Tara Moffitt - Agri4Africa

advertisement

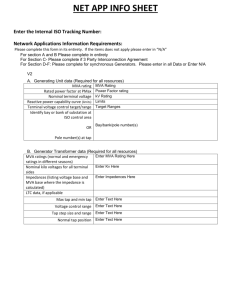

Grants & Incentives Agri-Processing 5 March 2013 Agenda • Introduction to Innovative Finance • Government Grant Objectives • Grants in Agriculture • Manufacturing Investment Programme (MIP) • Manufacturing Competitiveness Enhancement Programme (MCEP) Introduction to Innovative Finance • Specialist Financial Services Company adding value to Manufacturers and Industrial Businesses • Holistic Approach to procuring relevant finance products: • Funding in the form of debt / government subsidies • Private Equity and Venture Capital Government Grant Objectives • Industrial Policy Action Plan and NewGrowth Path • Focus on: • Employment Creation • Improving industrial capacity and output • Stimulating investment and growth in industrial sector • Broad Based Black Economic Empowerment Grants in Agriculture • Manufacturing in the Agricultural Industry? • Secondary processes = value add processes • Grants viewed as bonus payments from government and not financing • Paid retrospectively and payment is subject to meeting monitoring criteria during contractual period • Business sense is the first priority Grants Application Process Grants Claim Process Manufacturing Investment Programme • Released July 2008 for a six year term • Available to Manufacturers (SIC Code 3) • Companies, Closed Corporations and CoOperatives legally registered in SA • New start-ups or Expanding Businesses • Application must be submitted 90 days in advance of first asset brought into operation Manufacturing Investment Programme • Tax Free, Paid in Cash • < R 5 million – 30% of qualifying investment over a three year term • > R 5 million but < R 30 million – between 15% and 30% of qualifying investment calculated according to a regressive sliding scale over two years • > R 30 million – fixed 15% on qualifying investment over two years • Qualifying Investment includes: • Plant and Machinery • Owned buildings / rented premises and leasehold improvements • Commercial Vehicles used in production process Manufacturing Investment Programme MIP Qualifying Criteria • Meet the required number of points according to the prescribed Economic Benefit Criteria Tables • Expand in terms of revenue – 15% growth in year one and 25% growth in year two calculated respectively from base year • Prove sustainability and business feasibility • Prove the need for financial grant assistance • No reduction in base year employment • Growth in respect of historical asset base. DTI will not fund mere replacement. Manufacturing Investment Programme • Qualifying Criteria to remember: • Are you making significant investment in Plant and Machinery or Starting a New Business/Division? • Are you Creating Jobs? If the answer is Yes... You stand a good chance of obtaining a grant if the application is correctly structured MCEP • Cost Sharing Grant paying back between 30% and 70% of qualifying costs • Encourages manufacturers to upgrade facilities in order to sustain employment and promote competitiveness • Available to all existing manufacturers • Applications must be submitted 60 days in advance of project commencement MCEP: Key Elements • Production Incentive: • Capital Investment • Green Technology and Resource Efficiency • Enterprise Level Competitiveness Improvement • Feasibility Studies • Cluster Competitiveness • Industrial Financing Loan Facilities (via IDC) MCEP Benefit • Maximum grant calculated as a percentage of the applicant’s average Manufacturing Value Add over two years according to audited financial statements. • MVA = Gross Sales less Raw Material Input Costs MCEP Maximum Benefit Enterprise Size Maximum Percentage of MVA < R 5 million Direct Cost Sharing Grant; MVA cap not applicable 100% Black Shareholding 25% of MVA > R 5 million but < R 30 million 25% of MVA > R 30 million but < R 200 million 20% of MVA > R 200 million 10% of MVA MCEP Eligibility Criteria • Registered legal entity within South Africa • Applicants with a historical asset base of < R 5 million should invest a minimum of R 500 000 in Plant & Machinery • Applicants with historical asset base > R 5 million should expand by lower of: • 20% of existing Plant and Machinery Cost • R 2 million • Manufacturing entity (SIC Code3) in operation for a minimum of one year • No reduction in base year employment levels • BBBEE Level Four or able to provide a plan as to how Level Four will be achieved within four year period Innovative Finance Contact Details • Tara Moffitt: tara@inovativefinance.co.za • Rudi Scholtz: rudi@innovativefinance.co.za • Telephone: 021 838 2726 Thank you / Questions