Reporting and Analyzing Cash Flows

advertisement

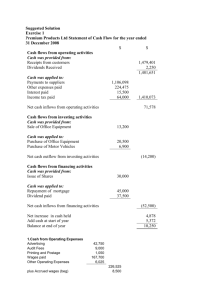

Reporting and Analyzing Cash Flows Chapter 17 Purposes of the Statement of Cash Flows Designed to fulfill the following: – predict future cash flows – evaluate management decisions – determine the ability to pay dividends plus interest and principal – show the relationship of net income to changes in the firm’s cash Cash Balance Includes... – cash on hand. – cash in the bank. – cash equivalents. Cash Equivalents Are.... …short-term, highly liquid investments convertible into cash with little delay. – money market accounts. – U.S. Government Treasury bills. Basic Organization of the Statement of Cash Flows A business may be evaluated in terms of three types of business activities: 1 Operating activities 2 Investing activities 3 Financing activities Operating Activities Related to transactions that make up net income. Also affect current assets and current liabilities on the balance sheet. Operating Activities Inflows – cash receipts from earning revenues Sale of goods or services Interest revenue Dividend revenue Other revenues Outflows – cash paid from incurring expenses Salaries and wages. Payments to suppliers for inventory. Taxes and fines. Interest paid to lenders Other expenses Focus your attention on: income statement, and changes in current assets, current liabilities Investing Activities Investing activities increase and decrease the assets that are available to the business. Related to the Long-Term Asset accounts. Investing Activities Inflows Selling long-term productive assets. Selling equity investments. Collecting of principal on loans. Other. Outflows Purchase long-term productive assets. Purchase equity investments. Purchase debt investments. Make loans. Focus your attention on changes in: plant assets, long-term investments, other long-term assets Financing Activities Transactions involving obtaining resources from the owners or returning resources to them. Also involves obtaining resources from creditors and repaying the amount borrowed. Financing Activities Inflows Issuing stock. Issuing bonds and notes. Outflows Cash dividends or withdrawals by owner. Purchase treasury stock. Repay cash loans. Focus your attention on changes in: long-term debt and stockholder’s equity Noncash Investing and Financing Investing and financing activities that affect the company’s financial position, but not the entity’s cash flow during the period. Items requiring separate disclosure include: Retirement of debt by issuing equity securities. Conversion of preferred stock to common stock. Acquiring land by issuing a note payable. Format of the Statement of Cash Flows FASB Statement 95 approved two methods for reporting cash flows from operating activities. 1 Indirect method 2 Direct method Format of Statement Company Name Statement of Cash Flows For the Period Ended XXXX Cash flows from operating activities: [List] Net cash provided (used) by operating activites Cash flows from investing activities: [List] Net cash provided (used) by investing activites Cash flows from financing activities: [List] Net cash provided (used) by financing activites Net increase (decrease) in cash Cash (and equivalents) balance at beginning of period Cash (and equivalents) balance at end of period $ ##### ##### ##### $ ##### ##### $ ##### Direct Method of Determining Cash Flows from Operating Activities Examine each income statement item with the objective of reporting how much cash was received or disbursed in association with the item. Start with Sales or Revenues Earned and work your way down through the income statement. Think about it Cash collected from customers = $24,440 or Sales – increase in accounts receivable $24,623 - 183 = $24,440 If accounts receivable is increasing, then our customers are charging more and paying less. Think about it. Cash Paid for Inventory, $18,516 or Cost of goods sold + increase in inventory increase in accounts payable 18,048 + 651 – 183 = $18,516 If inventory increases, you’re going to have to pay cash for it. If accounts payable increases, you are charging more, paying less Think about it: Cash paid for operating expenses = $4,793 Or Operating expenses – increase in accrued liabilities $4,883 – 90 = $4,793 Acquisitions of property and equipment: Property & Equipment Beg bal 3,428 269 Depreciation 3,159 1,186 End bal 4,345 Borrowing: Long-term liabilities Beg bal 464 14 End bal 478 Proceeds from issuance of common stock: Common stock Beg bal 446 230 End bal 676 Payment of cash dividends: Retained earnings Beg bal 3,788 Net inc. 886 4,674 End bal 4,531 143 Indirect Method of Determining Cash Flows from Operating Activities Begin with net income as reported on the income statement and adjust: Add any noncash expenses or any losses Deduct any noncash gains or revenues Adjust for changes in current operating assets and liabilities Indirect Method of Reporting Operating Cash Flows Changes in current assets and current liabilities. Cash Flows from Operating Activities Net Income + Losses and - Gains + Noncash expenses such as depreciation and amortization. Indirect Method of Reporting Operating Cash Flows Cash + Other Assets = Liabilities + Capital Cash flows provided by operating activities: Cash flows from investing activities: Cash paid to acquire plant assets $(101,000) Cash received from sale of land 24,000 Net cash flows used by investing activities Cash flows from financing activities: Cash received from stock issuance $30,000 Cash paid on long-term note (15,000) Cash paid for dividends (11,000) Net cash flows provided by financing activities Net increase (decrease) in cash Cash balance, beginning of year Cash balance, end of year $80,000 (77,000) 4,000 $7,000 20,000 $27,000