How to Improve Billing and Collections

advertisement

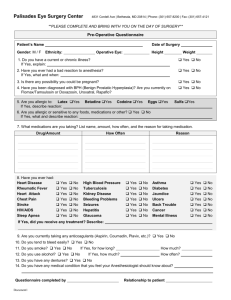

1 22 Case Study reflects financial findings/recommendations only – additional clinical findings/ recommendations are not presented 33 • 14 month old ambulatory surgery center evaluated because not meeting projected revenue • Semi-rural area • Joint-venture – 7 physicians/ local hospital • Average case volume - 350 month 4 ABC Surgery Center • Specialties - ENT - GI - Ophthalmology - Orthopedics - Podiatry - Pain Management • Payor Mix - Medicare - Medicaid - BCBS - W/C - PPOs - HMOs - Indemnity 5 ABC Surgery Center •Number of reasons for negative cash flow: - Fee schedule far lower than normally seen in an ASC - Managed care contracts low with unfavorable terms - Improper billing/coding practices - Managers with no ASC experience - Inefficient use of staff - Appropriate structure and policies and procedures not in place ABC Surgery Center 6 Findings • Evaluation of the fee schedule revealed that most fees were exceptionally low low compared to Medicare/BCBS ASC fees for this geographic locality • Many fees were actually less than Medicare allowable • Fee schedule had been based on physician DRGs • No consistency in fees – similar 7 procedures had wide variances ABC Surgery Center Recommendations • Develop fee schedule based on percentage of Medicare group rates • Carve-outs for higher ticket procedures • Decide on additional procedure discount • Sample fee schedule given to Board recommended 500% of current Medicare rates 8 ABC Surgery Center Findings • Low rates for an area with little managed care penetration • Some reimbursement methodologies varied from market standard • Unfavorable terms in contracts • Most carriers require accreditation • Some contracts were invalid as not voted on by Board ABC Surgery Center 9 Recommendations • Join local PHO and have them assist in recontracting for ASC • Cancel five major contracts whose reimbursement is based on Medicare rate • Great managed care market – suggest renegotiate for reimbursement based on percentage of billed charges • Move toward becoming accredited – mark applications as “Accreditation Pending” 10 ABC Surgery Center Findings • Coder with no ASC or surgical coding experience • Coding errors included: - not coding for bilateral procedures - not coding for multiple procedures - lack of sufficient modifiers - improper or no billing of toe implants - wrong anatomical part - coding from title – not from body of op note - no copy of coding history in patient chart - no cross check to ensure coded all cases 11 ABC Surgery Center Recommendations • Hire or outsource to certified coder, or • Immediate coding certification training for current coder • Code from body of operative note – use additional information when necessary 12 ABC Surgery Center Recommendations (continued) • Rebilling of all claims with coding errors that result in differences in reimbursement • Utilize coding form • Utilize schedule to make sure all patients have been coded 13 ABC Surgery Center Findings • Biller had no ASC/surgical billing experience • No electronic filing – all paper claims • All business office uses same printer • Billing for non-ASC services in same module – cannot separate in reports • No cross-check between coded cases and batch report 14 ABC Surgery Center Recommendations • Hire experienced biller, or • Immediate training for current biller including the following: CPT codes ICD-9 Dx Codes Sx Procedures Modifiers Medicare Guidelines • Electronic submission of all claims where possible ABC Surgery Center 15 Recommendations (continued) • Additional printer near biller to run claim forms • Purchase separate software module to bill for non-ASC services • Balance billing batch report to coding forms/schedule to ensure no unbilled revenue 16 ABC Surgery Center Findings • Payment poster not knowledgeable regarding managed care contract allowances – no copy of contracts • Accepts what payor allows – write-offs are adjusted to match what is paid and not pre-approved • Not checking to determine if refund due • Not balancing to deposit 17 ABC Surgery Center Recommendations • Hire experienced payment poster, or • Provide payment poster with copy of contracts and ASC fee schedule • If payment correct, transfer amount to be billed to secondary insurance or patient and send • If not paid correctly or denied, start denial process • If overpaid, begin refund process • Balance payment batch to deposit log 18 ABC Surgery Center Findings • Collections not being done regularly due to lack of business office staff • No system in place to determine oldest accounts and when to place with collection agency • High dollar amount over 150 days old - investigate to determine how much collectible ABC Surgery Center 19 Recommendations – Insurance Carriers • Use Aging by Carrier report to develop collection schedule • Check all outstanding balances with each carrier, oldest first • Remind carrier of state prompt payment regulation • Resubmit bill and/or additional documentation, if applicable 20 ABC Surgery Center Recommendations – Insurance Carriers (cont) • Develop tickler system to follow-up on promised payments • Future collections – follow-up in 15 days to make sure carrier received claim • Follow-up at 30 days to determine if carrier is following prompt payment rule • Document in patient’s account 21 ABC Surgery Center Recommendations – Patient Accounts • Collect deductibles and copays up-front • Perform patient financial counseling prior to DOS • Bill patients monthly • Add notes that increase in language as account ages • Contact patients by phone to determine status and offer payment alternatives, i.e., credit card, payment schedule, etc. ABC Surgery Center 22 Findings • Unbilled revenue due to: - bilateral procedures–second side not billed - billing from operative note title only • Sample coding review - 61 charts revealed 27 errors - estimated loss of allowable net revenue – $33,396 • Review of accounts over 1 year old which received no payment and were never rebilled - $79,124 gross 23 ABC Surgery Center Findings (continued) • 12 patient accounts not paid or rebilled ($21,338) – few days short of 12 months – rebilled immediately to avoid timely filing • Balances never transferred nor billed to secondary insurance and/or patient responsibility • Coding and billing are non-compliant due to: - inequity of charges - inequity of balance billing - errors 24 ABC Surgery Center Recommendations • Check all accounts over one year old to determine if can be rebilled • Assess all accounts over 150 days to determine need for collection, adjustments, before exceed statute of limitations • It may be more cost effective to outsource coding/billing/collections than to retrain and oversee current employees while trying remain current and recoup old revenue 25 ABC Surgery Center POSITIONS* DIRECTLY AFFECTING REIMBURSEMENT (Not Including Mgmt) • Scheduler • Admitting clerk (receptionist) • Insurance verification specialist • Patient financial counselor • Coder/biller • Payment poster/collector * Number of employees per position dependent on caseload ABC Surgery Center 26 Recommendations/Findings – Business Office • Currently whoever answers main phone line schedules patient • Suggest dedicated phone line for scheduling • Suggest one employee be assigned to schedule – others can be back-up • Have Business Office Manager learn all business office positions and act as back-up • Develop business office policies and procedures 27 ABC Surgery Center Recommendations/Findings – Business Office • If maintain billing in-house: - Add one FTE to business office staff – best choice – receptionist (lower salary and less training required) - Move current receptionist/biller to full time biller - Change current coder/biller to coding and collections • If outsource billing – no additional staff needed 28 ABC Surgery Center Recommendations - Business Office Manager • Hire experienced ASC Business Office Manager, or • Educate current BOM in following areas: - write-offs - adjustments - checking for errors - collection agency - refunds - audits 29 ABC Surgery Center Findings • No counter-check of deposits • No auditing of coding/billing • Reports invalid as reflect another business as well as ASC 30 ABC Surgery Center Recommendations • Utilize bank lock-box if available • If doing deposit in-house: - utilize and balance to deposit log - separate payment posting and deposits - BOM should check deposit for accuracy - BOM or designee make daily deposit • Weekly audits of coding and billing • Move other business billing functions into separate module 31 ABC Surgery Center • Governing Body approved and adopted recommendations • Hired outside management to institute changes • Outsourced coding and billing functions • Discontinued secondary business in ASC • Made other clinical changes not discussed in this report ABC Surgery Center 32 • Within 3 months surgery center in the black for first time • Gross charges tripled • Average gross charges per case doubled • Collections increased more than 250% • Profit increased more than 400% • Net income/case increased more than 300% 33 ABC Surgery Center Case Study reflects financial findings/recommendations only – additional clinical findings/ recommendations are not presented 34 34 • 10 month old ambulatory surgery center evaluated to determine compliance and efficiency and evaluate billing process • Semi-rural area • Solely owned by physician and non-physician partners • Average case volume – 80-100 month35 35 XYZ Surgery Center • Specialties - Orthopedics – 50% - Ophthalmology – 25% - Pain Management – 13% - Urology – 6% - Podiatry – 6% 3636 XYZ Surgery Center • Payor Mix - Medicare - Medicaid - BCBS - W/C - PPOs - Indemnity • Contract reimbursement is based on a mixture of: - percentage of Medicare groups - discount off billed charges XYZ Surgery Center 3737 Findings • Sharing practice management software with clinic • Software does not allow loading of contracts • Shared schedule with clinic • Software does not have place for Medicare groups nor APCs • Clearinghouse (part of software) reports not accurate XYZ Surgery Center 3838 Recommendations • Consider purchasing ASC-specific software – need to be able to schedule separately and load contracts • Suggest changing to independent clearinghouse 3939 XYZ Surgery Center Findings • Evaluation of fee schedule revealed that many fees were less than some contracts would reimburse • No minimum fee – some fees as low as $200 - $300 4040 XYZ Surgery Center Recommendations • May want to review entire fee schedule based on evaluation and comparison to reimbursement, as well as case cost • Suggest minimum fee of $1200 to $1500 4141 XYZ Surgery Center Findings • ASC does not have copy of most contracts • Contracts not loaded in computer • No insurance matrix available to determine accuracy of payments 4242 XYZ Surgery Center Recommendations • Request copies of all contracts • If change software, load contracts and adjust contractual allowances at time of billing • Develop insurance matrix and provide to appropriate billing personnel 4343 XYZ Surgery Center Findings • Physicians doing procedure coding diagnosis coding done by clinic coder • Back-up coder has no formal coding or ASC experience – also does billing, payment posting, collections for both ASC and clinic • No substantiation with operative note • Not being done daily • Most implant invoices and pathology reports not provided to biller 4444 XYZ Surgery Center Findings (continued) • Current coding books present – no CCI or other unbundling references • No coding audits being performed • 50 charts provided for coding review - 24 charts had errors - additional charts had insufficient back-up support for implants - $4,328 unbilled revenue - $5,558 over-billed revenue XYZ Surgery Center 4545 Recommendations • Utilize certified coder • Code from operative note • Track pathology reports and provide to coder • Code daily and balance to schedule • Subscribe to CCI edits to prevent unbundling 4646 XYZ Surgery Center Recommendations (continued) • Separate coding/billing from payment posting/collections • Audit to check for unbilled revenue or over-billed amounts needing refund • Continued monthly audits to remain compliant • Provide information to physicians regarding detailed dictation XYZ Surgery Center 4747 Findings • Claims are not being sent until at least 7-10 days post surgery • Batches are not closed daily therefore not able to balance to schedule to prevent unbilled revenue • Payments and charges are combined in same batches 4848 XYZ Surgery Center Findings (continued) • Contract profiles added based on what is being paid • ASC staff members unaware of upcoming 2008 Medicare changes • No out-of-network policy in place and no advance notification to payors • Contractual adjustments not done at time of billing 4949 XYZ Surgery Center Recommendations • Separate payment and charge batches • Keep necessary back-up of all charges • Bill electronically wherever possible • Develop tracking system to ensure billing for all implants 5050 XYZ Surgery Center Recommendations (continued) • Run clearinghouse reports – verify claim on file with payor • Process all claims within 48-72 hours from DOS • Notify all carriers of OON status on claim • Correct all errors/unsubmitted claims found on coding review and rebill 5151 XYZ Surgery Center Findings • Payment poster wears all billing hats for clinic and ASC – insufficient time • A/R is increasing – one week ago hired additional collector • Payment poster does not have knowledge of managed care contract allowances – does not have copies • Accepts what payor allows – write-offs are adjusted to match what is paid 5252 XYZ Surgery Center Findings (continued) • Some secondaries have not been billed – assigned to patient responsibility in error • Undetermined whether OON payments going to patient – no attempt to collect yet • No way to balance to deposit as payments and charges are in same batch • Not starting proceedings with denials or incorrect payments in timely manner 5353 XYZ Surgery Center Recommendations • Provide payment poster with copy of all managed care contracts and/or contract matrix • Payments should be posted daily • Bank deposits should be made daily • Keep necessary back-up of all payments received 5454 XYZ Surgery Center Recommendations (continued) • Review EOBs and promptly start denial process for erroneous payment or no payment • When posting, compare payment to original claim to determine accuracy • Credit balances to be reviewed and promptly refunded, where applicable 5555 XYZ Surgery Center Findings • Collections not being done regularly due to lack of business office staff • No upfront collections • No brochure for patients to outline financial policy • No policies/procedures on billing or related issues • No accounts have been placed with collection as no follow-ups done yet 5656 XYZ Surgery Center Findings (continued) • No training in Fair Debt Collection standards • Medicare claims not crossing over to secondaries • 30 day prompt payment law • Days in A/R 79 • Over 120 – 22% (mostly insurance) 5757 XYZ Surgery Center Recommendations • Review accounts that were denied or paid in error and rebill where applicable– timely filing may become an issue • Follow up on OON claims – determine which paid to patient and send statements • Need to audit Medicare and insurance payments to detect overpayments – correct and issue refunds where XYZ Surgery necessary Center 5858 Recommendations • Use aging reports to aid in collections • Use tickler files • Evaluate/correct problem with Medicare secondaries • Enforce prompt payment rule • Institute upfront collection of deductible and copays • Establish financial policies/procedures 5959 XYZ Surgery Center Findings • Administrator has no previous ASC experience • No business office manager • Only two FT business office employees • Billing staff leased part time from clinic • Few business office policies/procedures • Vague job descriptions – no real accountability 6060 XYZ Surgery Center Recommendations • Separate clinic and ASC staff if possible • If billing remains in-house, recommend hiring full time experienced coder/biller for ASC • Suggested some changes in positions to cover all tasks • When caseload increases, recommend hiring working business office coordinator who can fill any position as needed 61 61 XYZ Surgery Center Findings and Recommendations STAFFING • Information flow is fragmented between clinic and ASC – recommend evaluation and change • Need specific business office policies and procedures and job descriptions 6262 XYZ Surgery Center Findings/Recommendations – COMPLIANCE • Not enough separation between Clinic & ASC • Billing and payment posting should be separate and done by different employees • Three members of business office staff should review deposits • No Business Associate or confidentiality agreements • No financial policy information available to patients 6363 XYZ Surgery Center Findings and Recommendations – 2008 MEDICARE CHANGES • Administrator attended educational seminar on 2008 Medicare changes • Suggest share information with key personnel and billing staff • Evaluation team provided copy of proposed reimbursement to ASC 6464 XYZ Surgery Center • Governing body approved and adopted recommendations • Outsourced coding and billing functions • Made other clinical changes not discussed in this report 6565 XYZ Surgery Center • Outsource date - January 1, 2008 • Average caseload 100/month • Accounts receivable decreased 25% • Over 120 decreased from 22% to 8% • Average Collections increased from $160,000 to $250,000 per month • Average Gross Charges increased from $353,860 to $584,055 • Days in A/R decreased from 79 to 44 6666 XYZ Surgery Center • Inadequate fee schedule • Poor managed care contracts • No copies of managed care contracts • Insufficient staff • Wrong staff • No good policies/procedures in place • Compliance issues • No consistency in billing practices • Not billing for implants regularly 6767 Caryl Serbin 239-482-1777 cas@surgecon.com 6868