S 2 - Virginia Community College System

advertisement

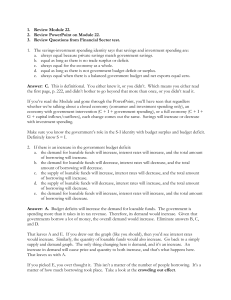

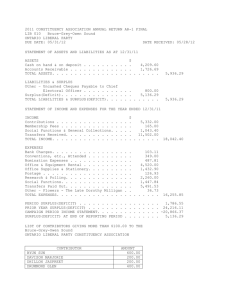

The Impacts of Government Borrowing 1. Government Borrowing Affects Investment and the Trade Balance The Macroeconomics of Saving and Investment The quantity of financial capital supplied in the market must equal the quantity of financial capital demanded. Two Main Sources for Financial Capital 1. Private saving (SPrivate) is equal to what households retain of their earned income (S) and inflow of foreign financial capital (X - M) SPrivate = S + X − M 2. Public saving (SPublic) equals the amount of tax revenue (T) the government retains after paying for government purchases (G): SPublic = T − G When G > T, SPublic is equal is negative, making the government a demander of financial capital so: STotal = S + (M − X) Two Main Sources of Demand for Financial Capital 1. Private sector investment (I) 2. Government borrowing which equals the difference between government spending (G) and net tax revenues (T): Private Investment = I + (G – T) National Savings and Investment Identity Private Investment = I + (G – T) Total Savings = S + (M − X) S + (M − X) = I + (G − T) Then, I = S + (T − G) + (M – X) If the budget deficit changes then private savings, investment, or the trade balance must change. Potential Results of a Budget Deficit Chart (a) shows the potential results when the budget deficit rises (or budget surplus falls). Chart (b) shows the potential results when the budget deficit falls (or budget surplus rises). 1. In a country, private savings equals 600, the government budget surplus equals 200, and the trade surplus equals 100. What is the level of private investment in this economy? S + (M − X) = I + (G − T ) but with surpluses, S + (T − G) = I + (X − M ) 600 + 200 = I + 100 800 = I + 100 I = 700 1.Assume an economy has a budget surplus of 1,000, private savings of 4,000, and investment of 5,000. a. Write out an national savings and investment identity for this economy. Since the government has a budget surplus, the government budget term appears with the supply of capital (again). S + (T − G) = I + (X − M ) 1.Assume an economy has a budget surplus of 1,000, private savings of 4,000, and investment of 5,000. b. What will be the balance of trade in this economy? S + (T − G) = I + (X − M ) 4,000 + 1,000 = 5,000 + (X – M) (X – M) = 0 1.Assume an economy has a budget surplus of 1,000, private savings of 4,000, and investment of 5,000. c. If the budget surplus changes to a budget deficit of 1000, with private savings and investment unchanged, what is the new balance of trade in this economy? With a budget deficit, the government budget term appears with the demand for capital. S + (M − X) = I + (G − T ) 4,000 + (M – X) = 5,000 + 1,000 (M – X) = 2,000 Showing a higher budget deficit and a higher trade deficit. Annual Deficits T is net taxes, so when the government must transfer funds back to individuals for safety net expenditures like Social Security and unemployment benefits, budget deficits rise. Market for loanable funds The interaction of borrowers and lenders that determines the market interest rate and the quantity of loanable funds exchanged. Demand and Supply in the Loanable Funds Market Demand is determined by the willingness of firms to borrow money to engage in new investment projects. Supply is determined by the willingness of household savings or government saving or dissaving. Demand and Supply in the Loanable Funds Market Equilibrium determines the real interest rate and the quantity of loanable funds exchanged. Demand and Supply in the Loanable Funds Market Movements in Saving, Investment, and Interest Rates An Increase in the Demand for Loanable Funds An increase in demand increases the equilibrium interest rate from i1 to i2, and it increases the equilibrium quantity of loanable funds from L1 to L2. Saving and investment both increase. The Effect of a Budget Deficit When the government begins running a budget deficit, the supply of loanable funds shifts to the left. The equilibrium interest rate increases from i1 to i2, the equilibrium quantity of loanable funds falls from L1 to L2. As a result, saving and investment both decline. Crowding out A decline in private expenditures as a result of an increase in government purchases. Crowding Out A decline in private expenditures as a result of an increase in government purchases. Interest rates rise. Fewer investments remain profitable The "crowding out" of private investment due to government borrowing to finance expenditures appears to have been suspended during the Great Recession. Long-run economic growth The process by which rising productivity increases the average standard of living. Best measured by real GDP per person, which is usually referred to as real GDP per capita. Measured in 2005 dollars, real GDP per capita in the United States grew from about $5,600 in 1900 to about $42,200 in 2010. The Growth in Real GDP per Capita, 1900–2010 What Determines the Rate of LongRun Growth? 1. Labor productivity The quantity of goods and services that can be produced by one worker or by one hour of work. 2. Increases in Capital per Hour Worked As the physical capital stock per hour worked increases, worker productivity increases. Increases in human capital are particularly important in stimulating economic growth. 3. Technological Change More important than increases in capital per hour worked. Public Investment in Physical Capital Types of Physical Capital Federal Outlays (2011) Transportation $59,920 billion Community and regional development $10,544 billion Natural resources and the environment $6,741 billion Education, training, employment, and social services $71 billion Other $8,427 billion Total $85,703 billion Public physical capital investment of this sort can increase the output and productivity of the economy. Public Investment in Human Capital A highly educated and skilled workforce contributes to a higher rate of economic growth. Public Investment on Technology Fiscal policy can encourage R&D using either direct spending or tax policy. Government could spend more on the R&D that is carried out in government laboratories, as well as expanding federal R&D grants to universities and colleges, nonprofit organizations, and the private sector. Public Investment Summary Physical Capital Human Capital New Technology Private Sector New investment On-the-job in property and training equipment Research and development Public Sector Public infrastructure Research and development encouraged through private sector incentives and direct spending. Public education Job training The effects of many growth-oriented policies will be seen very gradually over time, as students are better educated, physical capital investments are made, and new technologies are invented and implemented. Price Level SRAS1 G H G P1 AD1 Y1 AD2 Goods & Services (real GDP) • Government deficit would shift AD1 to AD2. • Household saving keeps demand unchanged at AD1. Loanable Funds Market Real interest rate S1 S2 e1 no effect on the interest rate, real GDP, and unemployment. e2 r1 D1 Q1 Q2 D2 Quantity of loanable funds 1. Government borrows from the loanable funds market, increasing the demand (to D2). 2. People save for expected higher future taxes (raising the supply of loanable funds to S2.) 3. Loans increase, but interest rate doesn’t. Potential GDP The level of real GDP attained when all firms are producing at capacity. Potential GDP increases as the labor force and the capital stock grow and technological change occurs. The smooth red line represents potential GDP, and the blue line represents actual real GDP. During recessions actual real GDP is been less than potential GDP. Actual and Potential GDP The Circular Flow The Financial System Financial markets Markets where financial securities, such as stocks and bonds, are bought and sold. A financial security is a document—sometimes in electronic form—that states the terms under which funds pass from the buyer of the security—who is providing funds—to the seller. Stocks are financial securities that represent partial ownership of a firm. Bonds are financial securities that represent promises to repay a fixed amount of funds. 1. In the national savings and investment identity framework, an inflow of savings from abroad is, by definition, equal to: A. private sector investment. B. the trade surplus. C. the trade deficit. D. domestic household savings. 2. When governments are borrowers in financial capital markets, which of the following is least likely to be a possible source of the funds from a macroeconomic point of view? A. B. C. D. central bank prints more money increase in household savings decrease in borrowing by private firms foreign financial investors 3. The US economy has two main sources for financial capital: A. private savings from U.S. households and firms; inflows of foreign financial investment. B. private sector investment; government borrowing. C. private savings from US households and firms; government borrowing.. D. private sector investment; inflows of foreign financial investment from abroad. 4. Which is one economic mechanism by which government borrowing can crowd out private investment? A. B. C. D. deficit decrease smaller trade surplus larger trade surplus higher interest rate