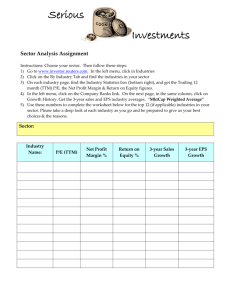

product - Beedie School of Business

advertisement

US Personal Computer Industry Presented by : Leslie Ling Philip Lam Winnie Liu PC Industry Development 1975 : Humble beginning as hobby computer kits in the spring of 1975 1990’s Tech boom AMEX Computer Hardware Index (INDEX) 2002-2004 5 Year Comparison between NASDAQ and NASDAQ Computer Index 1 Year Comparison between NASDAQ and NASDAQ Computer Index S&P500 vs. Computer Industry PC Market Segments ( by products) U.S. and Worldwide PC Market Segments Unit Sales 1990 1995 2000 2003 2005 2008 U.S. PC Server Sales (#M) 0.04 0.51 2.5 2.7 3.3 4.2 U.S. Desktop PC Sales (#M) 8.4 16.8 33.1 31.3 34.3 35.2 U.S. Mobile PC Sales (#M) 1.1 4.1 10.4 14.2 19.0 23.2 Worldwide PC Server Sales (#M) 0.06 0.94 5.5 7.1 9.4 13.4 Worldwide Desktop PC Sales (#M) 21.7 47.1 96.2 102.1 116.9 135.3 Worldwide Mobile PC Sales (#M) 2.4 10.0 27.9 40.1 54.6 74.0 PC Market Segments (by regions) U.S. and Worldwide PCs-in-Use and PC Sales Per 1,000 People Table 1.3 U.S. and Worldwide PCs-in-Use and PC Sales Per 1,000 People 1990 1995 2000 2003 2005 2008 U.S. PC Sales Per 1,000 People 38.2 81.0 163.5 165.0 188.9 201.8 U.S. PCs-in-Use Per 1,000 People 192.2 324.1 629.5 744.0 788.4 867.9 Worldwide PC Sales Per 1,000 People 4.6 10.2 21.4 23.7 28.0 33.4 Worldwide PCs-in-Use Per 1,000 People 18.7 39.8 86.1 117.0 138.7 175.2 World wide PC Vendor Market Share 2003 Market Share (%) Dell 15% Hewlett-Packard 14% 59% 5% 4% 3% IBM Fujitsu/Fujitsu Siemens Toshiba Others US PC Vendor Market Share 2003 Market Share (%) 27% 42% 19% 3% 4% 5% Dell Hewlett-Packard IBM Gateway Apple Others U.S. and Worldwide PC Market Growth 250 225 U.S. PC Sales (#M) 200 Worldwide PC Sales (#M) 175 150 125 100 75 50 25 0 1975 1980 1985 1990 1995 2000 2003 2005 2010 U.S. and Worldwide PC Market Growth U.S. PC Revenues ($B) Worldwide PC Revenues ($B) 350 300 250 200 150 100 50 0 1975 1980 1985 1990 1995 2000 2003 2005 2010 Business Models Big Box Stores vs. J.I.T. delivery Continuous Innovation Cost Leadership Differentiation Own Brand Retail stores Consulting Stripped Service – White Boxes Business Models Big Box Stores vs. J.I.T. delivery Low-cost Leader Product Differentiation Continuous Innovation Own Brand Retail stores White Boxes Competition PC Life Cycle Customers demand convenience and value for their money The need for speed has been diminished (Ebay)-market for second-handed machine Replacement cycle changed from every 2-3 years to every 5 years Machines are upgradeable Key Success Factors Innovation – R&D “TABLET PC” Product differentiation Branding Competitive pricing Constantly reexamine the way to do business After sales service Extensive product and service lines Future Consideration - Threats Commodity like market Products differ very little Constant downward price pressure Death of the PC Longer replacement cycle Future Consideration - Trends Branching out into ancillary services – IBM Global expansion Acquisitions and mergers Switch to Linux Cheap and open source operating software Look for smaller, cheaper and more taskspecific pieces Demand for wireless products International Business Machines Mission Statement “At IBM, we strive to lead in the creation, development and manufacture of the industry's most advanced information technologies, including computer systems, software, networking systems, storage devices and microelectronics. We translate these advanced technologies into value for our customers through our professional solutions and services businesses worldwide.” Company History • IBM was incorporated in the state of New York on June 15, 1911 as the Computing-TabulatingRecording Company (C-T-R) • C-T-R's name was formally changed to International Business Machines Corporation (IBM) on February 14, 1924 • 1944- Automatic Sequence Controlled Calculator • 1950s- IBM 701, IBM 650 Magnetic Drum Calculator, FORTRAN • 1960s- System/360, Customer Information Control System (CICS) • 1971- Floppy Disk Management Team Samuel Palmisano- Chairman of the Board, President, CEO; 31 years at IBM Nicholas M. Donofrio- Senior VP, Technology & Manufacturing; 37 years at IBM Doug T. Elix- Senior Vice President & Group Executive, Sales and Distribution; 35 years at IBM Mark Loughridge- Chief Financial Officer, Senior VP; 27 years at IBM Edward Lineen- Senior VP, General Counsel; 34 years at IBM Abby Kohnstamm- Senior VP, Marketing; 11 years at IBM J. Randall MacDonald- Senior VP, Human Resources; 4 years at IBM Products • Hardware: Servers, storage, personal systems, printing systems • Software: DBS (Information Management), Lotus, Tivoli, WebSphere • Services: Comprehensive IT services • Finances: leading provider of financing and asset management services to companies selling or acquiring IT related products and services • Research: Develop, market and deliver leading chip technologies and services New Strategies • Continual Innovation of IBM • Growth-driven • Reduce presence in retail PCs, application software, hard disk-drives… etc. • On-demand business strategy • Creating new leadership instead of defending existing ones • Supply Chain Improvement • Business Transformation Outsourcing • Acquisitions • Growth in Emerging Countries Revenue by Business Segment Revenue by Areas 33% Americas 22% Europe, Middle East & Africa Asia Pacific OEM 42% 3% Stock Summary Exchange NYSE Index Membership S&P 500, Dow Jones Industrials Last 94.45 52 Week High 100.43 52 Week Low 81.90 Average Daily Volume 4.908 million Shares Outstanding 1.665 billion Market Capitalization 157.2 billion Trailing P/E 20.10 Dividend Yield 0.80% Institutional Ownership 55.40% Book Value/ Share 17.84 1-Year Price Trend 1-Year Comparison with DJ Computer Index 5-Year Price Trend 5-Year Comparison with DJ Computer Index Balance Sheet Income Statement Cash Flow Statement Revenue (5-Year) 100,000 90,000 89,131 83,334 85,089 83,067 81,186 1999 2000 2001 2002 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Revenue 2003 Net Income (5-Year) 9,000 8,000 7,000 6,000 5,000 7,359 7,874 8,146 7,613 5,334 Net Income 4,000 3,000 2,000 1,000 0 1999 2000 2001 2002 2003 EPS (10-Year Trend) 5.00 4.50 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 1994 1995 1996 1997 1998 1999 2000 EPS 2001 2002 2003 ROE & ROA (10-Year Trend) ROA ROE 45 40 35 30 25 20 15 10 5 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Pricing Ratios (10-Year) 35 30 25 20 15 10 5 0 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Price to Book P/E Profit Margin (10-Year) 20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0% 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Profit Margin First 3 Quarters of 2004 1st Quarter 2nd Quarter Sales 3rd Quarter 22,250 23,153 23,429 Gross Operating Profit 9,191 9,652 9,807 Net Income 1,602 1,988 1,800 Diluted EPS 0.93 1.16 1.06 Comparing to 2003: • Revenue increased by 9% • Pretax income increased by 10% • Diluted EPS increased by 13% Growth Comparison 40% 35% 30% IBM 25% 20% 15% Industry: Diversified Computer Systems 10% 5% 0% 3rd Quarter Sales 5-Year Sales Average EPS (YTD) Price Comparison 30 25 20 IBM 15 Industry: Diversified Computer Systems 10 5 0 P/E Price/Sales Price/Book Profitability Comparison 45 40 35 30 25 IBM 20 15 Industry: Diversifed Computer Systems 10 5 0 Current Current 5-Year Gross Profit Gross Margin Margin Margin 5-Year Profit Margin Financial Condition Comparison 18 16 14 12 10 IBM Industry 8 6 4 2 0 Debt/Equity Current Ratio Leverage Book Value Ratio per Share Return Comparison 35 30 25 20 IBM Industry 15 10 5 0 ROE ROE (5-Y Average) ROA ROA (5-Y Average) Executive Compensation Summary Stock Option & SAR Grants in Last Fiscal Year Options / SAR Exercised & Year-end Values Earnings Estimate Estimated EPS Growth Rate 2004 Q4 2005 Q1 2004 2005 1.74 1.07 4.99 5.52 11.53% 14.73% 15.08% 10.44% Earnings Growth Rates IBM Industry S&P 500 5.30% 5.30% 3.20% 2005 10.20% 10.20% 6.40% Next 5 years 10.30% 15.10% 6.00% Last 5 Years Strengths and Weaknesses Strengths • • • • • • Earnings growth in the past year has increased rapidly Good Performance in 2004 High consistency across the board Good future growth prospects Stable dividend income High profit margin Weaknesses • Strong Competition • Higher debt ratios than industry average • High goodwill Analysts’ Recommendations Our Recommendation HOLD Present by Winnie Liu HP: Agenda >> Qualitative Analysis - Managment - product - market position - major competitor >> Key developments and Analysis - HP & Compaq Merger >> Fundamental analysis - Ratio analysis - Financial statements analysis >> Recommendation <<<< Qualitative Analysis >> Management >> company's activities --- product --- market position --- major competitor Management >> Carly Fiorina : --- Chairman and CEO --- Joining HP in July 1999 --- Prior to joining HP, spent nearly 20 years at AT&T and Lucent Technologies --- Fiorina has previously served on the boards of Cisco Systems, Kellogg Company and Merck & Company. Main executive team >> Gilles Bouchard, --- CIO & Executive Vice President of Global Operations --- Joined HP 1990. >> Robert P. Wayman, CFO & Executive Vice President & Joined HP 1969. a member of the Policy Council of the Tax Foundation , the Financial Executives Institute and the Council of Financial Executives of the >> Shane V. Robinson, Executive Vice President and Chief Strategy and Technology Officer Joined Compaq 2000. was senior vice president and chief technology officer of Strategy and Technology at Compaq Computer Corporation also spent seven years at Apple Computer Corporation >>>> >> Desktops & workstations >> Notebooks & tablet PCs >> Printing & multifunction >> Handheld devices >> Monitors & Projectors Products >> Fax, copiers & scanners >> Digital photography >> Entertainments >> Storage •HP is the second largest PC •vendor with 16.2% of the •worldwide market in the Q3 2004. •In the United States, HP holds the No. 2 position with 20.3 percent of the market •HP Commands No. 1 Position in Worldwide Notebook PC Market >>>> •#1 in total disk storage systems* •#2 globally in notebook PCs* •#1 globally in Pocket PCs* •#1 in customer support** •#1 position in customer satisfaction for ProLiant servers Market position •#1 globally in inkjet, all-in-one and single-function printers, mono and color laser printers, large format printing, scanners, print servers, and ink and laser supplies* •#1 globally in x86*, Windows*, Linux*, UNIX* and Blade servers** <<<< HP: major competitors HPQ DELL IBM Industry Market Cap: 60.64B 99.79B 157.23B 37.90M Employees: 142,000 53,000 319,273 126 Rev. Growth (ttm): 29.10% 17.10% 9.80% 13.80% Revenue (ttm): 79.90B 47.26B 94.74B 36.95M Gross Margin (ttm): 24.48% 18.22% 37.10% 35.04% EBITDA (ttm): 4.76B 4.37B 15.33B -382.00K Oper. Margins (ttm): 5.20% 8.56% 11.22% 1.12% Net Income (ttm): 3.50B 3.12B 8.11B -768.00K EPS (ttm): 1.149 1.21 4.703 N/A PE (ttm): 17.48 33.03 20.08 26.32 PEG (ttm): 1.30 1.31 1.89 1.25 PS (ttm): 0.77 2.13 1.67 1.16 Key development & Analysis 2001: HP and Compaq Computer Corp. agree to a $21 billion merger. The Hewlett family voices its opposition to the deal, as do various employees and shareholders. 2002 May: Despite opposition, HP completes its purchase of Compaq, which the firm claims will result in $2.5 billion in savings. Cost cutting measures include the elimination of overlapping products and 15,000 jobs. Key development & Analysis HP AND COMPAQ MERGER Before Merger Hewlett-Packard Compaq Founded: 1938 Founded: 1983 Employees: 86,200 Employees: 63,700 2001 Revenues: $45.2bn 2001 Revenues: $33.5bn 2001 profits: $408m 2001 loss: $785m CEO: Carly Fiorina CEO: Michael Capellas Key development & Analysis HP AND COMPAQ MERGER May 7, 2002 the largest merger in the history of computer industry Value of the deal at $25 billion 1 Compaq share = 0.6325 HP share Change ticker symbol from HWP to HPQ Compaq brand essentially disappear Key development & Analysis After Merger HPQ Year 2002: Projected annual revenue: $78.7 billion actual : $56.6billion Number of employees: 150,000 actual : 145,000 Number of planned layoffs: 15,000 over two years. Board of directors: Seven members from the old HP, five from Compaq. 1. Financial Summary company symbol HPQ exchange NYSE Last Price (11/09/04) 20.08 Change -0.18 % Change -0.89% Volume 10,307,000 Avg Daily Volume 10,391,818 Day's High 20.34 Day's Low 20.08 52 Week High 26.28 52 Week Low 16.08 Fundamental Data P/E 17.48 Earnings/Share 1.06 Dividend/Share 0.32 Current Div. Yield 1.59% Market Cap. 60.64B Tot. Shares Out. 3.02 Bil Financial Analysis Five-Year REVENUE Figures Growth Rates % HP Industry S&P 500 Sales (Qtr vs year ago qtr) 8.9 2.3 11.3 Sales (5-Year Annual Avg.) 12.33 4.25 4.8 EPS(3 year) Earnings Per Share - Quarterly Results FY (10/04) FY (10/03) FY (10/02) 1st Qtr $0.30 $0.24 $0.25 2nd Qtr $0.29 $0.22 $0.12 3rd Qtr $0.19 $0.10 ($0.67) 4th Qtr NA $0.28 $0.20 $0.78 $0.84 ($0.10) HP Industry S&P 500 EPS (YTD vs YTD) 43.5 35.8 26.6 EPS (Qtr vs year ago qtr) 97.3 -10.7 12.1 EPS (5-Year Annual Avg.) NA -19.37 0.48 Total Growth Rates % Hewlett-Packard Company: Earnings Estimates (EPS) Hewlett-Packard Company: Earnings Growth Rates Earnings Growth Rates Next 5 Years Last 5 Years FY 2005 FY 2006 05 P/E HP -4.40% 10.80% 14.70% 10.70% 15.50 Industry -4.40% 10.80% 14.70% 12.50% 18.80 S&P 500 3.20% 20.10% 6.40% 6.00% 17.80 P/E Ration Costs and Revenue Control Profit Margins % HP Industry S&P 500 Gross Margin 27.3 36.5 47.7 Net Profit Margin 4.2 4.6 7.6 5Yr Gross Margin (5-Year Avg.) 30.2 39.4 47.5 5Yr Net Profit Margin (5-Year Avg.) 3.5 5.4 5.6 ROE Investment Returns % HP Industry S&P 500 Return On Equity 8.4 11.3 14.5 Return On Equity (5-Year Avg.) 7.8 15.1 12.1 Financial statement Analysis >> Income statement >> Balance sheet >> Cash flow statement >> Revenue & Profit Income statement Net revenue Costs and expenses: Cost of sales Research and development Selling, general and administrative Amortization of purchased intangible assets Restructuring charges Acquisition-related charges In-process research and development charges Total costs and expenses Earnings from operations Interest and other, net Gains (losses) on investments Dispute settlement Earnings before taxes Provision for taxes Net earnings Twelve months ended October 31, 2004 2003(a) $ 79,905 $ 73,061 60,340 3,506 11,024 603 114 54 37 75,678 4,227 35 4 (70) 4,196 699 $ 3,497 53,858 3,651 11,012 563 800 280 1 70,165 2,896 21 (29) 2,888 349 $ 2,539 Net revenue break down Revenue Breakdown by segment Net Revenue Enterprise Storage and Servers Software HP Services Technology Solutions Group Imaging and Printing Group Personal Systems Group Financing Corporate Investments Total Segements Twelve months ended October 31, 2004 2003 $ Eliminations of inter-segement net revenue and other Total HP Consolidated $ 15,152 922 13,778 29,852 24,199 24,622 1,895 449 81,017 $ 14,593 774 12,357 27,724 22,569 21,210 1,921 344 73,768 -1,112 -707 79,905 $ 73,061 Earning break down Twelve months ended October 31, 2004 2003 Segment Contribution of Operating Income Earnings from operations: Enterprise Storage and Servers Software HP Services Technology Solutions Group Imaging and Printing Group Personal Systems Group Financing Corporate Investments Total Segements $ 173 -145 1,263 1,291 3,847 210 125 -178 $ 5,295 $ 142 -190 1,362 1,314 3,596 22 79 161 $ 4,850 Balance sheet October 31, October 31, 2004 2003 $12,663 $14,188 Short-term investments 311 403 Accounts receivable, net 10,226 8,921 Financing receivables, net 2,945 3,026 Inventory 7,071 6,065 Other current assets 9,685 8,351 42,901 40,954 Property, plant and equipment, net 6,649 6,482 Long-term financing receivables and other assets 6,657 8,030 19,931 19,250 $76,138 $74,716 ASSETS Current assets: Cash and cash equivalents Total current assets Goodwill and purchased intangibles, net Total assets Balance sheet (ctn) LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Notes payable and short-term borrowings $2,511 $1,080 Accounts payable 9,377 9,285 Employee compensation and benefits 2,208 1,755 Taxes on earnings 1,709 1,599 Deferred revenue 4,348 3,665 193 709 9,632 8,545 29,978 26,638 Long-term debt 4,623 6,494 Other liabilities 3,973 3,838 37,564 37,746 $76,138 $74,716 Accrued restructuring Other accrued liabilities Total current liabilities Stockholders' equity Total liabilities and stockholders' equity Cash flow Cash flow (con’t) Price History RECOMMENDATION •The annul EPS is above industry annul EPS •The projected earning growth rate is below industry average •The revenue growth rate is above industry revenue growth rate •Although the current profit margin is higher than the previous year, it’s still below industry average margin •Second position in the industry •P/E to growth ratio suggested stock might have been overvalued Recommendation HOLD DELL INC Company Overview Founded in 1984 by Michael Dell Direct sales model Offers an extensive selection of software and peripherals Sell its products worldwide and manufacture in six location throughout the world Rank #1 in worldwide market share with 18.3% and also #1 in US market share with 33.3% Direct Sales Model Communicate directly with our customer • In person, via Internet or by phone • In 2001, sales via Internet reach $50 million per day Five basic tenets: • • • • • Build-to-order Low-cost leader Most efficient path to the customer Standards-based technology Single point of accountability Products and Services Products: • • • • Desktop and notebook computers Servers and workstations Storage, printing and imaging system Software, peripheral and networking products Services: • Managed and professional services • Deployment and support services • Training and certification services Executive Compensation Summary Revenue by Product Line and Region Net Revenue 2004: 1-yr. growth rate: 17.1 percent 50 41. 4 40 31. 9 30 20 31. 2 35. 4 25. 3 18. 2 12. 3 10 0 1998 1999 2000 2001 2002 Net revenue (in billions) 2003 2004 Net Income 2004: 1-yr.growth rate: 24.6% 3 2.6 2.5 2.2 2 1.5 1.5 1 2.1 1.7 1.2 0.9 0.5 0 1998 1999 2000 2001 2002 2003 2004 Net income (in billions) Operating Expenses Earning per Share $1.20 $1.03 $1.00 $0.84 $0.80 $0.82 $0.68 $0.60 $0.53 $0.40 $0.48 $0.32 $0.20 $0.17 $0.00 1997 1998 1999 2000 2001 2002 2003 2004 ROE 80 70 73 65. 9 62. 9 60 50 43. 5 39. 8 % 40 31. 4 30 42. 1 26. 5 20 10 0 1997 1998 1999 2000 2001 2002 2003 2004 Average Price to Earnings 80 70. 8 70 59. 2 60 50 45. 2 51. 4 40 33. 2 26. 1 30 20 29. 6 14. 9 10 0 1997 1998 1999 2000 2001 2002 2003 2004 Valuation Ratios Comparison 35 30 33.03 29.27 25 17.06 20 15 8.77 10 2.13 5 0 P/E (ttm) 1.91 P/Sales (ttm) P/Book (mrq) Dell Industry Financial Strength (mrq) 1. 36 1.4 1.2 1. 112 1 0.8 Dell 0.6 0. 42 0.4 0. 086 0.2 0 Current Ratio Total Debt/Equity Industry Profitability (ttm) 10 9.66 8.56 8.83 8 6.61 6 Dell Industry 4 2 0 Operating Margin % Net Profit Margin % Management Effectiveness (ttm) 60 51.48 50 40 31.59 30 20 Industry 15.92 9.08 10 0 ROA % Dell ROE % Growth 50 47.2 40 30 25.6 20.4 22.4 20 14.6 17.9 18.5 Industry 10 1.9 0 This Year Next Year (11/2004) (11/2005) Last 5 Years Dell Next 5 Years Worldwide Growth Cash Flows Data Summary (in millions) Period Net cash flows from operating activities: 2003 2000 4195 Net cash flows from investing activities: (2814) (1381) (2260) (757) Net cash flows from financing activities: (1383) (2025) (2702) (2305) 85 3538 2001 3797 Net (decrease) / increase in cash and cash equivalents: 3670 2002 591 (1269) 1101 Cash and cash equivalents at end of period: 4317 4232 3641 4910 Net free cash flows: 3160 2973 3008 2785 Net free cash flows: Cash flows from operations less capital expenditures less tax benefit from employee stock plans 10 year Price Chart 1 year Price Chart 1 year comparison to NASDAQ Computer Index 2 year chart with indicators Current Financials As of November 19, 2004 Company Symbol DELL Exchange Market NASDAQ Price $39.97 52 Week High $40.97 52 Week Low $31.14 Volume Market Cap 12,951,300 99.79 B EPS $1.21 P/E 33.03 Analyst Recommendations (www.zacks.com) DELL INC. (NASDAQ) Analyst Ratings Current One Month Ago Two Months Ago Three Months Ago 1.73 1.81 1.65 1.57 11 11 12 12 Buy 8 8 8 7 Hold 5 4 4 3 Sell 0 0 0 0 Strong Sell 0 1 0 0 Consensus (Mean) Strong Buy Average Recommendation (1=Buy, 5=Sell) Recommendation Dell’s fiscal 2004 was the most successful year of the 20 year since their founding: • Product shipment grow 26%, nearly three times the average of other companies • Revenues increased 17% to $41.4 billion, while total sales by the rest of the industry declined • Operating expenses accounted just for 9.7%, it was the lowest full year rate in the history • EPS were up 26% to $1.01; competitors lost money Recommendations (Cont.) For the 26 weeks ended 7/30/04: • Revenues rose 20% to $23.25 billion Reflect increased product shipments in all geographic markets • Net income rose 36% to $1.53 billion Reflects a leveling off of R&D expenses From the analysis, the growth was expected to continue in the upcoming years Recommendations (Cont.) BUY