AgriLogic Consulting

Adjusted Gross Revenue

Insurance (AGR)

- A Risk Management Alternative

Wen-fei Uva, Ph.D.

Department of Applied Economics and

Management

Cornell University

Background for

AGR Insurance

BACKGROUND FOR AGR:

AGR insurance plan is a nontraditional, whole farm risk management tool which uses a producer’s historic tax information to provide a level of guaranteed revenue.

Snapshot of AGR:

•

Provides a safety net for farm revenue

•

Provides insurance coverage for multiple commodities under one insurance product

•

Cash is a common measurement

• Uses a producer’s historic

Schedule F tax form information to provide a revenue base for the insurance period

•

Uses the AGR farm report to determine coverage

Who Is Eligible?

•

Producing agriculture commodities in a

Pilot County (may include income from contiguous non-pilot counties).

•

Have 5 years Schedule F tax forms (or equivalent) under the same entity

•

No more than 35% of expected allowable income can be from animals and animal products.

•

No more than 50% of allowable income may come from products purchased for resale. -is available for diversified producers of minor crops, as well as direct marketers.

•

If more than 50% of expected income is from insurable crops, MPCI must be obtained (if available.) Note: protection, benefits, and premiums are coordinated.

2001/2002 PILOT AREAS

New England States (All Counties)

New York (16 Counties)

New Jersey (All Counties)

Pennsylvania (6 Counties)

Maryland (21 Counties)

Delaware (All Counties)

Virginia (26 Counties, 14 Cities)

In 2001 & 2002, subsidy and costshare were available for

Underserved Northeast Producers in the pilot areas.

Signup deadline was January 31 in

2001 and 2002.

UNDERWRITING:

Application

Five Years Schedule F Forms

Annual Farm Report:

–

5 year AGR allowable income and expense history

–

Intended Commodity Report - To estimated enterprise revenue for the insurance year

Beginning Inventory

Application Form FCIC 18050

UNDERWRITING:

Application

Five Years Schedule F Forms

Annual Farm Report:

–

5 year AGR allowable income and expense history

–

Intended Commodity Report - To estimated enterprise revenue for the insurance year

Beginning Inventory

5 continuous years of Schedule 1040 F

UNDERWRITING:

Application

Five Years Schedule F Forms

Annual Farm Report:

–

5 year AGR allowable income and expense history

–

Intended Commodity Report - To estimated enterprise revenue for the insurance year

Beginning Inventory

Annual Farm Report - AGR Form 821 r

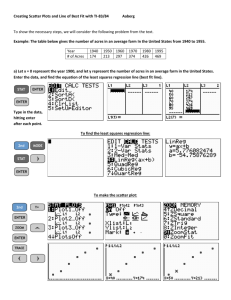

UNI TED ST ATES DEP ARTMENT O F AGRICULTU RE

Federal Crop Insurance Corporation

TE D GROS S REVENUE (AGR) REPO RT

ANNUAL FARM REPORT Š Form 821

INTE NDED C OMMO DITY REPO RT

Commodity

Name/Code

Allowable Income

Allowable Expenses Strawberri es 0628

# Years

Produced

6

Intended

Amount

Total

Amount

AGR

GR

511,893

636,116

835,534

866,673

950,350

3,800,566

760,113

760,113 x (1.651

4

$ 917,239

) = 1,254,569

458,236 Whol esale

572,795 Retai l

973,757 Peppers 0104 - Whole sale

828,030 Cucumbers 0603 - W holesale

925,202 Tomatoes 0086

Whol esale

3,758,020 Retai l

751,604 Cherry Tomatoes 0086 -

W hole sale

Sweet Corn 0044

Whol esale

Re tail

Summer Squash 0014 - W hol esale

Cabbage 0070- Whole sale

Beans 0082- W holesale

Peas 0064- W hole sale

$ 1,254,569

Sugar Peas 0064- Whole sale

Blueberries 0012

Whol esale

Re tail

Fancy Peppers 0045- W holesal e

Eggplants 0613- W hol esale

W in ter Squash 0652- W hole sale

Guards 0652- W holesale

Pumpki ns 0605- W hole sale

Muskmelon 0101- W holesale

Wate rmelon 0101- W holesale

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

6

20 acres

4 acres

10 acres

10 acres

16 acres

2 acres

6 acres

70 acres

5 acres

5 acres

5 acres

5 acres

3 acres

3 acres

3.5 acre s

0.5 acre s

2 acres

2 acres

5 acres

2 acres

6 acres

1 acres

3 acres

130,000 qt.

20,000 qt.

11,000 bu.

4,000 bu.

12,000 boxe s

400 bu.

126,000 pt.

7,700 bu.

550 bu.

10,000 _ bu.

2,700 boxe s

1,115 bu.

363 bu.

435 boxe s

7,280 pt.

500 pt.

1,500 bu.

1,500 bu.

2,500 bu.

1,000 _ bu.

60 tons

500 boxe s

45 tons

Expected Value

$ 1.5

195,000

$ 1.5

30,000

$ 8.0

$ 12.0

88,000

48,000

$ 12.5

150,000

$ 10.0

4,000

$ 0.6

75,600

$ 10.0

$ 14.0

$ 8.0

$ 7.0

$ 20.0

$ 25.0

$ 30.0

$ 1.3

$ 1.3

$ 9.0

$ 8.0

$ 11.0

$ 10.0

$ 200.0

$ 9.0

$ 200.0

Dollars

77,000

7,700

80,000

18,900

22,300

9,075

13,050

9,464

650

13,500

12,000

27,500

10,000

12,000

4,500

9,000

Total Numbe r Commoditie s 13 Total Expe cted Income $ 917,235

Allowable Income

•

Sales of animals and commodity raised and bought for resale

•

Taxable amount of cooperative distributions

•

Commodity Credit Corporation Loans

•

Taxable amount of CCC funds forfeited

•

Other income (bartering, by-passed acreage, diversion payments.

Excluded AGR Income

•

Value from post-production value added operations such as processing, packing, packaging, storage, etc.

•

Basis of commodities purchased for resale

•

Cooperative dividends (non-production)

•

Custom hire

•

Ag program and crop insurance payments

•

Net Gain from commodity hedges

Indexed Allowable Income

Question: For a growing operation , will you be able to insure at a higher level?

Answer : YES!

You are permitted to index your coverage upward by a Max of 20% a year based on the five-year history of schedule F revenue .

Maximum adjustment: (1.20) 4 = 2.07

x 5year Average Allowable Income

Calculating Indexed Allowable

Income

Indexed factor

1. 1996 allowable income $636,116 1995 allowable income $511,893 = 1.243

1.200

2. 1997 allowable income $835,534 1996 allowable income $636,116 = 1.313

3. 1998 allowable income $866,673 1997 allowable income $835,534 = 1.037

1.200

1.037

4. 1999 allowable income $925,202 1998 allowable income $866,673 = 1.097

1.097

5. Average Indexed Factor

6. Income Trend Factor = (Average Indexed Factor) 4

= 1.133

4 = 1.133 x 1.133 x 1.133 x 1.133 = 1.651

7. The Adjusted AGR = Average Allowable Income x Income Trend Factor

= $760,113 x 1.651 = $1,254,569

= 1.133

Although the maximum adjustment is 2.07 times of the 5-year Average Allowable

Income:

You can only insure the LESSER of

• the indexed allowable income, or

• the expected revenue from the intended commodity report

UNDERWRITING:

Application

Five Years Schedule F Forms

Annual Farm Report:

–

5 year AGR allowable income and expense history

–

Intended Commodity Report - To estimated enterprise revenue for the insurance year

Beginning and Ending Inventory

Inventory Market Value

•

Beginning Inventory: Will be valued at the local market value on January 1 of the insurance year, or the first day of the month in which the fiscal tax year begins.

•

Ending Inventory: Will be valued at the local market value on December 31 of the insurance year, or the last day of the month in which the fiscal year ends.

Coverage

Level %

Payment

Rate %

65

Coverage Election

75

Min # of

Crops

1

USDA

Premium

Share

59

65 90 2* 59

75 75 or 90 3* 55

80 75 or 90 4* 48

* Must meet minimum income qualification

Diversification Formula

(1/Number Of Crops * 0.333) * (Total

Expected Income)

= 1/19 * 0.33 * $1,449,670 = $25,178

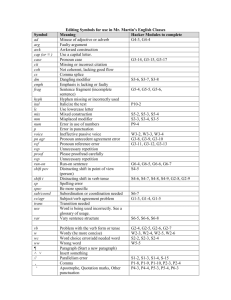

Agricultural Commodity Profile

•

Insured who select the 75 and 80 percent coverage levels are required to complete the Agricultural Commodity

Profile

•

This report required additional information about commodity marketing

Agricultural Commodity Profile -

AGR Form 823

UNI TED ST ATES DEP ARTMENT O F AGRICULTU RE

Federal Crop Insurance Corporation

AGRIC ULTURAL COMMODITY PROFILE Š FORM 823

PART I – PRODUCER INFO RMATIO N

SAMP LE FARM

Strawberries

Cabbage

Blueberries

Raspberries

Sweet Corn

Tomatoes

Peppers

Squash,

Summer

Melons

Tomatoes

Pumpkins

Fall Squash

Indian Corn

Apples

Apples

CROP

OR

COMMODITY

TAX YEAR

1995

Acres Market %

13

9

5

2

46

20

37

1

W/R

W/R

W/R

W/R

W/R

W/R

W/R

W/R

1 80/20

95/5

80/20

50/50

80/20

80/20

80/20

80/20

I

I

I

I

I

Irr.

Prac.

I

I

I

3

1

7

1

10

W/R

W/R

W/R

W/R

R

P for

R 2

50/50

90/10

70/30

90/10

100

100

No

I

I

I

I

TAX YEAR

1996

Acres Market %

2

52

15

35

1

15

10

5

W/R

W/R

W/R

W/R

W/R

W/R

W/R

W/R

80/20

95/5

80/20

50/50

80/20

80/20

80/20

80/20

I

I

I

I

I

Irr.

Prac.

I

I

I

TAX YEAR

1997

Acres Market %

25

12

5

W/R

W/R

W/R

1 80/20

95/5

80/20

Irr.

Prac.

I

I

I

41

25

35

2

W/R

W/R

W/R

W/R

80/20

80/20

80/20

80/20

I

I

I

I

1

1

7

10

10

W/R

W/R

W/R

W/R

R

P for R

50/50

90/10

70/30

90/10

100

100

I

I

I

I

NO

1

1

20

17

10

N/A

W/R

W/R

W/R

W/R

R

P for

R 2

50/50

90/10

70/30

90/10

100

100

NO

I

I

I

I

TAX YEAR

1998

Acres Market %

1

50

25

30

2

18

12

5

W/R

W/R

W/R

W/R

W/R

W/R

W/R

W/R

1 80/20

95/5

80/20

50/50

80/20

80/20

80/20

80/20

I

I

I

I

I

Irr.

Prac.

I

I

I

TAX YEAR

1999

Acres Market %

1

60

25

33

5

18

14

5

W/R

W/R

W/R

W/R

W/R

W/R

W/R

W/R

1 80/20

95/5

80/20

50/50

80/20

80/20

80/20

80/20

I

I

I

I

I

Irr.

Prac.

I

I

I

1

2

20

17

1

8

N/A

W/R

W/R

W/R

W/R

W/R

R

P for

R 2

50/50

90/10

70/30

90/10

90/10

100

100

I

I

I

I

I

I

NO

4

2

23

27

1

8

N/A

W/R

W/R

W/R

W/R

W/R

R

P for

R 2

50/50

90/10

70/30

90/10

90/10

100

100

I

I

NO

I

I

I

I

The Event of Damage or Loss

Coverage:

•

Covering income from crops & other agricultural commodities

•

Loss of revenue by unavoidable cause occurring during the insurance period.

•

Abandonment is not permitted.

• “Your decision not to harvest due to low market prices will not be considered abandonment.”

Will not cover loss due to:

• Negligence, mismanagement, wrongdoing

•

Failure to follow good management practices

• Water contained by any government, public, private dam or reservoir

•

Failure of irrigation equipment or facilities

•

Theft and vandalism

•

Inability to market the crop due to quarantine, boycott or refusal of anyone to accept crops

• Lack of labor

•

Failure of buyer to pay for commodities

The Event of Damage or Loss

•

Notice of damage or loss

•

Cause of loss

•

File tax for the insurance year

•

Convert to accrual accounting basis

•

Finalize other insurance claims covering insured commodities

•

Report all changes which are different than the initial farm report

•

Adjust allowable income if expenses fall below 70% of approved expenses

Impact of AGR Insurance on

Stabilizing Revenue

Approved AGR = $720,636

Coverage Election

Revenue

Loss

No Insurance 80/75

20%

Revenue Payment Revenue

Dollars ($)

576,509 0 576,509

30%

40%

504,445

432,382

54,048 558,493

108,095 540,477

50%

360,318 162,143 522,461

100%

0 432,382 432,382

Producer Premium Elements

•

Number (diversity) of crops

•

Type and proportion of crops

•

MPCI coordination

•

Producer subsidy

• 65% Coverage Level - 59%

•

75% Coverage Level - 55%

• 80% Coverage Level - 48%

•

Additional 50% cost share for

Underserved Areas (inc. NY pilot ctys)

Premium Calculation Example

A diversified vegetable farm in a NY pilot county

Approved AGR = $720,636

Coverage Level

Payme nt Rate

90%

75%

65%

$

1,722

1,297

75%

$

3,525

2,707

Less than 1% of Gross Sales

80%

$

5,647

4,367

2001/2002 AGR Program Sales Information for the NE Under-served Area

(As of June 3, 2002)

CONNECTICUT

DELAWARE

MAINE

MARYLAND

MASSACHUSETTS

NEW HAMPSHIRE

NEW JERSEY

NEW YORK

PENNSYLVANIA

RHODE ISLAND

VERMONT

Total Northeast

2001 Policies

24

0

3

9

36

4

37

79

5

2

___7____

206

2002 Policies

31

0

4

19

35

5

28

82

7

1

____ 8___

220

2001/2002 AGR Program Sales Information for New York Counties

(As of June 3, 2002)

CAYUGA

CHAUTAUQUA

ERIE

GENESEE

MONROE

NIAGARA

ONONDAGA

ONTARIO

ORANGE

ORLEANS

OSWEGO

SENECA

SUFFOLK

ULSTER

WAYNE

YATES

Total NY’s Pilot Counties

2001 Policies

0

5

38

2

79

3

9

3

3

2

3

2

0

4

3

1

1

2002 Policies

0

4

44

__1

82

2

9

3

4

2

2

2

0

5

3

1

0

2001/2002 AGR Program Sales Information by Coverage, NY and NE

(As of June 3, 2002)

NY

Coverage level 2001 poli cies 2002 poli cies

65%

75%

80%

19 (24%)

46 (58%)

14 (18%)

21 (26%)

44 (54%)

17 (21%)

NE 65%

75%

80%

65 (32%)

96 (47%)

45 (22%)

62 (28%)

94(43%)

64 (29%)

Any Concern About Using

Schedule F?

Suppose you have been using “creative tax management strategies!”

-- “We assume that anyone who cheats on his income taxes will do it consistently!”

AGR might not be for everyone:

Provide producers of crops without individual crop insurance programs an insurance alternative to guarantee a revenue level

Additional Information

Adjusted Gross Revenue Pilot Crop Insurance

Program for Specialty Crops at Michigan State

University

• www.aec.msu.edu/agecon/blackj/agr.htm

Risk Management Agency

• www.rma.usda.gov

Cornell Risk Management Web-site for Specialty

Crops

• http://hortmgt.aem.cornell.edu/programs2.

htm