Purchasing

advertisement

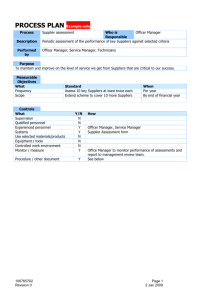

[PURCHASING] IBA PART 1 THE FUNDAMENTALS OF SUPPLY 1. THE SUPPLY CHALLENGE Materials management: not only for manufacturing – many service operations use large quantities of materials. The concept purchasing is usually discussed as part of the input, transformation, output model, where it is purchasing’s role to manage the inputs into the firm after being told what to purchase from the various planning systems contained within the firm. Supply needs to be thought about as a dynamic strategic process and not as a bureaucratic business function. Important of purchasing - Economics - Strategic congruence 2. THE EVOLUTION OF PURCHASING AND SUPPLY MANAGEMENT Evolution of purchasing (1) The 1940-1960s: logistics - Origins in military practice, Alexander the Great - Logistics as a business discipline got attention in the 1950s. Logistics is the entire process of material and products moving into, through, and out of the firm. Inbound logistics: movement of material, components and products received from suppliers. Material management: movement of components and materials within the factory or firm. Physical distribution: movement of finished goods outward from the end of the assembly line, and through the shipping department to the end customer (2) The 1970s: purchasing as an administrative function - General level of recognition, despite the 1973-4 oil crisis and related raw materials shortages - Passive role: to be a service provider to other functions within the enterprise, with the primary task of buying the required goods and services from approved sources of supply, making sure that they conformed to the required levels of quality and performance, delivery schedules and most competitive price. (3) - The 1980s: purchasing as supply chain management (SCM) Porter emphasized importance in Five Forces Model Enterprise Resource Planning (ERP): made supply chain optimization feasible World Class Manufacturing (WCM) required that the entire supply chain be world-class, focusing on JIT production and supported by Total Quality Management (TQM). Caused by intense Japanese competition. Supply chain focus is vital for the long-term well-being of any manufacturing firm. (4) The 1990s: supply management and strategic decision making - Firms start investing in SCM because of the realization that it could save money - Purchasing strategy refers to specific actions of the function to achieve its coal. - Purchasing operations deal with the day-to-day buying activities of the firm [PURCHASING] IBA When the activities and strategies of the purchasing function are aligned with the overall strategies of the firm can purchasing be a strategic function. - Shaping firms and its boundaries; should we buy from multiple suppliers? - Identify roles for suppliers within a supply base: mega, first-tier or tier-half Drivers of purchasing evolution Political Development policies Reduction focus in public expenditure Privatization Regulation constraints Economic Recession / depression Global competition New industrial alliances Corporate mergers Social National labor rates Quality of working life Change role managers Outsourcing: job losses Environmental and ethical issues Technological Global connectedness ↑ E-commerce, e-supply Time-to-market Shorter product innovation cycles Purchasing function implements competitive strategy Purchasing function supports strategy of other functions and those of the firms as a whole Purchasing function drives strategy of the firm Strategic stages in development of a purchasing function Stage 1: passive Purchasing function has no strategic direction and primarily reacts to requests from other functions. Stage 2: independent Purchasing function adopts the latest purchasing techniques and practices, but its strategic direction is independent of the firm’s competitive strategy. Stage 3: supportive Purchasing function supports the firm’s competitive strategy by adopting purchasing techniques and products, which strengthen the firm’s competitive position. Stage 4: integrative Purchasing’s strategy is fully integrated into the firm’s competitive strategy and constitutes part of an integrated effort among functional peers to formulate and implement a strategic plan. Strategic purchasers Heavily involved in decision making Focused more on supply chain management High level of integration with suppliers Undeveloped purchaser Akin to independent phase. Laggards of purchasing functions. Despite high skill and knowledge levels: low levels of organizational status, less integration and little involvement with strategic planning Capable purchaser High skilled Moderate level of status, internal integration and involvement in strategic matters Celebrity purchasers High level of status in the eyes of top managers, yet lower skill levels, involvement in strategic planning and internal integration than any other group. Charismatic leader, focus on ‘hands-on’ issues [PURCHASING] IBA 3. THE MAKE-BUY DECISION: A THEORETICAL PERSPECTIVE Link between make-buy decision, corporate strategy and supply strategy: the decision determines the areas where the firm will compete and those it will leave to others. The make-buy decision The boundaries of the firm are the combined activities that an organization performs in-house rather than using external suppliers. Vertical integration and horizontal integration Neoclassical economic theory Focus on the determination of prices, outputs, and income distribution in markets through supply and demand. Tells little about the make-buy decision. Raison d’être: maximize profits. Transaction cost approach (TCE) Based on the interaction of two behavioral assumptions, bounded rationally and opportunism, and two transaction assumptions, asset specify and uncertainty. * opportunism: achieving one’s goals through calculated efforts of guile, lying, stealing, cheating etc. * asset specify: transferability of an asset within an exchange relationship * environmental uncertainty: not being able to predict future states of technology, demand or supply. * behavioral uncertainty: not being able to predict the behavior of exchange partners TCE & make-buy decision Hold-up problem: not everyone is opportunistically but due to the effects of bounded rationality and uncertainty it is not possible to distinguish those who will cooperate from those who will be opportunistic. High governance costs: buy High asset specificity/uncertainty: make TCE criticism 1. TCE offers a somewhat static and limited view of the production capabilities of the firm. 2. TCE is a theory of cost minimization, not of value maximization. The capability approach / resource-based view (RBV) The basis for a competitive advantage of a firm lies primarily in the application of the bundle of valuable resources at the firm’s disposal. - Inimitability, non-substitutable, immobile RBV & make-buy decision Reasons why it may be costly to develop resources internally: Historical context, path dependency, social complexity, causal ambiguity Acquisition costs that may help inform managers during the decision-making process: Legal constraints, knock-on effects on value, technology tie-in, unwanted ‘baggage’. [PURCHASING] IBA With rising levels of outsourcing and many firms seeking to focus on fewer core capabilities, the make-buy decision is increasingly important to competitive advantage. 3. 4. SOURCING STRATEGIES AND SUPPLY CHAIN CONFIGURATIONS Supply base rationalization/supply base reduction Involves working more closely with fewer suppliers with main motivation: cost reduction. - A firm has a limited amount of resources and by reducing the suppliers it can focus on its recourses. Intel has an n+1 rule-of-thumb in determining the number of suppliers needed. The nature of the inter-firm relationship changes from relatively independent to relatively dependent. This requires different measurement and management systems to enable the relationship to work effectively. Often firms do not make these changes over-reliance on suppliers that are not capable of working in a more collaborative manner. 1. 2. 3. Operational costs (running day-to-day relationship) Figure 4.1, page 45 Cost of producing the purchase order, invoicing and so on Managerial costs (managing relationship) Problem solving, travelling to visit the supplier, quality workshop, supplier conferences Strategic costs (strategic risk, ability for supplier to act opportunistically) Issues about the model (above): 1. The more subjective the costs, the more difficult they are to measure and therefore the less likely they are to be considered by the firm. 2. Strategic costs post reduction increase as the buyer becomes more dependent on a smaller number of suppliers, whereas operational costs decrease by a given proportion because the number of transactions has decreased in proportion to the reduction of supplier numbers. In short term this strategy appears to be very successful as it has achieved cost reduction and taken out transaction costs. However, in the medium to long term it has changed the nature of the buyer-supplier relationship (independentdependent) which means that the buyer needs to consider carefully how this should be managed. The Kraljic matrix is the main positioning tool for thinking about supply management decisions. Classification of purchase items High Leverage: Best deal Critical: Cooperation Unit cost management important Custom design or unique specification because of volume usage Supplier technology important Substitution possible Changing source of supply difficult or costly Impact on Competitive supply market with several Substitution difficult business capable suppliers (internal Routine: Efficiency Bottleneck: Supply continuity issues) Standard specification or ‘commodity’ Unique specification type items Supplier’s technology important Substitute products readily available Production-based scarcity due to low Competitive supply market with many demand and/or few sources of supply suppliers Usage fluctuation not routinely predictable Low Potential storage risk Low Supply risk/supply market complexity (external issues) High [PURCHASING] IBA Porter’s five forces model gives a good indicator of the factors causing rivalry in an industry. - Barriers to new entrants, power of buyers, substitutes, power of suppliers, industry rivalry Pareto-analysis 80/20 rule. 20% of the products use to build a car will make up 80% of the costs The critical strategy = Group A First-tier suppliers, key technology suppliers, major outsourcing providers Each quadrant of the Kraljic matrix suggests a sourcing strategy which in turn dictates a related sourcing or supply structure. (1) Single sourcing Critical of bottleneck quadrants Easier to exchange ideas, clear understanding of cost structures, easy way to redesign Buyer has position of weakness, firms competitiveness is in danger. Windows Operating system has many loyal customers thereby forcing manufacturers to source exclusively from Microsoft. (2) Multiple sourcing Routine quadrant Competition based on price, focus on purchase price Dutch auctions (3) Delegated sourcing strategy Leverage and critical quadrant Making one supplier responsible for the delivery of an entire sub-assembly as opposed to an individual part. = first-tier supplier Reduce day-to-day transaction costs by working closely with the supplier Exchanging more detailed information, particularly around cost issues Transfer capabilities and technologies that enable that supplier to produce the required sub-assembly - Suppliers van become very powerful and exert their power over to the buyer, e.g. price increases. (4) Parallel sourcing Allows the buying firm to work on a single or sole-sourced basis with each component supplier within a product group while maintaining a multiple-sources relationship across product groups. Advantages of sole and multiple sourcing, excluding the disadvantages 5. X [PURCHASING] IBA 6. SUPPLIER DEVELOPMENT Supplier development is any effort of a buying firm with a supplier to increase its performance and/or capabilities and meet the buying firm’s short and/or long-term supply needs. This can be limited such as supplier evaluation and performance improvement requests. It can also be extensive which include training and investment in the supplier’s operations. Kaizen Improve supplier performance Workflow simplification, layout changes and set-up time reduction - Limited input of supplier, narrow understanding of underlying problem solving techniques and it ignored many socio-technical elements. Supplier capability development It is the buyer’s attempts to transfer its own in-house capabilities across firm boundaries and into the supplier. This approach is more problematic to achieve. One of the key challenges is managing the transition out of the supplier’s organization. - Large commitments of time and resources are required by the buyer, results may not come quickly and there is danger of frustration. Activities to develop supplier’s performance and/or capabilities: Evaluation of supplier performance, raising performance expectations, recognition and awards, promises of increased present and future business if supplier improves, training of supplier’s personnel, integrated technology roadmaps, financial assistance. Direct improvement activities such as standardized, technically focused approaches (value analysis, workflow analysis) have been unable to sustain their improvement rates. Supplier development may focus on achieving relatively short-term, narrow fixes to stabilize supplier performance. Improvement activities can then take place, seeking to improve dimensions such as quality, reliability, delivery and cost. Over the long term the partners will aim to build supplier capability, whereby improvement efforts on the part of the supplier become self-sustaining. Supplier development strategies 1. Competitive pressure 2. Evaluation and certification systems 3. Incentives (vooruitgestelde beloning) 4. Direct involvement Most effective strategy Capital and equipment investments in suppliers Partial acquisition of the supplier firm (vertical keiretsu) Investment of human and organizational resources The suppler development process [PURCHASING] IBA Step 1: Identify critical commodities Kraljic’s matrix: routine, leverage, bottleneck and critical Step 2: Identify critical suppliers Amount of expenditure Suppliers of strategically important components Likely length of relationship Improving weakest suppliers can be done by a Pareto analysis of supplier performance The type of manufacturing/administrative processes used by suppliers Step 3: Form a cross-functional team The buyer also needs to be conscious of their supply chain strategy and the role of procurement and the supplier within that strategy. Step 4: Meet with supplier top management Gaining commitment of top management s a key success factor for supplier development. Top management can push aside political barriers, assign resources etc. How? – show how supplier development would lead to greater profit/better quality, often through supplier forums or meetings. Step 5: Identify key projects Improvement efforts target work on the hottest items rather than step back and assess the highest-priority improvements with the greatest impact on operational performance. Step 6: Define details of agreement The value to be created and the metrics for doing so should be agreed on both sides. Step 7: Monitor status and modify strategies The most sustaining improvements occur where the supplier has been trained in capability development and the customer maintains an oversight and monitoring role on the supplier’s operation. Barriers to supplier development Table 6.1, page 87 E.g. lack of mutual trust, lack of supplier commitment, supplier not important enough to buyer. [PURCHASING] IBA PART 2 DEVELOPING SUPPLY STRATEGY 7. SUPPLY STRATEGY: THE DEVELOPMENT OF THE STRATEGIC SUPPLY WHEEL The main development of strategic supply came from these three basic approaches: Process-based approaches are those linked to specific organisations processes that need to be in place in order to facilitate strategy implementation. Include development of appropriate skills and competencies and information systems. Procedures-based approaches are those concerning the organisational procedures that are needed to facilitate implementation of a strategy through the organisational system. Include performance measure and total cost-benefit analysis. Policy-based approaches are necessary for the formulation of the strategy itself. Centre of model: no policy isolated strategy formulation and deployment lacking robustness Rationale of the supply wheel Appropriateness Most appropriate strategy is balanced against the other elements within the model. Strategic planning tool Strategic (capabilities) analyze, strategic choices, strategic implementation, identify gaps. Linkage with sourcing strategies and Kraljic’s positioning model [PURCHASING] IBA 8. ALIGNING SUPPLY WITH CORPORATE STRATEGY Strategy is a pattern or plan from which an organization can develop its major goals and objectives. - Affects the scale and scope of an organization’s activities over the long term. - Is about being responsive to changes in the external environment. - Is about aligning activities with strategic resources and capabilities inside-out approach Levels of strategy Corporate strategy Business-level strategy Functional-level strategy What business are we in? How do we compete in our chosen markets? How can our function support business- and corporate-level strategies? Strategic alignment Functional strategies should connect with business- and corporate-level strategies. A company with a low-cost corporate strategy should be supported at the functional level by activities that help get the product to market for the lowest price possible. Top down strategy development: from corporate to functional Bottom up strategy development from functional to corporate Aligning purchasing and corporate strategies Strategic alignment between supply chain and corporate strategies is achieved where supply chain strategy supports and facilitates corporate strategy. It is an internal activity and does not require large capital investment. It is more to do with information sharing, the status of the purchasing function, the knowledge and skills of purchasing personnel, and managing organization change. Organization’s competitive priorities for supply Cost Quality Delivery Flexibility Innovation Typical measurement criteria Total cost, pricing terms, exchange rates Durability, performance reliability Delivery speed and reliability Volume flexibility, mix flexibility Supplier technological capability, speed of NPD Organizations usually develop a reputation based on one or two of these priorities. EasyJet has established a reputation for low cost, Dell for flexibility and 3M a reputation for innovation. [PURCHASING] IBA Content of strategy examines the specifics of what was decided, whereas the process of strategy considers how such decisions are made within organizations. Objectives should conform to SMART: specific, measurable, achievable, relevant, time bound. Supplier base rationalization, supplier selection, supplier development, supplier performance measurement, relationship management 9. 10. ORGANIZATIONAL STRUCTURES FOR SUPPLY MANAGEMENT Selecting the right structure for the Supply department involves a combination of 3 schools of knowledge: strategic supply, competition, and organisational design. A good strategic will always consult the broadest possible literature before making decisions and designs, searching for ideas that others have not exploited in the search for competitive advantage. Roles within function dividing: 1. Day-to-day operations Focus concerned with efficiency measures such as lead-times and delivery reliability 2. Leading-edge deal making Responsible for supplier development, ensuring that they have capabilities to support HM and projecting what future needs are going to be. History: Venkatraman showed how information systems required organisations first to evolve and then go through a ´revolution´. In the 1990s, the rise of electronic commerce has been as a revolutionary stage. Business organisations have to join this wave or simply get left behind. The development of organizational design Many modern business organization are still close to a Weberian model of bureaucracy. During the 1970s, much discussion began on the need for a more practical approach to the horizontal flows of communication, i.e. a member of staff might be permitted to speak to their opposite number in another department without ‘going through’ their manager. The operational-level impact of this was the concept of cross-functional teams – in which people from different functional silos were put together to work as a unit, for a specific purpose. The purpose of organizational design is to arrange the intelligent resources of the organisation (people and ICT) in such a way that it can engage with the market effectively. [PURCHASING] IBA The basic approaches available to the Supply Strategist when deploying people and resources to provide the organisation with effective service. The actual choice will depend on market pressures. Centralization A powerful central purchasing office specifies and buys on behalf of the divisions. Decentralization A central Purchasing office makes policy, does corporate deals; the division purchase on their own behalf. Atomization A small central Purchasing office makes policy; responsibility for sourcing and supply management is given to budget holders. Federal structure Divisions award power to central office to develop policy and provide necessary services to them with specific mandates. Hybrids Combining the strengths of central planning with the necessities and opportunities of local sourcing. Advantages Economies of scale Standardization Policy deployment Financial control Auditing Policing Common ICT and systems Staff exchange Disadvantages Resentment in the regions Bucking the system Missed opportunities ‘Overweight’ overheads Slow response Autonomy Variety/diversity Local prudence Cross-deals Local satisfaction Inter-divisional competition Staff exchange Suppliers divide and confuse Cost anomalies Skills shortages/duplications Lack of financial control Local covert deals Maverick buying Personal favorites Suppliers divide and confuse Lack of control on prices Commercial risk Overload on support staff System update dislocation Department autonomy and responsibility Simple controls Procurement cards Removes budgeting anomalies Purchasing as a ‘school’ or specialist Quick response Agreed rules Dual citizenship Subsidiary Minimal central control Cross-fertilization Complex arrangement Unclear hierarchies Central bureaucrats Risk of instability [PURCHASING] IBA 11. PERFORMANCE MEASUREMENT To achieve the most effective blend, financial information with non-financial information. Performance measures as signaling devices Management can use performance measures as a means of signaling and influencing the actions of the people who are responsible for performing the tasks. Employees will take their lead from these criteria to maximize their own performance. A well-balanced and well-structured system should support and encourage performance in the areas which are critical to the firm’s success. Cascading performance measures The aim is to create an alignment: Hierarchy of performance measures: Benefits of measures Decision making Directing activity which is aligned to the needs of the organization and identifies variance from planned results. The cause-and-effect relationship will be more readily apparent, facilitating greater ease of planning, control and coordination. Communication Other functions must be aware of the contribution which Purchasing can make, to draw it to their own advantage. Visibility Identifying areas of waste in terms of defects, delays, surpluses and mistakes. Motivation People feel the need to contribute. If measures have no apparent purpose or link to the overall working of the company, there will be little attraction in achieving them. Problems with measurement Management system was not originally designed as a measurement tool, but to meet operational requirements. Order processing and inventory tracking [PURCHASING] IBA Key performance measurement concepts Efficiency is an operating ratio of effort against results. This may depend on organizational factors such as the workload, certain procedures, information system used, and the headcount, often focusing on transactions. Supplier development, value analysis, forward buying programs and lead-time reduction all impact on assessments of Purchasing effectiveness. Cost-based measures can be dysfunctional The real price may be blurred by quantity discounts, payment terms, credit and currency fluctuations. The price paid in one period compared to the previous may be meaningless. Who is actually responsible if a fall in the market occurs? Price savings value improvements, cost/price reductions, avoidance of higher costs Financial and non-financial measures Important issues are often overlooked when focusing on one performance. An over-reliance on efficiencybased measures has the problem that the nature of much financial data means that they may not be useful in decision making, when considered in isolation. Performance measurement systems in many of today’s companies focus on historic rather than future performance, financial rather than operational indicators, internal rather than external data and numeric rather than qualitative results. - This does not enable managers to monitor the activities and capabilities that enable them to perform a given process. Gaining buy-in Employees are closest to the action and will know more about the nature of their work and should be able to judge which measures will be relevant and effective. Cost Total distribution cost Total inventory cost Quality Three levels: manufacturing-related, supplier-related and customer-related. Production quality [PURCHASING] IBA Defects per supplier Trend analysis of individual suppliers, setting a minimum quality benchmark and making performance levels public across the supply base which provides social norms for improving performance. suppliers want to be on top Customer returns Time On-time deliveries, customer response time and backorder/stock out Supplier performance Level and degree of information sharing, degree of collaboration etc. Developing a performance measurement system Requires top management support, organizational buy-in and resources to set up procedures for appropriate date collection. 1. Determine goals to measure Specific measures are not necessary at this stage. Key pitfall: selecting goals which do not reflect the corporate- and business-level strategy of the firm. 2. Establish performance measures SMART. Performance measures (1) can lack of power to influence behavior where they are not linked to employee evaluation or incentive plane.. (2) Organizations select to many measures, leading to lack of focus. (3) Select too few measures which may lead to missing information. (4) Generate conflicting signals as to desired behaviors. 3. Establish standards for comparison Main approaches: Analysis of historical data Planned performance Publish lead table of highest performers, which stretch goals for the others. This can lead to dysfunctional rivalry as units compete, rather than cooperate. Competitive benchmarking 4. Monitor progress Firms must make decisions about the type of feedback they require from their performance measures. They must identify who the users are, what information they require etc. 5. Evaluate progress Problem: over-aggregation of data which can lead to masking of potentially important trends. 6. Implementing improvement actions The firm must move to correct the problems or issues identified. They have to ensure they are not driving the wrong performance; they must be sure that the measures used will result in the desired actions. 7. The Purchasing Balanced Scorecard = a tool for focusing the organization, improving communication, setting organizational objectives and providing feedback on strategy. Figure 11.6, page 159!! [PURCHASING] IBA 12. COST-BENEFIT ANALYSIS Measurement of costs Zero-based pricing worked until firms started to consider the ‘cost of quality’ rather than ‘cost of poor quality’. Price versus cost Price-focused approach means that you (as a customer) want to pay less than you did last time you bought the product or service. Selling price: Profit Variable costs Fixed costs Business cycle: price rises new sources of supply see a lucrative market they enter the market thus increasing the number of suppliers relative to the number of buyers equilibrium/break-even is reached prices stabilize process begins again. Total cost of ownership - Its purpose is to help consumers and enterprise managers determine direct and indirect costs of a product or system. - A TCO analysis includes total cost of acquisition and operation costs. A TCO analysis is more relevant in determining the viability of any sourcing initiative than just TCA. - The TCO concept, together with activity-based costing (ABC) system enable Purchasing managers to estimate these costs and/or savings. Quality Management Delivery Service Communications price The Degraeve and Roodhooft matrix can be used to help firms uncover all these relevant costs of procurement. The matrix enables managers to assess costs along the length of the procurement value chain, and at all levels of its supplier relationships. 5 stages: Initial acquisition Costs relate to activities which take place to receiving the product from supplier. Product price, cost related to negotiation and contracting, supplier vetting costs Reception Possession Costs occur when receiving goods, processing invoices and payments. Costs occur between receiving goods and actual utilization of goods in production or service. Internal transportation from storage to factory floor, inventory holding costs. Costs of use may include installation, personnel training and impact of product failure. Costs that are often omitted from the initial procurement decision, but can be represent considerable cost to the buying firm. Electronic equipment such as mobile phones, computer and consumer electronics Utilization Elimination Three hierarchical levels: 1. Supplier-level cost of supplier audit, salary of buyer responsible for managing the relationship 2. Order-level receiving, invoicing and external transportation 3. Unit-level production shutdown caused by suppliers faulty product, disposal/recycling. [PURCHASING] IBA 13. MANAGING INTER-FIRM RELATIONSHIPS Relationship management can be viewed from a variety of perspectives: level of the firm, level of a particular project or group within or between firms, and the level of the individual. Example 1. Example 2. Simple output: price reduction, simple input: buyer focusing on price negotiation. Complex output: technology development, risk and reward sharing etc. Complex input: cross-functional teams, inter-firm teams etc. There is a cost-benefit analysis equation that will need to be balanced when deciding on various relationship strategy approaches. What makes Japanese firms successful? – They see suppliers as essential to their business and view relationship management as the primary role of the procurement professional. The development of supply chain and relationship management Supply chain management has a convergence of two areas: logistics and purchasing Kanter – successful partnerships being needed to manage the relationship, becoming best PALs (pooling, allying and lining) Strategic Focused Outcomes Model (SFOM) Strategic /longterm Tactical/ shortterm Market collaboration B Shared merchandising Co-branding Joint selling Distribution channel mgmt Strategic collaboration C Align customer requirements Sharing basic technologies Joint NPD Shared production engineering Develop joint mktg entry status Develop joint capital expenditure Operational collaboration A Shared ops planning info Develop & share demand and forecast Link order mgmt systems (e.com) Joint capacity mgmt systems COST Differentiation [PURCHASING] IBA Relationships can be thought of as a process or course of action, which should be designed to deliver business outcomes. Strategic Relationship Positioning Model(SRPM) Opportunism: the dominant partner gets the change to take advantage of the situation. Adversarial: arm’s length contractual relationships. Tactical: because a modularity strategy or supply base reduction has been followed. Strategic collaboration: require large investments The 4 key dependencies 1. Historic Previous interaction > level of knowledge 2. Economic Switching costs e.g. training, patents 3. Technological Competencies and capabilities 4. Political P = big impact, p = small impact, know to play the political game. The 4 levels of certainty 1. Contractual Are you certain that the other will perform to the specifications and standards of the contract? 2. Competence Has one the capabilities to perform to the contract? E.g. required skill level, competencies 3. Goodwill Is the other willing to go (or not) beyond their contractual duties? 4. Political What are the political risks or gain of dealing with the party? Partnership Life Cycle Effect Figure 13.7, page 184 Embryonic solve huge barriers to the project’s implementation Growth different skills were required which align e.g. control and problem solution. Maturity requires amalgamation of the 2 previous approaches. Requires management monitoring and general problem solving. Decline - Limited in its description of what occurs within and between organizations. [PURCHASING] IBA Partnership Expectations Effect Figure 13.8, page 185 Short term (t1) Buyer and supplier set measurable benefits such as improvement in pricing. There can be a kaizen approach. Medium term (t2) Buyer and supplier have the opportunity to take a further decision: engender/rejuvenate. ROP = return on partnership Long term (t3) The level of goodwill and competence trust have again been built up Decision on the further development of the relationship is based on a cost-benefit analysis approach. Partnership Desert Figure 13.10, page 187 The model shows how in the short (t1), medium(t2) and long term (t3), the parties receive benefits from entering into relationships. The model depicts an oscillation effect, with deserts occurring at various time intervals. Implications for managing relationships 1. The management of inter-firm relationships is complex. 2. Relationships are referred to as processes that drive or facilitate changes in behavior. 3. Relationships should be considered at the level of the product or service and not at the level of the firm. 4. Relationships strategies are dynamic, they need to be thought through and managed over time. PART 3 STRATEGIC ISSUES IN SUPPLY CHAIN MANAGEMENT 14. ENVIRONMENTAL AND ETHICAL ISSUES IN SUPPLY MANAGEMENT Pressure: External sources include industry requirements, financial institutions, regulatory authorities and public bodies. Internal sources include the desires of marketing departments to go green their respective organization’s image; the legal mandates of health and safety inspectors. Triple bottom line refers to an organization’s responsibilities in the areas of economic behavior, environmental impact and social policies. Basic environmental concerns 1. Understanding pollution 2. Establishing a policy on environmental soundness Total Quality Environmental Management (TQEM) If a lean enterprise seeks to produce goods and services using significantly lower levels of input (materials, labor, time, space) and avoiding all forms of waste, it is likely to adopt the principles of environmentally sound supply easily. [PURCHASING] IBA Five main levels of approach: Reducing the total amount of resources used in the production and use of a unit of service/goods. The extension of the life of that unit The reduction of the unwanted side effects of the unit throughout its life, including pollution and waste. Reuse, recycling or incineration with energy recovery at the end of a products useful life. 3. Strategy for minimizing impacts Key areas of urging the supplier to improve their environmental performance at each stage of the supply chain through implementing the appropriate features of the waste hierarchy. Customer specification Quality requirements Interface waste due to distance, and differing customer-supplier processes Company internal processing of materials: scrap, stock and transport requirements Progression to the next manufacturing firm in the value chain Post-consumption waste, not consumed by the end user. Companies should focus on the quality of supply as a whole rather than just the constituents of the product. Standards, legislation expectations and competition will only become tighter and more stringent over time, so continuous improvement is the key to succeeding in this area of business. 4. Risks for purchasing and supply managers Measuring environmental effectiveness The number of incidents or prosecutions faced by the company over time is a public measurement, companies want to avoid. More sophisticated systems include progress against corporate goals, improvements against environmental audit results, waste tracking etc.. Supplier assessment Life cycle inventory is one tool which could enable Buyers or Purchasing managers to build an impact profile for suppliers, forming a baseline for assessing their future performance. Figure 14.6, page 210 Development of Kraljic’s model to incorporate environmental concern Issues to consider in using the matrix include the supplier’s capacity, utilization and flexibility, past variations in capacity utilization, the uniqueness of the product, volumes purchased and their expected demand, levels of technology, quality history and organizational culture. Strategy and senior management commitment Alignment between the purchasing and supply environmental strategy and the overall environmental goals of the organization is clearly vital. 15. G [PURCHASING] IBA 16. PUBLIC AND REGULATED SUPPLY MANAGEMENT The purpose of the EU procurement rules is to open up the public procurement market and to ensure the free movement of supplies, services and works within the EU. Public procurement: the purchases of goods, services and public works by governments and public utilities. European union is relevant to UK public procurement Public fund spending must explore the whole single market and have the best change of getting value for money. Firms in member stated get the chance of bidding for business throughout the whole market. Thresholds – financial levels above which the expenditure is deemed to be significant, are used to establish whether or not an amount is significant in the EU principles and purposes context. Regulations overheidsopdrachten moeten worden gegund na mededinging aanbestedende overheden moeten de gelijkheid der inschrijvers respecteren naleving van de principes van vrij verkeer van goederen en diensten maximale transparantie van de gunning van overheidsopdrachten door verplichting tot bekendmaking van overheidsopdrachten overheidsopdrachten worden gegund tegen een forfaitaire prijs verbod op afspraken en handelingen die de concurrentie belemmeren Rules of aggregation state that the thresholds apply to ‘one-off’ purchases and to a series of contracts with similar products and services, for a single or recurring need. If the eventual value of a contract is above the threshold, it is assumed that the purchaser should have foreseen this and followed the procedures. An organization that can show that the separate parts of the organization are DOU (a part of a business which buys goods for its own purpose) is does not have to aggregate. Attestation is the process where an organization can let their in-house procedures inspected for compliance so they will be viewed as having followed the correct path. Four award procedures are provided for in the Regulations: The open procedure, under which all those interested may respond to the advertisement in the OJEU by tendering for the contract; The restricted procedure, under which a selection is made of those who respond to the advertisement and only they are invited to submit a tender for the contract. This allows purchasers to avoid having to deal with an overwhelmingly large number of tenders; The competitive dialogue procedure, following an OJEU Contract Notice and a selection process, the authority then enters into dialogue with potential bidders, to develop one or more suitable solutions for its requirements and on which chosen bidders will be invited to tender; and [PURCHASING] IBA The negotiated procedure, under which a purchaser may select one or more potential bidders with whom to negotiate the terms of the contract. An advertisement in the OJEU is usually required but, in certain circumstances, described in the Regulations, the contract does not have to be advertised in the OJEU. An example is when, for technical or artistic reasons or because of the protection of exclusive rights, the contract can only be carried out by a particular bidder. a) Without a call for competition (including urgency procedure) b) Negotiated procedure with a call for competition Comments on Directives: Directives do not help small and medium-sized enterprises. Rather than firms in each of the EU countries bidding for business, there has been a tendency for large organizations to set up operations in those countries to bid for local contracts. 17. D 18. THE RELEVANCE OF COMMODITIES Commodities are materials and services which can be specified precisely and bought largely on the basis of price and availability. To be a true commodity, the liquidity of an item must be quantifiable (i.e. manageable lot sizes are agreed) and quality stabilized and guaranteed. - Affected by macroeconomic and geographical forces To be a trading centre, the location must be seen as stable and established – as it is trust that is key to the success of its business. As countries grow and develop so commodity markets change. 1. 2. 3. - Hard commodities include metals Base metals, such as aluminum, lead, nickel, tin, zinc, copper Precious metals, such as gold, silver, platinum, palladium Soft commodities include such things as cocoa, cocoa mash, white sugar, cotton, orange juice. Other categories: Grains and seeds Meat and livestock energy Open outcry is a method of trading that uses verbal bids and offers in the trading pits. Deal with price fluctuations: Private deals Know supply market well Relationships are good Avoid open market pressure Backward integration Involves the purchase of suppliers in order to reduce dependency. Owning the raw material production Opportunistic buying Opportunities may arise sporadic (risk of imminent obsolescence) or seasonal Involves quick responses or strategic planning Buying winter fuel in summer may mean paying less for it [PURCHASING] IBA Buying on the future market Moderate risks by hedging: financial documents are traded in their own market in order to avoid the problems of paying more than they planned. Spot price: Contango: Backwardation: Long: Short: Arbitrage: Bear: Bull: the price that would need to be paid for the commodity for delivery on that day. situation in which the futures price is higher than the spot price. situation in which the future price is lower than the spot price. owning commodities or futures that are not fully hedged selling commodities or futures in excess of what it actually owned. buying in one market and selling in another to exploit differences in prices. someone who speculates expecting a fall in price. someone who speculates expecting a rise in prices.