Tutorial_CF

advertisement

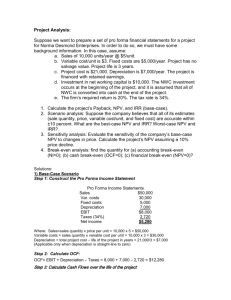

Tutorial Chapter III Cash Flow and Financial Planning Cash Flow and Financial Planning - Goals • Tax depreciation procedures • The firm’s statement of cash flows • Financial planning process (short-term and long-term) • Cash-planning process (cash budget) • The pro forma income statement • The pro forma balance sheet Depreciation = systematic charging of a portion of costs of Fixed Assets against revenues over time. - The amount is determined by using Modified Accelerated Cost Recovery System (MACRS) - Depreciable value - Depreciable life Statement of CF - Summarizes the firm‘s CF over a given period of time CF is divided into - operating flows - investment flows - financing flows Inflows – Decrease in A, Increase in Liab., EAT, Depreciation, Sale of stock Outflows – Inc. in A, Dec. in Liab., Net loss, Dividends paid, Repurchase of stock Formulas CF from operations = EAT + Depreciation Operating CF = EBIT*(1-T) + Depreciation = NOPAT + Depreciation FCF = OCF – NFAI – NCAI NFAI = Change in net fixed A + Depreciation NCAI = Change in current A – Change in (accounts payable + accruals) Financial planning process Long-term financial plans – cover a 2 to 10 years period, Strategic decisions Short-term financial plans – cover 1 to 2 years period, Operating financing Cash Budget = a statement of a firm‘s planned inflows and outflows of cash. As a basis is used the sales forecast provided by the marketing department. Financial planning process Profit planning – Pro-Forma Statements Pro-Forma Statements = projected income statements and balance sheets, two inputs are needed - the sales forecast and the financial statements for the preceding year. Preparing Pro-Forma Income Statement – percent-of-sales method Preparing Pro-Forma Balance Sheet – judgmental approach Exercise 3 - 3 • Determine OCF • Sales of $2,500,000 • Cost of goods sold $ 1,800,000 • Operating expenses $300,000 • Depreciation expenses $200,000 • Tax rate 35% Exercise 3 – 3 Solution • OCF = [EBIT * (1-t)] + Depreciation • EBIT = $2,500,000 - $1,800,000 $300,000 = $400,000 • OCF = [$400,000 * (1 - 0.35)] + $200,000 = $460,000 Exercise 3 - 4 • Calculate FCF • Increase in fixed assets $300,000 • Depreciation $200,000 • Increase in current assets $150,000 • Increase in accounts payable $75,000 • OCF was $700,000 Exercise 3 – 4 Solution • FCF = OCF - NFAI - NCAI • NFAI = change in fixed assets + depreciation • NFAI = $300,000 + $200,000 = $500,000 • NCAI = change in current assets - change in (acc. payable + accruals) • NCAI = $150,000 - $75,000 = $75,000 • OCF = $700,000 • FCF = $700,000 - $500,000 - $75,000 = $125,000 Exercise 3 - 5 • Estimate net profits before taxes • Sales forecast of $650,000 • Fixed costs of $250,000 • Variable costs 35% of Sales • Operating expenses include fixed costs of $28,000 and variable costs 7,5% of sales • Interest expenses are $20,000 Exercise 3 – 5 Solution Problem 3 - 2 • Accounting cash flow • Earnings after taxes $50,000 • Depreciation $28,000 • Amortization $2,000 • What was the firms accounting cash flow from operations? Problem 3 – 2 Solution • Earnings after taxes $50,000 • Plus: Depreciation $28,000 • Plus: Amortization $ 2,000 • Cash Flow from operations $80,000 Note: Deprec. and Amor. are non-cash charges. Depreciation is charged against tangible assets, amortization is charged against intangible assets. Problem 3 - 4 • Depreciation and accounting Cash Flow • Asset original cost of $180,000 has a 5-year • MACRS recovery period, now in 3rd year (19%) • Accruals $15,000 • Current assets $120,000 • Interest expense $15,000 • Sales revenue $400,000 • Inventory $70,000 • Total cost before deprec., int. and tax $290,000 • Tax rate on ordinary income 40% Problem 3 – 4 Solution Problem 3 - 5 Problem 3 – 5 Solution Problem 3 - 7 • Cash receipts • Sales of $65,000 in April, $60,000 in May • Sales of $70,000 in June, $100,000 in July and in August • Half of sales are for cash and the other half is collected evenly over next 2 months • What are firms expected cash receipts for June, July and August? • Use Excel sheet (Problem 3-7.xlsx) Problem 3 – 7 Solution Problem 3 - 8 • Cash disbursement schedule for April, May and June • Sales from February: $500,000 $500,000 $560,000 $610,000 $650,000 $650,000 • Purchases: 60% of next month’s sales, 10% in cash, 50% after 1 month, 40% after 2 month • Rent: $8,000 per month • Wages and Salaries: Fixed $6,000/month + 7% of sales • Taxes: $54,500 due in June • Fixed asset outlays: New equipment in April for $75,000 • Interest payments: A payment of $30,000 is due in June • Cash dividends: $12,500 will be paid in April • Principal payments and retirements: None • Use Excel sheet (Problem 3-8.xlsx) Problem 3 – 8 Solution Problem 3 - 14 • Pro forma income statement • Use the percent of sales method to prepare a pro forma income statement • Use fixed and variable cost data to develop a pro forma income statement • Use Excel sheet (Problem 3-14.xlsx) Problem 3 – 14 Solution a) Problem 3 – 14 Solution b) •Using fixed and variable costs higher profit is projected • Percent of sales method is more conservative, but fixed and variable costs method is more accurate Problem 3 - 17 • Pro forma balance sheet • Analyze expected performance and financing needs for 2008 - 2yrs ahead • Prepare pro forma balance sheet dated Dec. 31. 2008 • Discuss the financing changes suggested by the statement prepared • Use Excel sheet (Problem 3-17.xlsx) Problem 3 – 17 Solution Company must arrange for additional financing of at least $775,000 over the next two years based on the given constraints and projections