Intel value model

advertisement

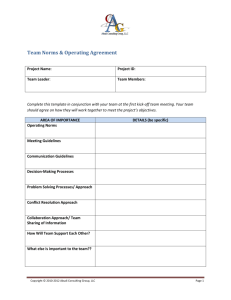

IT Performance: ottenere risultati con i dati e non con l'intuizione Intel’s Business Value Index Harry Chapman CMC, Principal Bay Area Consulting Group LLC Hchapman@baconsulting.net (415) 971-5746 12 © Bay Area Consulting Group LLC A Common Problem Facing IT 70% of companies consider IT a cost center (source - the Gartner Group) IT Departments are continually asked to “cut costs” - especially in uncertain economic times IT Departments are still expected to deliver long-term competitive advantage © Bay Area Consulting Group LLC Page 1 What the CFO Tells the CIO “You always want more money” “It is technology for technology’s sake” “I need flawless execution and operation” “You need to be a key source of business innovation” “Why do you use your own language?” “IT is too slow!” © Bay Area Consulting Group LLC Page 2 Can You Relate to This? The “IT Paradox” Help Enable Growth Help Improve Margins Help Reduce Costs Positive Growth Flat Growth Negative Growth © Bay Area Consulting Group LLC Page 3 Some History Intel’s IT Staff was challenged in 2001 to measure the bottom-line impact – the business value – of their IT solutions As a result, the IT department developed the “IT Business Value Program” (ITBV) to include: “Business Dials” – a standard set of financial measurements A Standard Measurement Methodology A Common Valuation Process – Finance acts as an independent auditor A Business-Value portfolio – Value determined by customergenerated critical success factors A Set of Ground Rules – Defines the programs operation and accountability Source: “Measuring the Business Value of Information Technology” by David Sword from the Intel Press © Bay Area Consulting Group LLC Page 4 What is “Business Value”? “Business Value” is the benefit for business units represented in dollar terms that result from IT solutions; Direct contribution to the corporation’s market position or revenue Deliverables and results that support solving customer business needs and challenges Customer cost savings or financial benefits Examples of technology investment that advance the industry © Bay Area Consulting Group LLC Page 5 Results from ITBV Program Year Program Goal Program Results 2002 $100M $423M 2003 $250M $923M 2004 $400M $1.2B 2005 $1.7B 2006 $1.3B 2007 $1.2B 2008 $1.5B © Bay Area Consulting Group LLC Page 6 So How Does ITBV Work? It is based on: Feedback Mechanism for Maximizing Value Managing IT “Like a Business” Managing the IT Budget Managing the IT Capability The Budget Drives IT Capability Managing IT for Business Value IT Capability Enables IT Business Value And can be expressed in “IT Capability Maturity Frameworks” © Bay Area Consulting Group LLC Page 7 IT Capability Maturity Framework Managing the IT Budget Maturity Sustainable Economic Model Managing the IT Capability Managing IT for Business Value Corporate Core Level 5 Optimized Value Competency Expanded Funding Strategic Business Partner Level 4 Systematic Cost Reduction Technology Expert Level 3 Predictable Performance Technology Supplier Level 2 Ad Hoc Ad Hoc Level 1 © Bay Area Consulting Group LLC Managing IT “Like a Business” Value Center Options and Portfolio Management Customer Service Focus ROI and Business Case Customer Service Orientation TCO Technology/ Product Focus Ad Hoc Ad Hoc Page 8 Defining Value What is of Value to the End Users? Bottom Line Impact? Top Line Growth? Using IT to Open New Markets? The Starting Point is a Common Definition Intel’s are: “Business Dials” – a standard set of financial measurements A Standard Measurement Methodology A Common Valuation Process – Finance acts as an independent auditor A Business-Value portfolio – Value determined by customer-generated critical success factors A Set of Ground Rules – Defines the programs operation and accountability © Bay Area Consulting Group LLC Page 9 Consider the Approach Based on User Needs (not Technology) Uses Common Terms Is an Overall, Repeatable Process Have Finance act as an auditor to give credence to the financial results © Bay Area Consulting Group LLC Page 10 What is “Business Value”? Business Value is “the contribution IT makes to helping a firm or other organization achieve it’s objectives” Revenue (Growth) Costs/Efficiency Assets (Productivity) Risks (Continuity) Increased Shareholder Value = F(Growth, Efficiency, Productivity, Continuity) © Bay Area Consulting Group LLC Page 11 Business Value “Dials” ….are Intel’s Standardized Indicators of Business Value The Goal is to have the Change Positively Influence the Business Value Dials Dial Financial Value Dials Non-Financial Value Dials •Days of inventory •Headcount productivity •Hardware and software cost avoidance •Capital equipment cost avoidance •Time to market •Direct revenue •Other cost avoidance •Customer satisfaction •Intellectual property risk reduction •Product development agility •Regulatory compliance © Bay Area Consulting Group LLC Page 12 Need to Also Consider the Intangibles Enhanced customer loyalty New business opportunities Intellectual property protection Product development agility Regulatory compliance © Bay Area Consulting Group LLC Page 13 To Summarize The Value of BVI…. Process based on what is important to IT’s customers Common language between IT and its customers Assess projects on consistent bases Reports $$$ value delivered by IT Changes the dynamic & perception that IT is a cost center © Bay Area Consulting Group LLC Page 14 Business Value – Corporate-wide Business Value (corporate-wide impact to Company's business) Criteria Explanation Weig ht Impact to Company Revenue Directly related to protecting or enhancing the revenue generation environment, not the magnitude of the impact (including: direct revenue, time to market, opening new markets, optimizing existing markets, cross-selling) 5 IT Customer Pull/Need (i.e. Company Biz group, or external company) Extent to which customers are asking for this deliverable and strength/influence of request/demand 4 Impact to Company's Business Risk Impact to Company's business continuity/security/stability/disaster recovery. (Total Risk = Severity of occurrence X Frequency of occurrence). 4 Requirement to comply with Legal or Regulatory obligation Mandatory investments that are required to comply with an external regulatory obligation. These regulations are government, legal, tax and regulatory practices. 5 Describe how the project's objectives align with Company's SOs (Stated Objectives) and the customer's organizations SOs Describe how the project's objectives align with Company's SOs (Stated Objectives) and the customer's organizations SOs 3 IT Customers' Performance Improvement Customer user productivity, process efficiency, such as HC productivity (including HC reduction and reduction in turnover), factory optimization and yield improvement 3 Innovation or Enhanced Capability that solves a biz problem or creates competitive advantage Completely new, innovative solution to solve a business problem that creates competitive advantage or an enhancement/ incremental improvement (including: reduction in days of inventory, reduction in days of receivables, factory uptime) 3 © Bay Area Consulting Group LLC Score (0 - 3) Page 15 Business Value – Corporate-wide Business Value (corporate-wide impact to Company's business) Criteria Explanation Weig ht IT Customer Product Unit Cost Reduction Impact to the cost of products that IT Customers are achieving due to the use of IT solutions, not IT products/services costs (higher profit margin for Company products; including system EOL, materials discounts, hardware/software cost avoidance, scrap reduction, yield improvement, waste reduction, other cost avoidance) 3 How this solution will influence the IT PE (Partnership Excellence) program scores addressing top customer issues How this solution will influence the IT PE scores from endusers and senior managers, including addressing top customer issues 2 Confidence of Successful Execution Confidence that the solution will be executed with high quality, flawlessly from a planning and implementation standpoint 2 Confidence in timeliness of solution delivery Confidence in ability to deliver solution in a timeframe that's most beneficial to the customer 2 Confidence that the solution will address the business need Confidence from a biz standpoint that the benefit would be delivered and the solution will meet the customer's business objective 2 Use of Company Products Extent of which project showcases use of Company products, vs just using them to deliver a solution internally 1 Intangible Benefits (benefits not captured above and not included in Business Value Dials) Please list the benefits 1 © Bay Area Consulting Group LLC Business Value Index: Score (0 - 3) Page 160 40 IT Efficiency IT efficiency (optimal utilization of IT's infrastructure and resource capabilities) Criteria Explanation Weight Pull/need from within IT Extent to which internal to IT customers are asking for this deliverable (volume and strength/influence of request/demand) 4 Describe how the project's objectives align with IT SOs and EB Goals Describe how the project's objectives align with IT SOs and EB Goals 4 Time to Market Increse the speed of IT products and services get deployed to customers (Company-wide) without impacting quality 3 Impact to IT Employee Performance Improvement Measure of impact to IT employee productivity, I.e. efficiency, faster throughput, higher quality 2 Level of Innovation and Learning for IT New technology approach/tool for IT internal usage 2 Unit Cost Reduction of IT products/services Impact to the Unit Cost of Products - please list the products and the type of costs affected 2 Impact on future investments Investments that provide a foundation or are necessary for future technologies, capabilities or have a direct impact on strategic roadmaps 3 © Bay Area Consulting Group LLC Score (0 - 3) Page 17 IT Efficiency IT efficiency (optimal utilization of IT's infrastructure and resource capabilities) Criteria Explanation Weight Maintain Quality and Reliability of IT products and services delivery Investments in maintaining required levels of quality of IT infrastructure, service delivery, operational efficiency, capacity, response rates, problem resolution 3 Opportunity of reusing existing components or creating of reusable components Opportunities to reuse existing standard applicable capabilities and assets or/and opportunities to create new ones for future reuse. 2 Fit with existing architecture and roadmaps Level of fit with existing architecture and integration required in order to introduce into the environment. Thus, solutions requiring new architecture, will not score high on this criteria, while they may be innovative in nature and the right thing to do. The level of innovation is evaluated in a separate critieron above. 2 IT Employee Satisfaction Impact Level of improvement on IT employee well-being, development, growth. 1 IT Efficiency Value Index © Bay Area Consulting Group LLC Score (0 - 3) 28 Page 18 Finance Finance Index Criteria Explanation Weight NPV (Net Present Value) Calculate under most likely assumptions. Typically, NPV is calculated over a 3 year period. More optimistic scenarios can be captured under "Option Value." 2 Payback Period Period between initial investment and recovery of the total investment 2 Option Value Potential future value not reflected in NPV. Option value should include any cost associated with bringing the product to market. 1 Internal Rate of Return Internal Rate of Return is the discount rate that makes the PV of costs over time equal to PV of benefits over time, i.e. NPV = 0. 3 Level of Initial Investment Initial spending (in most cases, quarterly) required as a percentage of department's quarterly budget 2 Finance Index: 10 © Bay Area Consulting Group LLC Score (0 - 3) 0 Page 19 Let’s Try Four Projects Project Cost Business Value IT Efficiency Finance A-Finance $500 1 2 3 B- Mid All $750 2 2 2 C- BV $1,000 3 2 1 D – Hi All $1,250 3 3 3 E – Lo All $1,500 1 1 1 F- Mixed All $1,750 0-3 0-3 0-3 © Bay Area Consulting Group LLC Page 20 Results Business Value Chart Business Value Matrix This chart shows how the BVI values of the scored projects map to the Business Value Matrix IT Efficiency + 0 ? ? 0 Business Value © Bay Area Consulting Group LLC + Project A - Finance Project B - Middle for All Project C - Business Value Project D - Hi for All Project E - Low All Project F - Mixed All 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Financial Index is represented by bubble width in chart Page 21