L10-PPP - Harvard Kennedy School

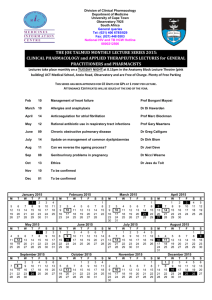

advertisement

LECTURE 10: Purchasing Power Parity

• Primary Motivation: How realistic is the assumption P = 𝑃?

• Secondary motivation: How integrated are global goods markets?

• Definition(s) of PPP

(Absolute vs. Relative PPP)

• Does PPP hold in practice?

• Barriers to international goods market arbitrage

• Four observed patterns of deviation from PPP

• Arbitrage enforces the Law Of One Price

in some sectors

but not

in others:

• Appendix 1: PPP within the Monetary Approach to the B of P

PPP: ALTERNATIVE DEFINTIONS

Absolute PPP :

P ≡ price of a basket of goods in domestic currency

esp. from the World Bank’s International Comparison Program.

• RER = 1,

•

P = E P*

•

𝑃

E=

𝑃∗

𝑃∗

where real exchange rate RER ≡ E

𝑃

=

1/𝑃∗

1/𝑃

ITF-220 Prof.J.Frankel

PPP: ALTERNATIVE DEFINTIONS (continued)

Relative PPP

CPI ≡ is a price index, expressed relative to an arbitrary base year

e.g., “CPI2000 ≡ 100.0” (from national agencies).

Define real exchange rate Q ≡ E 𝐶𝑃𝐼∗

.

𝐶𝑃𝐼

• Q is constant (at 𝑄),

• CPI =

1

𝑄

or

E=

𝐶𝑃𝐼

𝑄

.

𝐶𝑃𝐼∗

(E)(CPI*) .

• Depreciation = π - π*, where π and π* are

domestic & foreign inflation rates.

Prof. Jeffrey Frankel, Harvard Kennedy School

Does PPP hold in practice?

• No.

• Q varies a lot.

ITF-220 Prof.J.Frankel

Four patterns of

deviation from PPP

and their likely origins:

Q

Q

a) Band <= barriers

b) Random walk

<= shifts in

terms of trade

c) Trend <= BalassaSamuelson effect

d) Autoregression

<= sticky prices .

Band

Random Walk

Q

Q

𝑄

Trend

ITF-220 Prof.J.Frankel

Autoregression

Barriers to International Integration

of Goods Markets

• Transportation costs, which depend on:

• geography

• technology

• Tariffs & non-tariff trade barriers

• Currencies

• Other border frictions

ITF-220 Prof.J.Frankel

Long-distance transport costs

fell during the 19th century.

Source: FREIGHT RATES AND PRODUCTIVITYGAINS IN BRITISH TRAMP SHIPPING 1869-1950 by

Saif I. Shah Mohammed and Jeffrey G. Williamson

NBER Working Paper 9531 (http://www.nber.org/papers/w9531)

ITF-220 Prof.J.Frankel

By 1914, low

transport costs,

UK-led free trade,

& the Pax

Brittanica allowed

arbitrage between

the US & UK

in wheat.

ITF-220 Prof.J.Frankel

Arbitrage enforces the Law Of One Price

in some sectors, but not in others

• For homogeneous mineral & agricultural

commodities, the Law of One Price

– holds, if there are no trade barriers (gold),

– fails, if there are trade barriers (sugar).

• For goods & services not traded internationally,

there can be no arbitrage (haircuts).

• Other sectors fall in between:

– Manufactured goods.

– Big Mac hamburgers.

ITF-220 Prof.J.Frankel

The Law of One Price holds relatively well

for a standardized metal such as gold.

{

Note: India has tariffs &

quotas on gold imports.

G.Alessandria & J.Kaboski, 2008, “Why are Goods So Cheap in Some Countries? ”

ITF-220 Prof.J.Frankel

Business Review, Fed,Res,Bank of Philadelphia,

Q2. Table 2.

High trade

barriers in

agricultural

products

are still

common,

preventing

price

arbitrage.

ITF-220 Prof.J.Frankel

Prices of nontraded

services vary widely.

Notice that they are

lower in poorer (lowwage) countries

than rich.

ITF-220 Prof.J.Frankel

Jan.22, 2014

Why is the price

of Big Macs

so high in Norway?

Big Macs are

partly traded

(ingredients) &

partly nontraded

(cooking & retail).

Their price varies

widely across

countries.

higher in Brazil

than in Japan?

Low in India

& S.Africa?

ITF-220 Prof.J.Frankel

Non-Traded Goods

• Even if arbitrage quickly equalized prices for traded goods,

it would not do so for goods that are not traded internationally.

• If the price of Non-Traded Goods rises more rapidly in Japan

than in the US, then the yen will come to appear overvalued in

real terms, i.e., relative to PPP.

• Balassa-Samuelson effect: higher income per capita =>

higher relative price of non-traded goods => real appreciation.

– Usual mechanism: the higher productivity occurs in Traded Goods sector

= > ( PTG /PNTG ) ↓ .

– But PTG = E PTG *, tied to world markets

either way,

E ↓ (under a float)

=> (E P*/CPI)↓ :

or PNTG ↑ => CPI ↑

real appreciation.

{

}

ITF-220 Prof.J.Frankel

Balassa-Samuelson relationship:

Absolute price levels are higher in rich countries

(real exchange rates are lower).

1/Q

G.Alessandria & J. Kaboski, 2008, Bus.Rev, Fed.Res. Bank of Philadelphia, Q2. Fig.1

Sticky goods prices =>

autoregressive pattern in real exchange rate

(though you need 100 years of data to see it)

WWI inflation

1925 ₤

return

to gold

Thatcher

1931, 49, 69 appreciation 1990: ₤

₤ devaluations

entered

EMS

UK inflation during

Bretton Woods era

ITF-220 Prof.J.Frankel

1992:

₤ left

EMS

Bottom line conclusion from PPP

for the rest of the course

• For most goods & services, prices are “sticky”

– i.e., we can take their prices as exogenous in the SR.

– Exceptions:

• mostly agricultural & mineral products

• Especially in very small open economies.

• After a few years pass (Medium Run),

we must realize that prices adjust,

• closing about ¼ gap per year.

• In the Long Run, prices may adjust fully,

– returning us to a LR PPP equilibrium, 𝑄

– although even in the LR there can be changes in 𝑄 ,

• e.g., from exogenous changes in terms of trade

• or from Balassa-Samuelson effect.

Appendix 1: PPP within the MABP

Effect of a devaluation

•

•

•

•

E ↑ => P ↑ => (M/P) ↓ =>

(M/P) < L => “Excess Demand for Money”

=> residents cut back spending on goods (or assets)

=> BP ↑

the “real balance effect.”

• => Res rising over time

• + Nonsterilization

}

M rising over time

=> BP is self-correcting.

ITF-220 Prof.J.Frankel

Appendix 2: Transport Costs since the 19th century

Long

distance

transport

costs fell

sharply

during

the 19th

century.

Source: FREIGHT RATES AND PRODUCTIVITYGAINS IN BRITISH TRAMP SHIPPING 1869-1950 by

Saif I. Shah Mohammed and Jeffrey G. Williamson

NBER Working Paper 9531 (http://www.nber.org/papers/w9531)

Source: FREIGHT RATES AND PRODUCTIVITYGAINS IN BRITISH TRAMP SHIPPING 1869-1950 by

Saif I. Shah Mohammed and Jeffrey G. Williamson

NBER Working Paper 9531 (http://www.nber.org/papers/w9531)

ITF-220 Prof.J.Frankel

Appendix 3:

The Big Mac

Index in 2000.

The price tends

to be higher in

rich countries

(e.g., Europe &

Japan, compared

to China),

and in countries

with overvalued

currencies

(e.g., Argentina

in 2000).

ITF-220 Prof.J.Frankel

Three years later,

Big Macs were still

expensive in Europe

and cheap in China;

but now (2003),

they were cheaper

still in Argentina.

Why?

Devaluation.

Source: The Economist, January 2003.

ITF-220 Prof.J.Frankel

1/Q

Balassa-Samuelson

relationship

Source: “The Purchasing Power Parity Puzzle,” by Kenneth Rogoff, Journal of Economic Literature (1996).

ITF-220 Prof.J.Frankel