Money and Banking

advertisement

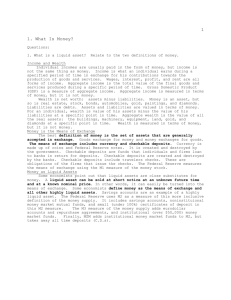

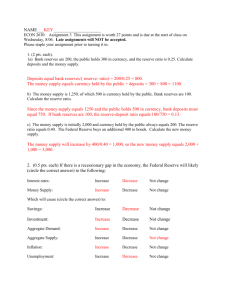

• http://www.youtube.com/watch?v=WCkOmcIl 79s FUNCTIONS OF MONEY FUNCTIONS OF MONEY • Medium of Exchange •Anything that is used to determine value during the exchange of goods and services FUNCTIONS OF MONEY • Unit of Account comparing the values of goods and services FUNCTIONS OF MONEY • Store of Value •Money keeps its value if you decide to hold onto it or spend it PAPER MONEY All paper money regardless of issue date is still legal tender • http://www.youtube.com/watch?v=Ll3uipTO4A 6 Characteristics of Money 1. Durability 2. Portability 3. Divisibility 4. Uniformity 5. Limited Supply 6. Acceptability Federal Reserve Notes • 99% of our money • Current Denominations: $1, $2, $5, $10, $20, $50, $100 • Before 1945: $500, $1,000, $5,000, $10,000 • July 14, 1969—Denominations of $500 and larger were retired • Treasury seal & serial numbers are green United States Notes • Make up less that 1% of currency • Since 1969, only $10 denominations have been issued. • Prior to 1969, $2 and $5 were issued. • 1966, $2 discontinued • 1968, $5 discontinued • Treasury seal and serial numbers are printed in red. UNFIT MONEY • Average life of $1 bill is 17-18 months • Larger denominations usually last longer • Old, worn, torn, or soiled money is sent to the Federal Reserve Bank to be exchanged for new Commodity Money •Objects that have value in themselves Representative Money • Objects that have value because they can be exchanged for something of value Fiat Money • • • • Government decree of “legal tender” not to be refused in settling debts or making purchases MONEY SUPPLY Money is defined two ways… Currency •Token Money •Federal Reserve Notes •Intrinsic Value Checkable Deposits •Commercial Banks •Thrift Institutions MONEY SUPPLY Near-monies or Savings Deposits • Money Market Deposit Accounts Smaller Time Deposits Money Market Mutual Funds (MMMFs) MONEY SUPPLY Currency (coins & paper money) plus Checkable deposits M1 M2 M3 equals M1 $1101 2000 Data (billions of dollars) MONEY SUPPLY Currency (coins & paper money) plus Checkable deposits M1 M2 M3 equals M1 plus Savings deposits, $1101 including MMDA’s plus Small time deposits plus Money market mutual fund (MMMF) balances equals M2 $4827 2000 Data (billions of dollars) MONEY SUPPLY Currency (coins & paper money) plus Checkable deposits M1 M2 M3 equals M1 plus Savings deposits, $1101 including MMDA’s plus Small time deposits plus Money market mutual fund (MMMF) balances equals M2 plus Large time deposits equals M3 $4827 2000 Data (billions of dollars) $6853 WHAT ABOUT CREDIT CARDS? WHAT BACKS THE MONEY SUPPLY? Money as Debt Value of Money • Acceptability • Legal Tender • Relative Scarcity Money and Prices • Value of the Dollar • D = 1/Price Level Inflation and Acceptability So, What Backs the Money Supply? Stable Value! through... •Appropriate Fiscal Policy •Intelligent Management of the Money Supply THE FEDERAL RESERVE AND THE BANKING SYSTEM Centralization and Public Control • Board of Governors • Assistance & Advice • Federal Open Market Committee • Three Advisory Councils • The 12 Federal Reserve Banks • Central Bank Role • Quasi-Public Banks • Banker’s Banks • Commercial Banks & Thrifts THE FEDERAL RESERVE AND THE BANKING SYSTEM Open Market Committee Advisory Councils Board of Governors 12 Federal Reserve Banks Thrift Institutions Commercial Banks (Savings & loan associations, mutual savings banks, credit unions) The Public (Households and businesses) FEDERAL RESERVE • • • • Receive $ from commercial banks and others Decides if it is fit or unfit Fit is stored Unfit is destroyed by machines that shred it to 1/16 of an inch • About 1/3 are unfit