Problem 13 Solution

advertisement

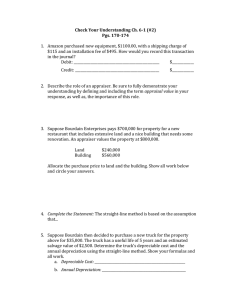

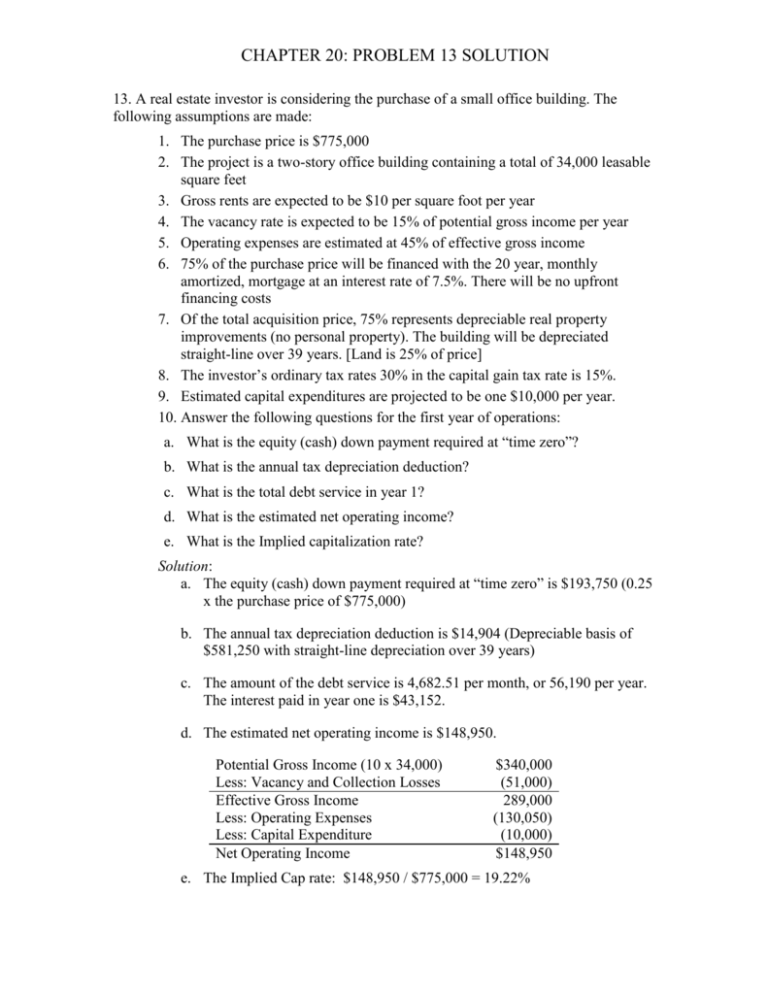

CHAPTER 20: PROBLEM 13 SOLUTION 13. A real estate investor is considering the purchase of a small office building. The following assumptions are made: 1. The purchase price is $775,000 2. The project is a two-story office building containing a total of 34,000 leasable square feet 3. Gross rents are expected to be $10 per square foot per year 4. The vacancy rate is expected to be 15% of potential gross income per year 5. Operating expenses are estimated at 45% of effective gross income 6. 75% of the purchase price will be financed with the 20 year, monthly amortized, mortgage at an interest rate of 7.5%. There will be no upfront financing costs 7. Of the total acquisition price, 75% represents depreciable real property improvements (no personal property). The building will be depreciated straight-line over 39 years. [Land is 25% of price] 8. The investor’s ordinary tax rates 30% in the capital gain tax rate is 15%. 9. Estimated capital expenditures are projected to be one $10,000 per year. 10. Answer the following questions for the first year of operations: a. What is the equity (cash) down payment required at “time zero”? b. What is the annual tax depreciation deduction? c. What is the total debt service in year 1? d. What is the estimated net operating income? e. What is the Implied capitalization rate? Solution: a. The equity (cash) down payment required at “time zero” is $193,750 (0.25 x the purchase price of $775,000) b. The annual tax depreciation deduction is $14,904 (Depreciable basis of $581,250 with straight-line depreciation over 39 years) c. The amount of the debt service is 4,682.51 per month, or 56,190 per year. The interest paid in year one is $43,152. d. The estimated net operating income is $148,950. Potential Gross Income (10 x 34,000) Less: Vacancy and Collection Losses Effective Gross Income Less: Operating Expenses Less: Capital Expenditure Net Operating Income $340,000 (51,000) 289,000 (130,050) (10,000) $148,950 e. The Implied Cap rate: $148,950 / $775,000 = 19.22%