presentation+eng

advertisement

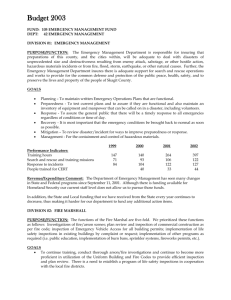

STUDY OF SMALL & MEDIUM ENTERPRISES IN AZERBAIJAN IFC AZERBAIJAN BEE Project Baku, 25 June 2009 1 1 www.ifc.org/azbee Azerbaijan was ranked Top Reformer in 2009 ‘Doing Business’ ECONOMY DB 2009 rank … … … … Latvia 29 Israel 30 France 31 South Africa 32 Azerbaijan 2 2 33 St. Lucia 34 Puerto rico 35 Slovakia 36 … … … … Ease of… DB 2009 rank DB 2008 rank Change in rank Doing Business 33 97 +64 Starting a Business 13 66 +53 155 160 +5 Employing Workers 15 67 +52 Registering Property 9 63 +54 Getting Credit 12 25 +13 Protecting Investors 18 110 +92 Paying Taxes 102 143 +41 Trading Across Borders 174 176 +2 Enforcing Contracts 26 27 +1 Closing a Business 81 78 -3 Dealing with Construction Permits Report covers a wide range of topics RECOMME NDATION TOPIC REPORT Analysis of the existing legislation Study of implementation of the legal norms and procedures SUBJECT Legal recommendations aimed at the current weaknesses in the laws and legal norms Institutional recommendations aimed at the proper implementation of the laws. Practical technical recommendations aimed at the proper and problem-free implementation of the administrative procedures Registration Permits Licensing Inspections Taxation Access to Finance Import/Export PROBLEM Detection of the current flaws in the law and legal norms Detection of problems caused by subjective reasons and by inappropriate execution of the laws Study of the problems caused by the legal illiteracy and passive attitude of entrepreneurs 3 3 Study of enterpreneurs’ opinions Comparison to the international legal norms and experience Sample of 1800 representatives of all business sectors and areas Existing and new enterprises Main sectors of economy 8 social and economic regions and Baku 9% Region % of respondents Baku 40% Aran 20% Ganja-Gazakh 12% 13% 1% 1% 2% 2% 43% 5% 7% 63% 10% Lenkeran 7% Sheki-Zagatala 6% Absheron 6% Quba-Khachmaz 6% 44% Retail and wholesale trade Transport and storage 4 4 Dagliq Shirvan 2% Yukhari Garabakh 1% Agriculture Up to one year Hotels and restaurants From one to three years Real estate, renting and business activities Repair of motor vehicles, household and personal goods Construction Three years and more Other manufacturing Many procedures still too burdensome How challenging were the following procedures? (for those who underwent these procedures) Percentage of respondents who evaluated the procedures as “problematic” and “very problematic” Since January 1, 2008, business registration is conducted through a one-stop-shop Access to finance – problem faced by more than half of entrepreneurs 5 5 Top five regulatory challenges Business registration Foreign trade Permits Enterprise Taxes 6 6 Inspections Informal arrangements was often a ‘solution’ Problems during business registration process Situation prior to introduction of the registration one-stop shop in 2008 (those who faced problems) 48% Extensive number of requested documents Extensive number of procedures (steps, bodies) during registration Didn't have problems 29% 41% 20% Lengthy registration process Had problems 71% Low professional level of staff of registering authorities Imposed requirements are not clear and transparent Necessity to use unofficial means 13% 11% 9% Every fourth entrepreneur made unofficial payments to solve problems 7 7 Business registration then & now BEFORE To register a business Entrepreneurs had to: • submit 33 documents • undergo 13 procedures This took 30-34 days to complete. AFTER Entrepreneurs have to: • submit 7 documents • undergo 6 procedures Overall this takes 8 days to complete. And the work goes on... 8 8 Registration simplification leads to significant savings Before the new system was implemented, the registration was a problem for 26% of entrepreneurs 26% ? 9 9 The success of the new system can be discussed only following research on the impact of the new system Registration system recommendaitons Legislative recommendations: • Introduce the ‘silence is consent’ principle in the law • Simplify the pre-registration process: • remove the requirement to obtain a confirmation of the legal address • no notarizations of registration documents • Simplify the procedure for voluntary liquidation through the one-stop-shop • Simplify procedures for opening, operating, and closing bank accounts Institutional recommendations: • Introduce electronic registration through a user-friendly online application • Equally apply to all banks the possibility to open an account online through the registration offices • Enable online access to information on existing business entities • Media broadcasts to be aired on any further procedural changes 10 10 Top five regulatory challenges Business registration Foreign trade Permits Enterprise Taxes 11 11 Inspections Obtaining permits still too cumbersome Didn't have problems 46% Had problems 54% Every 3rd entrepreneur made unofficial payments to address the problem 12 12 Almost all government agencies issue permits Approximately 62 agencies, including local executive authorities, issue permits 13 13 Permits system recommendations Legislative recommendations: • Review the list of all permits, their coverage, validity and issuance process • List all government agencies authorized to issue permits • Set up clear grounds for introducing new permits through a uniformed procedural act: 1. Protection of public health and safety, and environment protection 2. Ensure appropriate allocation of scarce resources 3. Refrain from excessive requirements • Introduce the “silence is consent” and “self-certification” principles in the act • Extend the “one-stop-shop” principle for issuance of certain types of permits Technical and practical recommendations: • Increase legal awareness of entrepreneurs by disseminating information on permits • Clear procedural maps available in permits issuing agencies • Organize roundtables aimed at increasing dialogue between private and public sector • Run PR campaign focused on procedural changes 14 14 Licencing system recommendations Legislative recommendations: • Ensure that all licenses are issued for same period as provided for by the Licensing Rules • Simplify and shorten the internal decision making process for granting of licenses • Introduce clear criteria for introduction of new licenses • Level the playfield for all enterprises when entering into licensable activities Technical and practical recommendations: • Increase legal awareness of entrepreneurs by disseminating information on licences • Clear procedural maps made available in license issuing agencies • Organize roundtables aimed at increasing dialogue between private and public sector • Run PR campaign focused on procedural changes 15 15 Top five regulatory challenges Business registration Foreign trade Permits Enterprise Taxes 16 16 Inspections Most entrepreneurs allocate large resources to inspections Inspections by the sectors of activity 86% Trade and restaurants 80% Construction 74% Manufacturing 70% Service Agriculture 17 17 22% Average for country - 79% Average number of inspections per year Average expenses per inspection, annually 9 inspections 363 manat Many inspections not officially registered Registration of inspections All inspecting (those who were inspected) 43% Ministry of Taxes agencies must officially record the Ministry of Econom ic Developm ent 42% on-site and off-site inspections carried 34% Ministry of Health Ministry of Labor and Social Protection 32% Ministry of Em ergency Situations 24% Ministry of Industry 24% 18 18 Presidential order #69 07 January, 1999 31% Ministry of Transport The information covers state authorities that conduct inspections in more than 5% of all enterprises. out, in their books. AVERAGE REGISTRATION – 42% Inspection system recommendations Legislative recommendations: • Regulate the objectives and procedures of inspections, and determine the list of state authorities carrying out inspections • Develop a risk based inspection (RBI) system • Introduce sanction mechanism to be launched only by judiciary decision Institutional recommendations: • Eliminate identical and duplicating functions of state authorities • Selecting subject of inspections applying risk management principles • Ensure the use of checklists for inspection conduct and compliance • Review inspection penalties and increase accountability of inspectors • Establish websites, hotlines, etc. of inspection authorities to increase awareness of entreprenuers 19 19 Top five regulatory challenges Business registration Foreign trade Permits Enterprise Taxes 20 20 Inspections A comparison in tax compliance requirements Comparison of some Azerbaijan’s and Kazakhstan’s tax indicators 21 21 Azerbaijan Kazakhstan Difference VAT, number of payments per year 1-12 1 0-11 Social security payments, number of payments per year 12 1 11 Profit tax, number of payments per year 1 1 0 All taxes, number of payments per year 23 9 14 Taxation system recommendations Legislative recommendations: • Review the VAT threshold and consolidate further the simplified tax; • Reduce overall tax burden of standard tax regime • Eliminate double taxation of corporate earnings • Reduce the number of VAT and social security reports – introduce unified tax reporting • Limiting the scope of tax inspections to tax specifics Institutional recommendations: • Further encourage electronic tax reporting • Further enhance risk based approach in planning and conducting inspections • Increase the supervision of tax inspectors and ethics standards 22 22 Top five regulatory challenges Business registration Foreign trade Permits Enterprise Taxes 23 23 Inspections Engagement of SMEs in foreign trade remains very low Main problems faced by SMEs in imports Administrative barriers and excessive bureaucracy are main export problems in foreign trade. Main problems faced by SMEs in exports Bureaucracy in customs authorities Customs clearance procedures Customs tariffs 24 24 Railway service control (access to trains, delays etc) 44% Customs tariffs Bureaucracy in customs authorities 33% 23% 33% 21% 20% Half of the entrepreneurs that conduct imports are dissatisfied with the control exercised by the railway department. Foreign trade system recommendations Legislative recommendations: • Reduce number of documents required for importing • Eliminate double certification requirements • Revise the list of standards of health and safety following good international practices • Introduce process rather than product certification • Introduce uniform tariff rates for similar types of goods Institutional recommendations: • Reduce the number of offices controlling foreign trade • Encourage establishment of bonded warehouses • Separate standardization and certification functions • Increase accountability of customs and railway service officials • Create internationally required laboratory facilities for certification 25 25 Azerbaijan BEE Project basics IFC’s Azerbaijan Business Enabling Environment Project will be working with the Azerbaijani Government until 2012 with the budget of US$ 4.7 million. IFC is prepared to assist the Republic of Azerbaijan in making further progress in all the aforementioned policy areas, as well as government capacity building and outreach to the private sector. IFC’s activities are generously supported by Swiss State Secretariat for Economic Affairs (SECO) and the British Petroleum (BP) on behalf of its coventurers. 26 26 THANK YOU FOR YOUR ATTENTION! International Finance Corporation Azerbaijan Business Enabling Environment Project www.ifc.org/azbee 27 27