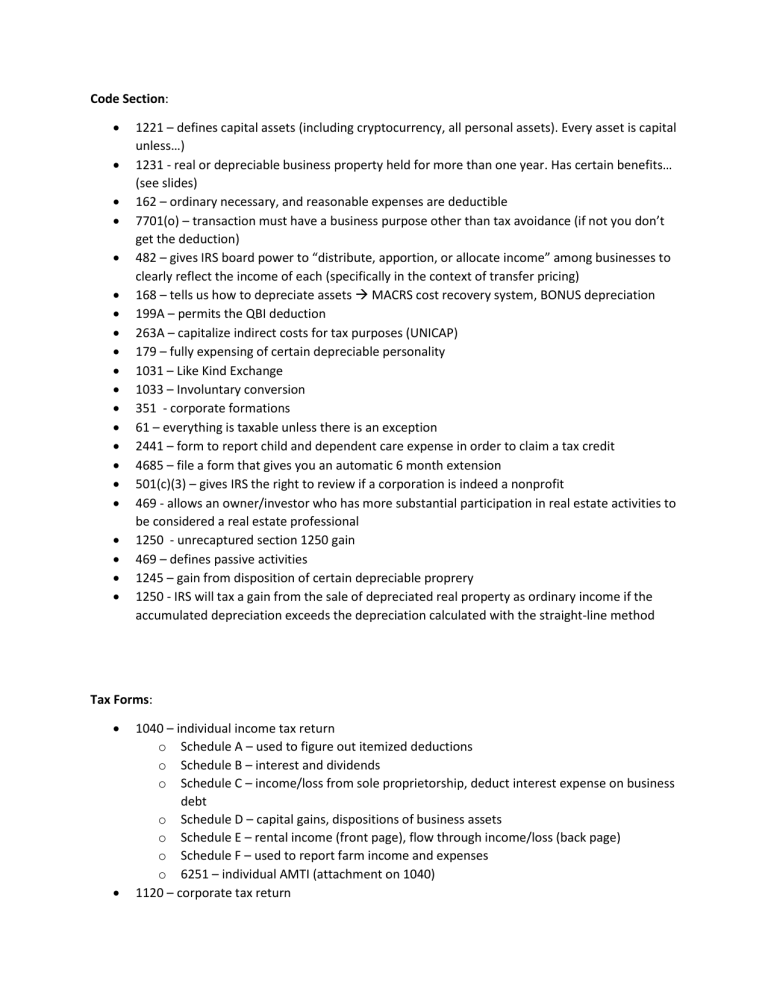

Code Section: 1221 – defines capital assets (including cryptocurrency, all personal assets). Every asset is capital unless…) 1231 - real or depreciable business property held for more than one year. Has certain benefits… (see slides) 162 – ordinary necessary, and reasonable expenses are deductible 7701(o) – transaction must have a business purpose other than tax avoidance (if not you don’t get the deduction) 482 – gives IRS board power to “distribute, apportion, or allocate income” among businesses to clearly reflect the income of each (specifically in the context of transfer pricing) 168 – tells us how to depreciate assets MACRS cost recovery system, BONUS depreciation 199A – permits the QBI deduction 263A – capitalize indirect costs for tax purposes (UNICAP) 179 – fully expensing of certain depreciable personality 1031 – Like Kind Exchange 1033 – Involuntary conversion 351 - corporate formations 61 – everything is taxable unless there is an exception 2441 – form to report child and dependent care expense in order to claim a tax credit 4685 – file a form that gives you an automatic 6 month extension 501(c)(3) – gives IRS the right to review if a corporation is indeed a nonprofit 469 - allows an owner/investor who has more substantial participation in real estate activities to be considered a real estate professional 1250 - unrecaptured section 1250 gain 469 – defines passive activities 1245 – gain from disposition of certain depreciable proprery 1250 - IRS will tax a gain from the sale of depreciated real property as ordinary income if the accumulated depreciation exceeds the depreciation calculated with the straight-line method Tax Forms: 1040 – individual income tax return o Schedule A – used to figure out itemized deductions o Schedule B – interest and dividends o Schedule C – income/loss from sole proprietorship, deduct interest expense on business debt o Schedule D – capital gains, dispositions of business assets o Schedule E – rental income (front page), flow through income/loss (back page) o Schedule F – used to report farm income and expenses o 6251 – individual AMTI (attachment on 1040) 1120 – corporate tax return o Schedule M-1: Reconciliation of Income (loss) per books with income per return o Schedule M-3: for corporations with >=$10m in assets (don’t need to file M1) o 1120S – income tax return for S corporations 1120X – amended return o Can be filed to apply unused credits carried back (get a refund from the gov’t) 4797 – dispositions of business assets 4562 – claim deductions for depreciation/amortization 1040-ES – used to figure and pay your estimated tax (income not subject to withholding, (e.g. not wages) needs to be estimated) 1040-SE—used to report self-employment income 1065 – partnership income tax return 4 of these, 1 each quarter o Each partner files a K-1 to report their share of earnings o share of partnership income gets reported on Schedule E (attached to 1040, also reports any rental income) K-1 - federal tax document used to report the income, losses, and dividends of a business' or financial entity's partners or an S corporation's shareholder 1023 – request tax-exempt status for corporations (nonprofit) 2553 – form to file to become an S Corporation (IRS election) 8814 – parent’s file to report children’s income (“kiddie tax”) 7004 – corporations file to get 6 month extension (still have to pay on time but get longer to file the return) 4868 – extension for individuals to file tax return 8829 – home office deduction (cannot create loss for sole proprietor) note: social security – 6.2% Medicare – 1.45 % self-employment – 15.3% (for taxpayers under 140,000)