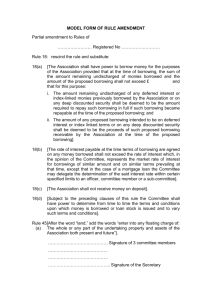

Document

advertisement

Important Issues in Audit vis-à-vis applicability of various Accounting Standards Naresh Kumar Kataria Partner B.K.Khare & Co. Content ► Auditor’s responsibility vis-à-vis Accounting Standards (AS) ► Certain audit issues vis-à-vis applicability of various Accounting Standards Going concern assumption Accounting estimates & SA 540 requirements Exceptional item Borrowing cost Revenue Depreciation on revalued asset Goodwill- accounting treatment Investments Auditor’s responsibility vis-à-vis Accounting Standards (AS) ► Preface to the Statement of Accounting Standards (AS) Duty of Auditors to ensure that: ASs are implemented in the presentation of Financial Statements Adequate disclosures are made in Audit report in the event of deviations from AS. Non-compliance with AS should be subject matter of qualification. Materiality of the relevant item to be considered in making qualification. Auditor’s responsibility vis-à-vis Accounting Standards (AS) ► Under the Companies Act, 2013: Auditor’s responsibility: Auditors to express opinion on compliance of Financial Statements (FS) with AS as specified under 133 of the Act. (Section 143-3). Management responsibility: FS shall give a true and fair view, comply with notified AS (Section 129(1)) In case of non-compliance, disclosures to be made of: 1. deviation from AS 2. reasons for such deviation 3. financial effect Auditor’s responsibility vis-à-vis Accounting Standards (AS) ► Under the Companies Act, 2013 (cont’d): Non-compliance is punishable with imprisonment for a term up to 1 year or fine (Min. Rs 50K, Max. Rs.5 Lac) or both. (applicable to MD/WTD in charge of finance/ CFO and all the directors in the absence of any officers). Director’s responsibility statement in director’s report to state that applicable ASs are followed with the explanation relating to material departure. (Section 134(5)) Going concern assumption: ► Fundamental accounting principle in preparation of FS ► Management responsibility to make assessment of entity’s ability to continue as going concern. ► Auditor’s responsibility (SA -570) to: Obtain sufficient audit evidence about the appropriateness of management use of going concern assumption Conclude whether there is material uncertainty about the entity’s ability to continue as going concern. Determine implication for the auditor’s report Going concern assumption (cont’d): ► Events or conditions that may cast doubt about going concern assumption: Substantial operating losses and negative operating cash flows Net-worth erosion. BIFR / CDR filings (non-compliance of debt covenants / defaults) Disruption of key raw material supplies Loss of major markets, key customers, technological obsolescence Change in law/regulation/government policy having material adverse effect Going concern assumption (cont’d): ► Auditor to evaluate management plan for future action: Plan to liquidate assets / borrow money / restructure of debts / infusion of capital / reduce cost Projected cash flows considering impacts of expected turnaround on the above actions ► Support by promoter / third parties (funding / guarantees etc.)-support letter. Evaluating reasonableness of assumptions / forecasts and reliability of underlying data. ► Obtaining representation from management regarding plans for future action and feasibility of this plan. Going concern assumption (cont’d): Effects on the Auditor’s report Adequacy of disclosure of material uncertainty in notes Mater of emphasis Inadequacy of disclosure of material uncertainty in notes Qualification No disclosure in notes Adverse opinion Use of going concern in appropriate- irrespective of Adverse opinion disclosure Accounting Estimates ► Provision for diminution in value of Investments ► Determination of future cash-flows used for impairment testing of assets ► Determination of total estimated project cost and stage of completion in the case of construction contracts (Accounting Standard 7) ► Estimation of future losses in the case onerous contracts based on total estimated revenue and estimated cost to completion (Accounting Standard 29) ► Contingent Liabilities ► Retirement Benefits (Accounting Standard 15) ► Useful life of Assets and residual value ► Outcome of long term contracts / litigations – comment required in revised auditors report ► Doubtful debts ► Derivative Instruments (mark to market value) SA 540 requirement ► Risk of material misstatement including their susceptibility to unintentional or intentional management bias ► Auditor need to obtain sufficient audit evidence that accounting estimates are reasonable ► Auditors Responsibility Test the underlying data and evaluate the data Consider source, relevance and reliability of data Reasonableness of method used and assumptions made. E.g. Discounted Cash flows, estimated values, Networth Test the operative effectiveness of controls and how management evaluates accounting estimates Management review/approval process and reliability of data Sensitivity analysis Review outcome of the prior period accounting estimates Consistency of methods Exceptional Items ► What is an exceptional item? ► Not defined in AS-5 and Schedule III ► AS-5, Para 12 “When items of income and expenses within profit and loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately” ► Per Clause 41 of listing agreement - ‘All items of income and expenditure arising out of transactions of exceptional nature shall be disclosed’ ► Matter of judgment considering materiality and significance of impact on results ► Examples: ► Profit on sale of investments/disposal of subsidiaries/properties ► Voluntary retirement schemes/labour settlements ► Provision for diminution in value of investments/impairment of assets ► Provision towards litigations Exceptional Items, Contd…. ► Impact of CDR with banks ► Significant write offs/ write back of provisions ► Discontinued Operations ► Standard permits disclosure in notes or face of Profit and Loss ► Schedule III requires disclosure on face of Profit and Loss Account Extra ordinary Items Vs. Exceptional Items ► Extra ordinary items arise out of rare and infrequent occurrences arising from events distinct from ordinary course of business. E.g. : Earthquake ► Ind AS prohibit presentation of any item as an extra-ordinary. Borrowing cost ► Amount of premium/discount on forward contracts - Whether part of borrowing cost and capitalisable upto the date asset is ‘ready to use’. ► Borrowing cost under AS 16 – borrowing costs comprise interest and other costs incurred in connection with borrowing of funds and includes amortisation of discount or premium relating to borrowings. ► Different accounting treatment being followed ► One view is that amortised cost is integral part of borrowing, hence capitalisable. ► EAC has taken a contrary view on the grounds that discount or premium on forward contracts are costs incurred to hedge currency risk and not arranging borrowing. ► AS 11 specifically requires such costs to be charged to P/L. Borrowing cost, Contd…. ► ► Loan processing costs – whether can be amortised over the loan period. ► Borrowing cost includes amortisation of ancillary cost incurred in connection with borrowing. ► AS 26 specifically excludes borrowing costs. ► Under Ind AS, processing costs are considered for effective interest rate calculation. Capitalisation of borrowing costs in case of delayed projects. ► Depends on facts and circumstances of the case. ► Currently relevant as many large capital projects like Power Plants are delayed due to issues in Gas supply or lack of transmission linkages. ► Capitalisation not permitted during extended periods when active development is stopped. ► MCA has clarified that borrowing cost incurred during extended delay in commencement of commercial production after the plant is otherwise ready does not increase the worth of fixed assets. Such cost can not, therefore, be capitalized. Revenue: Timing of Recognition - Transfer of significant risk and reward of ownership: Specific Matters Views can be considered Sale on C.I.F basis In the event when seller arranges and pays for carriage and insurance under Inco-terms and the buyer is the named beneficiary of any insurance – revenue may be recognized when BOL prepared. Sale of goods with option Revenue may be postponed till the expiry of option or of return make provision for sales return based on historical experience. Contract for sale of Depends upon the terms and duration of the contract material and installation and whether multiple element transactions required commission separate timing for recognition. (e.g. EPC contract under AS -7) Revenue: ► Revenue whether Gross or Net discount: ► Trade and volume discount should be net of sales (as per recent EAC opinion, discount should not be shown separately) Accounting treatment of discount or offers given to buyer: Combined sales (2 product with 1 product free) – at billed value Discount on secondary sales through distributors – marketing expenses Discount coupon for future purchases to customers – reduce from sales on basis of historical data random distribution of discount coupons - no link to initial sales - marketing expense. Depreciation on revalued asset: ► Depreciation on revalued assets: As per application guidance on schedule II, depreciation to be charged to P&L on revalued asset. (depreciation on revalued portion can not be withdrawn from revaluation reserve to P&L) Schedule II requires depreciation on actual cost or substituted cost vis-à-vis historical cost as per old schedule XIV. Guidance permits transfer of portion of revaluation reserve to general reserve as assets is used. Goodwill: Accounting treatment Goodwill arising on acquisition of business (Excess of consideration over net assets) Not mandatory; Prudent to amortize Goodwill on Amalgamation Goodwill on Consolidation Over 5 Years No Specific Guidance; Tested for Impairment Goodwill on Consolidation of foreign subsidiary - translation at year end rate and corresponding effect to foreign currency translation reserve. Investments ► Investments originally held for long term – Change in intention to dispose ► Reclassification at lower of cost or realisable value ► Due diligence cost/successor fees cost to investment banker – whether part of cost ► Not to be part of acquisition charges as per ICAI opinion Thanks