Building a brand

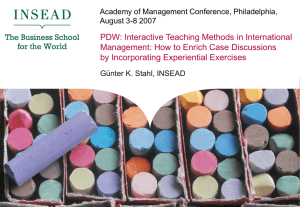

© Günter K. Stahl

EIASM Workshop on International Strategy and Cross-Cultural

Management, Helsinki, September 24-26 2009

How, Where and Why Culture Matters in Mergers and Acquisitions: A Research Synthesis and Agenda for Future Research

Günter K. Stahl, WU Vienna and INSEAD

Mergers and Acquisitions: Cultural Integration Challenges

© Günter K. Stahl

© Günter K. Stahl

Do Cultural Differences Matter in M&A?

Lots of Anecdotal Evidence Showing Negative Effects

Another drug industry mega merger goes bust: Clash of cultures kills Monsanto-AHP marriage.

T. Burton & E. Tanouye, Wall Street Journal , October 14, 1998

Every CEO who has been through a cross-border merger says he knew culture was going to matter but did not realise how much.

C. Firstbrook, Head of Strategy Europe, Accenture , Financial

Times , July 31, 2008

It’s difficult enough for two domestic firms with markedly different cultures to combine. But in a cross-border context, opportunities to misunderstand and disagree multiply like weeds.

R. Bruner, Harvard Business Review, May 2004

The Role of Cultural Distance in M&A: What Do We Know?

Theory Predicts Negative Effect

“Cultural Distance” Hypothesis: The difficulties, costs and risks associated with cross-cultural contact increase with growing cultural differences

(Hofstede, 1980).

M&A literature has sought to explain M&A failure in terms of “cultural distance” (Morosini et al., 1998), “cultural divergence” (Birkinshaw et al.,

2000), “cultural incompatibility” (Larsson & Finkelstein, 1999), “cultural risk”

(David & Singh, 1994) or related concepts.

Cultural fit (e.g., Cartwright & Cooper, 1996) and acculturation models

(Nahavandi & Malekzadeh, 1988) propose that the cultures of merging firms have to be similar in order to integrate successfully.

Social identity theory (e.g., Hogg & Terry, 2000) and trust research (e.g.,

Stahl & Sitkin, 2005) suggest that cultural distance has an adverse impact on interorganizational relationships and post-merger integration.

But some theoretical evidence that cultural differences can be a source of value creation and learning in M&A (Vermeulen & Barkema, 2001).

Source: Stahl & Javidan (2009). Comparative and cross-cultural perspectives on cross-border mergers and acquisitions. In Bhagat & Steers

(Eds.), Handbook of culture, organization, and work . Cambridge University Press.

© Günter K. Stahl

Case Study: Lenovo-IBM – A Marriage Across 12 Time Zones

Lenovo

• $3b revenues

• 27% of Chinese Market

• No. 8 global PC maker

•

Founded 1984, HK listed 1994

IBM PC Division

• $10b revenues (IBM total: $96b)

• 8% of global market

• No. 3 global PC firm

•

IBM founded 1911

$1.75b deal: 600m equity (19% stake), $650m cash, take over $500m liabilities

Lenovo takes over IBM PC Division (announced 8 Dec 2004, completed 1 May 2005)

• Right to use IBM brand name for 5 yrs

• IBM provides sales and support services

• IBM will be preferred vendor for financing and maintenance services

• 10,000 IBM employees join Lenovo

© Günter K. Stahl

Source: Stahl, Ngo & Yean (2008). Lenovo-IBM: A marriage across 12 time zones. INSEAD Case.

Case Study: Renault Nissan – Partnering with the Unfamiliar

Source: Korine, Asakawa & Gomez (2005). Renault and Nissan: Partnering with the unfamiliar. In Stahl & Mendenhall (Eds.),

Mergers and acquisitions: Managing culture and human resources . Stanford Business Press.

© Günter K. Stahl

Case Study: DaimlerChrsyler

Source: Kühlmann & Dowling (2005). DaimlerChrysler: A case study of a cross-border merger. In Stahl & Mendenhall

(Eds.), Mergers and acquisitions: Managing culture and human resources . Stanford Business Press.

© Günter K. Stahl

The Role of Culture in Alliances, Mergers & Acquisitions:

Example Renault-Nissan

Some people consider cultural differences as a source of friction and conflicts. It is true. But cultural differences are basically a source of enrichment and progress.

(Carlos Ghosn, 2000)

Cultural differences can be viewed as either a handicap or a powerful seed for something new. What we see today [in Renault-Nissan] is that differences in culture are … seen more and more as a means of cross-fertilization and innovation.

… So, it is a careful selection of best practices.

(Carlos Ghosn, 2001)

Sources: Carlos Ghosn, INSEAD Tokyo Forum, November 2000;

Emerson 2001 ‘An interview with Carlos Ghosn, President of Nissan Motors and Industry Leader of the Year. Journal of World Business, 36, 3-10 .

© Günter K. Stahl

The Role of Cultural Distance in M&A: What Do We Know?

Empirical Evidence is Mixed

Cultural distance was found to be negatively related (e.g., Weber, Shenkar

& Raveh, 1996), unrelated (e.g., Markides & Oyon, 1998), or positively related (e.g., Morosini, Shane & Singh, 1998) to measures of postacquisition performance.

Success rate of cross-border M&A was found to be higher than for domestic M&A (e.g., Chakrabarti et al., 2009).

Source: Stahl & Javidan (2009). Comparative and cross-cultural perspectives on cross-border mergers and acquisitions. In Bhagat & Steers

(Eds.), Handbook of culture, organization, and work . Cambridge University Press.

© Günter K. Stahl

Cultural Distance and M&A Performance: Causal Models

a) Unmediated model

Cultural

Distance

M&A

Performance b) Mediated model

Cultural

Distance

Mediating Variable

(e.g., Resistance)

M&A

Performance

Moderating Variable

(e.g., Integration Level) c) Moderated model

Cultural

Distance

© Günter K. Stahl

M&A

Performance

Cultural Distance and M&A Performance: Causal Models

d) Complex model

National

Industry

Functional

Company A

Culture

Corporate

Professional

Moderating Variable

(e.g., Integration Level)

Cultural Differences

- Practices

- Values

- Assumptions

National

Industry

Functional

Company B

Culture

Corporate

Professional

Mediating Variable

(e.g., Resistance)

M&A Performance

- Operational synergies

- Accounting performance

- Abnormal returns

Source: Stahl (2008). Cultural dynamics and impact of cultural distance within mergers and acquisitions. In Smith, Peterson

& Thomas (Eds.), The Handbook of cross-cultural management research (pp. 431-448). Thousand Oaks: Sage.

© Günter K. Stahl

Hypothesized Effect of Cultural Distance on M&A Performance

Dimension of

Cultural Differences

(Moderators)

Degree of

Relatedness

Note: a The relationship between cultural differences and task integration has not been examined with sufficient frequency in previous research to be considered in this meta-analysis.

Cultural Distance

- Practices

- Values

- Basic assumptions

Integration Process

Sociocultural

Integration

- Shared identity

- Positive attitudes

- Trust

M&A Performance

Synergy

Realization

Accounting performance

Task Integration a

- Capability transfer

- Resource sharing

- Learning

Shareholder Value

Abnormal returns

Time

Source: Stahl & Voigt (2008). Do cultural differences matter in mergers and acquisitions? A tentative model and meta-analytic examination. Organization Science , 19, 160-176.

© Günter K. Stahl

Meta-analysis: Method and Sample

Literature

Search

Coding of

Studies

Data

Analysis

I.

II.

III.

Final Sample: 46 studies that examined the relationship between cultural distance and M&A performance, with a combined sample size of 10,710 M&A, completed over a 54-year period (1950-2004)

© Günter K. Stahl

Results of Meta-Analyses of M&A Outcome Measures

Outcome Measure K N Mean ES

Range of

ES

Q

Sociocultural Integration

(Behavioral/Attitudinal Measures)

Synergy Realization

(Accounting Measures)

Shareholder Value

(Stock Market Measures)

– Announcement effects

– Longer-term effects

– Target firms

– Acquiring firms

15

15

16

9

7

6

8

1316

1692

7702

2418

5693

5490

2041

-0.09*** -0.74; 0.23

0.01

-0.01

0.08*

-0.05*

-0.38; 0.42

-0.62; 0.22

285.05***

-0.62; 0.20

-0.40; 0.22

43.59***

86.77***

40.92***

214.94***

0.07** -0.03; 0.20

19.32**

-0.26*** -0.62; 0.19

102.07***

Notes: k = Number of studies; N = Sample size (number of M&A); Mean ES = Weighted mean effect size;

Q = Value of chi-square distributed homogeneity statistic Q ; * p < .05; ** p < .01; *** p < .001.

Source: Stahl & Voigt (2008). Do cultural differences matter in mergers and acquisitions? A tentative model and meta-analytic examination. Organization Science , 19, 160-176.

© Günter K. Stahl

Performance Impact of Cultural Differences in M&A

Explanations for Zero-Direct-Effect Relationship

1. Positive and negative effects on outcome variables (which partly or fully offset one another);

2. Moderated relationships (e.g., impact of contextual factors);

3. Mediating mechanisms and intervening variables;

4. Non-linear effects of cultural distance on outcome variables;

5. Combining of outcome measures that share little common variance (i.e., the mixing of “apples and oranges”);

6. Effects of study design and sample characteristics.

Source: Stahl (2008). Cultural dynamics and impact of cultural distance within mergers and acquisitions. In Smith,

Peterson & Thomas (Eds.), The Handbook of cross-cultural management research (pp. 431-448). Sage.

© Günter K. Stahl

Impact of Cultural Distance on M&A Performance: Key Results

Focal Organization

Shareholder

Value

Note: + ,

–

, n.s.

indicate significant and non-significant main effects

Time n.s.

Cultural

Distance

-

Sociocultural

Integration

+

+

Relatedness n.s.

Example: Moderator Analysis

Outcome

Measure

Sociocultural

Integration

Synergy

Realization

Moderator:

Degree of

Relatedness

Low

High

Low

High

Z

2.24

*

3.28

*** k N

Mean

ES

9 994 -0.06

4 306 -0.21

3 328 0.16

6 805 -0.06

Level of

Culture

Synergy

Realization

Notes. Z = Z value of critical ratio test for the comparison of subgroups; k = Number of effect sizes; N = Number of

M&A examined; Mean ES = Weighted mean effect size;

* p < .05; ** p < .01; *** p < .001.

Source: Stahl & Voigt (2008). Do cultural differences matter in mergers and acquisitions? A tentative model and meta-analytic examination.

Organization Science , 19, 160-176.

© Günter K. Stahl

Conclusions and Implications for Research

• Cultural differences present “double-edged sword” – may be positively or negatively associated with M&A performance, depending on contingencies such as the degree of relatedness and integration design.

• The ability to manage the sociocultural integration process in an effective manner appears to be a key factor influencing M&A outcomes.

• Research design characteristics such as type of outcome measure, time of measurement, and focal organization (acquirer, target) affect study results.

• Existing research suffers from methodological weaknesses : level-of-analysis problems; validity of ‘cultural distance’ measure; simplistic assumptions about cause-effect relationships; lack of control for confounding variables; etc.

• Future research should open the “black box” of M&A integration . Issues that deserve more research attention include:

–

–

– the temporal dynamics of the sociocultural integration process; the role of context in shaping the performance effects of cultural differences; how differences in culture facilitate or undermine the transfer of capabilities, resource sharing and learning.

© Günter K. Stahl

Research on M&A Integration: Ongoing and Follow-up Studies

• Sociocultural dynamics and synergy exploitation: A study of Israeli biotechnology firms engaged in M&A (with Yaakov Weber) .

• Cultural distance and capability transfer in M&A: The mediating roles of capability complementarity, absorptive capacity, and social integration

(with Eero Vaara, Riikka Sarala and Ingmar Björkman) .

• The role of trust in the post-merger integration process

– Role of leadership in M&A: Integration managers as gate keepers and trust builders (with Sim Sitkin)

– Factors influencing trust in acquisitions: A decision-making simulation

(with Amy Pablo and Chei Hwee Chua)

– Role of trust in the post-acquisition integration process: A case survey

(with Rikard Larsson)

• M&A case studies

– Lenovo-IBM: A marriage across 12 time zones

(with Winston Yean)

– Teva Pharmaceuticals: Growth through acquisitions (with Haim Benjamini)

– Emirates Bank/National Bank of Dubai: Building a regional champion

(with Paul Evans)

© Günter K. Stahl

The Same Pattern can be Found in Culturally Diverse Teams

Note: + ,

–

, indicate significant main effects

Team Size

+

Conflict

Task Complexity

+

Creativity

Cultural

Diversity

Performance

Social

Integration

Team Dispersion

-

+

(no direct relationship between diversity and performance found)

Satisfaction

Team Tenure

Sample: 108 studies, with combined sample size of 10,632 teams

Source: Stahl, Maznevski, Voigt & Jonsen (forthcoming). Unraveling the diversity-performance link in multicultural teams:

Meta-analysis of studies on the impact of cultural diversity in teams. Journal of International Business Studies.

© Günter K. Stahl

Interested in Learning More About M&A Integration?

Mergers and Acquisitions

Managing Culture and Human

Resources

Edited by Günter K. Stahl and

Mark E. Mendenhall

Contributors: D. Schweiger, H. Lane,

P. Dowling, M. Javidan, R. Larsson,

A. DeNisi, P. Evans, S. Cartwright,

S. Sitkin, I. Björkman, S. Chaudhuri,

Y. Weber, H. Korine, K. Asakawa,

V. Pucik, R. Olie and others

Professors Stahl and Mendenhall have done a superb job putting together a book that focuses on one of the most important yet often neglected areas in the field of mergers and acquisitions, that of creating a common corporate culture and optimizing human capital.

Jean-Pierre Garnier, CEO, GlaxoSmithKline

This book rejects simplistic analyses and instead explores the human and social paradoxes, complexities and challenges that are inherent when business systems integrate.

Carlos Ghosn, CEO, Nissan and Renault

This book, a unique collaboration between leading academics and seasoned practitioners, offers the most insightful and practical account yet of how one can get a grip on the 'softer' social, psychological and cultural aspects that are at the heart of successful integration.

Philippe Haspeslagh, Paul Desmarais Chaired Professor, INSEAD

This book provides a wealth of insights into the human side of the integration process: where it goes wrong, and what firms can do to manage it better.

Julian Birkinshaw, Professor of Strategy, London Business School

The book effectively blends scholarship and practice with chapters by respected scholars, commentaries by top executives and actual cases of M&A … This volume is of significant value to both scholars and executives alike.

Michael Hitt, Joseph Foster Chaired Professor, Texas A&M University

© Günter K. Stahl