Horticulture Industries Horticulture and

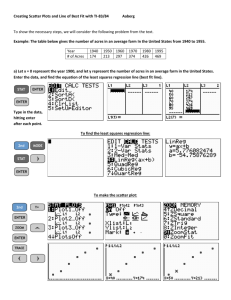

advertisement

Unit One – Characteristics of Horticultural Industries AEC 317 Fall 2013 Horticulture and Horticulture Industries The Horticulture Industry Nursery Fruits and nuts Greenhouse Vegetables Floriculture Grapes and wine Landscaping and services Sod Characteristics of Horticulture Production and Marketing 1. High input – high value 2. Labor intensive 3. Management intensive 4. Capital intensive – including land 5. Perishable products – fast moving supply chains determine quality 6. Large number of horticultural “commodities” – specialty crops 7. Annual and perennial cropping systems 8. Relatively little contracting – cash markets dominate – fewer risk management tools 9. Production consolidation and specialization 10. Market segmentation Netted apple trees Trellised grapes Comparative Labor Costs Commodity Annual labor $ per acre Lettuce (iceberg) $5,200 Raspberries $4,900 Peaches $4,100 Broccoli $3,300 Blueberries $2,000 Wine grapes $1,600 Sweet potatoes $970 Alfalfa $47 Corn $35 Sources: UC Davis (CA), U Georgia, and Iowa St Univ budgets The Specialty Crop Problem IR-4 designation Production supply chains Pest management tools and scale economies Commodity-specific R&D and scale economies The Perennial Crop Problem Capital budgeting Market response vs supply glut Industry coordination Production cycles (in nuts and some fruit) More on marketing orders later Sweet cherries and olives Where’s the futures market for watermelons? Risk management limits for perishable crops Smaller volume of specialty products Difficult to forward contract – high number of production and quality variables Significant direct contracting for processed products Increasing contracting for fresh Increases in vegetable consumption Source: Vegetable & Melons Situation and Outlook, ERS, 2012 U.S. Vegetable Farm Cash Receipts Source: U.S. and State Farm Income and Wealth Statistics: Cash receipts, by commodity groups and selected commodities, 1924-2011 1992-2002 Produce Acreage Changes (thousand acres) 0 +105 -25 -28 +3 +823 0 +1 0 -7 -9 +11 -7 -9 -92 -4 -1-1 -13 -5 +2 0 0 -2 -2 -11 -30+2 -12 -6 -5 -9 -5 +17 0 0 +5 +5 +34 0 -24 -2 -11 +45 -57 -2 -50 -69 1 to +10,000 acres gain 11,00 to 45,000 acres gain > Source: 100,000 USDA acres Census gain of Agriculture 1992 – Produce Acres in U.S. Fruits and Nuts (2012) Vegetables and Pulses (2011) Share of Farm Cash receipts Share of Farm Cash receipts CA 63% CA 36.6% WA 12% FL 9.4% FL 10% WA 6.4% AK 6.4% ID 5.4% Source: Selected ERS Commodity Yearbooks Market Segmentation Produce adapting to segmented U.S. consumer Organics and sustainable production systems Value-added products General growth in credence attributes Fair trade, local, eco-labels