Capital Structure Decision

advertisement

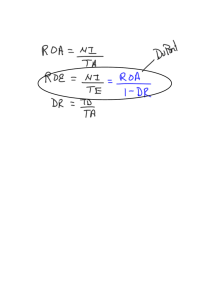

Capital Structure Decision MM propositions Financial management: lecture 10 Today’s plan Review what we have learned in the last lecture The capital structure decision • • The capital structure without taxes • • MM’s proposition 1 MM’s proposition 2 The capital structure with taxes • • MM’s proposition 1 MM’s proposition 2 Financial management: lecture 10 What have we learned in the last lecture In the last lecture, we have discussed the case in the end of chapter 12, what have you learned from this case? In the last lecture, we have also discussed three forms of market efficiency, what are they and what is your understanding of these three forms of market efficiency? Financial management: lecture 10 Look at the both sides of a balance sheet Asset Liabilities and equity Market value of equity E Market value of the asset V Market value of debt D V=E+D Financial management: lecture 10 Capital structure Capital structure refers to the mix of debt and equity in a firm. We often use D/E or D/V (V=D+E) to indicate the capital structure of a firm. • Usually, the higher the ratio, the more debt a firm has The capital structure problem for a firm is to determine what is the maximum amount of debt a firm should have to maximize the firm’s value. Financial management: lecture 10 Does capital structure affect the firm value? Equity Debt Debt Equity Govt. Slicing the pie doesn’t affect the total amount available to debt holders and equity holders Slicing the pie can affect the size of the slice going to government Financial management: lecture 10 Equity wasted Debt Govt. Slicing the pie can affect the size of the wasted slice MM’s proposition 1 Modigliani & Miller • If the investment opportunity is fixed, there are no taxes, and capital markets function well, the market value of a company does not depend on its capital structure. How can we understand this? • The size of a pizza has nothing to do with how you slice it. Financial management: lecture 10 MM’s proposition 2 Modigliani & Miller • If the investment opportunity is fixed, • there are no taxes, and capital markets function well, the expected rate of return on the common stock of a levered firm increases in proportion to the debt-equity ratio (D/E), expressed in market values. The WACC is independent of how the firm is financed Financial management: lecture 10 WACC without taxes in MM’s view r rE WACC rD D V Financial management: lecture 10 M&M (Debt Policy Doesn’t Matter) Example - River Cruises - All Equity Financed Data Number of shares 100,000 Price per share $10 Market Value of Shares $ 1 million Outcome Operating Income Earnings per share Return on shares State of the Economy Slump $75,000 $.75 7.5% Expected 125,000 1.25 12.5% Boom 175,000 1.75 17.5% Financial management: lecture 10 M&M (Debt Policy Doesn’t Matter) Example cont. 50% debt Data Number of shares 50,000 Price per share $10 Market Value of Shares $ 500,000 Market val ue of debt $ 500,000 Outcome State of the Economy Slump Expected Boom Operating Income $75,000 125,000 175,000 Interest $50,000 50,000 50,000 Equity earnings $25,000 75,000 125,000 Earnings per share $.50 1.50 2.50 Return on shares 5% 15% 25% Financial management: lecture 10 M&M (Debt Policy Doesn’t Matter) Example - River Cruises - All Equity Financed - Debt replicated by investors Outcome State of the Economy Earnings on two shares LESS : Interest @ 10% Slump $1.50 $1.00 Expected 2.50 1.00 Boom 3.50 1.00 Net earnings on investment Return on $10 investment $.50 5% 1.50 15% 2.50 25% Financial management: lecture 10 Capital structure and Corporate Taxes The use of debt has a lot of implications: • • Financial risk- The use of debt will increase the risk to share holders and thus Increase the variability of shareholder returns. Interest tax shield- The savings resulting from deductibility of interest payments. Financial management: lecture 10 An example on Tax shield You own all the equity of Space Babies Diaper Co.. The company has no debt. The company’s annual cash flow is $1,000, before interest and taxes. The corporate tax rate is 40%. You have the option to exchange 1/2 of your equity position for 10% bonds with a face value of $1,000. Should you do this and why? Financial management: lecture 10 C.S. & Corporate Taxes All Equity EBIT Interest Pmt 1/2 Debt 1,000 0 Pretax Income 1,000 Taxes @ 40% 400 Net Cash Flow $600 Financial management: lecture 10 C.S. & Corporate Taxes All Equity 1/2 Debt 1,000 1,000 0 100 Pretax Income 1,000 900 Taxes @ 40% 400 360 $600 $540 EBIT Interest Pmt Net Cash Flow Financial management: lecture 10 Capital Structure and Corporate Taxes All Equity 1/2 Debt 1,000 1,000 0 100 Pretax Income 1,000 900 Taxes @ 40% 400 360 Net Cash Flow $600 $540 EBIT Interest Pmt Total Cash Flow All Equity = 600 *1/2 Debt = 640 (540 + 100) Financial management: lecture 10 Capital Structure and tax shield PV of Tax Shield = D x rD x Tc rD = D x Tc Example: Tax benefit = 1000 x (.10) x (.40) = $40 PV of 40 perpetuity = 40 / .10 = $400 PV Tax Shield = D x Tc = 1000 x .4 = $400 Financial management: lecture 10 MM’s proposition 1 with tax firm value = value of all equity firm + PV(tax shield) Example, all equality firm value =600/0.1=6,000 PV( tax shield)=400 firm value=6,400 Financial management: lecture 10 MM’s proposition 2 The weighted average cost of capital is decreasing with the ratio of D/E, that is D E WACC (1 Tc )rdebt r equity DE DE Can you understand this intuitively? Financial management: lecture 10 WACC Graph Financial management: lecture 10 Financial Distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress Financial management: lecture 10 Financial distress Costs of Financial Distress - Costs arising from bankruptcy or distorted business decisions before bankruptcy. Market Value = Value if all Equity Financed + PV Tax Shield - PV Costs of Financial Distress Financial management: lecture 10 Optimal Capital structure Trade-off Theory - Theory that capital structure is based on a trade-off between tax savings and distress costs of debt. Pecking Order Theory - Theory stating that firms prefer to issue debt rather than equity if internal finance is insufficient. Financial management: lecture 10 Financial Distress Market Value of The Firm Maximum value of firm Costs of financial distress PV of interest tax shields Value of levered firm Value of unlevered firm Optimal amount of debt Debt Financial management: lecture 10