmrc.gov.uk/ Taxes on Tobacco (in addition to VAT) Product Duty Cigarettes 22 %retail price plus £105.10 per thousand cigarettes Cigars £153.07 per kilogram Hand-rolling tobacco £110.02 per kilogram Other smoking tobacco and chewing tobacco £67.30 per kilogram Source: http://www.hmrc.gov.uk/ 11 Taxes on Fuel (in addition to VAT) Pence per litre Sulphur-free petrol/diesel Ultra low sulphur petrol/diesel Biodiesel Bioethanol Duty rate 48.35p 48.35p 28.35p 28.35p 12 Source: http://www.hmrc.gov.uk/ UK Taxes on Income • Income tax is paid on all income including income from employment and income from investments. • National Insurance Contributions (NICs) are paid on income from employment only. 13 Modelling the Effects of an Income Tax 14 • Budget constraint without tax Pc = W(T – n) or Pc + Wn = WT or c + wn = wT c = consumption, T = total time, n = time outside paid employment “leisure” W = money wage rate, P = price of consumption w = W/p = real wage rate 15 The effects of a 20% proportional income tax. 16 • Assume at first for simplicity that the only tax is a proportional income tax of 20% or total earnings. • Tax revenue = total tax paid = 0.2 W (T-n) (W = money wage rate, T – n = hours worked) • Budget constraint with tax Pc = W (T – n) – 0.2 W(T-n) or Pc = 0.8 W (T – n) (P = price of good, c = consumption) • Budget constraint with income tax can be written as c + 0.8 wn = 0.8 wT 17 where w = W/p = real wage rate. • Assume that the imposition of the income tax does not change the wage rate W or the price of goods P so the real wage before tax w = W/P does not change. (May not be realistic). • Then the effect of the tax is to change the budget constraint from c + wn = wT to c + 0.8wn = 0.8wT. • In effect the 20% income tax changes the real wage rate from w to 0.8w. 18 c wT This diagram is distorted to make it easier to follow, 0.8wT should be much closer to wT, and the slopes of the lines should be much closer to each other. 0.8wT slope - w slope – 0.8 w 0 T n19 c wT budget constraint with no tax slope - W/P = - w budget constraint with tax slope – 0.8 W/P = - 0.8 w 0.8wT consumer’s optimum with tax (c*,n*) 0 T n20 Tax revenue given T- n* and c* as labour and consumption = 0.20 W (T – n*) (0.2 = tax rate, W wage, T – n* labour) = W T – 0.8 WT - 0.2 n* W = WT – (Pc* + 0.8 W n* ) – 0.2 n* W (because from the budget constraint Pc* + 0.8Wn* = 0.8WT) = WT – (Pc* + Wn*) = WT – cost of (c*, n*) at pre tax prices P and W 21 wT line through (c*,n*) with slope - W/P = - w and equation c* + wn* c – c* = - w (n – n*) when n = 0 line meets the vertical axis and 0.8wT c = c* + wn* (c*,n*) 0 T n22 wT From 2 slides back tax revenue = WT – (Pc* + Wn*) c* + wn* = P (wT – (c* + wn*) ) 0.8wT =P (c*,n*) 0 T n23 Definition: Equivalent Variation for a price change • • • • • The price of good 1 starts at p1A. At this price utility is uA. The price of good 1 rises to p1B p2 does not change. Taking away the equivalent variation, EV, without changing p1 from p1A has the same effect on utility as increasing p1 from p1A to p1B without changing income. 24 Definition: Equivalent Variation of a tax • The tax changes the price of good 1 “leisure” from W to 0.8W. • Taking away the equivalent variation, EV, without changing the price of “leisure” has the same effect on utility as imposing the tax. 25 wT Taking away the EV (equivalent variation) from the consumer has the same effect on utility as imposing the tax. Show the budget line that gives the EV. 0.8wT (c*,n*) 0 T n26 wT Taking away the EV (equivalent variation) from the consumer has the same effect on utility as imposing the tax. Show the budget line that gives the EV. 0.8wT slope – 0.8 w (c*,n*) 0 T n27 wT EV = P 0.8wT slope – 0.8 w (c*,n*) 0 T n28 wT tax revenue = P c* + wn* EV = P 0.8wT (c*,n*) 0 T n29 wT tax revenue = P c* + wn* EV = P 0.8wT Tax revenue – EV = P (c*,n*) 0 T n30 wT Definition: Excess burden of a tax = tax revenue – equivalent variation c* + wn* = P 0.8wT (c*,n*) 0 T n31 wT Taking from the consumer as a lump sum gives the budget constraint and the same tax revenue as the income tax but is better for the consumer. c* + wn* 0.8wT (c*,n*) 0 T n32 This is a general argument. A lump sum tax that reduces income by a fixed amount that does not depend on anything the consumer does reduces utility by less than a tax where the revenue can be changed by changing consumption, work or saving. (e.g. excise tax, VAT, income tax…) The only feasible lump sum tax is a “poll tax” where everyone pays the same amount. Is a poll tax ethically desirable? Is a poll tax politically feasible? 33 The effects of a 25% proportional consumption tax. 34 • Now assume at that the only tax is a proportional tax on consumption at a rate of 25% on total consumption. (e.g. a sales tax or VAT) • Total tax paid = 0.25 P c (P = price of consumption c) • Budget constraint with consumption tax Pc = W (T – n) – 0.25 Pc or 1.25 Pc = W (T – n) or 1.25 c + wn = wT where w = W/p = real wage rate. 35 • Assume that the imposition of the consumption tax does not change the wage rate W or the price of goods P so the real wage rate before tax P = W/p does not change. (May not be realistic). • Then the effect of the tax is to change the budget constraint from c + wn = wT to 1.25 c + wn = wT or dividing by 1.25 and noting that 1/1.25 = 0.8 the budget constraint with a 0.25 % consumption tax is c + 0.8 wn = 0.8 wT. 36 • If the only tax is a proportional 20% income tax the budget constraint is c + 0.8wn = 0.8wT. • If the only tax is a proportional 25% consumption tax the budget constraint is c + 0.8wn = 0.8wT. • A proportional income tax at a rate of 25% has exactly the same effect as a proportional consumption tax at a rate of 20%. • In effect the 20% income tax changes the real wage rate from w to 0.8w. 37 In both cases the budget constraint is the same, c + 0.8 wn = 0.8 wT or as w = W/P multiplying by P Pc + 0.8 W n = 0.8 WT so standard consumer theory tells us that consumers behave in the same way with the two taxes. Revenue from consumption tax is 0.25 Pc. Revenue from income tax is 0.20 W (T – n). But from the budget constraint Pc = 0.8 W ( T – n) so consumption tax revenue is 0 .25 Pc = 0.25 x 0.8 W (T-n) = 0.2 W (T – n) 38 = income tax revenue. c wT budget constraint with 20% income tax or with 25% consumption tax constraint slope - W/(1.25)P 0.8wT = - 0.8 W/P = 0.8w. slope - w slope – 0.8 w 0 T n39 • More generally, we get the same budget constraint with a proportional income tax at rate tm as with a proportional consumption tax at a rate tc if (1 - tm ) (1+ tc ) = 1. • Both taxes have the same effect on the budget constraint and thus on consumer behaviour. • The revenue raised by the two taxes is the same. • All the arguments are exactly the same as before with 0.20 replaced by tm and 0.25 replaced by tc so (1 - tm ) (1+ tc ) = 0.8 x 1.25 = 1. 40 A more realistic model of income tax • More realistically income tax is not directly proportional to income. • Income tax schedule divide income into tax brackets. 41 Suppose that there are three tax brackets Bracket 1 £ 0 - £5000 Bracket 2 £5000 - £20 000 Bracket 3 > £20 000. With an income of £15 000 you have £ 5000 in bracket 1 £ 15 000 – 5000 = £10 000 in bracket 2. 42 bracket 3 income £15 000 £20,000 bracket 2 £0 in bracket 3 £10 000 in bracket 2 £5,000 bracket £0 1 £5000 in bracket 1 43 Suppose that there are three tax brackets Bracket 1 £ 0 - £5000 Bracket 2 £5000 - £20 000 Bracket 3 > £20 000. With an income of £30 000 you have £ 5000 in bracket 1 £ 20 000 – 5000 = £15 000 in bracket 2. £ 30 000 - 20 000 = £10 000 in bracket 3. 44 bracket 3 income £30 000 £20,000 bracket 2 £10 000 in bracket 1 £15 000 in bracket 2 £5,000 bracket £0 1 £5000 in bracket 1 45 • An income tax system gives a marginal tax rate for each bracket, with higher brackets having higher marginal tax rates. • The system described in the next slide has marginal tax rates 0 % bracket 1 20% bracket 2 40 % bracket 3 • Total income tax = 0.00 (income in bracket 1) + 0.20 (income in bracket 2) + 0.40 (income in bracket 3). 46 Usual description of this tax scheme total annual £ marginal tax income rate < 5000 0 5000 - 20000 20 % > 20000 40 % 47 tax income bracket £15,000 £0 in 40% bracket 40% £20,000 £10,000 in 20% bracket 20% £5,000 £5,000 0% in 0% bracket £0 total tax = 0 x 5000 + .20 x 10,000 + 0.40 x 0 = £2,000 48 Definition: Marginal Income Tax Rate Marginal income tax rate is the number of extra pennies tax you pay on £1 extra earnings. With a 20% marginal income tax rate you pay £ 0.20 = 20p extra tax when you earn £1 more. In the previous slide the marginal income tax rate for someone earning £15000 is 20%. 49 Definition: Average Income Tax Rate Average Income Tax rate = total income tax total income In the previous someone earning £15000 pays income tax £ 0 x 5000 + .20 x 10,000 + 0.40 x 0 = £2,000 so average income tax rate = 2000 = 13% 15 000 50 tax income bracket £15,000 £0 in 40% bracket 40% £20,000 £10,000 in 20% bracket 20% £5,000 £5,000 0% £0 in 0% bracket marginal tax rate 20% average tax rate 2 000/15 000 = 13% 51 tax income bracket £30,000 £10,000 in 40% bracket 40% £20,000 £15,000 in 20% bracket 20% £5,000 £5,000 0% in 0% bracket £0 total tax = 0 x 5000 + 0.20 x 15 000 + 0.40 x 10 000 52 = £7 000 tax income bracket £30 000 £10 000 in 40% bracket 40% £20,000 £15 000 in 20% bracket 20% £5 000 £5,000 0% £0 in 0% bracket marginal tax rate 40% average tax rate 7 000/30 000 = 23% 53 See consumer theory worked example 10 on website for more explanation and details of how to calculate the budget constraint. 54 annual consumption (£) Budget Constraint slope - 2.4 wage £4 per hour 17000 slope - 3.2 5000 8760 3760 7510 time outside employment (annual hours) 55 Important Find the kinks by looking at hours and after tax income at tax bracket boundaries. 56 With a wage of £4 per hour earning £5000 takes £5000/4 = 1250 hours and leaves annual time outside employment of 8760 - 1250 = 7510 hours. 8760 = 365 x 24 = hours in year. With £5000 income tax paid = 0, so (7510,5000) is the corresponding point on the budget constraint. (5000 = income) 57 annual consumption (£) Budget Constraint slope - 2.4 wage £4 per hour 17000 slope - 3.2 5000 8760 3760 7510 time outside employment (annual hours) 58 With a wage of £4 per hour earning £20000 takes £20000/4 = 5000 hours and leaves annual time outside employment of 8760 - 5000 = 3760 hours. 8760 = 365 x 24 = hours in year. With £20 000 income tax paid = 0 x 5000 + 0.2 x 15000 = 3000 so (3760,17000) is the corresponding point on the budget constraint. (17000 = after tax income = 20000 – 3000) 59 annual consumption (£) Budget Constraint slope - 2.4 wage £4 per hour 17000 slope - 3.2 5000 8760 3760 7510 time outside employment (annual hours) 60 Slope of the budget constraint • The slope of the budget constraint = - w (1-tm) where tm is the marginal income tax rate and w is the hourly wage rate. 61 2006 – 7 Income Tax total annual £ < 5035 marginal tax income rate 0 5035 - 7185 10 % 7185 - 38335 22 % The UK tax system > 38335 40 % The tax rates rarely change. From April 2000 until April 2008 the rates were 10%, 22% and 40%. The tax brackets change every year in April (roughly at the inflation rate), don’t try to remember 62 them exactly. 2007 – 8 Income Tax total annual £ marginal tax income rate < 5435 0 5435 - 41 435 20 % > 41 435 40 % The UK tax system In April 2008 the 10% rate was abolished, and the “basic rate” was cut from 22% to 20%. 63 2006 - 7 approximate tax brackets total annual £ < 5000* marginal tax income rate 0 5000 - 7000 10 % 7000- 38000 22 % 38000 40 % The UK tax system * The level at which income starts to be taxed is called the “personal allowance” which depends among other things on age. 64 National Insurance Contributions (NIC) • These function as an additional income tax system. • They are determined by weekly income. Income Tax is determined by annual income. The UK tax system 65 weekly income £y < 97 employee’s NIC £ 0 employer’s NIC £ 0 97 - 645 0.11(y – 97) 0.128( y – 97) > 645 0.11(645 – 97) + 0.01(y – 645) 0.128( y – 97) 2006 – 07 NICs 66 weekly income £y < 89 employee’s NIC £ 0 employer’s NIC £ 0 89 - 585 0.10(y – 89) 0.118( y – 89) >585 0.10(585 – 89) + 0.01(y – 585) 0.118( y – 89) 0.118( y – 89) 2002 – 3 NIC 67 Why the change in structure of NIC? In April 2003 NICs for both employers and employees were increased by 1% NIC on earnings above the NIC threshold. This was announced in the March 2002 budget. It has much the same effect as a 2% rise in the income tax rate. But there was a political commitment not to change income tax rates. 68 Modelling budget constraints 69 Diagrams for seeing budget constraints consumption The Economist’s Diagram c The economists diagram has the advantage that indifference curves have their usual shape. But non economists don’t understand it. budget set 0 “leisure” n 70 Flip the economists’ diagram horizontally. income after tax indifference curves slope the other way. 0 hours worked This diagram makes much more sense to non economists. 71 You often see diagrams with earnings before tax rather than hours worked on the horizontal axis. Earnings after tax With this diagram the shape of the graph does not depend on the wage rate. 0 Contrast with previous slides. earnings 72 Flat Tax • Introduced Russia 2001, and in other transition economies • Simpler than the UK income tax structure. • Discussed UK, US, Germany 73 Flat Tax • Simpler than the UK income tax structure. • Exempts a fixed amount of income, then has the same marginal tax rate at all levels of income. 74 Example of a flat tax • £10 000 tax exempt income • 30% marginal tax rate • Total tax payment income y ≤ £10 000 income y > £10 000 tax 0 tax 0.30(y – 10 000) 75 Relative to existing tax • A flat tax would decrease marginal tax rates at the bottom of the income distribution (more people tax exempt) • and at the top (lower marginal tax rate). 76 Arguments for a flat tax • Reduces tax rates so increases labour supply. (this argument is not right, see next slide) • Simplification of the tax system reduces administration costs and improves compliance. 77 • Labour supply may or may not increase when a flat tax is introduced. • Introducing a flat tax changes marginal and average tax rates • Analyse the effects on labour supply using income and substitution effects. 78 You need to understand and remember • When the average income tax rate falls people are better off, assuming “leisure” to be a normal good the income effect reduces labour supply. • When the average income tax rate rises people are worse off, assuming “leisure” to be a normal good the income effect increases labour supply. 79 earnings after tax average income tax rate, makes people better off. assume time outside employment normal good income effect labour supply w(1 – t) earnings 80 You need to understand and remember • When the marginal income tax rate falls the substitution effect increases labour supply. • When the marginal income tax rate rises the substitution effect decreases labour supply. 81 slope budget line w(1 – t) earnings t marginal income tax rate after tax Decrease marginal tax rate from t1 to t2 steeper budget line, subst effect labour supply w(1 – t2) w(1 – t1) earnings 82 Flat Taxes • The UK has 4 tax brackets (marginal tax rates of 0%, 10%, 22% and 40%). • In its simplest form a “flat tax” has only two tax brackets, 0% and for example 30% marginal tax rates. • The next slides compare between a multi rate system with 3 tax brackets and a flat tax system with 2 brackets. 83 earnings after tax multi rate income tax Tax bracket boundaries earnings 84 earnings after tax flat tax Tax bracket boundary earnings 85 effect of flat tax earnings after tax multi rate income tax flat tax earnings 86 • The next slides work through the effects of the change to a flat tax both on utility and on the labour supply and different levels of income. • You are not expected to remember the details of this argument. • You are expected to be able to analyse a change in the tax system in this way, using income and substitution effects. 87 effect of flat tax earnings after tax multi rate income tax flat tax = earnings – total tax Higher line has lower average tax rate. earnings 88 effect of flat tax earnings after tax average tax rates In regions the flat tax gives lower average tax rate, utility increases. earnings 89 effect of flat tax earnings after tax multi rate income tax flat tax Slope of line = 1 – tm where tm is marginal income tax rate. Steeper line has lower marginal tax rate. earnings 90 effect of flat tax earnings after tax Marginal tax rates In regions flat tax gives lower marginal tax rate. earnings 91 effect of flat tax earnings after tax lower average tax rate with flat tax, lower marginal tax rate with flat tax earnings 92 effect of flat tax earnings after tax both average and marginal tax rates fall with flat tax, effect on lab supply earnings 93 ambiguous (see next slide) • When the average tax rate falls people are better off, assuming “leisure” to be a normal good the income effect reduces labour supply. • When the marginal tax rate falls the substitution effect increases labour supply. • When both average and marginal tax rates fall the effect on labour supply is ambiguous 94 effect of flat tax earnings after tax both average and marginal tax rates rise with flat tax, effect on lab supply earnings 95 ambiguous (see next slide) • When the average tax rate rises people are worse off, assuming “leisure” to be a normal good the income effect increases labour supply. • When the marginal tax rate rises the substitution effect decreases labour supply. • When both average and marginal tax rise the effect on labour supply is ambiguous 96 effect of flat tax earnings after tax average tax rate falls, marginal tax rates rises with flat tax, labour supply decreases (see next slide) earnings 97 • When the average tax rate falls people are better off, assuming “leisure” to be a normal good the income effect reduces labour supply. • When the marginal tax rate rises the substitution effect decreases labour supply. • When the average tax rate falls and the marginal tax rates rises labour supply falls. 98 effect of flat tax earnings after tax average tax rate rises, marginal tax rate falls with flat tax, labour supply increases earnings 99 Summing up the Impact of a Change in Income Tax • You are definitely better off if a change to the income tax schedule reduces your average tax rate. • The effect on labour supply depends on what happens to both the marginal and average tax rates. It is ambiguous if income and substitution effects work in opposite directions. • The effects of a change to income tax are usually different at different levels of income. 100 Russia’s `Flat Tax` • Ivanova, Keen, Klemm, • Economic Policy June 2005 • Before top marginal tax rate 30% • After marginal tax rate 13%. • Revenue increased by 26%. 101 Russia’s `Flat Tax` • Other changes in tax system • better compliance • No evidence for increased labour supply. 102 Possible Flat Tax in UK • simplify income tax (one marginal tax rate rather than three) • but complications of tax system are interaction of income tax, other taxes and benefits. 103 Flat Tax in UK • labour supply effects unclear • top and bottom of income distribution better off • mid range income worse off 104 effect of flat tax earnings after tax average tax rates Gainers from a flat tax Losers from a flat tax earnings 105 from Economist September 8 2005 106 Options for a UK ‘flat tax’ Stuart Adams and James Browne Institute for Fiscal Studies, http://www.ifs.org.uk/ August 2006 This discusses various possibilities including the one we have looked at. The outcome depends greatly on the details of the system. There is no simple story. 107