of employment

advertisement

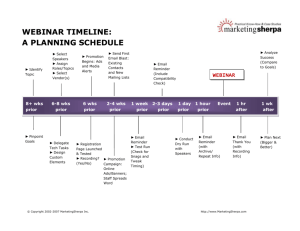

INDIANA AMERICAN PAYROLL ASSOCIATION CANADIAN PAYROLL THURSDAY SEPTEMBER 17, 2015 10:00 AM TO 11:00 AM Presented By: Nina Scott CPP Executive Alliance ABOUT EXECUTIVE ALLIANCE Founded in 1992, Executive Alliance is the longest, continuously operating independent provider of Payroll and Human Capital Management (HCM) consulting services in the country We are a multi-disciplinary management consulting firm with significant experience in all aspects of HCM systems, processes and people. We have managed many global HR and Payroll projects Commitment & Focus Expertise • Independent and have no proprietary relationship with any solution provider • Years of experience with all major software and service providers • Ability to provide our clients complete and unbiased guidance, from product evaluation through implementation, and ongoing operations • Assist organizations looking to improve their Payroll and HCM processes and the use of technologies that support these processes • Areas of focus • Strategic operational assessment & planning • Vendor selection • Implementation and project management Process design and improvement Technology optimization • Interim management services HR strategic planning for systems and service delivery In depth knowledge of vendors/service providers in the HR/Payroll marketplace Development of business requirements and management of full life-cycle sourcing process Decision making support tailored to client business objectives: presentation of options, associated metrics Experience in all HR functional areas: recruiting, performance, compensation, benefits, payroll, talent, learning, compliance, employee relations, HRIS Executive Assist clients with change impacts ofconsulting new Alliance has provided technology solutions andBoston service delivery services to 42% of The Globe Top 100 models Places to Work Award Recipients (Nov. 2009, employers with over 1,000 employees) 2 EXPERIENCE PROCESSING/IMPLEMENTING PAYROLL Processed and/or implemented payroll in 6 of the 7 continents Processed or implemented a payroll 3 Canadian Payroll Employees Expectations: 1. Timely & accurate payment 2. Confidentiality of personal information https://www.youtube.com/watch?v=kRPGPAnPNa8 Canada & US Payroll are very similar…. Things the United States doesn’t have…. Stars Who Hail from Canada Beaver for a National Animal Currency that Looks Like Monopoly Money A Prime Minister AND A Queen Culinary Specialties Metric System 5 Employee & Employer Relationship Factors consider in Employee & Employer relationship Factor Control: When, where, how work performed Tools & Equipment: Who furnishes tools Subcontracting Work: Hiring or firing Financial Risk: No liability for operating expenses Responsibility for Investment: No capital investment in business Opportunity for Profit: No profit or loss Exclusivity: Only work for one employer Contract in Place: Contract governs relationship Payment Terms: Salary Performs Services Under Business Name 6 SOCIAL INSURANCE NUMBER A company must collect a SIN and TD1 from all new hires First digit of a SIN indicates province of registration 1: Atlantic: New Brunswick, Newfoundland, Nova Scotia, Prince Edward Island 2 & 3: Quebec 4 & 5: Ontario 6: Prairies: Alberta, Manitoba, Saskatchewan, Northwest Territories, Nunavut 7: British Columbia, Yukon 8 & 0: Not Used 9: Work Permit Pop: 37 Pop: 44 Pop: 4,631 Pop: 37 Largest Country in Americas Population: 35.54M Pop: 4,122 Pop: 527 Pop: 1,125 Approximate Population of CA: 12% of US population Indiana: 6.6 M Pop: 1,282 Pop: 8,215 Pop: 146 Pop: 13,679 Pop: 754 Pop: 943 Company must have a register business number to pay taxes SOURCE: Statistics Canada: 2014 Populations in thousands 7 SOCIAL INSURANCE NUMBER VERIFICATION Employer must ask to see the SIN verification from every employee Record of Employment requires the name and SIN to match exactly the SIN card/letter (no nicknames) Social Insurance Number Digits (193456787) 1. SIN to verify 1 2. Extract the digit in the first 4 odd numbered positions – add across 1 9 3 4 3 5 6 5 7 8 7 7 16 3. Extract the digit in each even number position 9 4 6 8 4. Double the extracted digits 18 8 12 16 5. Add each of the digits in the above step (considering a 2 digit number separately) 1+8 8 1+2 1+6 27 6. Add the sums 43 7. Round to the nearest number ending in 0 50 8. Subtract Step 7 minus Step 6 7 9. Valid if last digit in SIN equals step 8 7 8 SOCIAL INSURANCE NUMBER VERIFICATION (ANOTHER ONE) Effective 3/31/14 Service Canada will not longer issue SIN cards All numbers will be issued via paper format Social Insurance Number Digits (193456787) 1. SIN to verify 1 9 3 4 5 6 7 8 7 2. Fixed number 1 2 1 2 1 2 1 2 1 3. Multiple step 1 * 2 1 18 3 8 5 12 7 16 7 4. Add each of the digits in the above step (considering a 2 digit number separately) 1 1+8 3 8 5 1+2 7 1+6 7 5. The SIN is valid if step 4 is divisible by 10 evenly 50 5 Website to see if validate SIN: http://www.runnersweb.com/running/sin_check.html 9 WITHHOLDING ELECTION FORMS Employees are responsible for completing TD1 (federal and provincial)/TP-1015.3V form upon hire or 7 days from the change in personal situation Federal: TD1 Quebec: TP-1015.3V In addition to completing the federal TD1: Employees who claim more than the basic personal amount have to complete to the TD1 that corresponds to their province or territory of employment TD1X/TP-1015.R.13.1-V: Commission employees who incur business expenses 10 MINIMUM WAGE Conversion Rate: 0.76 USD Jurisdiction Federal Prevailing provincial wage Alberta $10.20 ($11.20 - October 1, 2015); $9.20 Liquor Servers British Columbia $10.25 ($10.45 – September 15, 2015) $9.00 Liquor Servers ($9.20 – September 15, 2015) Manitoba $10.70 ($11.00 - October 1, 2015) New Brunswick $10.30 Newfoundland & Labrador $10.25 ($10.50 - October 1, 2015) Northwest Territories $12.50 Nunavut $11.00 Nova Scotia $10.60 Ontario $11.00 General Workers ($11.25 – October 1, 2015) $9.55 Liquor Servers ($9.80 – October 1, 2015) $10.30 Student Under 18 (less than 28 HRs/wk) ($10.55 – October 1, 2015) Prince Edward Island $10.50 Quebec $10.55; $9.05 If Gratuities Apply Saskatchewan $10.20 ($10.50 - October 1, 2015) Yukon $10.86 11 OVERTIME REQUIREMENTS BY JURISDICTION Jurisdiction Daily OT Weekly Rate Federal 8 hrs 40 hrs 1.5 x reg rate Yes Alberta 8 hrs 44 hrs 1.5 x reg rate Yes: 1 OT = 1 Time Off British Columbia 8 hrs 12hrs 40 hrs 1.5 x reg rate 2.0 x reg rate Yes: 1 OT = 1.5 Time Off Manitoba 8 hrs 40 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off New Brunswick - 44 hrs 1.5 x reg rate - Newfoundland & Labrador - 40 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off 8 hrs 40 hrs 1.5 x reg rate Yes Nunavut - 40 hrs 1.5 x reg rate Yes Nova Scotia - 48 hrs 1.5 x reg rate - Ontario - 44 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off Prince Edward Island - 48 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off Quebec - 40 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off Saskatchewan 8 hrs 40 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off Yukon 8 hrs 40 hrs 1.5 x reg rate Yes: 1 OT = 1.5 Time Off Northwest Territories Banking Banking: Allows employee to defer the payment or the taking of equivalent time off at later date within regulated period with signed agreement – not mandatory to offer 12 HOLIDAYS Days Wkly Std Hours Decrease Holiday in OT Rate Pay for Work on Holiday Federal 6 Yes No 1.5x Alberta 9 No No 1.5x British Columbia 10 No Yes: Worked 1.5x/2x 8+1 No Yes: Not Worked 1.5x New Brunswick 7 No No 1.5x Newfoundland & Labrador 6 No No 2.0x Northwest Territories 10 Yes No 1.5x Nunavut 10 Yes No 1.5x Nova Scotia 6 No Yes: Worked 1.5x Ontario 9 No No 1.5x Prince Edward Island 7 No No 1.5x 8 No Yes: Not Worked 1.0x Saskatchewan 10 Yes No 1.5x Yukon 9 Yes No 1.5x Jurisdiction Manitoba Quebec Statutory Holidays: • New Years Day • Canada/Memorial Day • Labour Day • Christmas Day • Remembrance Day • Good Friday Provincial Holidays: • Jan 2 • Family Day • Islander Day • Easter Monday • National Aboriginal Day • Fete National • First Monday in Aug • Discovery Day • Thanksgiving • Victoria Day • Boxing Day Each province has regulations on: • Entitled to holiday • Not qualified and works • Holiday not on a normal work day and does not work • Qualified and does not work • Qualified, works, wants another day off 13 VACATION TIME Jurisdiction Length Annual Federal 2 wks; 3 wks after 6 yrs Alberta 2 wks; 3 wks after 5 yrs British Columbia 2 wks; 3 wks after 5 yrs Manitoba 2 wks; 3 wks after 5 yrs New Brunswick 2 wks; 3 wks after 8 yrs Newfoundland & Labrador 2 wks; 3 wks after 15 yrs Northwest Territories 2 wks; 3 wks after 5 yrs Nunavut 2 wks; 3 wks after 5 yrs Nova Scotia 2 wks; 3 wks after 8 yrs Ontario 2 wks after 12 mths Prince Edward Island 2 wks after 12 mths; 3 wks after 8 yrs Quebec 2 wks; 3 wks after 5 yrs Saskatchewan 3 wks; 4 wks after 10 yrs Yukon 2 wks after 12 mths • Many jurisdictions legislate employees take time in 1 or 2 week increments • Vacation earnings 4% (2 weeks)/6% (3 weeks) of vacationable earnings must be paid when vacation taken or before. Includes (in most jurisdictions): • • • • • • • • • Regular wages/salary Overtime pay Bonuses Pay in lieu of notice Holiday Sick Previously paid vacation Director’s fees Board and lodging taxable benefit • Employees must take time within a period ranging from 4 to 12 months after earned • Notice must be given to the employer 24 hours to 4 weeks in advance • Each jurisdiction has regulations if used and accrued vacation time must show on remuneration statement 14 LEAVES Qualifying periods, length of leave and qualifications are legislated by each province/territory Jurisdiction Leaves offered in all provinces/territories: • Maternity (pregnancy): range 17 to 18 weeks • Parental/adoption/child care: range 35 to 52 weeks • Paternal: 5 days (Quebec) Federal 6 mths Alberta 52 wks British Columbia Manitoba Other leave types (vary by jurisdiction): • Bereavement • Jury duty • Leaves for family situations • Citizenship leave • Compassionate care leave • Sick • Voting • Wedding • Reservists • Organ donor leave Qualifying Period New Brunswick 7 mths - Newfoundland & Labrador 20 wks Northwest Territories 12 mths Nunavut 12 mths Nova Scotia 12 mths Ontario Prince Edward Island Quebec 13 wks prior to delivery 20 wks - Saskatchewan 20 wks Yukon 12 mths 15 TERMINATIONS/WORKERS’ COMPENSATION Involuntary Terminations: • Notice: 2 weeks or in lieu pay 50+ employees: at least 16 weeks • Must complete Record of Employment for each employee • Severance: Must complete 12 consecutive month of employment with the employer Two regular working days for each completed year of employment Minimum 5 days Dismiss for cause are not eligible • Accrued vacation must be paid out • “Retiring allowances” are paid at the discretion of the employer Workers’ Compensation: • Provincial/territorial difference exist • Workers who become sick or injured due to their employment are entitled • Administered at the provincial/territorial level • Premium rates based on occupational grouping • Employers are obligated to notify provincial workers compensation office when employees become injured and must submit an injury report • Must complete Record of Employment for each employee • Maximum insurable income varies by jurisdiction 16 RECORD OF EMPLOYMENT • Employers provide work history (hours/earnings) for employees receiving insurable earnings who stop working and experience an interruption of earnings • Information provided helps determine Employment Insurance benefits • Two ROE forms available: paper/electronic (web/SAT) • Insurable earnings: Earnings provided to employees in which EI premiums are paid • Interruption of earnings: • Seven consecutive calendar days with no work and no insurable earnings • Employee’s salary falls below 60% if regular weekly earnings • Deadline for issuing ROE: • Paper: 5 calendar days following the interruption of earnings • Electronic: 5 calendar days after the end of the pay period • Paper ROEs have serial numbers that should be tracked similar to check stock • 3 part form: 1) employee, 2) Service Canada, 3) employer retained 17 State Work Comp Dept of Labor Social Internal Security Revenue Admin Service CANADIAN GOVERNMENT AGENCIES Canada Revenue Agency (CRA) Service Canada • URL: http://www.cra-arc.gc.ca/ • Administers: Income Tax Act (ITA), Goods and Services Tax (GST), Harmonized Sales Tax (HST) • Collects: Income Tax (ITA), Canada Pension Plan (CPP), Employment Insurance (EI), Provincial Income Tax • URL: http://www.servicecanada.gc.ca/ • Administers: Canada Pension Plan (CPP), Employment Insurance (EI) • Collects: None • URL: http://www.statcan.gc.ca/ Statistics Canada • Administers Labor statistics • Collects: Wage and headcount information Workers’ Comp Board Provincial Income & Medical Authorities • URL Listing Provincial WCB: https://www.ccohs.ca/oshanswers /information/wcb_canada.html • Administers: Wage loss benefits and rehabilitation of injured or disabled workers (by province/territory) • Collects: Workers Comp Board Assessments • Funded: Employer • URL: http://www. revenuquebec.ca/en/ • Administers: Quebec Taxation Act Revenue Quebec • Collects: Quebec Provincial income tax, Quebec Pension Plan (QPP), Quebec Parental Insurance Plan (QPIP), Quebec Heath Services Fund (QHSF), Training Tax, Commission de normes du travail, Commission de la sante et de la security du travail •Administers: Provincial health care 18 PAYROLL TAXES: PAY AS YOU GO Employee Income Tax (ITA) Employees pay both federal and provincial income tax (including Quebec) Employment Insurance (EI) Temporary financial support to unemployed (including maternity excluding Quebec) Canada/Quebec Pension Plan (CPP/QPP) Retirement pensions, survivor, disability and death benefits Quebec Parental Insurance Plan (QPIP) Subject to tax on worldwide income 4 divisions of taxes: 15 to 29% Special tax considerations for: • • • • • Bonus Stock Retroactive Lump sum/commissions Termination pay Employer * Some payroll providers consolidate with provincial Non Quebec: Annual Max: $49.5K Rate: 1.88% Quebec: Annual Max: $49.5K Rate: 1.54% Non Quebec: Annual Max: $49.5K Rate: 2.632% Quebec: Annual Max: $49.5K Rate: 2.156% Non Quebec: 18 to 70 years Annual Contribution Max: $50.1K Rate: 4.95% Quebec: 18+ years Annual Contribution Max: $50.1K Rate: 5.25% Non Quebec: 18 to 70 years Annual Contribution Max: $50.1K Rate: 4.95% Quebec: 18+ years Annual Contribution Max: $50.1K Rate: 5.25% Quebec: Annual Max: $70K Rate: 0.559% Quebec: Annual Max: $70K Rate: 0.782% CRA Remittances: PD7A Series • Quarterly • Monthly • Semi-monthly • 3 business days Revenue Quebec Remittances: • Annual • Quarterly • Monthly • Semi-monthly • 3 business days Maternity, parental, and adoption benefits Provincial Income Tax & Employer Payroll Taxes 19 INCOME TAX CALCULATION Income Tax Calculation + Salaries, wages, commissions + Bonuses, vacation pay, gratuities Calculation methods: 1.Table 2.Manual 3.Formula 4.Payroll Online calculator + Pensions, retiring allowances, death benefits + Value of taxable benefits - EE contribution to registered pension plan - RRSP contributions - Federal union dues - Deduction for living in prescribed zone Annual Net Taxable Income Rate Constant $0-44,701 15% $0 $44,701-89,401 22% $3,129 $89,401-138,586 26% $6,705 $138,586+ 29% $10,863 - Deductions authorized by the CRA/Rev Quebec = Net taxable income Federal Tax Credits x Pay period frequency (annualize) Basic Person & Spouse (each) $11,327 x Annual tax rate Infirm Dependent 18+ $6,700 - Constant (considers lower tax brackets) Eligible Pension Income $2,000 - Federal tax credits Age 65 $7,033 = Annual tax amount Disability $7,899 Divide by number of pay periods Caregiver $4,608 = Pay Period Tax Education (FT) $465/mth Education (PT) $140/mth 20 TAXABLE FRINGE BENEFITS All fringe benefits are included in income unless specifically excluded FMV less employee contribution Differences between United States and Canada: • Parking: Taxable unless FMV of the parking cannot be determined (i.e. public parking) • Group Term Life, AD&D and Dependent Life: Full value of the premium including all sales tax and excise tax • Gift & Awards: Exempts non-cash gifts (cash/near cash always taxable) for special occasions (i.e. religious holiday, birthday, wedding) and awards for employment related accomplishments are considered de minimis up to $500 maximum annually. Service awards every 5 years up to $500 are non taxable • Overtime Meals: Very specific, excluded from income reasonable costs (generally <$17) for overtime greater than 2 hours before/after regularly schedule shift • Relocation: Exemptions for all relocation expenses related to the transportation of household goods, employee travel and lodging expenses in moving from the old residence, meals, temporary living, house hunting expenses and selling expenses • Personal Use of Company Vehicle: Very different formula for calculating value(refer to www.cra.arc.gc.ca) Complete List: http://www.cra-arc.gc.ca/tx/bsnss/tpcs/pyrll/bnfts/menu-eng.html Provincial tax treatments may be different 21 TAXATION: EMPLOYEE SHARE PLANS Definition: • Stock Purchase Plan: ownership allows the purchase of stock at a discount, generally 10 to 15% Taxable Event Exercise Price Grant Price Option to 100 shares Grant Price: $80 Paid for by payroll deductions Exercise Price: $100 Taxable Event $8,000 $10,000 $2,000 Taxation: • • • Discount is taxable at exercise If stock held by employee AND stock gains value, each calendar year, the employee self reports, the capital gains rate (difference between the already taxed discount and the gain in value the stock made) A deduction equal to one half of difference between price of shares exercised and sale gain is permitted in income at marginal rate **RSU taxation similar to US at vest for FMV 22 PROVINCIAL TAXES Income Tax Provincial taxes include income, health, education and training taxes Income Tax • Resident • Progressive: 5.9-14.05% Payroll Tax • Employer • 2% Income Tax Income Tax • Resident • Progressive: 4-11.5% Payroll Tax • Employer • 2% • Resident • Progressive: 7.04-12.76% • Resident • Progressive: 16-25.75% Employer Paid • Health Services: 2.7-4.26% of worldwide payroll • Labour Standards Contribution: .08% up $70K of pay per employee • Workforce Skills Development & Recognition: >$1M payroll pay 1% Income Tax • Resident • Progressive: 7.7-13.3% Income Tax Health/Post Secondary Ed • Resident • Progressive: 5.06-16.8% • Employer • >$1.2M: 2% Income Tax • Resident • Progressive: 9.8-16.7% Income Tax • Resident • Flat tax: 10% Income Tax • Resident • Progressive: 11-15% Tax credits are different by province Income Tax • Resident • Progressive: 8.79-21% Income Tax • Resident • Progressive: 10.8-17.4% Health/Post Secondary Ed • Employer • <$1.25M: 0%; $1.252.5M: 4.3%; >$2.5M: 2.15% Income Tax • Resident • Progressive: 5.05-13.16% Employer Health Tax Income Tax • Resident • Progressive: 9.68-25.75% • Employer • Progressive: 0.98-1.95% Home based employees who don’t report to a permanent establishment, the province of employment would where wages and salary are paid from 23 T4: STATEMENT OF REMUNERATION PAID • Complete T4 slips for all individuals who received remuneration during the year if: • There was deductable CPP/QPP contributions, EI premiums, PPIP premiums, or income tax from the remuneration; or • Remuneration was more than $500 • Report earnings in year in which paid • Distribution of T4s should be on or before the last day of February following the year end earnings were paid. Number of copies: • Mail: Two paper copies last known address • Person: Two paper copies • Electronic: One copy with written consent • Complete a separate T4 for each province/territory the employee worked in • One copy of the T4 should be sent with T4 Summary to CRA 24 REFERENCES • http://www.payworks.ca/payroll-legislation • http://www.bna.com: Canada Primer & Canadian Payroll Association’s Canada Payroll: A Comprehensive Overview • http://www.cra-arc.gc.ca/ • http://service canada.gc.ca/ • http://www.statcan.gc.ca • https://www.ccohs.ca/oshanswers /information/wcb_canada.html • http://www.runnersweb.com/running/sin_check.html • http://www.american payroll.org 25 QUESTIONS Thank You Nina Scott, CPP Executive Alliance ninascott@executivealliance.com 904 687-9818 (cell) 26

![Garneau english[2]](http://s3.studylib.net/store/data/009055680_1-3b43eff1d74ac67cb0b4b7fdc09def98-300x300.png)