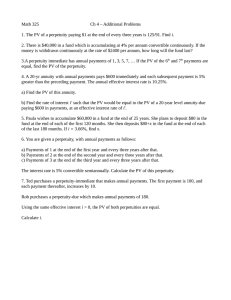

Math 325 Ch 4 – Additional Problems i.

advertisement

Math 325 Ch 4 – Additional Problems 1. The PV of a perpetuity paying $1 at the end of every three years is 125/91. Find i. 2. There is $40,000 in a fund which is accumulating at 4% per annum convertible continuously. If the money is withdrawn continuously at the rate of $2400 per annum, how long will the fund last? 3.A perpetuity immediate has annual payments of 1, 3, 5, 7, … If the PV of the 6th and 7th payments are equal, find the PV of the perpetuity. 1 Math 325 Ch 4 – Additional Problems 4. A 20-yr annuity with annual payments pays $600 immediately and each subsequent payment is 5% greater than the preceding payment. The annual effective interest rate is 10.25%. a) Find the PV of this annuity. b) Find the rate of interest i' such that the PV would be equal to the PV of a 20-year level annuity-due paying $600 in payments, at an effective interest rate of i'. 5. Paula wishes to accumulate $60,000 in a fund at the end of 25 years. She plans to deposit $80 in the fund at the end of each of the first 120 months. She then deposits $80+x in the fund at the end of each of the last 180 months. If i = 3.66%, find x. 2 Math 325 Ch 4 – Additional Problems 6. You are given a perpetuity, with annual payments as follows: a) Payments of 1 at the end of the first year and every three years after that. b) Payments of 2 at the end of the second year and every three years after that. c) Payments of 3 at the end of the third year and every three years after that. The interest rate is 5% convertible semiannually. Calculate the PV of this perpetuity. 7. Ted purchases a perpetuity-immediate that makes annual payments. The first payment is 100, and each payment thereafter, increases by 10. Rob purchases a perpetuity-due which makes annual payments of 180. Using the same effective interest i > 0, the PV of both perpetuities are equal. Calculate i. 3