File - Davison Accounting

Accounting Test Review

Test is Friday (53 Points)

Study Guide Due By Thursday

Challenge Problem (Extra Credit) Available

Practice Test is Available

Talk to Ames for reposts

Paid cash for liability for employee income tax, $460.00; social security tax, $757.90;

Medicare tax, $177.25; total, $1,395.15.

C45.

◦ Goes in cash payments journal

◦ Debit Employee income tax payable $460

◦ Debit Social security tax payable $757.90

◦ Debit Medicare tax payable $177.25

◦ Credit Cash $1395.15

Paid cash for semimonthly payroll, $2,565.72

(total payroll, $2,971.00, less deductions: employee income tax, $178.00; social security tax, $184.20; Medicare tax, $43.08).

C46.

◦ Goes in the cash payments journal

◦ Debit Salary expense $2971.00

◦ Credit Employee income tax payable $178.00

◦ Credit Social security tax payable $184.20

◦ Credit Medicare tax payable $43.08

◦ Credit Cash $2565.72

Recorded employer payroll tax expense for the semimonthly pay period ended April 15. M26.

◦ Goes in the general journal

◦ Debit Payroll tax expense $411.48

Total of all the taxes below

◦ Credit Social security tax payable $184.20

Total earnings/payroll $2971 x .062

◦ Credit Medicare tax payable $43.08

Total earnings/payroll $2971 x .0145

◦ Credit Unemployment tax payable-Federal $23.77

Total earnings/payroll $2971 x .008

◦ Credit Unemployment tax payable-State $160.43

Total earnings/payroll $2971 x .054

◦ Goes in the general journal

◦ Debit Payroll tax expense $411.48

Total of all the taxes below

◦ Credit Social security tax payable $184.20

Total earnings/payroll $2971 x .062

◦ Credit Medicare tax payable $43.08

Total earnings/payroll $2971 x .0145

◦ Credit Unemployment tax payable-Federal $23.77

Total earnings/payroll $2971 x .008

◦ Credit Unemployment tax payable-State $160.43

Total earnings/payroll $2971 x .054

Paid cash for federal unemployment tax liability for quarter ended March 31, $121.20.

C47.

◦ Goes in cash payments journal

◦ Debit Unemployment tax payable-Federal $121.60

◦ Credit Cash $121.60

Paid cash for state unemployment tax liability for quarter ended March 31, $818.10. C48.

◦ Goes in cash payments journal

◦ Debit Unemployment tax payable-State $818.10

◦ Credit Cash $818.10

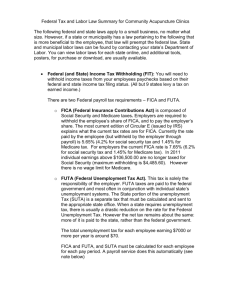

Tax

Employee

Income Tax

Social Security

Medicare

Unemployment-

Federal

Unemployment-

State

Employee

X

X

X

Employer

X

X

X

X

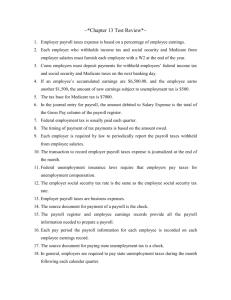

Employees have Federal Income, Social

Security, and Medicare taxes removed from their checks

Tax amounts are based on a percentage of gross pay

Payroll register and employee earnings records provide the information needed

Business expenses for the company

Employers must pay Social Security,

Medicare and Federal and State

Unemployment taxes

Based on a percentage of employee earnings

◦ Employers pay the same percentage of Social

Security and Medicare as employees

◦ Employers are not required to pay unemployment taxes after the first $7,000 earned

If an employee’s accumulated earnings are $6,500, the employer is only subject to the next $500 of employee earnings.

To journalize the employee taxes (cash payments journal):

◦ Paid cash for semimonthly payroll, $2,565.72 (total payroll,

$2,971.00, less deductions: employee income tax,

$178.00; social security tax, $184.20; Medicare tax,

$43.08).

Debit to Salary Expense (using the total of the gross pay column of the payroll register)

Salary Expense $2,971.00

Credit to employee income tax payable, social security tax payable, medicare tax payable and cash (total net pay)

Employee Income Tax Payable $178.00

Social Security Tax Payable $184.20

Medicare Tax Payable $43.08

Cash $2,565.72

◦ The source document for payment of payroll is a check

To journalize the employer taxes (general journal):

◦ Recorded employer payroll tax expense for the semimonthly pay period ended April 15. M26.

Paid cash for semimonthly payroll, $2,565.72 (total payroll, $2,971.00, less deductions: employee income tax, $178.00; social security tax, $184.20;

Medicare tax, $43.08).

Total earning $2,971.00

◦ The Employer payroll tax expense is journalized on the same date as the employee salary expenses

Credit to social security tax payable, medicare tax payable and federal and state unemployment payable

Social security Tax Payable $184.20

Medicare Tax Payable $43.08

Unemployment Tax Payable-Federal $23.77

Unemployment Tax Payable-State $160.43

All of the tax payables are liabilities

Debit to Payroll Tax Expense (total of all of the credits)

Payroll Tax Expense $411.48

◦ The source document for journalizing employer payroll taxes is a memo

Employee Income, Social Security and Medicare taxes are paid periodically to the federal government in a combined payment

◦ Some employers must pay on the next banking day, others end of the month or semiweekly

◦ Some use the Electronic Federal Tax Payment System

(EFTPS)….not required

◦ Paid cash for liability for employee income tax, $460.00; social security tax, $757.90; Medicare tax, $177.25; total,

$1,395.15. C45.

Debit Tax Payables

Employee Income Tax Payable $460.00

Social Security Tax Payable $757.90

Medicare Tax Payable $177.25

Credit Cash

Cash $1,395.15

Unemployment tax payment

◦ Paid quarterly

◦ Paid cash for federal unemployment tax liability for quarter ended March 31, $121.20. C47.

Debit to state or federal unemployment tax payable

Unemployment Tax Payable-Federal $121.20

Credit to cash

Cash $121.20

◦ Source document for paying state/federal unemployment tax is a check

Each employer is required by law to periodically report the payroll taxes withheld from employee salaries

◦ Each employer who withholds income tax and social security and Medicare tax from employee salaries must furnish each employee with an annual statement

The annual statement of earnings and withholdings must be provided to the employee by January 31 of the following year

The federal tax used for state and federal administrative expenses of the unemployment program is federal income tax