a Copy

advertisement

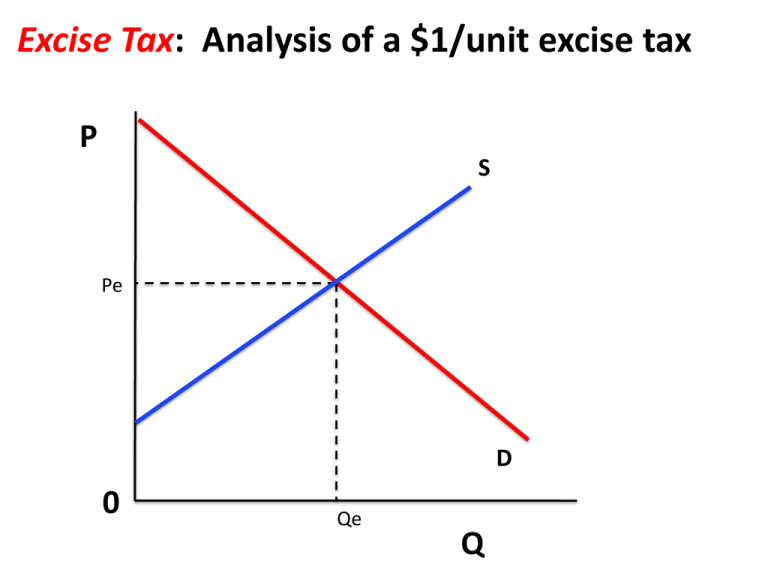

Excise Tax: Analysis of a $1/unit excise tax P S Pe D 0 Qe Q Excise Tax: Analysis of a $1/unit excise tax Cigarettes P Here is the market for cigarettes in equilibrium. What will happen if a 1$/pack tax is enacted? S Pe D 0 Qe Q Excise Tax: Analysis of a $1/unit excise tax Cigarettes P Here is the market for cigarettes in equilibrium. What will happen if a 1$/pack tax is enacted? S What will happen to Demand as a result of the tax? Pe NOTHING HAPPENS TO DEMAND. Excise taxes work like production costs and affect SUPPLY. D 0 Qe Q Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S $7 Here is the market for cigarettes in equilibrium. What will happen if a 1$/pack tax is enacted? What will happen to Supply as a result of the tax? $6 Supply will move up (and to the left). It will move UP by the amount of the tax. D 0 Qe Q Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S $7 Notice though, that the PRICE does not go up by the full amount of the tax. This shows that the tax burden is shared by consumers and producers. Pt $6 Quantity also goes down, as with any decrease in supply. D 0 Qt Qe Q Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S OK, let’s assume that this is split right down the middle and the new price is $6.50. How much are consumers now paying for cigarettes? $6.50 $6.50 $6 How much are producers actually getting for cigarettes? $5.50 (They have to pay the $1 tax.) $5.50 D 0 Qt Qe Q Compared to before, each is paying exactly half of the $1.00 tax. Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S To do that, we remove the new Supply curve (St). $6.50 $6 $5.50 What happened to the rest of it? D 0 Let’s look at the areas of consumer surplus, producer surplus, and deadweight loss after the tax. Qt Qe Q Excise Tax: Analysis of a $1/unit excise tax Cigarettes P S Some of it goes to the government in the form of the tax. What about the last part? $6.50 $6 $5.50 Tax Revenue Tax Revenue D 0 Qt Qe Q Excise Tax: Analysis of a $1/unit excise tax Cigarettes P S Some of it goes to the government in the form of the tax. What about the last part? $6.50 $6 $5.50 You guessed it: Deadweight Loss Tax Revenue Tax Revenue D 0 Qt Qe Q Excise Tax: Analysis of a $1/unit excise tax P Cigarettes $10 S Original Consumer Surplus? New Consumer Surplus? Original Producer Surplus? New Producer Surplus? Tax Revenue? Deadweight Loss? $6.50 $6 $5.50 Tax Revenue Tax Revenue $2 D 0 Let’s put some numbers in here and do some calculations: 90 Qt 100 Qe Q Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S $7 $6.80 Price for cigarettes is now $6.80. Consumers pay 80% of the tax. Producers only pay 20% of the tax. $6 $5.80 D 0 When demand is very inelastic, producers can pass on more of the tax to consumers. Qt Qe Q Excise Tax: Analysis of a $1/unit excise tax St Cigarettes P S $7 When demand is very elastic, producers cannot pass on much of the tax to consumers. Price for cigarettes is now $6.20. Consumers pay 20% of the tax. Producers pay 80% of the tax. $6.20 $6 $5.20 D 0 Qt Qe Q

![Efficiency_and_Deadweight_Loss[1]](http://s3.studylib.net/store/data/009434002_1-f7581b2930e0def184879bc9efc1b24b-300x300.png)