kardan institute of higher education

advertisement

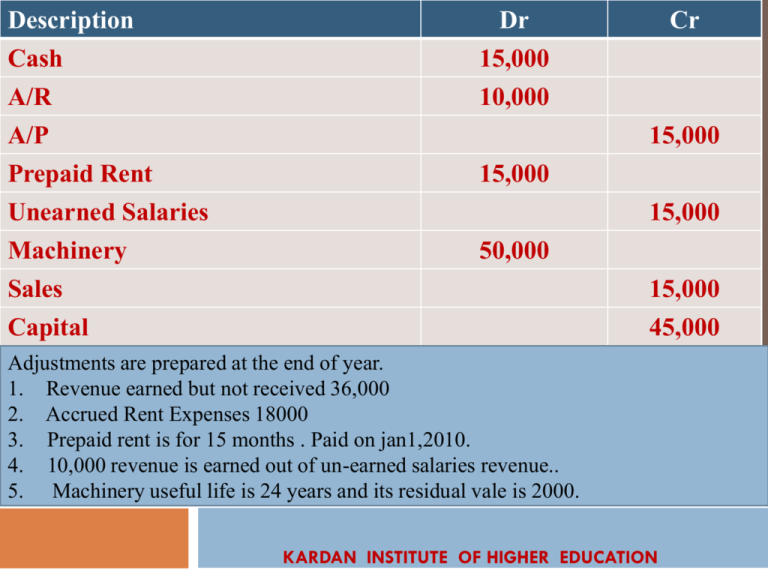

Description Cash A/R A/P Prepaid Rent Unearned Salaries Machinery Sales Dr Cr 15,000 10,000 15,000 15,000 15,000 50,000 15,000 Capital 45,000 Adjustments are prepared at the end of year. 1. Revenue earned but not received 36,000 2. Accrued Rent Expenses 18000 3. Prepaid rent is for 15 months . Paid on jan1,2010. 4. 10,000 revenue is earned out of un-earned salaries revenue.. 5. Machinery useful life is 24 years and its residual vale is 2000. KARDAN INSTITUTE OF HIGHER EDUCATION Trial Balance of ABC & Co For The Period Ended Dec,2010 DESCRIPTION DR CASH 20,000 Prepaid Rent 30,000 Rent expenses CR 3000 Prepaid Salaries 12,000 Inventory 7000 Machinery 60,000 Account payable 28,000 Un-earned advertisement revenue 22,000 Sales 40,000 Capital 42,000 TOTAL 1,32,000 1,32,000 KARDAN INSTITUTE OF HIGHER EDUCATION OTHER RELEVANT INFORMATION 1) Prepaid rent is for 2-years and made on january1,2010. 2) Prepaid salaries is for one year, paid on 1st July 2010. 3) Machinery useful life is 15-years. 4) Advertisement revenue is earned 15,000 for current year. KARDAN INSTITUTE OF HIGHER EDUCATION Trial Balance For The Period…………… Account Title Cash Accounts receivable Supplies Prepaid rent Furniture Accumulated depreciation Accounts payable Salary Payable Unearned service revenue Income tax payable Common stock Retained earnings Dividends Service revenue Rent expense Salary expense Supplies expense Depreciation expense Utilities expense Income tax expense Trial Balance Debit Credit 24,800 2,250 700 3,000 16,500 Adjustments Adjd.Trial Balance 13,100 450 20,000 11,250 3,200 7,000 950 400 KARDAN INSTITUTE OF HIGHER EDUCATION Information For Adjustments 5 (a) Prepaid rent expired, $1000. (b) Supplies on hand, $400 (balance before adjustment equals $700). (c) Depreciation on furniture, $275. (d) Accrued salary expense, $950. (e) Accrued service revenue, $250. (f) Amount of unearned service revenue that has been earned, $150. (g) Accrued income tax expense, $540. Accrual Accounting and the Financial Statements 5 Trial Balance For the Period Ended 31ST Dec.2010 DESCRIPTION DR CR Cash 50,000 A/R 30,000 A/P 20,000 Pre-paid rent 18,000 Pre-paid Salaries 12,000 Un-earned Advertisement revenue 50,000 Building 80,000 Office supplies 40,000 Capital 100,000 Advertisement Revenue 60,000 TOTAL 1- Accrued Rent Expenses 12,000. 2- Accrued Salaries Revenues 50,000. 2,30,000 2,30,000 KARDAN INSTITUTE OF HIGHER EDUCATION Trial Balance Of ABC & Co For the Period Ended 31.Dec 2010 Description DR ($) Cash 30,000 Inventory 15,000 A/R 10,000 Prepaid Insurance 18,000 Prepaid Salaries 9,000 Building 74,000 Land 100,000 Car 10,000 CR ($) Unearned Advertisement Revenues 48,000 Unearned Rent Revenue 60,000 A/P 20,000 Capital 138,000 TOTAL 266,000 266,000 ADJUSTMENT REQUIRED AT YEAR END 31,DEC.2010 1) Prepaid insurance is for one year paid on 1st April 2010. 2) Prepaid salaries is for one year paid on 1st January 2010. 3) Building useful life is 35 years and its residual value is $ 4000.Building is acquired in January 2010. 1) Car useful life is 10 years and is purchased in January 2010. 2) Unearned Advertisement revenue is received on 31st March 2010 for 2 years. 3) Rent revenue of $30,000 is earned out of total unearned rent revenue. 4) Accrued rent Revenue was $15,000 & Accrued Salaries expenses $ 10,000 for the period . KARDAN INSTITUTE OF HIGHER EDUCATION TRIAL BALANCE FOR YEAR ENDED DEC 31,2010 DESCRIPTION DR Cash 20,000 A/R 15,000 Office Supplies 30,000 Furniture 50,000 Prepaid Rent 20,000 Rent Expenses 5000 CR Unearned Salaries Revenue Salaries Revenue 25,000 10,000 Capital 105,000 TOTAL 140,000 140,000 Prepared adjusted Trial Balance at year ended 31st Dec.2010. 1) 2) 3) 4) 5) 6) Closing balance of Office supplies is $ 7000. Useful life of furniture is 24 years and its residual value is $ 2000. Prepaid rent is for one year paid on 1st July 2010. Earned $ 10,000 Salaries Revenue out of Unearned revenue. Accrued Advertising Expenses are $ 5000. Accrued salaries revenue is $ 7000.