Handout #4B CVP

ACG 4361

Handout #4B – CVP

Spring 2016

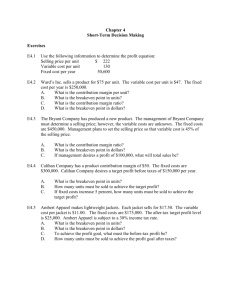

PROBLEM 1. Teeson Tires makes lawn mower tires. The revenue and cost information for

July when 2,500 tires were produced and sold appears in the table below:

Sales revenue

Variable cost

Fixed costs

Operating income

Profit per tire

Contribution margin per tire

The company’s tax rate is 30%.

$40,000

23,750

7,800

$8,450

$3.38

$6.50

1. If Teeson sells 2,300 tires, how much is its net income?

2. How much out of every sales dollar is available to cover fixed costs and contribute to profit?

3. How many units will Teeson sell at breakeven?

4. How much sales revenue will the company report at breakeven?

5. How much will total sales be at a targeted pretax income of $13,600 in July?

6. If three more tires are sold, by how much will net income increase?

7. If an additional sale of $608 is rung up on the cash register two minutes before closing on the July 31, by how much will profit increase?

Updated December 26, 2015

Problem 2. Gill Company produces widgets. Information is summarized for the month of May during which Gill Company sold 4,000 widgets in the following table.

Units selling price

Unit fixed cost

Unit variable cost

Gill Company’s tax rate is 30%.

$15.00

2.00

6.00

1. How much will total fixed costs be at breakeven?

2.

How do ‘operating income’ and ‘net income’ differ?

3. How much will total sales be at a targeted net income of $14,000 in July?

Updated December 26, 2015

Problem 3. Evans Company manufacturers and sells cologne. This product has a contribution margin per unit of $20 and a contribution margin ratio of 40%. Fixed expenses were $8 per unit in June. The income tax rate is 30%. The company sold 3,600 units during June.

1. If 10 more units are sold, by how much will income before taxes increase?

2

. If one of Evans’ customers spends $240 more dollars, by how much will income before taxes increase?

3. How much is the margin of safety in dollars in June? Interpret your answer.

4. How much is operating leverage for June?

5. Use the operating leverage approach to indicate the following effects if June sales decrease by 26%:

A. percentage by which income before taxes will decrease

B. the dollar amount by which income will decrease

C. the new operating income

Updated December 26, 2015

Problem 4 - Atta Boy Company produces two models of stools, short and tall. The company has a stable sales mix. Budgeted information regarding these products for May follows:

Short Tall Total

Number of units

Sales revenue

Variable costs

Fixed costs

Operating income

Contribution margin per unit

Profit per unit

4,600 5,400 10,000

$120,000 $160,000 $280,000

71,000 76,000 147,000

26,000 50,000 76,000

$23,000 $34,000 $57,000

$10.6522 $15.5556

$5.00 $6.2963

A. Show the calculation breakeven sales revenue for each model of stool for Atta Boy using the bundle approach and the weighted average approach for Atta Boy.

B. Show the calculation breakeven units for each model of stool for Atta Boy using the bundle approach and the weighted average approach for Atta Boy.

Updated December 26, 2015

Problem 5 - Snack Time sells two varieties of chips: Crunchy and Munchy. Information on sales for July of 2015 follows:

Crunchy Munchy

Selling price

Variable cost per unit

$5.60

$3.64

$7.00

$3.85

The company sells 3 crunchy snacks for every 2 bags of munchy snacks.. The sales mix is expected to be stable. Total fixed costs are $17,136. Snack Time has an income tax rate of

34%.

A. Show the calculation of the breakeven point in bags of chips 'per bundle'. Circle your answer.

B. Show the calculation of how many bags of Munchy chips that Snack Time will sell at breakeven. Circle your answer.

Updated December 26, 2015

Problem 6 - Query Company sells pillows for $25.00 each. The manufacturing cost, all variable, is $10 per pillow. The company is planning on renting an exhibition booth for both display and selling purposes at the annual crafts and art convention. The convention coordinator allows two options for each participating company. They are:

1. paying a fixed booth fee of $5,010, or

2. paying an $4,000 fee plus 10% of revenue made at the convention, or a. Compute the breakeven sales in pillows of each option. b. How many pillows will Query sell at the point of indifference? c. How much is profit at the point of indifference?

Updated December 26, 2015

Problem 7 CalCo sells two products. Its total monthly fixed costs are $32,400 at capacity and are allocated to the two products. The income tax rate is 30%. The following additional information is provided:

Number produced/sold

Blankets

7,000

Pillows

3,000

Sales revenue

Variable costs

Fixed costs

Operating income before taxes

Revenue per unit

Variable cost per unit

$84,000

33,600

26,000

$24,400

$12.00

4.80

$30,000

18,000

6,400

$5,600

$10.00

6.00

A. Determine the sales mix in two forms. Display in proper form and reduce to lowest terms.

B. Calculate the number of units and total revenue for each product needed to generate net income totaling $4,200 for CalCo using two different methods,

Updated December 26, 2015