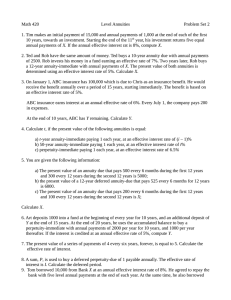

Math 420 Varying Annuities Problem Set 3a 1

advertisement

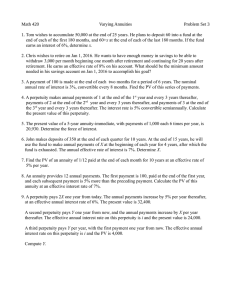

Math 420 REVIEW 1 Varying Annuities Problem Set 3a Math 420 Varying Annuities Problem Set 3a 1. Tom wishes to accumulate 50,000 at the end of 25 years. He plans to deposit 60 into a fund at the end of each of the first 180 months, and 60+x at the end of each of the last 180 months. If the fund earns an interest of 6%, determine x. 2. Chris wishes to retire on Jan 1, 2016. He wants to have enough money in savings to be able to withdraw 3,000 per month beginning one month after retirement and continuing for 20 years after retirement. He earns an effective rate of 8% on his account. What should be the minimum amount needed in his savings account on Jan 1, 2016 to accomplish his goal? 2 Math 420 Varying Annuities Problem Set 3a 3. A payment of 100 is made at the end of each two months for a period of 6 years. The nominal annual rate of interest is 3%, convertible every 8 months. Find the PV of this series of payments. 4. A perpetuity makes annual payments of 1 at the end of the 1st year and every 3 years thereafter, payments of 2 at the end of the 2nd year and every 3 years thereafter, and payments of 3 at the end of the 3rd year and every 3 years thereafter. The interest rate is 5% convertible semiannually. Calculate the present value of this perpetuity. 3 Math 420 Varying Annuities Problem Set 3a 5. The present value of a 5-year annuity-immediate, with payments of 1,000 each 6 times per year, is 20,930. Determine the force of interest. 6. John makes deposits of 350 at the end of each quarter for 10 years. At the end of 15 years, he will use the fund to make annual payments of X at the beginning of each year for 4 years, after which the fund is exhausted. The annual effective rate of interest is 7%. Determine X. 4 Math 420 Varying Annuities Problem Set 3a 7. Find the PV of an annuity of 1/12 paid at the end of each month for 10 years at an effective rate of 5% per year. 5 Math 420 Varying Annuities Problem Set 3a 8. An annuity provides 12 annual payments. The first payment is 100, paid at the end of the first year, and each subsequent payment is 5% more than the preceding payment. Calculate the PV of this annuity at an effective interest rate of 7%. 9. A perpetuity pays 2X one year from today. The annual payments increase by 5% per year thereafter, at an effective annual interest rate of 6%. The present value is 32,400. A second perpetuity pays Y one year from now, and the annual payments increase by X per year thereafter. The effective annual interest rate on this perpetuity is i and the present value is 24,000. A third perpetuity pays Y per year, with the first payment one year from now. The effective annual interest rate on this perpetuity is i and the PV is 4,000. Compute Y. 6