Adjustments and Closing Entries for a Corporation

advertisement

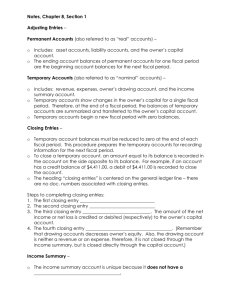

Adjustments and Closing Entries for a Corporation JEOPARDY Adjustments & Closing for a Corporation Financial Statements Adjusting Entries Closing Entries Post Closing Trial Balance Vocabulary GRAB BAG 100 100 100 100 100 100 200 200 200 200 200 200 300 300 300 300 300 300 400 400 400 400 400 400 500 500 500 500 500 500 600 600 600 600 600 600 Financial Statements - 100 The income statement of a merchandising business has three main sections… what is . . . Revenue, Cost of Merchandise Sold and Expenses Financial Statements - 200 A financial statement that shows changes in a corporation’s ownership for a fiscal period what is . . . Equity A statement of Owner’s Financial Statements - 300 The two sections in a statement of stockholders’ equity what are . . . Capital Stock & Retained Earnings Financial Statements - 400 Calculation for the book value of Accounts receivable What is . . . Accounts receivable less Allowance for Uncollectible Accounts Financial Statements - 500 Two classifications of Assets for our Merchandising Balance sheet what are . . . Current Assets and Plant Assets Financial Statements - 600 A value assigned to a share of stock and printed on the stock certificate is called what is . . . Par Value Adjusting Entries - 100 The purpose of adjusting entries what is . . . Bring the general ledger account balances up to date. Adjusting Entries - 200 Which accounting concept relates to the adjusting entry procedure what is . . . Matching revenue with expenses Adjusting Entries - 300 Company ABC estimated that 2,000 will be uncollectible; the adjusting entry… what is . . . DR Uncollectible Accts. Expense, CR Allowance for Uncoll. Accts Adjusting Entries - 400 Adjusting Entry for Merchandise Inventory when the count at year end is lower… what is . . . Dr. Income Summary. Cr. Merchandise Inventory Adjusting Entries - 500 Adjusting entry for depreciation store Equip… what is . . . Dr Depreciation Expense, Cr Accum. Depre – Store Equip Adjusting Entries - 600 The balance in supplies prior to adjustments is 3,480. Supplies on hand is 750 what is . . . Dr Supplies Expense and Cr Supplies Office $2,730 Closing Entries - 100 This account is used only at the end of the fiscal period to help prepare accounts for a new fiscal period. what is . . . Income Summary Account Closing Entries - 200 Assets, Liability and Owner’s Capital Accounts what is . . . Permanent or Real Accounts Closing Entries - 300 The first step to the closing process what is . . . Close income statement accounts with credit balances (Sales, Purchase Discounts, Purchases R & A) Closing Entries - 400 The third step in the closing process what is . . . Closing entry to record net income (or loss); zero out income summary Closing Entries - 500 The fourth step in the closing process what is . . . Closing entry for dividends. (Dr retained earnings, Cr dividends) Closing Entries - 600 Four steps to close the temporary accounts what are . . . Close Income statement account Cr balances; Close Income statement account Dr balances; Close Income Summary (record profit or loss); Close Dividends Post Closing Trial - 100 These accounts have up to date balances to begin the new fiscal period. what are . . . Balance sheet accounts (A, L, OE) Post Closing Trial - 200 These accounts have zero balances to begin the new fiscal period. what are . . . Temporary accounts (Revenue, Cost and Expense Accounts) Post Closing Trial - 300 This is prepared to prove the equality of debits and credits in the general ledger and to prepare the GL for the next fiscal period. what is . . . Post Closing Trial Balance Post Closing Trial - 400 The supporting reports prepared for the balance sheet. what are . . . Schedule of Accounts Receivable and Accounts Payable Post Closing Trial - 500 The normal balance of Capital Stock what is . . . Credit Post Closing Trial - 600 The normal balance of Merchandise Inventory what is . . . Debit Vocab/Concepts - 100 A comparison between two items of financial information what is . . . A financial ratio Vocab/Concepts - 200 The amount of net income after federal income tax belonging to a single share of stock what is . . . Earnings Per Share Vocab/Concepts - 300 The relationship between the market value per share and earnings per share what is . . . Price-earnings ratio Vocab/Concepts - 400 The two contra accounts for Sales what are . . . Sales discounts and Sales Return and allowance. Vocab/Concepts - 500 The normal balance for an Income Summary Account what is . . . Zero Vocab/Concepts - 600 Companies with a high price-earnings ratio what are . . . Growth Companies GRAB BAG - 100 The financial statements should provide information about a business’s financial condition, changes in this financial condition and the progress of operations what is . . . Adequate Disclosure GRAB BAG - 200 Financial information must be reported the same way from one fiscal period to the next what is . . . Consistent Reporting GRAB BAG - 300 A source document is prepared for each transaction. what is . . . Objective Evidence GRAB BAG - 400 The amount an owner expects to receive when a plant asset is removed from use what is . . . Estimated salvage value GRAB BAG - 500 The total amount of depreciation expense that has been recorded since the purchase of a plant asset what is . . . Accumulated depreciation GRAB BAG - 600 The special journal used to record sales on account. what is . . . Sales Journal Final Jeopardy Calculate Total Cost of Merchandise Available for Sale Merchandise Inventory 1/1 140,480.00 Net Purchases 204, 826.90 Merchandise Inventory 12/31 124, 640.00 Purchases Discounts 1, 648.15