Cash Flows & Valuation

advertisement

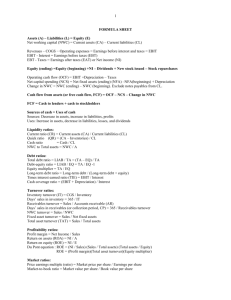

Business Finance Michael Dimond What CF do stockholders really buy? • Dividend? • Net Income? • Free Cash Flow? • To understand cash flow, you must understand financial statements and what the figures represent Michael Dimond School of Business Administration Discounting the cash flows is the easy part… • Computing the correct cash flow is a little more complicated. • Trying to accurately predict the future (plus or minus a little ) • Trying to use accounting figures to show economic reality • You must understand what the number represents and what went into it before you can present an accurate valuation. • Remember the financial statements? • Income statement • Balance sheet • Statement of cash flows • You will be computing cash flows… • from financial statements to evaluate existing businesses • from pro forma financials to evaluate proposals and scenarios • You may need to measure sensitivity to certain inputs • What if sales or costs are less than (or more than) expected? • What if growth is less than (or more than) expected? Michael Dimond School of Business Administration Cash Flows • NOPAT = Net Operating Profit After Taxes EBIT(1-t) • OCF = Operating Cash Flow NOPAT + Depreciation Expense Why doesn’t this work: NI + Interest + Depreciation Expense • NOTE: Operating Cash Flow is not the same as Cash Flow from Operations • FCF = Free Cash Flow OCF – Net Cash Investment in Operating Capital • Free Cash Flow: The cash generated which is available to satisfy the needs of lenders and the wants of investors. • FCFE = Free Cash Flow for Equity FCF – Net Cash Flow to Debt • Free Cash Flow to for Equity: The cash generated which is available to satisfy the wants of investors. Michael Dimond School of Business Administration Working with financial statement data • Accounting figures are distorted for several reasons • Rules & laws • Assumptions & “Generally Accepted Accounting Principles” • Inaccuracies & manipulations • Financial Analysis tries to get those numbers to represent economic reality • Non-cash “expenses” • Categorization of revenues and expenses • Operating Cash Flow (OCF) is the basic starting point of all valuation efforts • • • • Need to understand the figures being used OCF = NOPAT + Depreciation Expense NOPAT = EBIT(1-t) :. OCF = EBIT(1-t) + Depreciation Expense Michael Dimond School of Business Administration EBIT • Given a bunch of financial data, how do you compute EBIT? • Top down or bottom up? • Bottom up is easier to remember • Top down helps you understand better • Building a pro forma income statement Michael Dimond School of Business Administration Tax Rate • Tax expense ÷ EBT (Earnings Before Taxes) • • • • EBT is also called Net Profit Before Taxes Average tax rate Marginal tax rate Typical tax rates in finance problems will be 34%, 35% or 40%. This is not true in real life. Michael Dimond School of Business Administration Depreciation • What is depreciation? • Straightline vs MACRS • Why do we adjust for depreciation when computing OCF? • What about other non-cash expenses? Michael Dimond School of Business Administration Operating Cash Flow (OCF) • EBIT = … • NI + Tax + Interest • Sales – Direct Costs – Indirect Costs – Depreciation • Sales – Total Variable Costs – Total Fixed Costs – Depreciation • Tax rate = … • Might be given (e.g. 34%, 35%, 40%) • Might be derived from Tax ÷ EBT • EBT = EBIT - Interest • NOPAT = EBIT(1-t) • OCF = NOPAT + Depreciation Expense Michael Dimond School of Business Administration Michael Dimond School of Business Administration Michael Dimond School of Business Administration Michael Dimond School of Business Administration Operating Cash Flow (OCF) • From the income statement • EBIT x (1-t) + Depreciation = OCF • 370 x (1-0.4) + 100 = 322 Michael Dimond School of Business Administration OCF → FCF • FCF = Free Cash Flow • Free Cash Flow: The cash generated which is available to satisfy the needs of lenders and the wants of investors. OCF – Net Cash Investment in Operating Capital • What is operating capital? • Assets used for operating purposes • Not financial assets • Operating assets can be classified as Fixed Assets and Current Assets • Fixed assets are normally capitalized, so depreciation is involved • Current Assets are also called Working Capital. We really care about Net Working Capital • Net Working Capital is Current Assets – Current Liabilities • Are all current liabilities operating items? • NWC for our purposes will be limited to operating items only, so… NWC = Current Assets – (Accounts Payable + Accruals) which should be the same as NWC = Current Assets – (Current Liabilities – Non-operating CLs) Michael Dimond School of Business Administration OCF → FCF • OCF – Δ GFA – Δ NCA = FCF • 322 – 300 – 0 = 22 • Net Fixed Assets increased 200, and depreciation was 100, so Δ GFA = 300 • How much did current assets change? • How much did AP & Accruals change? Michael Dimond School of Business Administration OCF → FCF • OCF – ΔGFA – ΔNCA = FCF • 322 – 300 – 0 = 22 • Current Assets increased 100, so Δ CA = 100 • CLOP (AP + Accruals) was 700 in 2011 and 800 in 2012, so Δ CLOP = 100 • We need the Net amount, so we subtract: Δ CA - Δ CLOP = Δ NCA 100 - 100 = 0 Michael Dimond School of Business Administration Capital Budgeting Decisions • To make an objective business decision, we have to understand the scenario, the relevant cash flows, the change in cash flow caused by the decision, and the net present value of those incremental cash flows. • At its simplest, it might be like this capital budget proposal: 9% Hurdle Rate YEAR 0 (1,110,400) Initial Investment Incremental CF Terminal Value Total CF PV NPV (Sum of PVs, less Initial Investment) IRR PBP 1 2 3 4 257,200 344,400 274,200 258,800 (1,110,400) 257,200 (1,110,400.0000) 235,963.3028 100,900.3907 12.24% 3.91 344,400 289,874.5897 274,200 211,732.7102 258,800 183,340.4446 5 274,800 172,000 446,800 290,389.3434 • Is life ever that simple? Michael Dimond School of Business Administration Scenario • How long is the timeline? • What happens, and when? Proposal: 0 Sell old machine Buy new machine Install new machine Increase NWC needs 1 2 3 4 Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs 5 Reduced Operating Costs Sell “new” machine Reduce NWC needs Michael Dimond School of Business Administration Relevant Cash Flows • What are the cash inflows and outflows? Proposal: 0 Sell old machine Buy new machine Install new machine Increase NWC needs 1 2 3 4 Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs 5 Reduced Operating Costs Sell “new” machine Reduce NWC needs Michael Dimond School of Business Administration Relevant Cash Flows • What are the cash inflows and outflows? Proposal: 0 Sell old machine Buy new machine Install new machine Increase NWC needs 1 2 3 4 Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs Reduced Operating Costs 5 Reduced Op. Costs Sell “new” machine Reduce NWC needs $147,000 Inflow $25,000 Inflow __________________ TV = $172,000 Inflow $264,600 Inflow $1,200,000 Outflow $150,000 Outflow $25,000 Outflow _________________ Io = $1,110,400 Outflow $350k $350k $350k $350k $350k • Is that all? • We also need to consider the effect which depreciation has on tax expense. Michael Dimond School of Business Administration Relevant Cash Flows • Depreciation is a non-cash expense, but it does have an effect on tax expense (therefore depreciation has an effect on a cash flow). CF for New Machine YEAR Reduction in Operating Cost Depreciation Net Profit before Tax Tax (@40%) Net Profit After Tax Operating Cash Flow 0 1 350,000 270,000 80,000 32,000 48,000 318,000 2 350,000 432,000 (82,000) (32,800) (49,200) 382,800 3 350,000 256,500 93,500 37,400 56,100 312,600 4 350,000 162,000 188,000 75,200 112,800 274,800 5 350,000 162,000 188,000 75,200 112,800 274,800 Michael Dimond School of Business Administration Incremental Cash Flows • What & when would the BAU cash flows be? • No cost savings • What about the effect which depreciation would have had on tax expense? • What salvage value would the existing (BAU) equipment have after year 5? CF for Old Machine YEAR 0 Depreciation Net Profit before Tax Tax (@40%) Net Profit After Tax Operating Cash Flow 1 2 3 4 152,000 (152,000) (60,800) (91,200) 60,800 96,000 (96,000) (38,400) (57,600) 38,400 96,000 (96,000) (38,400) (57,600) 38,400 40,000 (40,000) (16,000) (24,000) 16,000 5 - • What is the difference between BAU and the proposal cash flows? Incremental CF YEAR New Machine CF Old Machine CF Incremental CF (Difference) 0 1 318,000 60,800 257,200 2 382,800 38,400 344,400 3 312,600 38,400 274,200 4 274,800 16,000 258,800 5 274,800 274,800 Michael Dimond School of Business Administration DCF analysis • What is the hurdle rate? • 9.0% • What/when are the incremental cash flows? 9% Hurdle Rate YEAR 0 (1,110,400) Initial Investment Incremental CF Terminal Value Total CF PV NPV (Sum of PVs, less Initial Investment) IRR PBP 1 2 3 4 257,200 344,400 274,200 258,800 (1,110,400) 257,200 (1,110,400.0000) 235,963.3028 100,900.3907 12.24% 3.91 344,400 289,874.5897 274,200 211,732.7102 258,800 183,340.4446 5 274,800 172,000 446,800 290,389.3434 Michael Dimond School of Business Administration Objective decision • Do the incremental cash flows have a positive NPV? • Yes, $100,900 • Is the IRR greater than the hurdle rate? • Yes, 12.2% > 9.0% • Is the payback period acceptable? • Depends on what management says about PBP, but NPV and IRR should be used to make the actual decision. I use PBP just to show a complete picture. 9% Hurdle Rate YEAR 0 (1,110,400) Initial Investment Incremental CF Terminal Value Total CF PV NPV (Sum of PVs, less Initial Investment) IRR PBP 1 2 3 4 257,200 344,400 274,200 258,800 (1,110,400) 257,200 (1,110,400.0000) 235,963.3028 100,900.3907 12.24% 3.91 344,400 289,874.5897 274,200 211,732.7102 258,800 183,340.4446 5 274,800 172,000 446,800 290,389.3434 Michael Dimond School of Business Administration Michael Dimond School of Business Administration