Financial Policy #1504 Deposit of Cash Receipts

advertisement

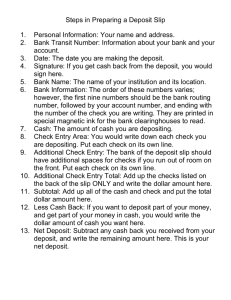

Prepared by the Department of Cash Management and the Office of Audit ,Compliance and Privacy of the University of Pennsylvania CASH HANDLING UNIVERSITY POLICY RESPONSIBILITY ACCOUNTABILITY COMPLIANCE CASH HANDLING CASH HANDLING A SERIOUS ISSUE … If you are responsible for handling cash, you are accountable for that cash. You must comply with University policy. CASH HANDLING Essential Reading : University Policy in the Financial Policy Manual- Policy # 1504 http://www.finance.upenn.edu/vpfinance/fpm/1500/1504.asp Principles of Responsible Conduct http://www.upenn.edu/audit/oacp_principles.htm Human Resources Policy - #007 Fraud http://www.hr.upenn.edu/policy/Policies/007.aspx CASH HANDLING All schools and centers within the University handle cash. Over $300,000,000 a year in cash and checks are deposited through the Cashier’s Office. Coin Currency Money Orders Checks/Traveler’s Checks Credit Card Transactions FINANCIAL POLICY #1504 DEPOSIT OF CASH RECEIPTS Purpose: Establish sound Cash Management practices and safeguard cash receipts against theft or loss. http://www.finance.upenn.edu/vpfinance/fpm/1500/1504.asp CASH HANDLING PROCESS Your department should establish sound cash handling practices by segregating and defining duties for each employee involved in the process. CASH HANDLING PROCESS Collect Cash Reconcile Make Deposit Secure Cash Prepare BEN Deposit FINANCIAL POLICY #1504 DEPOSIT OF CASH RECEIPTS All cash and checks received must be deposited with the University’s Cashier Office the day of receipt. (Cash and checks received over a weekend must be retained in a secure location and deposited the next business day.) #1504 Tax Records Internal Revenue Code requires: The University to file Form 8300 for all cash payments in the amount of $10,000 or greater within 15 days of receipt of cash from an individual or corporation in one or more related transactions. (Cashier’s Office fills out form per your written confirmation.) Depositors must retain images or facsimiles of checks for 7 years. #1504 Depositing Coins and Currency Cash Depositors must hand deliver daily deposits to the Cashier’s Office and must wait for a receipt from the cashier Depositors can not replace cash in a deposit with a personal check Deposits that include $20.00 or more in coin must have a separate deposit for the coins Depositors making a cash deposit can not receive cash back from the deposit #1504 Depositing Checks Depositors must ensure that checks are prepared accurately: Checks are signed Check date is valid, not post-dated Numeric amount and written amount are consistent ( credit given for written amount) #1504 Depositing Checks Endorse checks immediately with your department endorsement stamp Include an adding machine tape with deposit Limit deposits to 100 checks per deposit Foreign checks must be prepared on a separate deposit Do not include UPENN checks in deposits, forward to Accounts Payable #1504 Cash Administration Departments will be charged a returned check fee for any check returned unpaid for any reason Depositors must notify the Cashier’s Office if they do not receive an electronic receipt within two business days Financial Administrator must reconcile deposit accounts monthly per policy #1402 Depositors must notify Public Safety of stolen cash or checks FINANCIAL POLICY #2703 SAFEGUARDING UNIVERSITY ASSETS University and Health System management at all levels are responsible for safeguarding financial and physical assets and being alert to possible exposures, errors and irregularities. Management must be aware of internal control weaknesses which can lead to or permit misuse, misappropriation, or destruction of assets. http://www.finance.upenn.edu/vpfinance/fpm/2700/2700_pdf/2703.pdf FRAUD TRIANGLE CASH CONTROLS •Develop & implement written procedures for receiving, recording, reconciling, safeguarding and depositing cash •Ensure SEGREGATION OF DUTIES throughout the process •Employ a system to determine completeness of cash receipts: •e.g. a computerized point of sale system, a cash register, means of pre-numbered receipt forms, or on a handwritten log. •Account for all cash immediately upon receipt CASH CONTROLS (continued) •Require that receipts be provided for all transactions (& post signs). •Each person collecting cash should have their own cash drawer to establish accountability. •Close out cash registers/drawers at the end of day or end of shifts. •Secure cash in a safe or locked cash box stored in a locked, fire resistant location. •Ensure sufficient Supervisory oversight through daily reconciliation of cash to point of sale system/cash register/receipt log, surprise cash counts, periodic audits, etc. CASH CONTROLS – SEGREGATION OF DUTIES •No individual has control over the entire transaction cycle •Segregate responsibilities of receiving, depositing, recording, and reconciling. •Ensure proper Management oversight by performing monthly reconciliations of sales, cash receipts and deposits. FRAUD RED FLAGS •Untimely or lagged deposits •Employee standard of living changes •Customer complaints increase (bill already paid) •Employee regularly works late, on weekends, refuses to take vacations (for fear of detection) •Increase in or excessive number of refunds or voided transactions •Unusual decrease in revenue •Missing supporting documentation •Known employee issues (gambling, drinking, etc.) CASH HANDLING CONTACTS Cashier’s Office 3451 Walnut Street Franklin Building Lobby 215.898.7258 Department of Cash Management 215.898.7256 Office of Audit, Compliance and Privacy 215.P.COMPLY http://www.upenn.edu/215pcomply WEB REFERENCES http://www.finance.upenn.edu/vpfinance/fpm/1500/1504.asp http://www.finance.upenn.edu/treasurer/cashier/ http://www.upenn.edu/audit/oacp_principles.htm http://www.hr.upenn.edu/policy/Policies/007.aspx http://www.upenn.edu/215pcomply