Annual report 2013*14 - Queensland Curriculum and Assessment

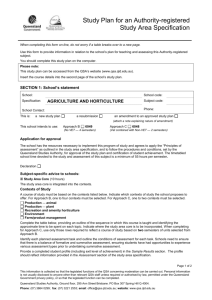

advertisement