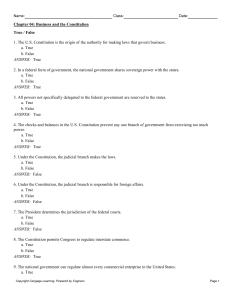

Chapter 4 Constitutional Law

advertisement

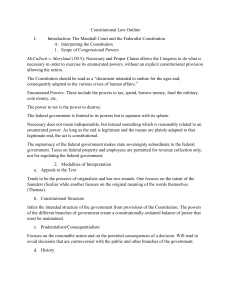

THE CONSTITUTION AND BUSINESS Separation of Powers Power shared by branches of government. Legislative: enacts legislation appropriates funds. Executive: commander-in-chief of armed services ensures laws are faithfully executed. Judicial: interpreting laws and applying them to disputes. Checks and balances Each branch keeps the others from dominating the government. Supremacy Clause Article. VI. Clause 2 This Constitution, and the Laws of the United States which shall be made in Pursuance thereof; and all Treaties made, or which shall be made, under the Authority of the United States, shall be the supreme Law of the Land; and the Judges in every State shall be bound thereby, any Thing in the Constitution or Laws of any State to the Contrary notwithstanding. Preemption If federal law preempts and area of regulation, no state law is permitted. Any attempted state law will be unconstitutional under the supremacy clause. Federal preemption is not presumed; it must be clearly and explicitly stated. Commerce Clause Gives Congress power to regulate interstate commerce Includes any activity that substantially affects interstate commerce. Most economic legislation is presumed to be constitutional. Commerce Clause as a restriction on state authority. States have general police power. Health, safety, welfare of its citizenry. But states cannot regulate interstate commerce. Unless the burden imposed on interstate commerce is outweighed by the state’s interest in enforcing the legislation. First Amendment Freedom of speech and the press 1st amendment freedoms are not absolute. Other freedoms: religion, assembly, petition. Can’t yell “fire” in a crowded theater. Can’t injure someone’s reputation with false statements. Content-based restrictions not usually allowed. E.g., Communications Decency Act 4-5 State Taxation State taxation of corporate income must be apportioned to allocate the tax burden of interstate commerce among states entitled to impose a tax. To ensure that interstate businesses only pay their fair share of state taxes. Corporate Speech Corporate Commercial Speech Defined: Speech that proposes a commercial transaction. Less protected than political speech. Test: Is the speech misleading? Is it related to unlawful activity? Does the state have a substantial interest to achieve by restricting the speech? Will the restriction advance the state’s interest? Is the restriction narrowly drawn? Corporate Political Speech Examples Supporting political candidates. Influencing a referendum. Protected to the same extent as political speech of ordinary citizens. 4-6 4th Amendment Protects security in persons, homes, and property. From unreasonable searches and seizures. Warrant requirement. Probable cause. Exclusionary rule. Searches by administrative agencies. Warrantless search allowed if industry is subject to pervasive regulation. 4-7 Due Process: the 5th Amendment No deprivation of life, liberty, or property without due process of law. Procedural due process Applies to federal government, and also to states under 14th Amendment. Due process requires a fair trial. Substantive due process. Laws must have a proper purpose. Economic legislation usually presumed constitutional. Laws affecting personal rights must bear a substantial relationship to a compelling governmental purpose. 4-8 Takings Clause: the 5th Amendment Taking of property by government requires A public purpose. Just compensation. Government regulations can be so burdensome as to be considered a taking. Especially when the regulation deprives the owner of all economically beneficial use of the property. 4-9 14th AMENDMENT DUE PROCESS PRIVILEGES AND IMMUNITIES EQUAL PROTECTION 14th Amendment CONTINUED Applies the due process clause to the states. Originally only applied to federal government in 5th amendment. Interpreted to apply most of bill of rights to the states. Equal protection clause. Prohibits discrimination, especially based on race. 4-10