Econ 299 Chapter 04... - University of Alberta

advertisement

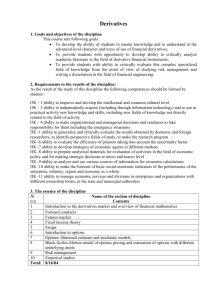

4. Models with Multiple Explanatory Variables Chapter 2 assumed that the dependent variable (Y) is affected by only ONE explanatory variable (X). Sometimes this is the case. Example: Age = Days Alive/365.25 Usually, this is not the case. Example: midterm mark depends on: how much you study how well you study intelligence, etc 1 4. Multi Variable Examples: Demand = f( price of good, price of substitutes, income, price of compliments) Consumption = f( income, tastes, wages) Graduation rates = f( tuition, school quality, student quality) Christmas present satisfaction = f (cost, timing, knowledge of person, presence of card, age, etc.) 2 4. The Partial Derivative It is often impossible analyze ONE variable’s impact if ALL variables are changing. Instead, we analyze one variable’s impact, assuming ALL OTHER VARIABLES REMAIN CONSTANT We do this through the partial derivative. This chapter uses the partial derivative to expand the topics introduced in chapter 2. 3 4. Calculus and Applications involving More than One Variable 4.1 Derivatives of Functions of More Than One Variable 4.2 Applications Using Partial Derivatives 4.3 Partial and Total Derivatives 4.4 Unconstrained Optimization 4.5 Constrained Optimization 4 4.1 Partial Derivatives Consider the function z=f(x,y). As this function takes into account 3 variables, it must be graphed on a 3-dimensional graph. A partial derivative calculates the slope of a 2-dimensional “slice” of this 3-dimensional graph. The partial derivative ∂z/∂x asks how x affects z while y is held constant (ceteris paribus). 5 4.1 Partial Derivatives In taking the partial derivative, all other variables are kept constant and hence treated as constants (the derivative of a constant is 0). There are a variety of ways to indicate the partial derivative: 1) ∂y/∂x 2) ∂f(x,z)/∂x 3) fx(x,z) Note: dy=dx is equivalent to ∂y/∂x if y=f(x); ie: if y only has x as an explanatory variable. (Therefore often these are used interchangeably 6 in economic shorthand) 4.1 Partial Derivatives Let y = 2x2+3xz+8z2 ∂y/ ∂x = 4x+3z+0 ∂y/ ∂z = 0+3x+16z (0’s are dropped) Let y = xln(zx) ∂ y/ ∂ x = ln(zx) + zx/zx = ln(zx) + 1 ∂ y/ ∂ z = x(1/zx)x =x/z 7 4.1 Partial Derivatives Let y = 3x2z+xz3-3z/x2 ∂ y/ ∂ z=3x2+3xz2-3/x2 ∂ y/ ∂ x=6xz+z3+6z/x3 Try these: z=ln(2y+x3) Expenses=sin(a2-ab)+cos(b2-ab) 8 4.1.1 Higher Partial Derivatives Higher order partial derivates are evaluated exactly like normal higher order derivatives. It is important, however, to note what variable to differentiate with respect to: From before: Let y = 3x2z+xz3-3z/x2 ∂ y/ ∂ z=3x2+3xz2-3/x2 ∂ 2y/ ∂ z2=6xz ∂ 2y/ ∂ z ∂ x=6x+3z2+6/x3 9 4.1.1 Young’s Theorem From before: Let y = 3x2z+xz3-3z/x2 ∂ y/ ∂ x=6xz+z3+6z/x3 ∂ 2y/ ∂ x2=6z-18z/x4 ∂ 2y/ ∂ x ∂ z=6x+3z2+6/x3 Notice that ∂2y/∂x∂z=∂2y/∂z∂x This is reflected by YOUNG’S THEOREM: order of differentiation doesn’t matter for higher order partial derivatives 10 4.2 Applications using Partial Derivatives As many real-world situations involve many variables, Partial Derivatives can be used to analyze our world, using tools including: Interpreting coefficients Partial Elasticities Marginal Products 11 4.2.1 Interpreting Coefficients Given a function a=f(b,c,d), the dependent variable a is determined by a variety of explanatory variables b, c, and d. If all dependent variables change at once, it is hard to determine if one dependent variables has a positive or negative effect on a. A partial derivative, such as ∂ a/ ∂ c, asks how one explanatory variable (c), affects the dependent variable, a, HOLDING ALL OTHER DEPENDENT VARIABLES CONSTANT (ceteris paribus) 12 4.2.1 Interpreting Coefficients A second derivative with respect to the same variable discusses curvature. A second cross partial derivative asks how the impact of one explanatory variable changes as another explanatory variable changes. Ie: If Happiness = f(food, tv), ∂ 2h/ ∂ f ∂tv asks how watching more tv affects food’s effect on happiness (or how food affects tv’s effect on happiness). For example, watching TV may not increase happiness if someone is hungry. 13 4.2.1 Corn Example Consider the following formula for corn production: Corn = 500+100Rain-Rain2+50Scare*Fertilizer Corn = bushels of corn Rain = centimeters of rain Scare=number of scarecrows Fertilizer = tonnes of fertilizer Explain this formula 14 4.2.1 Corny Example 1) Intercept = 500 -if it doesn’t rain, there are no scarecrows and no fertilizer, the farmer will harvest 500 bushels 2) ∂Corn/∂Rain=100-2Rain -each additional cm of rain changes corn production by 100-2Rain -positive impact if rain < 50 cm -negative impact if rain > 50 cm 15 4.2.1 Corny Example 3) ∂2Corn/∂Rain2=-2<0, (concave) -More rain has a DECREASING impact on the corn harvest -More rain DECREASES rain’s impact on the corn harvest by 2 4) ∂Corn/∂Scare=50Fertilizer -More scarecrows will increase the harvest 50 for every tonne of fertilizer -if no fertilizer is used, scarecrows are useless 16 4.2.1 Corny Example 5) ∂ 2Corn/∂Scare2=0 (straight line, no curvature) -Additional scarecrows have a CONSTANT impact on corn’s harvest 6) ∂ 2Corn/∂Scare∂Fertilizer=50 -Additional fertilizer increases scarecrow’s impact on the corn harvest by 50 17 4.2.1 Corny Example 7) ∂Corn/∂Fertilizer=50Scare -More fertilizer will increase the harvest 50 for every scarecrow -if no scarecrows are used, fertilizer is useless 8) ∂ 2Corn/∂Fertilizer2=0, (straight line) -Additional fertilizer has a CONSTANT impact on corn’s harvest 18 4.2.1 Corny Example 9) ∂ 2Corn/∂Fertilizer ∂Scare =50 -Additional scarecrows increase fertilizer’s impact on the corn harvest by 50 19 4.2.1 Demand Example Consider the demand formula: Q = β1 + β2 Pown + β3 Psub + β4 INC (Quantity demanded depends on a product’s own price, price of substitutes, and income.) Here ∂ Q/ ∂ Pown= β2 = the impact on quantity when the product’s price changes Here ∂ Q/ ∂ Psub= β3 = the impact on quantity when the substitute’s price changes Here ∂ Q/ ∂ INC= β4 = the impact on quantity when income changes 20 4.2.3 Partial Elasticities Furthermore, partial elasticities can also be calculated using partial derivatives: Own-Price Elasticity = ∂ Q/ ∂ Pown(Pown/Q) = β2(Pown/Q) Cross-Price Elasticity = ∂ Q/ ∂ Psub(Psub/Q) = β3(Psub/Q) Income Elasticity = ∂ Q/ ∂ INC(INC/Q) = β4(INC/Q) 21 4.2.2 Cobb-Douglas Production Function A favorite function of economists is the CobbDouglas Production Function of the form Q=aLbKcOf Where L=labour, K=Capital, and O=Other (education, technology, government, etc.) This is an attractive function because if b+c+f=1, the demand function is homogeneous of degree 1. (Doubling all inputs doubles outputs…a happy concept) 22 4.2.2 Cobb-Douglas University Consider a production function for university degrees: Q=aLbKcAf Where L=Labour (ie: professors), K=Capital (ie: classrooms) A=Administration 23 4.2.2 Average and Marginal Products Finding partial derivatives: ∂ Q/ ∂ L =abLb-1KcAf =b(aLbKcAf)/L =b(Q/L) =b* average product of labour -in other words, adding an additional professor will contribute a fraction of the average product of each current professor -this partial derivative gives us the MARGINAL PRODUCT of labour 24 4.2.2 Cobb-Douglas Professors For example, if 20 professors are employed by the department, and 500 students graduate yearly, and b=0.5: ∂ Q/ ∂ L =0.5(500/20) =12.5 Ie: Hiring another professor will graduate 12.5 more students. The marginal product of professors is 12.5 25 4.2.2 Marginal Product Consider the function Q=f(L,K,O) The partial derivative reveals the MARGINAL PRODUCT of a factor, or incremental effect on output that a factor can have when all other factors are held constant. ∂ Q/ ∂ L=Marginal Product of Labour (MPL) ∂ Q/ ∂ K=Marginal Product of Capital (MPK) ∂ Q/ ∂ O=Marginal Product of Other (MPO) 26 4.2.2 Cobb-Douglas Elasticities Since the “Labor Elasticity” (LE) is defined as: LE = ∂ Q/ ∂ L(L/Q) We can find that LE =b(Q/L)(L/Q) =b The partial elasticity with respect to labor is b. The partial elasticity with respect to capital is c The partial elasticity with respect to other is f 27 4.2.2 Logs and Cobbs We can highlight elasticities by using logs: Q=aLbKcCf Converts to Ln(Q)=ln(a)+bln(L)+cln(k)+fln(C) We now find that: LE= ∂ ln(Q)/ ∂ ln(L)=b Using logs, elasticities more apparent. 28 4.2.2 Logs and Demand Consider a log-log demand example: Ln(Qdx)=ln(β1) +β2 ln(Px)+ β3 ln(Py)+ β4 ln(I) We now find that: Own Price Elasticity = β2 Cross-Price Elasticity = β3 Income Elasticity = β4 29 4.2.2 ilogs Considering the demand for the ipad, assume: Ln(Qdipad)=2.7 -1ln(Pipad)+4 ln(Ptablet)+0.1 ln(I) We now find that: Own Price Elasticity = -1, demand is unit elastic Cross-Price Elasticity = 4, a 1% increase in the price of tablets causes a 4% increase in quantity demanded of ipads Income Elasticity = 0.1, a 1% increase in income causes a 0.1% increase in quantity demanded 30 for ipads 4.3 Total Derivatives Often in econometrics, one variable is influenced by a variety of other variables. Ie: Happiness =f(sun, driving) Ie: Productivity = f(labor, effectiveness) Using TOTAL DERIVATIVES, we can examine how growth of one variable is caused by growth in all other variables The following formulae will combine x’s impact on y (dy/dx) with x’s impact on y, with other variables held constant (δy/δx) 31 4.3 Total Derivatives Width Assume you are increasing the square footage of a house where AREA = LENGTH X WIDTH A=LW dL Length If you increase the length, the change in area is equal Area to the increase in length times the current width: Notice that: δA/δL=W, (partial derivative, since width is constant) Therefore the increase in area is equal to: dA=(δA/δL)dL 32 4.3 Total Derivatives Length Width A=LW If you increase the width, the change in area is equal to the increase in width times the current length: Area dW Notice that: δA/δW=L, (partial derivative, since length is constant) Therefore the increase in area is equal to: dA=(δA/δW)dW Next we combine the two effects: 33 4.3 Total Derivatives Width A=LW An increase in both length and width has the following impact on area: dW Length Area Now we have: dA=(δA/δL)dL+(δA/δW)dW+(dW)dL dL But since derivatives always deal with instantaneous slope and small changes, (dW)dL is small and ignored, resulting in: dA=(δA/δL)dL+(δA/δW)dW 34 4.3 Total Derivatives dA=(δA/δL)dL+(δA/δW)dW Width Length Area dW dL Effectively, we see that change in the dependent variable (A), comes from changes in the independent variables (W and L). In general, given the function z=f(x,y) we have: f ( x, y ) f ( x, y ) z z dz dx dy dx dy x y x y 35 4.3 Total Derivative Example In a joke factory, QJokes=workers(funniness) You employ 500 workers, each of which can create 100 funny jokes an hour. How many more jokes could you create if you increase workers by 2 and their average funniness by 1 (perhaps by discovering any joke with an elephant in it is slightly more funny)? q q dq df dw f w dq wdf fdw dq 500(1) 100( 2) dq 500 200 700 36 4.3 Total Derivative Extension The key advantage of the total derivative is it takes variable interaction into account. The partial derivative (δz/δx) examines the effect of x on z if y doesn’t change. This is the DIRECT EFFECT. However, if x affects y which then affects z, we might want to measure this INDIRECT EFFECT. We can modify the total derivative to do this: f ( x, y ) f ( x, y ) z z dz dx dy dx dy x y x y dz z dx z dy z z dy dx x dx y dx x y dx 37 4.3 Total Derivative Extension f ( x, y ) f ( x, y ) z z dz dx dy dx dy x y x y dz z dx z dy z z dy dx x dx y dx x y dx Here we see that x’s total impact on z is broken up into two parts: 1) x’s DIRECT impact on z (through the partial derivative) 2) x’s INDIRECT impact on z (through y) Obviously, if x and y are unrelated, (δy/δx)=0, then the total derivative collapses to the partial derivative38 4.3 Total Derivative Example Assume Happiness=Candy+3(Candy)Money+Money2 h=c+3cm+m2 Furthermore, Candy=3+Money/4 (c=3+m/4) The total derivative of happiness with regards to money: dh h h dc dm m c dm dh [3c 2m] [(1 3m)(1 / 4)] dm dh 0.25 3c 2.75m dm 39 4.3 Total Derivative and Elasticity Total derivatives can also give us the relationship between elasticity and revenue that we found in Chapter 2.2.3: TR PQ TR TR dTR dP dQ P Q dTR dP dQ Q P dP dP dP dTR P dQ Q(1 ) dP Q dP dTR Q(1 ) (where is price elasticity of demand) 40 dP 4.4 Unconstrained Optimization Unconstrained optimization falls into two categories: 1) Optimization using one variable (ie: changing wage to increase productivity, working conditions are constant) 2) Optimization using two (or more) variables (ie: changing wage and working conditions to maximize productivity) 41 4.4 Simple Unconstrained Optimization For a multivariable case where only one variable is controlled, optimization steps are easy: Consider the function z=f(x) 1) FOC: Determine where δz/δx=0 (necessary condition) 2) SOC: δ2z/δx2<0 is necessary for a maximum δ2z/δx2>0 is necessary for a minimum 3) Determine max/min point Substitute the point in (2) back into the original equation. 42 4.4 Simple Unconstrained Optimization Let productivity = -wage2+10wage(working conditions)2 P(w,c)=-w2+10wc2 If working conditions=2, find the wage that maximizes productivity P(w,c)=-w2+40w 1) FOC: δp/δw =-2w+40=0 w=20 2) SOC: δ2p/δw2= -2 < 0, a maximum exists 43 4.4 Simple Unconstrained Optimization P(w,c)=-w2+10wc2 w=20 (maximum confirmed) 3) Find Maximum P(20,4)=-202+10(20)(2)2 P(20,4)=-400+800 P(20,4)=400 Productivity is maximized at 400 when wage is 20. 44 4.4 Complex Unconstrained Optimization For a multivariable case where only two variable are controlled, optimization steps are more in-depth: Consider the function z=f(x,y) 1) FOC: Determine where δz/δx=0 (necessary condition) And Determine where δz/δy=0 (necessary condition) 45 4.4 Complex Unconstrained Optimization For a multivariable case where only two variable are controlled, optimization steps harder: Consider the function z=f(x,y) 2) SOC: δ2z/δx2<0 and δ2z/δy2<0 are necessary for a maximum δ2z/δx2>0 and δ2z/δy2>0 are necessary for a minimum Plus, the cross derivatives can’t be too large compared to the own second partial derivatives: 2 z z z 2 2 0 x y xy 2 2 2 46 4.4 Complex Unconstrained Optimization 2 z z z 2 2 0 x y xy 2 2 2 If this third SOC requirement is not fulfilled, a SADDLE POINT occurs, where z is a maximum with regards to one variable but a minimum with regards to the other. (ie: wage maximizes productivity while working conditions minimizes it) Vaguely, even though both variables work to increase z, their interaction with each other outweighs this maximizing effect 47 4.4 Complex Unconstrained Optimization Let P(w,c)=-w2+wc-c2 +9c , maximize productivity 1) FOC: δp/δw =-2w+c=0 2w=c δp/δc=w-2c+9=0 w=2c-9 w=2(2w)-9 -3w=-9 w=3 2w=c 6=c 48 4.4 Complex Unconstrained Optimization P(w,c)=-w2+wc-c2 +9c δp/δw =-2w+c=0 δp/δc=w-2c+9=0 w=3, c=6 (possible max/min) 2) SOC: δ2p/δw2= -2 < 0 δ2p/δc2= -2 < 0, possible max 2 p p p 2 2 (2)( 2) 12 w c wc 2 2 2 2 p p p 2 2 3 0 w c wc 2 2 2 Maximum confirmed 49 4.4 Complex Unconstrained Optimization P(w,c)=-w2+wc-c2 +9c w=3, c=6 (confirmed max) 3) Find productivity: p( w, c) w2 wc c 2 9c p( w, c) 32 (3)6 6 2 9(6) p( w, c) 9 18 36 54 p( w, c) 27 Productivity is maximized at 27 when wage=3 and working conditions=6. 50 4.5 Constrained Optimization Typically constrained optimization consists of maximizing or minimizing an objective function with regards to a constraint, or Max/min z=f(x,y) Subject to (s.t.): g(x,y)=k Where k is a constant 51 4.5 Constrained Optimization Often economic agents are not free to make any decision they would like. They are CONSTRAINED by factors such as income, time, intelligence, etc. When optimizing with constraints, we have two general methods: 1) Internalizing the constraint 2) Creating a Lagrangeian function 52 4.5 Internalizing Constraints If the constraint can be substituted into the equation to be optimized, we are left with an unconstrained optimization problem: Example: Bob works a full week, but every Saturday he has seven hours left free, either to watch TV or read. He faces the constrained optimization problem: Max. Utility=7TV-TV2+Read (U=7TV-TV2+R) s.t. 7=TV+Read (7=TV+R) 53 4.5 Internalizing Constraints Max. U=7TV-TV2+R s.t. 7=TV+R We can solve the constraint: R=7-TV And substitute into the objective function: U=-TV2+7TV+(7-TV) U=-TV2+6TV+7 54 4.5 Internalizing Constraints Max. U=7TV-TV2+R s.t. 7=TV+R U=-TV2+6TV+7 We can then perform unconstrained optimization: FOC: δU/ δTV=-2TV+6=0 TV=3 R=7-TV R=7-3 R=4 55 4.5 Internalizing Constraints Max. U=7TV-TV2+R s.t. 7=TV+R U=-TV2+6TV+7, TV=3, R= 4 δU/ δTV=-2TV+6 SOC: δ2U/ δTV2=-2<0, concave max. Evaluate: U=7TV-TV2+R U=7(3)-32+4 U=21-9+4=16 56 4.5 Internalizing Constraints Max. U=7TV-TV2+R s.t. 7=TV+R U=-TV2+6TV+7, TV=3, R= 4 δU/ δTV=-2TV+6 δ2U/δTV2=-2<0, concave max. U=21-9+4=16 Utility is maximized at 16 when Bob watches 3 hours of TV and reads for 4 hours. 57 4.5 Internalizing Constraints Substituting the constraint into the objective function may not be applicable for a variety of reasons: 1) The substitution makes the objective function unduly complicated, or substitution is impossible 2) You want to evaluate the impact of the constraint 3) The constraint is an inequality 4) Your exam paper asks you to do so In this case, you must construct a Lagrangian function. 58 4.5 The Lagrangian Given the optimization problem: Max/min z=f(x,y) s.t. g(x,y)=k (Where k is a constant) The Lagranean (Lagrangian) function becomes: L=z*=z(x,y)+λ(k-g(x,y)) Where λ is known as the Lagrange Multiplier. We then continue with FOC’s and SOC’s. 59 4.5 The Lagrangian L=z*=z(x,y)+λ(k-g(x,y)) FOC’s: L 0, x L 0, y L 0 Note that the third FOC simply returns the constraint, g(x,y)=k Typically, one will solve for λ in the first two conditions to find a relationship between x and y, then use this relationship with the third condition to solve for x and y. 60 4.5 The Lagrangian L=z*=z(x,y)+λ(k-g(x,y)) After finding FOC’s, to confirm a maximum or minimum, the SOC is employed. This SOC must be negative for a maximum and positive for a minimum Note that for more terms, this function becomes exponentially complicated. SOC’s: δg SOC δx 2 δ z δg 2 δy δy 2 2 δ 2 z δg δg δ 2 z 2 2 δx δx δy δxδy 61 4.5 Lagrangian example Max. U=7TV-TV2+R s.t. 7=TV+R L=z*=z(x,y)+λ(k-g(x,y)) L=7TV-TV2+R+λ(7-TV-R) FOC: L L L 7 - 2TV - 0 1- 0 7 - TV - R 0 TV R 7 - 2TV 1 7 TV R 62 4.5 Lagrangian example (1) 7 - 2TV ( 2) 1 (3)7 TV R (1) (2) 7 2TV 1 TV 3 (3) : 7 TV R 7 3 R 4R 63 4.5 Lagrangian Example 2 δg δ z δg SOC 2 δTV δR δR 2 2 δ 2 z δg δg δ 2 z 2 2 δTV δTV δR δTVδR SOC 1 0 1 - 2 2110 2 2 SOC 2 0 Since the second order condition is negative, the points found are a maximum. Notice that we found the same answers as internalizing the constraint. 64 4.5 The Lagrange Multiplier The Lagrange Multiplier, λ, provides a measure of how much of an impact relaxing the constraint would make, or how the objective function changes if k of g(x,y)=k is marginally increased. The Lagrange multiplier answers how much the maximum or minimum changes when the constraint g(x,y)=k increases slightly to g(x,y)=k+δ 65 4.5 Lagrangian example 7 - 2TV TV 3 R4 7 - 2TV 7 - 2(3) 1 This means that if Bob gets an extra hour, his maximum utility will increase by approximately 1. (Alternately, if Bob loses an hour of leisure, his maximum utility will decrease by approximately 1.) Check: If 8=TV+R, TV=3.5, R=4.5, U=16.75 66 (utility increases by approximately 1)