- Write Source

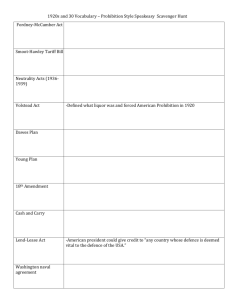

advertisement

Save Now, or Pay Later by Burnett Sawyer Your paycheck Imagine that you’ve finished school, gotten a job, worked hard all week, and this dollar bill represents your whole paycheck. Minus income tax . . . As your employer, I’m about to hand you the check when I stop, tear off about 20% like this, give it to Uncle Sam and say, “Here’s my employee’s income tax.” Minus Social Security . . . Then I tear off another 30% like this, give that to Uncle Sam too and say, “And here’s her Medicare and Social Security tax.” What is Medicare? What is Social Security? You get what’s left . . . Finally, I give you this half and say, “Here, hard worker, this is what’s left of your whole paycheck.” Does that sound like science fiction? Senator Alan Simpson doesn’t think so. In Modern Maturity magazine, he says that unless legislation changes the Social Security system, our generation will pay 20% of our paychecks as income tax, and 30% as Social Security tax. That means we can keep just 50% of what we earn! But the news gets worse! Remember this 30% that we paid to Social Security? Well, that won’t be enough money for retired people to live on in the year 2043. Remember that year, 2043—we’ll come back to that soon. What’s the problem? The Social Security system can’t ensure our savings for retirement. What’s the solution? We have to start our own savings plans, and the earlier the better! Social Security Timeline 1935: Social Security starts Ever since the Social Security system started in 1935, it has never been secure. Social Security Timeline 1935: Social Security starts 1983: System is adjusted 2056: Social Security to end While the system has been “fixed” a number of times, these fix-it jobs haven’t solved the problem. For example, writer Keith Carlson points out that in 1983 Congress raised payroll taxes, extended the retirement age, and said that the system would be in good financial shape until 2056. Social Security Timeline 1935: Social Security starts 1983: System is adjusted 1992: System is revised 2043: Social Security to end 2056: Social Security to end But then, says Carlson, just nine years later, a report said that Congress had been wrong. It said that Social Security money wouldn’t even last until 2056; it would run out by 2043. Remember that year, 2043? That’s six years before we’re supposed to retire at age 67! Social Security Timeline 1935: Social Security starts 1983: System is adjusted 1992: System is revised 2029: US bankrupted! 2043: Social Security to end 2056: Social Security to end What is the AARP? Do you think that news is bad? The AARP Bulletin reported on the Bipartisan Commission on Entitlement and Tax Reform, which warned that entitlement programs such as Social Security are growing so fast they could “bankrupt the country” by the year 2029— when we’re only 47! So what should we do? Next fall we can vote in a presidential election for the first time. Both Democrats and Republicans say they have a plan that will use money from the budget surplus to fix Social Security. What if we all vote for the presidential candidate with the best plan? Will that save our retirement funds? Don’t count on it! As the track record for Social Security shows, one more fix-it job won’t fix the system. We have to start our own retirement plans . . . . . . and do it early in our careers. In fact, in his book, Retirement 101, Willard Enteman says that we should start a personal savings plan the day we get our first paychecks. In sociology class last week, Mr. Christians made the same point. He gave us this bar graph showing that if our goal is to save $200,000 by age 67, we had better start early before saving gets too expensive. A $200,000 Savings Plan $900 $800 $700 $600 Age 25 Age 35 Age 45 Age 55 $500 $400 $300 $200 $100 $0 Monthly savings necessary As you can see from the graph, if we start saving when we’re 25, we can reach $200,000 by saving just $49 a month. A $200,000 Savings Plan $900 $800 $700 $600 Age 25 Age 35 Age 45 Age 55 $500 $400 $300 $200 $100 $0 Monthly savings necessary If we wait until we’re 35, we’ll have to save $113 a month. A $200,000 Savings Plan $900 $800 $700 $600 Age 25 Age 35 Age 45 Age 55 $500 $400 $300 $200 $100 $0 Monthly savings necessary If we wait until we’re 45, we’ll have to put away $279 a month. A $200,000 Savings Plan $900 $800 $700 $600 Age 25 Age 35 Age 45 Age 55 $500 $400 $300 $200 $100 $0 Monthly savings necessary And if we wait until we’re 55, we’ll need $832 a month. Look at the difference! $900 $800 $700 $600 Age 25 Age 35 Age 45 Age 55 $500 $400 $300 $200 $100 $0 Monthly savings necessary To reach $200,000 by age 67 would cost $49 a month if we start at 25, and $832 a month if we start at 55. What’s my point? The Social Security system can’t promise us financial security when we retire in 2049. What’s the solution? We have to start our own savings plans . . . . . . and the earlier we start, the easier it will be to reach our goals. So let’s get started!