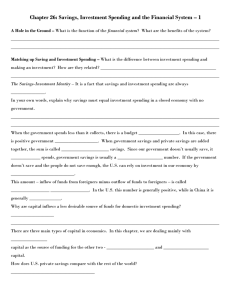

Review Module 22. Review PowerPoint on Module 22. Review

1.

Review Module 22.

2.

Review PowerPoint on Module 22.

3.

Review Questions from Financial Sector test.

1.

The savings-investment spending identity says that savings and investment spending are: a.

always equal because private savings match government savings. b.

equal as long as there is no trade surplus or deficit. c.

always equal for the economy as a whole. d.

equal as long as there is not government budget deficit or surplus. e.

always equal when there is a balanced government budget and net exports equal zero.

Answer: C. This is definitional. You either knew it, or you didn’t. Which means you either read the first page, p. 222, and didn’t bother to go beyond that more than once, or you didn’t read it.

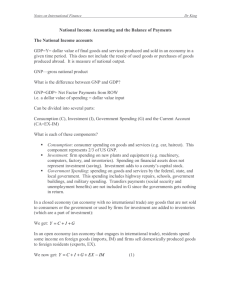

If you’ve read the Module and gone through the PowerPoint, you’ll have seen that regardless whether we’re talking about a closed economy (consumer and investment spending only), an economy with government intervention (C + I + government spending), or a full economy (C + I +

G + capital inflows/outflows), each change comes out the same. Savings will increase or decrease with investment spending.

Make sure you know the government’s role in the S-I identity with budget surplus and budget deficit.

Definitely know S = I.

2.

If there is an increase in the government budget deficit: a.

the demand for loanable funds will increase, interest rates will increase, and the total amount of borrowing will increase. b.

the demand for loanable funds will decrease, interest rates will decrease, and the total amount of borrowing will decrease. c.

the supply of loanable funds will increase, interest rates will decrease, and the total amount of borrowing will increase. d.

the supply of loanable funds will decrease, interest rates will increase, and the total amount of borrowing will decrease. e.

the demand for loanable funds will increase, interest rates will increase, and the total amount of borrowing will decrease.

Answer: A. Budget deficits will increase the demand for loanable funds. The government is spending more than it takes in in tax revenue. Therefore, its demand would increase. Given that governments borrow a lot of money, the overall demand would increase. Eliminate answers B, C, and D.

That leaves A and E. If you drew out the graph (like you should), then you’d see interest rates would increase. Similarly, the quantity of loanable funds would also increase. Go back to a simply supply and demand graph. The only thing changing here is demand, and it’s an increase. An increase in demand will cause price and quantity to both increase, and that’s what happens here.

That leaves us with A.

If you picked E, you over thought it. This isn’t a matter of the number of people borrowing. It’s a matter of how much borrowing took place. Take a look at the crowding out effect.

3.

One way to reduce financial risk is: a.

to only buy stock in a major company. b.

to only buy bonds in a major company. c.

to buy a variety of assets, both financial and physical. d.

to buy only one form of physical asset. e.

to purchase physical assets in one developing nation.

Answer: C. This is the textbook definition of diversification. Diversification is investing in a variety of different assets so that any possible losses are smoothed out. Reducing risk is one of the tasks of any financial system. A, B and D are so wrong. Wrong wrong wrong. Do not invest your money this way. E is the worst answer up here. I’m pretty sure that this answer is a throw back to the reputation of developing countries (euphemistically called the “third world”) of being corrupt to the point of soliciting bribes or nationalizing industries. In the latter, a country would nationalize a particular local industry and seize all the physical assets of a company. That leaves C.

4.

Which of the following assets would be considered to be the least liquid? a.

cash b.

checking account balance c.

corporate bond d.

shares of stock in a publicly traded corporation e.

a house

Answer: E. We’re looking for something that is illiquid, meaning that it can’t be easily spent or converted into cash. A is wrong. It’s…cash. It’s the very paragon of liquidity. B is wrong, checking account balance just shows the amount of money you have in your checking account, which can be used as cash. C is wrong. Corporate bonds are not easily spent or converted into cash, but it can be done. Plus, we’re looking at the least liquid. This would come in second. D is wrong.

Shares of stock in a publicly traded corporation. These can be sold very easily. This morning, I sold

100 shares on my online account, it takes virtually no time. E is the right answer. You can’t go to

7-11 and buy a Coke with a 3 bed/2 bathroom house. You can’t do it with corporate bonds either, but the issue here is “least liquid.”

5.

If the price of an asset is expected to rise in the future: a.

asset owners will be more willing to sell it now. b.

it will be more in demand today. c.

the price of the asset will fall today. d.

the supply of the asset will increase today. e.

the demand for the asset will decrease today.

Answer: B. Go back to basic supply and demand and take a look at MERIT, specifically the E in

MERIT: consumer Expectations. If I know that the price of the good I want will go up in the future, then my demand for it right now will go up. That’s similar to what’s happening here.

A is wrong. If I know the price of what I have is going to go up, I’m going to hold on to it, and sell it later. That deals with producer expectations. C is wrong. There’s no indication that just because the price will go up in the future that current prices will drop. And if that did happen, then the price in the future would go up to what it currently is? C is a silly answer. D is wrong. This is looking at

it from producer expectations. As a producer, if I know that the price of an asset is going to increase in the future, then I’m not going to increase my supply today—I’ll wait and increase it in the future. E is wrong. It’s just the opposite of what you would actually do.

4.

Practice Problems a.

Review Multiple Choice on pp. 229-230. b.

Review the following questions.

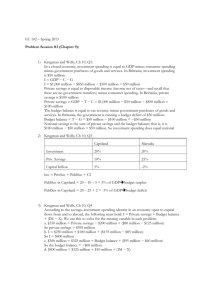

1.

Financial markets are beneficial a.

To savers because they provide interest payments for the use of savers’ funds. b.

To borrowers because they provide a source of funds for productive investments. c.

To the government because they provide both a use for surplus government funds and a source of funds should the government run a deficit. d.

All of the above.

2.

Investment spending includes all of the following EXCEPT a.

The construction of a new residence during the current year. b.

The purchase of a new piece of equipment at a factory during the current year. c.

The purchase of a home, built 20 years ago, during the current year. d.

The acquisition of new computers for a business during the current year.

3.

Source of funds for investment spending include a.

Domestic savings b.

Foreign savings. c.

The Federal Reserve Bank. d.

A, B and C are all correct. e.

A and B are correct, but not C.

4.

When government spending is greater than net taxes, a.

Government savings is positive. b.

There is a budget surplus. c.

There is a positive surplus. d.

There is a budget deficit.

5.

Suppose a country exports goods and services worth $50 million, while it imports good and services worth $60 million. This country a.

Has a positive capital inflow. b.

Lends funds to foreigners. c.

Has a negative capital inflow. d.

A and B are both correct. e.

B and C are both correct.

Answer Key

1.

Answer: D. Okay, so this is kind of a loaded question. Financial markets provide funds for borrowers and ways to earn interest for savers (surplus funds).

2.

Answer: C. Investment spending goes to any physical capital. A, B, and D are wrong for that reason. C refers to a house built 20 years ago. Putting aside the construction of a house as used for investment, the key here is that this is something pre-existing and the sale is something that represents a change in ownership, not actually spending (go back to definition of GDP).

3.

Answer: E. The Federal Reserve does not loan funds for private borrowers for investment spending purposes.

4.

Answer: D. Government is spending more than it’s getting in tax revenue. That’s the idea behind a budget deficit. A, B, and C are all ways of saying budget surplus, though C is kind of ridiculous. Of course a surplus is positive.

5.

Answer: A. First off, as a matter of net exports, this country has more imports coming in than out. That’s the very definition of a positive capital inflow. When capital inflow is positive, the country spends more on imports than it earns from exports, and must borrow the difference from foreigners.

A fits this, but there are a couple of other answers to look at. Eliminate C and E right off. A is the right answer, it’s a positive capital inflow. That leaves us with B. B is wrong. When a country has more imports, it has to borrow money to cover the excess imports. It’s going to get that from foreigners.