Accounting Chapter 14 Section 1 o Separate payroll accounts for

advertisement

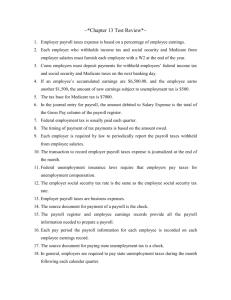

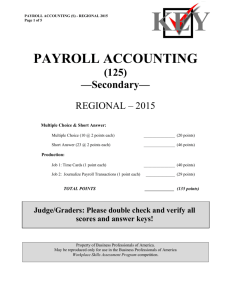

Accounting Chapter 14 Section 1 o Separate payroll accounts for each employee are not kept in the general ledger o Accounts are kept in the general ledger to summarize total earnings and deductions for everyone o Payroll journal entry is based on the totals of the Earnings Total column, each deduction column and the Net Pay column o Totals of Regular and Overtime Earnings and Deductions Totals columns are not used to journalize the payroll o The total earnings column is the Salary Expense for the pay period-it is debited o Credit: Employee Income Tax Payable, Social Security Tax Payable, Medicare Tax Payable, Health Insurance Premiums Payable, U.S. Savings Bond Payable, United Way Donations Payable, Cash (Net Pay amount)-these equal Salary Expense o Journalize payment of a payroll to Cash Payments Journal o Debit Salary Expense and credit about accounts o Cash is credited on first line of entry in cash credit column o Total Earnings = Salary Expense o Net Pay = Credit to cash Section 2 o Employers must pay the government the taxes withheld from employee earnings o Amounts withheld are liabilities until actually paid to the government o Employers also must pay taxes of their own on behalf of the business o Employer Social Security Tax o Medicare Tax o Federal Unemployment Tax o State Employment Tax o Employer payroll taxes expense is based on a percentage of employee earnings o Social Security and Medicare are the only taxes paid by both employer and employee-employer matches employee o Unemployment taxes are paid by employers to pay workers benefits for limited periods of time o Unemployment tax is applied to the first $7,000 earned by each employee for each calendar year o Federal unemployment tax rate is 6.2% of the first $7,000-state unemployment tax can amount for 5.4% of this so federal unemployment tax is .8% o Federal Unemployment Tax o State Unemployment Tax o Social Security Act specifies certain standards for unemployment compensation laws o Journalize employer payroll taxes in General Journal o Debit Payroll Taxes Expense and credit the four types of payroll taxes o Salary Expenses and Payroll Expenses are recorded at the same time payroll is journalized Section 3 o Employees must be given an annual report of all taxes withheld by the employer o Amounts are obtained from employee earnings record o Report is the W-2 must be given out by Jan. 31 of the following year o 4 copies (A-D) prepared: o A-goes to Social Security Administration o B-attached to tax return o C-kept by employee o D-kept by employer o If state has state income tax need extra copies o Form 941-quarterly tax report that lists all taxes withheld-information gotten from employee earnings record o See page 351 for how to prepare Form 941 o Form W-3: Transmittal of Wage and Tax Statement to Social Security Administration o Copy A of W-2s sent by Feb. 28 Section 4 o Frequency of payments is determined by the amount owed o If total amount paid in previous four quarters is $50,000 classified as a monthly depositor o Each deposit must be made by the 15th of the following month along with a Form 8109 (Federal Tax Deposit coupon) o Two exceptions to standard tax schedule: o If less than $500 tax liability is accumulated in a 3 month period- may be made quarterly o If a tax liability of $100,000 is accumulated in 1 day must be deposited the next banking day o Federal Unemployment Taxes are paid quarterly with a form 8109 – 940 box marked to indicate the type of tax o Payment for Federal Unemployment Tax- Cash Payments Journal o Debit o Payment for State same as Federal and paid quarterly

![[Product Name]](http://s2.studylib.net/store/data/005238235_1-ad193c18a3c3c1520cb3a408c054adb7-300x300.png)