Chapter 11 - TeacherWeb

advertisement

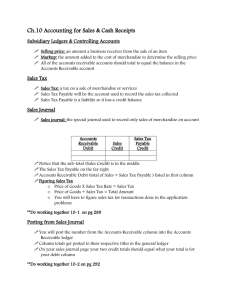

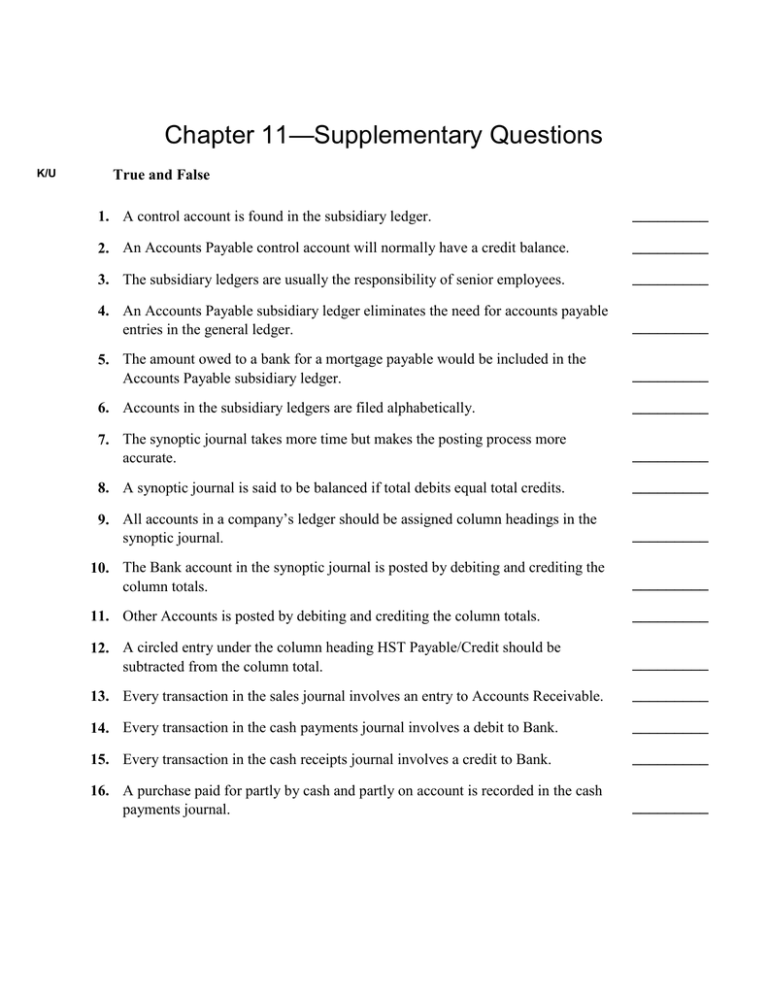

Chapter 11—Supplementary Questions K/U True and False 1. A control account is found in the subsidiary ledger. _________ 2. An Accounts Payable control account will normally have a credit balance. _________ 3. The subsidiary ledgers are usually the responsibility of senior employees. _________ 4. An Accounts Payable subsidiary ledger eliminates the need for accounts payable entries in the general ledger. _________ 5. The amount owed to a bank for a mortgage payable would be included in the Accounts Payable subsidiary ledger. _________ 6. Accounts in the subsidiary ledgers are filed alphabetically. _________ 7. The synoptic journal takes more time but makes the posting process more accurate. _________ 8. A synoptic journal is said to be balanced if total debits equal total credits. _________ 9. All accounts in a company’s ledger should be assigned column headings in the synoptic journal. _________ 10. The Bank account in the synoptic journal is posted by debiting and crediting the column totals. _________ 11. Other Accounts is posted by debiting and crediting the column totals. _________ 12. A circled entry under the column heading HST Payable/Credit should be subtracted from the column total. _________ 13. Every transaction in the sales journal involves an entry to Accounts Receivable. _________ 14. Every transaction in the cash payments journal involves a debit to Bank. _________ 15. Every transaction in the cash receipts journal involves a credit to Bank. _________ 16. A purchase paid for partly by cash and partly on account is recorded in the cash payments journal. _________ K/U 17. Every entry in the purchases journal involves a debit to Accounts Payable. _________ 18. The general journal must be posted before the other journals. _________ 19. The general journal is part of the five-journal system. _________ 20. There is no advantage to learning manual journalizing systems because computer technology has made them obsolete. _________ Multiple Choice 21. Which of the following statements regarding the synoptic journal is false? A. It is designed mainly for small businesses with only a few employees. B. It speeds up the posting process. C. It is balanced after posting has been completed D. Cross-balancing involves checking to see if total debits equal total credits. 22. Which of the following statements concerning the synoptic journal is true? A. It is posted at the end of each day. B. No journal entry may use more than one line. C. Column headings are allotted to every account in the ledger. D. It is balanced when a page is filled up. 23. Identify the column total that would not be posted to the ledger. A. Bank B. Other Accounts C. Sales D. HST Payable 24. Select the source document that would not be involved in a transaction entered in the cash receipts journal. A. cash sales slip B. bank credit advice C. cash receipts list D. credit invoice 25. Which of the following is not an advantage of using several journals in the accounting system? A. It eliminates the need for a general journal. B. It allows for several people to be involved in the journalizing process at the same time. C. It makes the accounting system more efficient by allowing specialization of duties. D. The columnar journals save time in journalizing and posting. 26. Which of the following entries would be journalized in the cash receipts journal? A. debit Bank, credit Sales B. debit Bank, credit Accounts Receivable C. debit Bank, credit Interest Earned D. All of the above. 27. Select the entry that would be found in a sales journal. A. debit Accounts Payable, credit Sales B. debit Accounts Receivable, credit Sales C. debit Sales, credit Accounts Payable D. debit Sales, credit Accounts Receivable 28. Select the source document that would be involved in a cash payments journal transaction. A. sales invoice B. bank debit memo C. cheque copy D. cash sales slip 29. The entries in the Accounts Payable column of the cash payments journal are A. credited each day to a creditor’s account. B. debited each day to a creditor’s account. C. credited each month to a creditor’s account. D. debited each month to a creditor’s account. 30. When a supermarket buys fruits and vegetables from a grocery wholesaler on account, in which journal is the accounting entry made? A. cash receipts journal B. sales journal C. cash payments journal D. purchases journal 31. When a business receives a bank credit memo for interest, in which journal is the accounting entry made? A. cash receipts journal B. sales journal C. cash payments journal D. purchases journal 32. When a sale is made on account, in which journal is this accounting entry made? A. cash receipts journal B. sales journal C. cash payments journal D. purchases journal 33. When an owner withdraws funds from his business, in which journal is the withdrawal recorded? A. cash receipts journal B. sales journal C. cash payments journal D. purchases journal 34. When a firm buys new office furniture on account, in which journal is the transaction recorded? A. cash receipts journal B. sales journal C. cash payments journal D. purchases journal 35. When a figure in a synoptic journal is circled, A. it must be reviewed by a senior accountant. B. it is to be debited if the column heading is Credit. C. it is to be omitted from the column total. D. it must be posted as a separate entry by itself. 36. Which of the following tasks would the accounts receivable clerk not normally do? A. File customer accounts alphabetically. B. Prepare the accounts receivable summary. C. Enter a credit in customers’ accounts for receipts on account. D. Post the accounts receivable control account. 37. Which of the following statements is true? A. A subsidiary ledger is updated at the same time as the general ledger. B. As a result of a receipt on account, the accounts receivable ledger clerk would debit the accounts receivable control account. C. For each sales invoice, the accounts receivable clerk makes a debit entry to a customer’s account. D. The general ledger clerk does not have to make an entry for every source document. 38. Which of the following would not be a routine entry in the Accounts Receivable system? A. debit Accounts Receivable, credit Sales B. debit Bank, credit Accounts Receivable C. debit Drawings, credit Accounts Receivable D. All of the above.