Federal Tax and Labor Law Summary for Community Acupuncture

advertisement

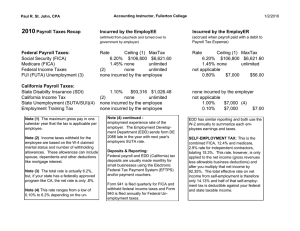

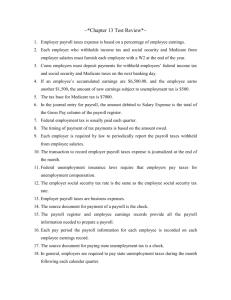

Federal Tax and Labor Law Summary for Community Acupuncture Clinics The following federal and state laws apply to a small business, no matter what size. However, if a state or municipality has a law pertaining to the following that is more beneficial to the employee, that law will preempt the federal law. State and municipal labor laws can be found by contacting your state’s Department of Labor. You can view labor laws for each state online, and additional tools, posters, for purchase or download, are usually available. Federal (and State) Income Tax Withholding (FIT): You will need to withhold income taxes from your employees paychecks based on their federal and state income tax filing status. (All but 9 states levy a tax on earned income.) There are two Federal payroll tax requirements – FICA and FUTA. o FICA (Federal Insurance Contributions Act) is composed of Social Security and Medicare taxes. Employers are required to withhold the employee’s share of FICA, and to pay the employer’s share. The most current edition of Circular E (issued by IRS) explains what the current tax rates are for FICA. Currently the rate paid by the employee (but withheld by the employer through payroll) is 5.65% (4.2% for social security tax and 1.45% for Medicare tax. For employers the current FICA rate is 7.65% (6.2% for social security tax and 1.45% for Medicare tax). In 2011 individual earnings above $106,500.00 are no longer taxed for Social Security (maximum withholding is $4,485.60). However there is no wage limit for Medicare. o FUTA (Federal Unemployment Tax Act). This tax is solely the responsibility of the employer. FUTA taxes are paid to the federal government and most often in conjunction with individual state’s unemployment systems. The State portion of the unemployment Tax (SUTA) is a separate tax that must be calculated and sent to the appropriate state office. When a state requires unemployment tax, there is usually a drastic reduction on the rate for the Federal Unemployment Tax. However the net tax remains about the same: more of it is paid to the state, rather than the federal government. The total unemployment tax for each employee earning $7000 or more per year is around $70. FICA and FUTA, and SUTA must be calculated for each employee for each pay period. A payroll service does this automatically (see note below) o In addition some states require a Temporary Disability Insurance withholding on employee earnings, which must be deposited to the state unemployment system. For employers who chose not to use a payroll service or bank to do payroll, they have to periodically deposit the withheld monies to make payment pay the IRS and to the appropriate state agencies. There are steep penalties for paying these taxes late or for miscalculated payroll taxes. It is highly recommended that small businesses consider a payroll service that will calculate all payroll taxes, and make deposits to the IRS on the business’s behalf in a timely manner. Make sure you hire a payroll service that will be responsible to pay the penalties and fees if they make a mistake or mis-file any of your taxes. The following federal labor laws apply to all businesses, regardless of size: Equal Pay Act—requires that differences in pay between sexes be based on seniority, merit, wage incentive plans, or factors other than gender, for jobs performed under similar conditions, requiring similar skills, efforts and responsibilities. Immigration Reform and Control Act (IRCA)—requires employers to verify that applicants for employment are authorized to work in the United States. To comply applicants must complete an I-9 form (Employment Eligibility Verification), and the employer must view and/or make a photocopy of acceptable documentation as specified on the form. A completed I-9 form should be on file for each employee. This act also prohibits discrimination based on national origin or citizenship provided the individual is authorized to work in the U.S. The Department of Justice and the Immigration Naturalization Service (INS) enforce this law. Knowingly violating this act can carry both civil and criminal penalties for an employer. The Fair Labor Standards Act (FLSA)—addresses minimum wage, overtime, record keeping and child labor practices. The employees of CA clinics will be for the most part considered exempt from these laws, because of the “professional” or “white collar” nature of the work (i.e. we are not producing goods for interstate commerce and generally do not employ anyone for more than 40 hours per week). If you have more than 14 employees your business is subject to: Title VII Civil Rights Act American with Disabilities Act (ADA) Pregnancy Discrimination Act If you have more than 19 employees your business is subject to: Age Discrimination in Employment Act (ADEA) Older Worker Benefit Protection Act (OWBPA) Employee Retirement Income Security Act (ERISA) Safety The Occupational Safety & Health Administration Act (OSHA) requires businesses that employ 10 or more people to report illnesses and injuries at work and to be inspected periodically. Certain types of “low-hazard” business are exempt from OSHA reporting and inspection requirements too. Community Acupuncture clinics most likely fall into this exempt category, however it is in the best interest of all employers and business owners to promote a safe and hazard-free workplace and to comply with other OSHA requirements. Some of the basic safety concerns that may concern CA clinics are: Having a fire/emergency evacuation plan Having fire extinguisher(s) on the premises Making sure that entry/exit is unobstructed and sound. For example there is a secure handrail if there is a staircase, or ice and pooled water is kept to a minimum All walking surfaces are unobstructed and slip-proof Having a needle stick protocol in place Making sure that employees are aware of potential work hazards and know what policies and protocols to follow should an incident occur. Again, this is not meant to serve as legal guidance for you or your practice. Please use this information as a starting point for your own research or seek out legal counsel in your area.