L8 - Harvard Kennedy School

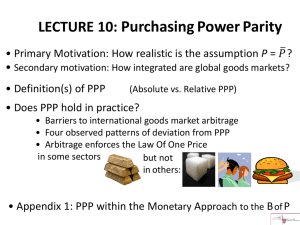

LECTURES 8 & 9:

PURCHASING POWER PARITY (PPP)

EMPIRICAL TESTS OF PPP

Motivating questions:

How integrated are goods markets internationally?

How rapidly do prices adjust?

PPP: ALTERNATIVE DEFINTIONS

Absolute PPP :

P ≡ price of a basket of goods in domestic currency esp. from the World Bank’s International Comparison Program.

•

•

RER = 1, where real exchange rate RER ≡ E

𝑃∗

𝑃

P = E P*

•

𝑃

E =

𝑃∗

=

1/𝑃∗

1/𝑃

• In logs: e = p - p*.

ITF-220 Prof.J.Frankel

PPP: ALTERNATIVE DEFINTIONS (continued)

Relative PPP

CPI ≡ is a price index, expressed relative to an arbitrary base year e.g., “CPI

2000

≡ 100.0” ( from national agencies ).

Define real exchange rate Q ≡ E

𝐶𝑃𝐼∗

𝐶𝑃𝐼

.

• Q is constant (at ), or E = 𝑄

𝐶𝑃𝐼

𝐶𝑃𝐼∗

.

• CPI =

1

𝑄

(E)(CPI*) .

• In logs, Δe = Δ cpi – Δ cpi*

(relative to some base year).

• Annual depreciation = π - π* .

Prof. Jeffrey Frankel, Harvard Kennedy School

PPP: EMPIRICAL QUESTIONS

• Does PPP hold: in the short run?

in the long run?

• What is the estimated speed of adjustment to the LR?

• What is the test’s “statistical power”?

• Are PPP deviations:

• related to variation in nominal exchange rates?

- Can one infer causality?

- Is Var (q) related to currency regimes?

• related to geography?

- To distance? To borders?

• Does the Law of One Price hold better in some sectors than others?

- Commodities vs. Manufactures & Services

- Tradables vs. Nontradables

- Imports. (Is there full pass-through?)

API120 - Prof. J.Frankel

PPP in a sense holds well in hyperinflations:

The cumulative change in E corresponds to the cumulative change in CPI.

API120 - Prof. J.Frankel

SPECIFICATION OF PPP TEST : the real exchange rate as an autoregressive process

H

0 q t

:

k

1

q t

1

u t where u t

≡ random disturbance with E(u t

) = 0.

(random walk, or unit root)

H

1

:

0 (full adjustment to PPP)

H

Alt

: 0

1 (gradual adjustment to PPP).

Common finding in tests of 1980s: can’t reject H

0

.

True problem:

Insufficient power in the tests, due to insufficient data.

Since 1990, studies have sought more data.

API120 - Prof. J.Frankel

q t

With 100 or 200 years of data it is not hard to reject a random walk,

i.e., to detect regression to the mean.

API120 - Prof. J.Frankel

Studies with long

JF (1990) time series:

Time

Period

1869-1987

Estmt.

δ

.84

Updated WTP (2007) 1791-2005 .88

Lothian & M. Taylor (1996) 2 centuries

Alan Taylor (2002)

19 currencies

Pappell & Prodan (2005)

1870-1996 .79

1870-1998

Cross-country Number of panel data studies: countries

Frankel & Rose (1995) 150

Wei & Parsley (1998)

Choi, Mark & Sul (2004)

14

21

API120 - Prof. J.Frankel

Speed of

Adjustment

.16

.12

(s.e.=.05)

.21

(s.e.=.01)

Half-life

(years)

4

4

3-5

3.4 – 4.1

1-2

4

4-5

5.5

Taylor spliced together 100+ years of data for 20 currencies: 1870-1996

One lesson: reversion to LR Q

PPP clearly fails in the short run.

What is H

Alt

? Sticky prices? How can we tell?

Three useful kinds of empirical evidence:

• The pattern of movement in real exchange rates:

• band or threshold

• Random Walk

• trend

• AR .

• Effects of exchange rate regime on variability in Q.

• Tests of Law of One Price for narrowly defined goods.

API120 - Prof. J.Frankel

Four patterns of deviation from PPP

Q ≡ and their likely origins: a) Band <= barriers to trade b) Random walk

<= shifts in terms of trade c) Trend <= Balassa-

Samuelson effect d) Autoregression

<= sticky prices.

Q ≡

Band

Trend

API120 - Prof. J.Frankel

Q ≡

Q ≡

Q

Q ≡

Random Walk

Autoregression

Var(e t

) and Var (q t

) are correlated.

Is it coincidence? No, it can’t be: Every time a regime switch raises variability of nominal exchange rates, it also raises variability of real exchange rates.

· Pre- and post-1973

(Fig. 19.4)

· Inter-war period ( Eichengreen,

1988

): 1922-26 float vs. 1927-31 fix

· Post-war regimes ( Mussa,

1986

):

- Canadian float in the 1950s

- Ireland regime changes (see appendix table)

· A century of PPP ( A.Taylor, 2002

) :

1870-1914 Gold standard

1914-45 Interwar

1946-71 Bretton Woods

1971-96 Float

Figure 19.4

Nominal & real exchange rates both became more volatile after 1973.

Monthly Changes in Nom inal Japanese Yen /Dollar Rate percent change

15

10

5 When nominal exchange rate variability

(¥/$) went up with floating,

0

-5

-10

-15 real exchange rate variability went up in tandem.

Monthly Changes in Real Japanese Yen /Dollar Rate percent change

15

10

5

0

-5

Coincidence?

-10

-15

1973

API120 - Prof. J.Frankel

The final nail in the coffin:

Exchange rate variability across a century of regimes

Each observation is a country-regime.

(Adapted from A.Taylor, 2002)

Variability of real exchange rate

1870-1996

Again, each time a more flexible regime raises nominal variability, it raises real variability too.

Variability of nominal exchange rate

Prof. Jeffrey Frankel

Appendix: Another comparison of regimes

Mussa (1986):

Each time Ireland changed its exchange rate arrangements

(₤, $, DM), bilateral real exchange rate variability has followed bilateral nominal exchange rate variability.

API120 - Prof. J.Frankel

Looking ahead -- Lecture 9: FAILURES OF

PURCHASING POWER PARITY (PPP)

Tests of the Law of One Price

NTGs

Commodities

Manufactures

Big Mac hamburgers

Imports

Barriers to International Integration

Transportation costs

Tariffs & non-tariff trade barriers

Border frictions

Currencies

N

on

-

T

raded

G

oods

-- The Balassa-Samuelson Effect