Ch. 9 Notes Adjusting and Closing Entries

advertisement

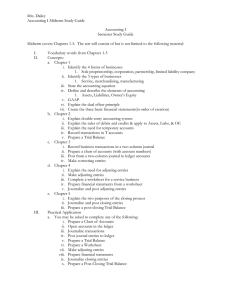

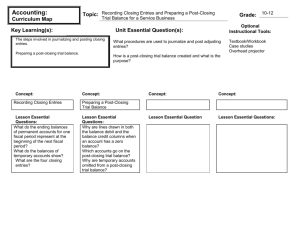

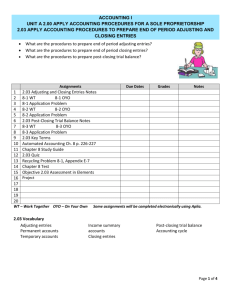

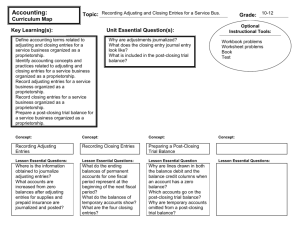

Mr. Belolan Objectives 1. Explain the purpose of adjusting and closing entries by journalizing and posting several transactions 2. Using the completed book work, pinpoint and make recommendations based on the fiscal year’s adjusting and closing entries The Accounting Cycle 1. 2. 3. 4. 5. 6. 7. Collect source documents Analyze each transaction Journalize transactions in the general journal Post to general ledger Prepare the trial balance Prepare a work sheet Prepare financial statements (income statement and balance sheet) 8. Journalize and post adjusting and closing entries 9. Prepare post-closing trial balance Permanent and Temporary Accounts Permanent Accounts Accounts used to accumulate information from one fiscal period to the next Examples? Temporary Accounts Accounts used to accumulate information until it is transferred to the owner’s capital account Each account starts over with a zero balance each fiscal period Examples? Closing Entries Closing Entries Journal entries used to prepare temporary accounts for a new fiscal period 1. Revenue 2. Expenses 3. Net income or loss 4. Drawing Post-Closing Trial Balance Post-Closing Trial Balance Prepared after the closing entries are posted Lists all permanent accounts and their balances Odds and Ends The source document for closing entries is the work sheet A business’ fiscal period can run from Jan. 1st through Dec. 31st, but it doesn’t have to Examples? Concept Review 1. How many steps are there in the accounting cycle? 2. Why do we “close” accounts? 3. What are the 4 closing entries? 4. Explain why a fiscal period is not always from Jan-Dec?